Open source securities said that the volume of hydrogenated Ding (HNBR) is about to be, and "the only beneficiary shares" had been strange to the positive electrode materials: I have never heard of it

Author:Daily Economic News Time:2022.07.21

Today (July 21), a research report of open source securities circulating on the Internet, titled "Hydrogenation Ding Ding (HNBR) Lithium Electricity, is as soon as possible, and the 10,000 -ton market will be issued." It is worth mentioning that only one company launched by the research report, Daen (SZ002838, a stock price of 25.16 yuan, and a market value of 11.24 billion yuan). Not long ago, the stock became a bull stock and continuously closed the daily limit.

The hydrogenation of Ding Ding (HNBR) is going to enter the battery, so is the industry's evaluation of it so high? "Daily Economic News" reporter called two positive pole materials companies. "As far as I know, I have not used this material." The director of the listed company of Yizhiji Materials told reporters that after communicating with the company's technical director, he said that he was not sure of the alternative of the above research report. In fact, there is no advantage. "Another positive material company said:" I don't know this material. "

Open source Securities Sales Department once found the Tao En Co., Ltd. Tiger Dragon List

Today, a research report of open source securities circulating on the Internet is titled "Hydrogenated Ding Ding (HNBR) Lithium Electric Volume, and the 10,000 -ton market is about to be issued."

According to the research report, as a special rubber, hydrogenated Ding Ding (HNBR) is generally used in the fields of automotive, oil, aerospace, and national defense military industry. As the demand for lithium battery and new energy continues to expand, the role of HNBR in the field of lithium battery has gradually become highlighted. HNBR, as a positive adhesive in the field of lithium battery, can improve battery electrochemical performance; as a dispersant, its decentralization is excellent and can ensure the conductivity of the conductive agent. The domain of the field of different troops has become a trend, and the market space in the future is broad, and domestic enterprises will continue to rise. Recently, the open source securities and chemical team released the industry in -depth report "HNBR is about to be capacity in the lithium battery field, and the 10,000 -ton market will be issued". The market space can be calculated in detail to tap related investment opportunities for you. "

According to the prediction of research reports, in 2021, the amount of HNBR as a positive adhesive may have reached about 1200 tons, and in 2025, the amount of HNBR as the adhesive in the field of power batteries is close to 18,000 tons, of which the ternary lithium battery The dosage is 13,000 tons, and the amount of lithium iron phosphate battery is 0.48 million tons. Its conservative estimates that HNBR in 2025 is close to 18,000 tons of materials in the positive adhesion.

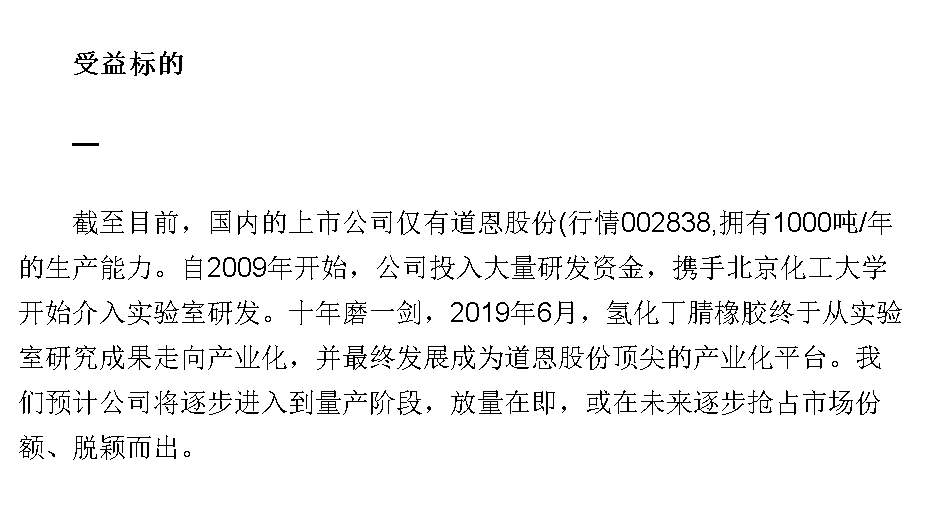

"Daily Economic News" reporter noticed that the beneficiary label launched by the research report was only one company -Doun.

It is worth mentioning that this is not the first time that open source securities are optimistic about hydrogenation Ding (HNBR). As early as June 29, open source securities issued a deep research report "Ding Ding-Ding Ding-Rubber Section Crown Pearl, entering the lithium power track, market potential is ready", and the beneficiary target launched is only Daoban shares.

At that time, the reason proposed by open source securities was "combined with the current thesis research results, HNBR can be applied to the battery adhesive, decentrals, and solid electrolytes in the lithium battery field. Other application areas are researching and breakthrough."

It is worth mentioning that when the open source securities fiercely pushed the hydrogenation of Ding Ding (HNBR), the stock price of Daen's shares was at a high level after frying.

From June 23rd to June 28th, Doun shares ushered in four consecutive daily limit.

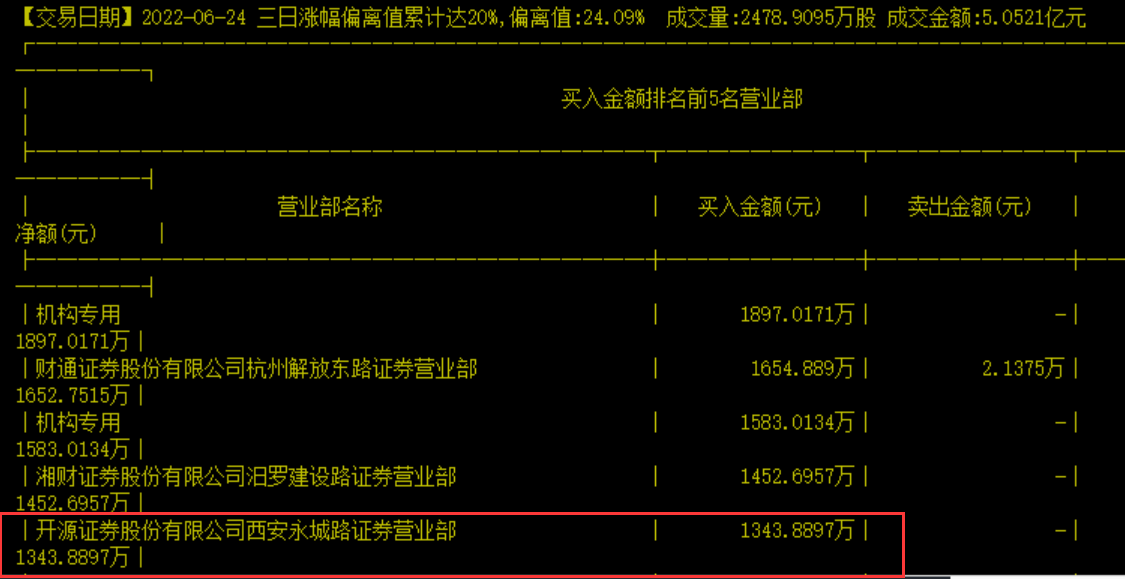

In this wave, the institution is the main force to buy. Among the five major buying seats on June 24, there were two institutions. On July 1, there were three institutions.

Especially on June 24th, the Securities Sales Department of Xi'an Yongcheng Road, Xi'an Yongcheng Road, to buy 13.4389 million yuan. On the same day, Daen's shares were still "one" daily limit, and the turnover of the day was only 33.63 million yuan.

Picture source: transaction software screenshot

Corporate Materials Enterprise: Unscailorical alternative effect

"Daily Economic News" reporter found that the reason for the waves of Dorin's shares came from institutional investigations on June 22. At that time, Wang Youqing, deputy general manager and secretary of the board of directors, and Xing Hailin, general manager of Dounte Bullet Company, was investigated. There were 100 institutions such as open source securities in the research list of group agencies.

The investigation time of the institution is also after the market, that is, 20 pm.

At that time, in the investigation of the institution, Doun's shares mentioned that "the company is concerned about (hydrogenated Ding 腈) may be applied to the field of new energy batteries, and the company will continue to pay attention."

According to the introduction of Daen's shares at that time, Ding Dingyu was jointly developed by Daen and Beijing University of Chemical Technology. In 1992, Beihua and South Emperor Company jointly developed. Around 2010, the base was developed as the only normal national defense production platform in China.

The company mentioned that the hydrogenation of 3,000 tons of capacity was planned, and the current 1,000 -ton production capacity was currently 1,000 tons. Among the major domestic and foreign manufacturers, foreign countries are Alang New Science and Ryon, and Daen and Zannan Technology (1,000 tons of capacity) in China. The global total production capacity is about 22,000 tons. The import of foreign products is not only high in China, but the retail market can reach 400 yuan/kg.

It is worth mentioning that the research report of open source securities also quoted Zannan Technology's point of view.

Since the hydrogenation is so concerned, has it been mass -produced or used on the new energy battery?

Because of the positive adhesives, the reporter also called the two positive pole materials.

"As far as I know, I have not used this material." The director of the listed company of Yizhiji Materials told reporters that after communicating with the company's technical director, he said that he was not sure of the alternative of the above research report.In fact, there is no advantage. "Another positive material company also said," I don't understand this material. "It should be noted that the research report of open source securities claims to quote Tianea Technology (SH688116, the stock price is 157.03 yuan, and the market value is 36.47 billion yuan)He Germany (SZ300769, the stock price of 378.25 yuan, a total market value of 65.72 billion yuan) announced content.

However, the reporter reviewed the annual reports of the two companies in 2021, and neither mentioned the hydrogenation.

The round of Doun's stock stir also caused the spread of concept stocks. Some investors asked the hydrogenation of Ding Ding in the interactive platform of Shengbang (SZ301233, a stock price of 46.43 yuan, and a market value of 2.39 billion yuan).

Daily Economic News

- END -

He was taken away by the police, and the woman on the opposite side was stunned.

The man was caught by monitoring when the crime was committed.The Yangtze River Da...

Interview with Peng Jiaxue, Secretary of the Ningbo Municipal Party Committee: Accelerate the construction of a modern coastal metropolis strive to go at the forefront of the "two advances"

Zhejiang News Client reporter Xie Yan He Yuankai