Without issuing the performance forecast, BOE is silent at this time?

Author:A little financial Time:2022.07.21

In recent times, it has shown that the industry has faced various bad situations: the price of panels has fallen, the demand for terminal brands has decreased, and price reductions and production reduction have become the most common vocabulary since the fourth quarter of 2021.

In the face of this downside tide, almost everyone was unable to resist. According to the current performance trailers released by major display companies, the net profit in the first half of the year declined by more than 50%, and even pre -losses even occurred in the second quarter. But it is an exception that has not yet disclosed the performance trailer. When other display companies fell into losses, BOE announced the profitability of its second quarter with the confidence of not issuing performance forecasts.

The so -called success cycle, the defeat cycle, as the economic downward pressure increases, the terminal demand decreases, and the panel that is greater than the request will inevitably appear to move closer to the cost end and the profit is decline. This cyclical fluctuation is not uncommon in the panel industry For panel companies, they are also familiar with them.

Everyone is looking for a road that weakens the attributes of the cycle. The existence of BOE has allowed us to see the possibility of weakening the influence of the cycle of the industry on the enterprise itself, and we also see the hope of the growth of panels from cyclical growth. Of course, behind this "change of roads" is decades of depth accumulation, and it is also a wide range of future plans.

Cyclical problem

In the previous upward cycle, semiconductor display companies have made a lot of money in the past two years. The annual report shows that 2021 is the best year for BOE in nearly thirty years. The revenue exceeded 2 billion yuan for the first time, and net profit increased by 412.96%year -on -year; TCL technology revenue increased by 88.4%year -on -year, and net profit increased by 339.6%year -on -year.

But the good times are not long. After the second half of 2020, the strong display panel industry has entered the downward channel since the fourth quarter of 2021.

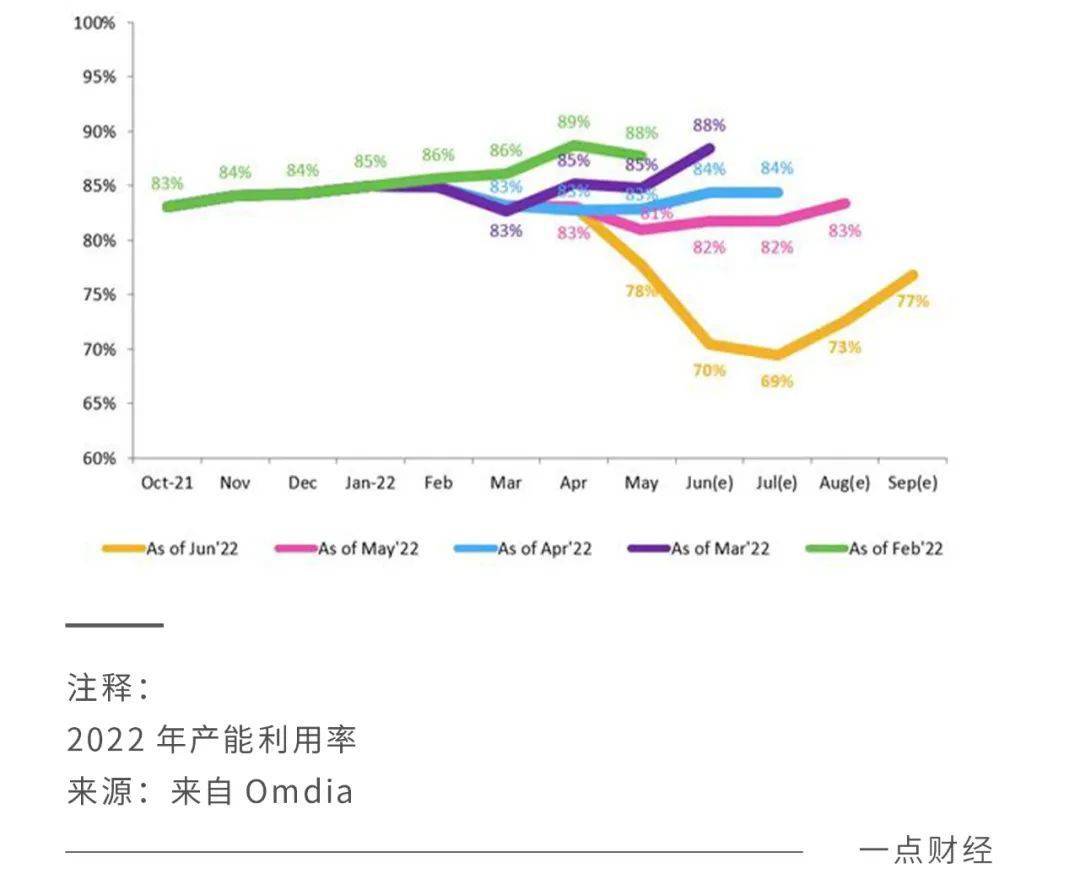

Affected by factors such as the downstream demand of macroeconomics, poor downstream demand, poor logistics, and geopolitics, the panel industry began to decline. According to the OMDIA display panel production and inventory tracking report, the global display panel manufacturer's production capacity utilization rate in the third quarter of 2022 is expected to fall to 73%, which is a record low in the industry since 2012.

For example, the price of LCD TV display panels fell to a new low in June because TV manufacturers continued to cut demand in the second and third quarters. To this end, the display panel manufacturer has greatly reduced the capacity utilization rate from June. According to the follow -up report of OMDIA, the capacity utilization rate is expected to be reduced to 70%and 69%of the design capacity in June and July, the lowest value in ten years.

Under the influence of the environment, the performance of panel companies has begun to look good. TCL Technology, Vindino, and Rainbow shares announced the performance forecast in the first half of 2022, and net profit has fallen sharply.

Among them, TCL Technology's net profit in the first half of the year is expected to decrease by 89%-90%year-on-year, and the pre-loss in the second quarter is 6.03-703 million yuan; Victoria's net profit predecessors in the first half of the year will lose 10.5 billion yuan to 120 million yuan. 470 million to 62 million yuan; Rainbow shares pre-losses of 11-12 billion yuan in the first half of 2022, of which the pre-loss of 359 million yuan to 459 million yuan in the second quarter.

See if domestic panel companies have to withstand this challenge, or may there be signs of victory in this challenge? When a large area of losses, the market's attention focuses on what answers can be given by BOE.

According to regulations, companies listed on the Shanghai and Shenzhen motherboards need to conduct performance previews within one month after the end of their net profit, a profit of profit, and a decline in net profit. The preview time is shortened to 15 days.

When the TCL Technology and Weixino listed on the Shenzhen Stock Exchange, the Rainbow shares listed on the Shanghai Stock Exchange have released the semi -annual performance trailer. BOE, which did not release the performance trailer, immediately became a hot spot for many investors. Combined with the relevant regulations of the Shenzhen Stock Exchange, its net profit The drop is within 50%.

Based on the net profit of 12.762 billion yuan in the first half of last year, in the first half of this year, the net profit of BOE was at least 6.381 billion yuan. It is inferred that the net profit of BOE in the second quarter of this year requires at least 1.992 billion yuan.

Can the panel show that the industry can get rid of the constraints of cyclical? To be honest, it is difficult. However, with the development of the industry to the maturity period, the concentration increases and the survival of the fittest, this industry can move from strong periodic to weak cycle. Enterprises in the industry can resist cycles and can minimize the impact of cycles on itself as much as possible. At least, BOE has maintained profit in the second quarter when most of the companies showed that the company's pre -losses, proved this possibility.

From the perspective of "One Certain Finance", periodicity is a law and a constraint, and any object to get rid of the restraint movement must have enough centrifugal power to jump out of the cycle. For enterprises, what is the power of its anti -cycle or even jumping cycle? The answer is nothing more than technology and products with the power of "inertia" -centrifugal power is a manifestation of inertia.

So, what is centrifugal force and inertia?

How to weaken the cycle?

Coping cyclical challenges, enterprises in different industries and different development stages need to give different methods.

How is the periodicness of the display panel reflected?

New technologies and new products have increased demand, panel supply is in short supply, and enterprises enter the bureau to invest; as production capacity expands, supply is greater than demand, panel price declines, production capacity decreases, and price declines have brought enlarged demand, supply is not in short ... Two, one is the demand, the other is the price of the price, and the breakthrough of the periodic problem is also here. What stage does the current display panel develop?

From TV to computers, mobile phones, tablets, and new energy vehicles, VR equipment, etc., in this society where the screen is ubiquitous, showing that after years of development, the panel industry has matured, especially Chinese companies have started from zero in 20 years from zero. From the beginning to parallel, it has deeply accumulated in terms of products, technology, and markets.

In 2021, data showed that China won a sales of $ 64.8 billion in the global display market, accounting for 41.5%of the global market share, ending the list of 17 years after South Korea in 2004. Among them, BOE became the world's largest display panel manufacturer. In 2021, LCD screen sales reached 28.6 billion US dollars, accounting for 26.3%of the world's.

When an industry develops to a certain scale, the industry concentration is relatively high, and the market, products, and technological advantages accumulated by leading enterprises will become its natural "centrifugal power", allowing it to have a stronger anti -risk ability when the industry downside. This is the case in BOE.

From the perspective of "One Certain Finance", companies like it are already in the industry's head, from large to greater, from strong to stronger, need two legs to walk, one goes into the depths, deeply digging technology and corporate moat , That is, "deep building walls"; one goes to wide, broaden the product category and application scenarios, that is, "Guangji Grain".

For BOE, the "deep wall" is a vertical, and it is technically up along the "screen of the screen". This allows it to maintain both the competitiveness of the display panel industry, but also find a new growth window.

From this, we can move from a strong cycle to a weak cycle, and have the power to respond when wind and rain come.

01) "Deep Wall"

Chinese panels start late, and facing foreign technology blockade, what really makes domestic panel companies stronger is the insistence on technology and innovation. BOE established a new generation of LCD display production lines in 2003.

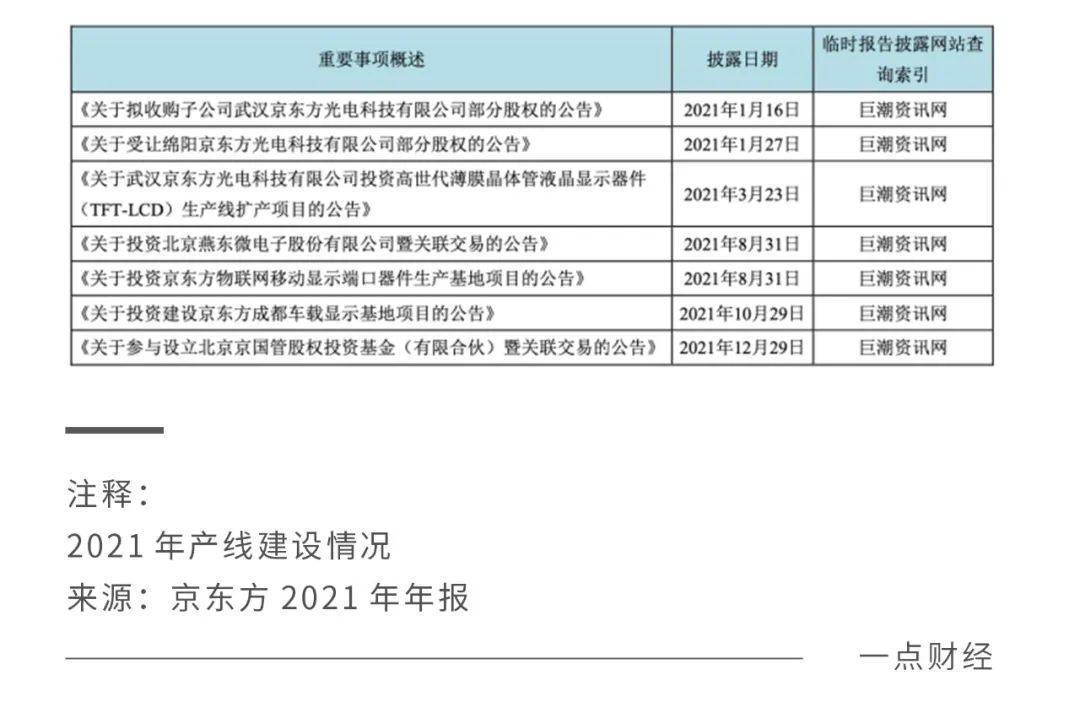

After several storms, BOE has always adhered to "respect for technology and insistence on innovation", while maintaining high -intensity investment in R & D, while the industry's trough is a trough for enterprise development opportunities, and layout of multiple semiconductor display production lines.

The annual report shows that in 2021, BOE A R & D investment reached 12.436 billion yuan, an increase of 31.72%year -on -year, and an annual new patent application exceeded 9,000.

In terms of manufacturing capabilities, BOE layout 16 semiconductor display production lines nationwide, including the first 5th, 6th generation, 8.5th generation LCD production line independently built in mainland China, and the world's first 10.5 -generation LCD production line and the world's leading 6 Age flexible AMOLED production line.

The panel industry, standing in the industry scale, is basically about the "key" to the next stage.

02) "Guangji Grain"

The application scenarios of display panels are constantly expanding. From TV, computer to mobile phones, tablets to today's Internet of Things, in order to fight against the cycle, companies need to continue to follow the pace of expansion to more products and categories, greater products and categories, greater categories, greater categories Market and demand, a key part of cyclical fluctuations, is "demand fluctuations".

At present, BOE has covered almost all panel application scenarios, and it is highly competitive in the high maturity scenarios. There are four display screens in the world from BOE.

OMDIA data shows that in 2021, BOE ’s LCD display in the five major application fields in smartphones, tablets, laptops, displays, and television all ranked first in the world. Sigmaintell predicts that by 2022, BOE will reach 28.9%in the global large -sized LCD share, which will continue to occupy the industry's leading position.

The display of the display screen in the field of innovative applications such as BOE also has also led the lead: Among them, the field of vehicle display, OMDIA data shows that in 2021, the shipping area of BOE on the vehicle has jumped to the world's first. The shipping volume also continues to ranks first in the world.

As the BOE says, in the future, the development of the industry is more opportunities to display technology and the integration of the Internet of Things technology in addition to displaying technology and products themselves. Let the "screen" integrate more functions (technical progress), derive more forms (products and processes), and implant more scenarios (markets and customers), which is called "screen of the screen" by BOE.

The growth of the IoT innovation business is also extremely rapid, with revenue increased by nearly 50%in 2021.

This year, BOE's Internet of Things business is still in an orderly and steady progress: as the first screen supplier of the national "Hundred Cities and Thousands" project, the first to complete the construction of multiple 8K ultra -high -definition outdoor screens in Beijing; smart financial solutions are to be as a smart financial solution. More than 2,500 banks nationwide provide services; smart park solutions have been applied in more than 20 cities including Beijing, Tianjin, and Chongqing ...

In addition, the "N" in the "1+4+N" development architecture has also achieved gratifying results. BOE Metrics, BOE Yiyun, and Industrial Internet Platform have achieved leapfrog development. Among them, BOE Steel Electric Power issued an announcement on July 11. It is expected that the net profit attributable to mothers in the first half of 2022 increased significantly by 140%to 180%year -on -year. New products, new scenarios, new fields, BOE's advantages accumulated in traditional display fields such as television, mobile phones, laptops, and monks, adherence to technology, understanding of the market, and ingenuity of products, and let it be extremely in innovative fields such as the Internet of Things. Growth potential. In this way, it not only opened the growing ceiling, but also more likely to resolve the impact of cyclical fluctuations in the industry.

Conclusion

In the industry with a strong periodic fluctuation of the panel, many companies must be used to switching between the wind and the backwind. At the time of the wind, we must resist the temptation of rapid expansion. When the wind is against the wind, we must maintain confidence in the future. The response and development of anti -wind test also test the ability of enterprises and management.

BOE, which implements the "Federation of Screen", has both the endurance of temptation and deep research, as well as forward -looking layouts and future -oriented sharpness. When the industry is deeply trapped in cyclical problems, it may provide reference and reference for the future growth of Chinese display panel companies.

- END -

Chengdu Transportation Bureau: The city's road passenger line has suspended the operation of 98 lines 丨 Directly hit the press conference

Cover Journalist Lai Fangjie Intern Dai JianglanOn July 18, Wang Qingyu, a member ...

The 23 -year -old mesonal hospital emergency opening blood vessels to rescue a life

Recently, a 23 -year -old guy had a sudden chest pain, accompanied by chest tightness and poor breathing. He went to the hospital for a myocardial infarction. The hospital opened the blood vessels urg