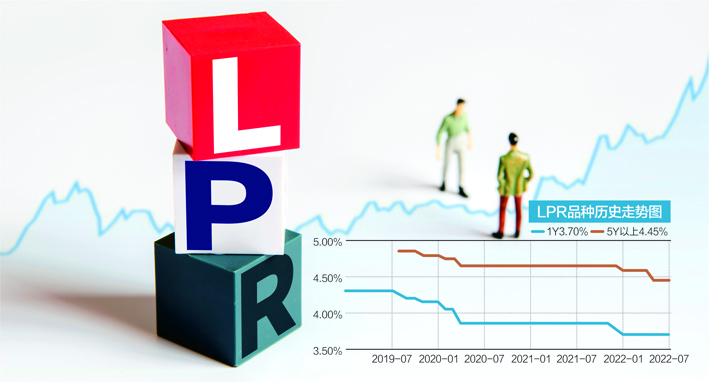

In July LPR quotation, two interest rates were "motionless in place"

Author:Daily Economic News Time:2022.07.20

In January this year, the 1 -year LPR and 5 -year LPR fell simultaneously; in May, the 5 -year LPR dropped 15 basis points alone. As of now, the 1 -year LPR has remained unchanged for 6 consecutive months, and 5 -year LPR has not been adjusted for 2 consecutive months.

"LPR continues to remain unchanged this month, which is basically in line with expectations." Zhou Maohua, a macro researcher of the Financial Market Department of Everbright Bank, said in an interview with reporters, "On the one hand, financial and economic data showed that domestic economic activities were accelerated, and the real economy financing was accelerated, and the real economy financing The demand is obviously recovered, the credit structure is optimized, and the market interest rate has maintained a low level. This month's MLF policy interest rate is not moving. ; In order to cope with the complex operating environment, continue to increase the disposal of non -performing assets, and some banks are also actively increasing profits. "

LPR offer in July remained unchanged

Due to the MLF operation on the 15th of this month, the interest rate was not adjusted. Many analysts believed that the LPR reference basics did not change in July, and the LPR quotation remained in line with market expectations.

Wen Bin, chief economist of Minsheng Bank, pointed out that the offer of LPR and LPR above 5 years in July 1st period remained unchanged. The main reason is that on the one hand, on July 15, the central bank and other amounts continued to do 100 billion yuan for a one -year MLF, and the bid interest rate was 2.85%, which remained unchanged. LPR interest rates are linked to MLF. Under the background of MLF interest rates, the foundation of LPR quotation in July has not changed. On the other hand, since the second quarter, under the dual squeezing of supply and demand, the two -ends of the deposit and loan, the downward pressure of the bank's net interest margin has further increased, and the power of LPR quotes in the short term is not strong.

Dongfang Jincheng chief macro analyst Wang Qing believes that the MLF interest rate remained unchanged in July, which means that the foundation of LPR quotation in the month has not changed; in terms of points, the RRRC has not been implemented after April, and other new banks have not been introduced in the near future. Cost -down measures, and the scale of loans in June was sharply high, and the loan interest rate was near the minimum level of history.

"As a result, from the perspective of bank capital costs and the balance of supply and demand in the loan market, the July quotation bank lacks the motivation to reduce the increase. To a certain extent, digestion in April Rensing and the establishment of a market -oriented adjustment mechanism for deposit interest rates on bank liabilities. As a result, the LPR quotation in July does not meet the market's general expectations. "Wang Qing said.

At the same time, Wang Qing also pointed out that the LPR quotation unchanged in July, and the actual loan interest rate of the bank will remain near the historical low, and some banks may also reduce the actual loan interest rate of enterprises and residents. In the stage of economic shift, this will help boost the demand for the real economy financing and promote the growth rate of the balance of various loans. In addition, this year's newly established structural monetary policy tools (scientific and technological innovation reinsurances, pilot loan pilots of inclusive pensions, and special re -loans of transportation and logistics) will be applied for the first time in July. While driving the incremental expansion of bank loans, this will also form a certain "reduction price" effect.

How to "go" in the future?

Speaking of the future direction of LPR quotation, Wang Qing believes that there will be some room for regulating the 5 -year LPR quotation in the third quarter. First of all, in the next few months, in the future, the Fed will continue to greatly tighten the prospect of monetary policy. While adhering to the "master of me" tone, domestic monetary policy will pay more attention to internal and external balance, and the possibility of MLF interest rates is less likely. Next, the focus of monetary policy operations will be to stabilize policy interest rates, focus on guiding the decline in actual loan interest rates, continuously reduce the cost of financing of the real economy, and consolidate economic restoration trend with wide credit.

Based on the consideration of the current property market trend and control related risks, Wang Qing judged that the probability of regulating the 5 -year LPR quotation in the third quarter was greater; depending on the investment and consumption restoration of the momentum in the second half of the year, it did not rule out that the 1 -year LPR quotation was slightly small. The possibility of lowering. "Stabilizing MLF interest rate+down reduction LPR quotation" will be a specific move to "take into account both internal and external balance" while maintaining a stable growth orientation in the coming period.

Zhou Maohua believes that from the perspective of trend, the central bank has reduced interest rate cuts in the toolbox, and the LPR interest rate still has room to reduce, mainly because the domestic economic growth and employment are still not small in the second half of the year. It is necessary to increase the support of key emerging areas such as the weak links of the real economy, manufacturing, and key projects, promote consumption and investment accelerated recovery, and promote the economy to return to the right track as soon as possible.

Zhou Maohua said that the subsequent reduction and interest rate cuts need to be further data guidelines; overall, the stable monetary policy continues to adopt "total amount+structural tools", focusing on stable employment, stable prices and preventive risks, to ensure that the total amount is reasonable and stable, increase the increase, increase the increase, and increase the increase. The support of weak links and key areas; at the same time, maintain the normal competitive order of the deposit market, guide bank financial institutions to strengthen asset -liability management (prevent and resolve risks, strengthen debt cost management, optimize credit structure, etc.), tap the potential for LPR reform, effectively reduce the comprehensive comprehensive economic economy Financing costs to ease the pressure of corporate management.

Daily Economic News

- END -

52 cases of new natives were added to Shanghai yesterday.

The Shanghai Municipal Health Commission notified this morning (July 10): At 0-24,...

"Food" is cool on the tip of the tongue.

Text/Yangcheng Evening News all -media reporter Wang Min Ma SiyongPhoto/Interviewe...