Important announcement of listed companies: BOE A plans to transfer 7.278 billion yuan to Hefei BOE 28.33%of the equity

Author:Securities daily Time:2022.07.20

Taiyuan Heavy Industries: A total of 1.458 billion yuan in the amount of major litigation amounts involved in major litigation amounts of 1.458 billion yuan. BOE A: It is intended to transfer 7.278 billion yuan to Hefei BOE 28.33%of the equity in Nandu Power.The company's capital increase Guidong Electric: Due to the disclosure of suspected information, the CSRC filed a case

An important announcement of Shanghai City Heavy Industry: The total amount of litigation involved in major litigation was 1.458 billion yuan Taiyuan Heavy Industry (600169) announced that the company filed a lawsuit with the Taiyuan Intermediate People's Court due to contract disputes, and claimed that Dolbert Mongolia Autonomous County pulled bubble wind power Power Generation Co., Ltd. and Daqing Yuanjing Technology Co., Ltd. and other interests to repay the company's arrears of 1.444 billion yuan and the interest from May 1, 2019 to actual payment. As of May 1, 2022 The amount of litigation accounts for 30.39%of the company's recent audited net assets. Guidong Power: Due to the disclosure of information disclosure of illegal and violations, the CSRC announced the company's announcement of the company's case in Guidong Electric (600310). The CSRC decided to file a case against the company because the company suspected information disclosure of information disclosure. COSCO Haifa: At present, the company and subordinate subsidiaries have sold a total of about 2.29%of the A -share shares (601866) Announcement of China Collection Group. From July 19, 2021 to July 18, 2022 A total of about 2.29%of the SCO Groups and other methods of large -scale transactions, centralized bidding, etc., with a sale amount of about 1.302 billion yuan. Anti -holding of vinegar shares (603968) announced that shareholders Gu Qingquan, Qingjiu, Ding Caifeng, Shuai Jianxin, Qian Jin, Xue Jinquan was planned to focus on concentrated bidding transactions within 6 months from August 11, 2022. The reduction of not more than 3.9094 million shares, that is, no more than 1.91%of the company's total share capital. Shanghai Electric Power (600021) announced that 6.15%of the shareholders of the Three Gorges Group planned to reduce their holdings of not more than 2%. The Three Gorges Group and the Yangtze River Electric Power held a total of 8.27%of the company. Sano Medical (688108) announced that Great Nobestment Limited, a 2.1%shareholder, intends to reduce its holdings of no more than 2.1%of the company; 5.97%of the shareholders CSF Stent Limited intends to reduce the company's holdings of no more than 5.97%of the shares. Two shareholders' fitness reduction companies do not exceed 8.07%of the shares. Baolong Technology (603197) announced that Chen Hongling, one of the actual controller holding 18.59%of the actual controller, intends to reduce its holdings of not more than 2%through a major transaction. Chen Hongling and his unanimous actors Zhang Zuqiu and Song Jin held a total of 29.93%of the company. Important Announcement of Shenzhen Oriental A: It is intended to transfer 7.278 billion yuan to Hefei BOE 28.33%of the equity of BOE A (000725) Announcement. After the completion, the company's proportion of shares displayed by Hefei BOE will increase from 8.33%to 36.67%. Shunwang Technology: Signing a strategic cooperation agreement with China Athletics Association, such as Shunwang Technology (300113), the company signed the "Strategic Cooperation Agreement" with the China Track and Field Association and signed the "Strategic Investment Agreement" with Beijing Zhongtian Sports Development Co., Ltd. In -depth cooperation in the field of sports digital copyrights, empowering each other and stimulating vitality. In -depth cooperation in the field of sports yuan (virtual space, virtual figures, virtual reality, digital twin/simulation, game engine technology), jointly develop sports theme virtual space, virtual characters, sports games, online virtual events, online, online Large -scale activities and conference exhibitions are responsible for operation and commercial development. Wanfu Bio: The company's new crown antigen detection product is included in the WHO emergency use list Wanfu Biological (300482) Announcement. Recently, the company received the World Health Organization (WHO) notice that the company's new coronary virus (2019-NCOV) antigen detection test agent The box (immune layer analysis method) was included in the WHO emergency use list on July 18, 2022, which can be purchased for other countries and regions. Nandu Power: In the first half of the year, net profit increased by 1305.85%-1348.85%year-on-year Nandu Power (300068) released a performance trailer. It is expected that the net profit of the first half of the year is 523 million to 539 million yuan, a year-on-year increase of 1305.85%-1348.85%. During the reporting period, the amount of non -recurring profit and loss on net profit was about 489 million yuan. Xiamen Cinda: It is planned to transfer 88%of Zhangzhou Xindong Equity Xiamen Cinda (000701) announcement. Transfer, the listing reserve price is not less than 90.3925 million yuan. Field Bridge Raiders: In the first half of the year, net profit decreased by 65.57%year -on -year. Each share income is 0.01 yuan. Dahua Intelligent: Holding subsidiary intends to participate in the bidding 75%equity of Huaguan Optoelectronics Dahua Smart (002512) announcement. %Equity.

If you can successfully obtain the equity of Huaguan Optoelectronics, inject its existing IT resources into Fume Technology, it can achieve a large -size full coverage in IT/TV, and combines the advantages of the existing polarizer, smart terminals and other links in Fumei Industrial Park and Huahua Terminal. Guan Optoelectronics brand customer resources realize the complete optoelectronic display industry chain from naked glass to the whole machine, and form a large -scale economic display technology industry cluster in the park and surrounding areas. Tongda: This year's cumulative value -added tax refund and government award supplement of 148 million yuan Tongda (002560) announcement. As of the announcement date, the company and subsidiaries have received a total of value -added tax refund, export tax refund and government award -to -government supplementary couples of the year. 148 million yuan (data was not audited), and the above -mentioned government subsidies were cash and have all arrived. Tianqi Lithium Industry: It is planned to increase the capital of Tianqi Lithium (002466), a wholly -owned subsidiary. The capital was 326 million yuan; the new registered capital of Chengdu Tianqi was subscribed for 6.2 billion yuan. Jing'ao Technology: It is intended to invest in Ningjin 5GW section, 6GW high -efficiency battery project Jing'ao Technology (002459) announcement to build Ningjin 5GW section, and to expand the company's integrated production capacity. Jin 5GW slice and 6GW high -efficiency battery projects are expected to invest 2.532 billion yuan. Demei Chemical: It is planned to invest a annual output of 100,000 tons of textile auxiliary construction project Demei Chemical (002054) announced that it is planned to invest in the construction of an annual output of 100,000 tons of textile auxiliary construction projects, mainly investing in the production of textile printing and dyeing agents and industries and industries and industries and industries and industries and industries and industries. Products in new materials for civilian materials. It is expected that the total investment in this project in the future will be US $ 100 million. The company plans to set up a new holding company in Haiyan Economic Development Zone in Zhejiang as the main body of this project. Zhongke Jincai: It is planned to increase capital of 950 million yuan in capital. Hainan Rongxiang Zhongke Jincai (002657) announced. Essence Among them, China Science and Technology Finance recognized a capital increase of 950 million yuan. After the completion of this investment, Zhongke Jincai held 49.87%of Hainan Rongxiang's equity. Deng Han Yin, a 7.23%shareholder, an announcement of the reduction of the three sacred shares (002742). Zhongtong Bus (000957) announced that Shandong State Investment continued to reduce the company's shares of 5.929 million shares through centralized bidding transactions on July 19, accounting for 1%of the company's total share capital, all of which were increased holdings of the secondary market. After the completion of the holding of holdings, Shandong CSI held 15.9553%of the company's shares. Dazhen Intelligent (300670) announced that Nanjing Mingzhao, a 7.69%shareholder, intends to reduce its holdings of not more than 6%. Tianqin Equipment (300922) announced that 7.1912%of the shareholders of Zhuhai Hanhu planned to reduce the total shareholding of the company with a centralized bidding transaction or a large transaction method (6%of the company's total share capital). Xi Ling Power (300733) announced that Yu Yinglian, a shareholder holding 21.41%of the shareholders, plans to reduce the company's shares of 12 million shares in an agreement (accounting for 6.97%of the company's total share capital). I know you are "watching"

- END -

Honggou Town Carry out the publicity activity of "National Anti -drug and Harmony Society"

In order to enhance the awareness of anti -drug and drug refusal of residents, on ...

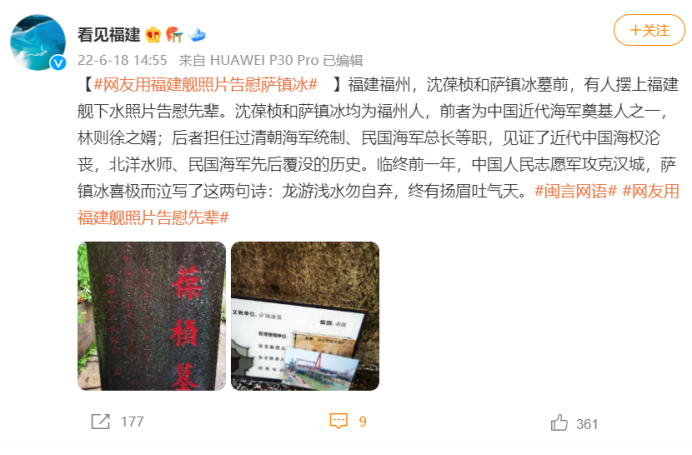

"I like this romanticism in the bones of Chinese netizens"

Someone uses a photo of Fujian ship to comfort the predecessors of modern Chinese ...