From 0 to 10 billion, the valuation problems of the large manufacturers

Author:Changjiang Business School Time:2022.07.20

The following article comes from Xue Yunkui.

The valuation of the company according to the financial report is one of the basic skills of investors. However, for Internet companies, this skill has encountered greater challenges. Because of the profit model or industry ecology, Internet companies are completely different from traditional companies, so the interpretation of Internet companies' financial reports is completely different from traditional industries.

Xue Yunkui, a professor of accounting at the Yangtze River Business School, has always been good at interpreting listed companies through financial statements. He used the four -dimensional analysis method created by his own "Discovering the Business Logic of the Internet" to challenge the valuation problem of Internet companies. The three major challenges of financial report analysis of Internet companies.

Author | Xue Yunkui

Source | Xue Yunkui

The following sections are selected from Professor Xue Yunkui's new book "Through the Financial Report and Discover the Business Logic of the Internet".

Xue Yunkui

Professor of Accounting, Changjiang Business School

Four -dimensional analysis founders

In the past two years, the Chinese Internet industry is in the autumn of events. Suddenly interrupted the listing road, encountered antitrust surveys, and the game was reprimanded as "spiritual opium" ... The story is one after another, and the wonderful layers are endless. Under the intervention of strong government supervision, subtle changes in the micro ecology of China's Internet industry. Ten years of comments.

The interpretation of the Internet industry's financial report is completely different from traditional manufacturing, because Internet companies are completely different from manufacturing companies in both profit models and industry ecology.

From income confirmation to cost calculations, from expense classification to income metering, from R & D investment to daily operations ... Compared with traditional manufacturing companies, the financial reports of Internet companies are simple, but risk factors are more complicated and secret. It is more compatible than principles, and the future trend is more difficult to grasp. In the face of these challenges, if there is not enough knowledge preparation, it is really difficult to get trusted analysis conclusions.

Overall, the financial report analysis of Internet companies faces three major challenges.

01

The financial report framework of Internet companies still does not get rid of the traditional accounting framework, and it cannot get rid of this kind of cricket in a short time, unless the accounting standard allows such changes.

The traditional financial statement system was formed in the era of industrial economy of large machines and large equipment. The definition and measurement of all financial report elements and its measurement matched the characteristics of the manufacturing industry.

Regardless of assets, liabilities and shareholders' equity, or income, costs, expenses and profits, it has a natural internal connection with factory management and business models in the industrial economy era. This is completely different from the business logic of "wool coming out of pigs" in the Internet era.

For example, Tencent, its main products are WeChat, QQ and other communication tools, but in the financial reports, they do not generate income. More than half of their income comes from Internet value -added services, including game virtual items sales and social network member service income.

Another example is Google's Alphabet (Alphabet). Its mission is to organize useful information in the world for free use, so its main business does not generate income. More than 80%of its income comes from advertising.

The same is true for Facebook's parent company Meta (Meta). The social network platforms they have built, including Facebook, Instagram, Messenger, WhatsApp, etc., are all free products, and more than 97%of their income are also derived from advertising.

Because "wool is on the pig", it is difficult to match the income and cost of Internet companies, and it is difficult to separate R & D activities and business activities.

It can be seen that the Internet corporate financial report that we usually see based on the current accounting standards only borrows the "shape" of traditional financial reports and cannot pass on its "God". The content of the financial report has been greatly deviated from the nature of the transaction.

Therefore, where should the financial statements of Internet companies go? Is it aggressive and reform to meet the needs of the continuous development and change of the Internet industry, or adhere to the authority of authoritative accounting, and use old bottles to carry new wine?

This issue is indeed worthy of our serious thinking.

The United States Internet Corporation (including Amazon, Alphabet and other companies) has made a lot of attempts in the disclosure of financial report information, but whether these innovations will lead the development trend of information disclosure of the Internet industry in the future. We cannot conclude at present and need authoritative institutions to determine.

For the interpretation of the financial report, although we do not need to stick to the agreement of accounting standards, the limitations of the information disclosure framework and methods are limited to the access channel of public information, making it difficult for us Internal logic relationship. Therefore, this has put forward huge challenges to the design and conception of the content of the Internet financial report.

02

Human understanding of the business nature of the Internet industry is still in a very early stage. The theory of Internet business nature and profit model is difficult to learn properly.

Because their development is far behind Internet practice, people's understanding of the laws of the Internet industry border and industry development is still immature, and it is difficult to be our theory and method in the process of financial report analysis.

According to the principle of Metkov effect, if any two nodes in the network may interact, then the value of the network platform depends on the degree of activity between nodes.

Economist Xu Xiaonian made theoretical calculation of the value of the Tencent platform for this:

If there are 1 billion users established by Tencent, then its potential value should be the 9th side of the 10th side of 10, more than 10 billion yuan, which is 250 times that of Taobao. Because Taobao establishes only bilateral interaction between buyers and sellers rather than multilateral interaction business model.

However, the gap between them is far from 250 times. Tencent did not find appropriate business model realization for a long time, and finally rely on the game to survive.

The market that originally only interacts with the bilateral interaction between the commodity sellers and the buyer has successfully constructed the interactive scenario between buyers. Through the underlying business logic of groups, agglomerations, and bargaining, it integrates consumption and entertainment to form interaction between buyers who have no connected. The attractiveness of the platform and evolved traditional e -commerce to social e -commerce. Through the recommendation and credit endorsement between buyers and friends, transactions are promoted.

Therefore, the commercial innovation of the Internet era makes anything unexpected. The subversive innovation of the business model of corporate business is continuous development, evolution, and iteration, which makes it difficult for the relevant theories of Internet business nature to keep up with the speed of practical development and evolution.

03

The biggest difference between Internet companies and traditional manufacturing companies is that its underlying driving force is rapidly changing.

The traditional manufacturing industry characterized by large machines and large equipment, the driving force of the enterprise is mainly derived from capital. Therefore, the existing financial report system and its analysis framework are basically established around the core of capital.

The rapid iteration of many Internet companies today is obviously not capital -driven, but mainly due to technological innovation, commercial innovation, and human capital drive.

Therefore, if traditional manufacturing companies are capital -driven, then Internet companies are more human -driven.

The change of corporate driving force has caused many traditional financial analysis indicators to lose its due meaning, such as asset turnover rate, inventory turnover rate, receivable turnover, asset remuneration, etc. The number of active users, the cost of customer acquisition, the ratio of people, the effectiveness ratio, and the cost of performance.

In addition, traffic monetization has also greatly expanded the boundaries and application scenarios of enterprise development. This makes the main business of Internet companies complex and diversified.

In particular, the main business of many platform -type Internet companies has superimposed equity investment, and established an enterprise ecological group or competition alliance with joint venture and joint ventures.

For example, Tencent's equity investment has exceeded operating assets, including the investment in the joint venture, the investment of the joint venture, and the financial assets measured at fair value. The fair value of the assets of listed companies has exceeded 1.2 trillion yuan by the end of 2020.

Ali, JD, Baidu, and Xiaomi, Meituan, and byte beating are not willing to be willing to chase me, have a considerable proportion of equity investment, and continue to launch various types of "land movements" in the world.

The changes in the cost, equity and fair value of equity assets have increased the complexity of the financial report interpretation, and of course, it also increases the risk of judging the future performance changes trend of such companies.

Of course, there are always many methods than difficulties. No matter how complicated or the limitations of these companies' financial reports, it will not hinder us from drawing the corresponding conclusions from the relevant financial report information.

Although these conclusions are superficial or rough, today's attempts will laid an important foundation for the establishment of a more systematic financial report system and the establishment of analysis methods tomorrow. This is also a test of whether the four -dimensional analysis framework applies to interpretation of Internet companies.

The conclusions of the analysis of the financial report of the Internet company, in addition to the financial reports of China's major Internet companies, will also compare the Internet companies in the United States, and expect to define the gap between the development of Chinese Internet companies.

The sample companies that we are about to open up include Tencent, Ali, JD, and Baidu, as well as comparison of American company letters, Amazon and Yuan universe.

Although there may not be a clear comparability between China -US Internet companies, I believe that through the abstract comparison of financial report data, I believe it will help everyone understand the core capabilities of these companies and the differences between them.

In the analysis process, we will mainly adopt the principle of four -dimensional analysis, but it does not rule out the necessary discussions on these sample companies in strategic ideas and corporate culture and values to help everyone use a broader field of vision and a more bottom -level logic To understand the story behind the financial report.

2021 is the turning year of the development of China's Internet industry. Growing from barbaric to standardized development is the only way for the rise of any industry. There is only the difference between or late or late, or fast or slow, and there is no difference in the fundamental path.

Whether it is the loser, a victim, or a successful way, they are not different. They are founders, practitioners, and promoters of this industry. They are precious wealth in the development process.

Without continuous trial and error and error correction, it is impossible for any industry to mature. Of course, the faster the trial and error correction, the faster the development and improvement of the industry.

7 o'clock tonight

Yangtze Public Class

Special

Professor Xue Yunkui

Take you through the financial report

Interpret the Internet business model

The picture in the article comes from Tuwu's creativity, and the reprint needs to be authorized.

- END -

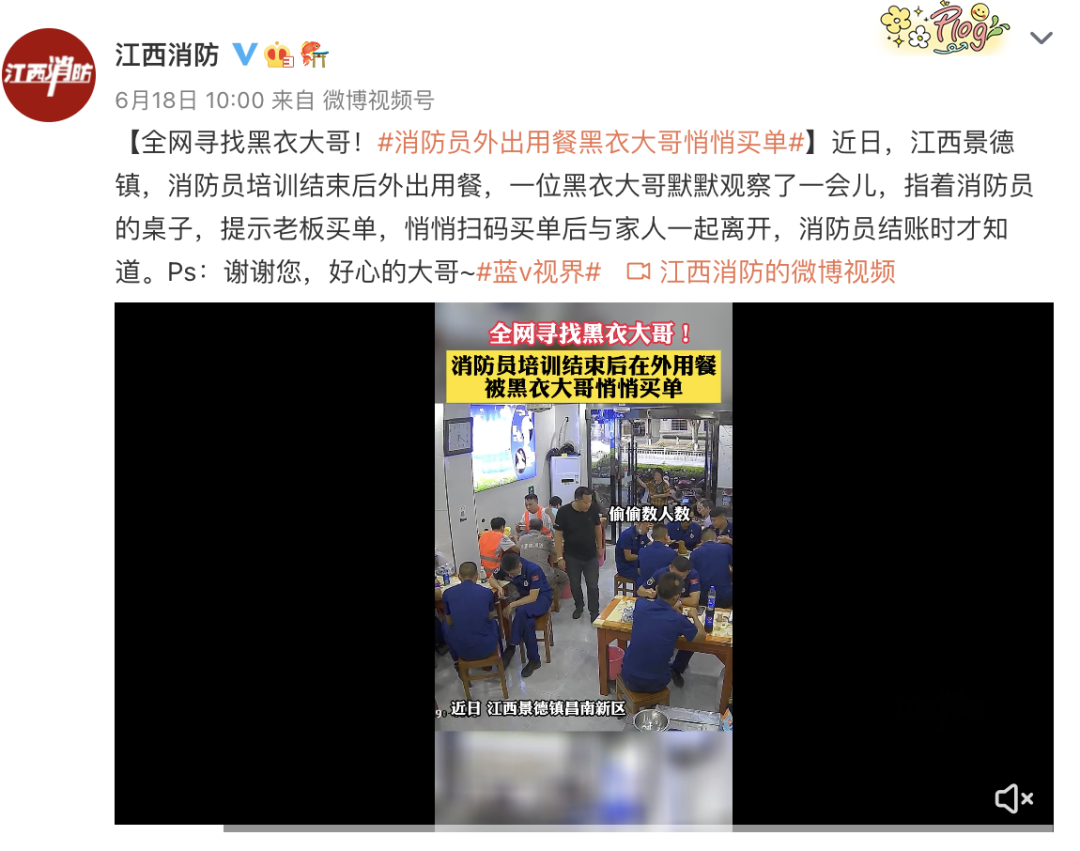

Search on the whole network!Inch head, wearing black clothes

Recently,@Jiangxi Fire Fighting released oneSpecial tracing noticeLooking for a bi...

"Three Going to the Countryside" with cultural and technological hygiene: Welcome to the new journey of the 20th and Forwarding