The State Administration of Taxation announced a group of fraudulent tax refund, export tax refund cases and tax personnel violations of laws and disciplinary violations

Author:China Economic Network Time:2022.07.22

China Economic Net, Beijing, July 22, on July 22, the State Administration of Taxation announced five cases of fraudulent tax refund cases, including three groups of fraudulent tax refund cases, and two large cases of fraudulent tax refund. At the same time, two cases of fraudulent export tax refund, one tax personnel were suspected of being filed for cases in case of disciplinary violations in the implementation of tax refund policies, and 1 tax personnel were investigated and punished in the implementation of the export tax refund policy.

I. Guizhou investigated and dealt with a false invoicing gang to defraud for retention tax refund cases. Recently, the tax audit department of Guizhou Province, in accordance with the analysis of clues, jointly investigated and dealt with the public security economic investigation, the People's Bank of China and other departments to investigate and deal with the cases of deductible tax refund cases across regions. After investigation, the gang adopted a "separation of tickets" to open a total of 5.2 billion yuan in taxation for VAT invoices. The tax audit department has verified and recovered the gang downstream enterprise through the virtual invoicing to increase the tax refund of more than 1,200 million yuan in tax refund, and successfully blocked more than 1,300 million yuan in tax refundable tax refund applied for by the ticket company. In -depth inspections of enterprises with invoicing and fraudulent tax refund. At present, the public security investigation department has arrested 15 suspects.

2. Liaoning investigated and dealt with a case of farewell gangs to defraud for tax refund cases. Recently, the tax audit department of Shenyang City, based on analysis, and jointly investigated and dealt with the public security economic investigation department in accordance with the law to investigate and discount tax refund cases. After investigation, the gang controlled a number of empty shell companies for obtaining a total of 1.542 billion yuan in taxes for virtual VAT invoices. 1491 billion yuan. The tax audit department has successfully blocked the gang to defraud more than 6 million yuan in tax refund, which is conducting in -depth inspections on the illegal facts of suspected fraudulent tax refund tax refund for downstream companies. At present, the public security investigation department has arrested 13 suspects.

3. Ningxia investigated and dealt with a case of virtual voting gangs fraudulently to retain tax refund cases. Recently, the tax audit department of the Ningxia Hui Autonomous Region has investigated and dealt with the public security economic investigation department to investigate and discount tax refund cases in accordance with the law according to the analysis clues. After investigation, the gang controlled a number of enterprises and had a total of 393 million yuan in taxation for the dedicated VAT invoice. The tax inspection department has verified the illegal facts of downstream companies to defraud the retaining tax refund of 1.68 million yuan, and it is conducting in -depth inspections on other related companies suspected of using virtual invoicing to deceive tax refunds. At present, the case has been transferred to the public security and investigation department to investigate criminal responsibility of relevant personnel in accordance with the law.

4. Guangdong investigated and dealt with a business enterprise fraudulent tax refund case. Recently, the Foshan Taxation Bureau's Inspection Bureau analyzed clues based on tax big data, investigating and punishing Foshan Shunde District Xuelong Trading Co., Ltd. to deceive the retained tax refund case. After investigation, the company fraudulent tax refund of 2.608 million yuan by hiding sales revenue, reducing output taxes, and false declarations of false declarations. The tax audit department recovered the retained tax refund that the company was deceived in accordance with the law, and was fined 1 times in accordance with the relevant provisions of the "Administrative Penalty Law of the People's Republic of China" and "The Taxation Management Law of the People's Republic of China".

V. Tianjin investigating and dealing with a technical service company to deceive the tax refund case. Recently, the Tianjin Taxation Bureau Audit Bureau analyzed clues based on tax big data and investigated and dealt with a case of retaining tax refund cases in Tianjin's technology Co., Ltd. in accordance with the law. After investigation, the company scrambled the tax refund of 1.0233 million yuan by obtaining a false value -added tax invoice in the virtual value -added tax invoices and the false declaration of false declarations. The tax audit department recovered the retained tax refund that the company was deceived in accordance with the law, and was punished with a fine of 1 times the fines of the "People's Republic of China Administrative Penalty Law" and the relevant provisions of the Taxation Management Law of the People's Republic of China. At present, the tax department has transferred the clue to the public security organs.

6. Hebei investigated and dealt with the export tax refund case together. Recently, Cangzhou Taxation Bureau found that there were abnormalities in exported goods from Singing County in accordance with Tianjin Customs's suspected fraudulent export tax refund cases. The taxation department quickly set up joint investigations with public security, customs, and People's Bank of China to conduct in -depth investigations in accordance with the law. They successfully killed 3 tax fraud gangs and 1 black intermediary, arrested 8 suspects, and officially arrested 1 person. After investigation, the gang obtained a virtual VAT invoice, colluding with the "DIP" company to obtain customs declaration documents illegally obtained the export tax refund, involving 42 export companies, and suspected of fraudulent export tax refund of RMB 51.714 million. At present, the public security organs are further investigating and will investigate criminal responsibility of relevant personnel in accordance with the law.

7. Qingdao investigated and dealt with a case of tax refund. Recently, based on the analysis of the tax big data and customs export data of the Qingdao City Taxation Bureau, the Qingdao City Taxation Bureau found that some enterprises exported goods were abnormal. The taxation department quickly set up a joint investigation with the public security, customs, and People's Bank of China to conduct in -depth investigations in accordance with the law, and successfully cracked down three tax fraud gangs. After investigation, these gangs acquired a special VAT invoice through fictional agricultural products acquisition business, colluding with "distribution" companies illegally obtained customs declaration documents, and fraudulent export tax refund, involving 7 export enterprises such as Qingdao Agricultural Development Co., Ltd., suspected of fraudulent export tax refund 10723 10,000 yuan. At present, the procuratorial organs have filed a public prosecution, and the case is under further trial.

8. A tax personnel from Inner Mongolia are suspected of accepting the arrangements of criminals and other arrangements and saying hello to say that they are facilitated for the case for their voting votes for fraudulent tax refund. Recently, when the Taxation Bureau of Inner Mongolia Autonomous Region conducted a dual investigation on a case of deductible tax refund cases, it was found that Gao Moumou, deputy director of the tax bureaus of Ordos City, was suspected of receiving criminal banquets and other arrangements. During the business increase, the tax personnel said hello to relevant tax personnel, and provided convenience for their votes to invoiced, which led to the deduction tax refund of downstream tickets to be incorporated by the false income tax. At present, the local tax department's disciplinary inspection agency has filed a case for Gao Mou, and will be held accountable in accordance with regulations, discipline, law. Nine, a tax personnel in Jiangsu colluded with illegal export tax refund internally and outside the Jiangsu personnel. The disciplinary inspection agency of the Jiangsu Provincial Taxation Bureau and the local disciplinary committee jointly investigated and dealt with the case of illegal export tax refund cases internally and outside the tax personnel. After investigation, Jingmou, a tax cadre of a tax bureau in Nanjing, used the convenience of his work in export tax refund management. Du, with a company's legal person, illegally embezzled the export tax refund and made a profit from it. At present, Jingmou has been expelled from the party, was expelled from public office, and was transferred to the judicial organs to investigate its criminal responsibility in accordance with the law.

In the next step, the taxation department will conscientiously implement the decision -making and deployment of the Party Central Committee and the State Council on cracking down on fraudulent tax refund and export tax refund work, give play to the role of the six departments' joint crackdown mechanisms, and fought on the criminal crimes of retained tax refund and export tax refund, and they will fight. Severe punishment of non -loan, especially focusing on illegal crimes such as gang -style, cross -region, false issuance of virtual invoices, and fraudulent tax refund and export tax refund. The strong signal of export tax refund illegal criminal behavior forms an overwhelming trend of cracking down on tax refund and export tax refund. At the same time, serious investigation and punishment of tax personnel lost their jobs, especially collusion between internal and external collusion, cheating fraud, retained tax refund and export tax refund, and other violations of discipline and violations. The escort retain tax refund and export tax refund policy has been settled.

- END -

Farewell to the summer heat!Live in the ideal summer of Wenchuan, blow "natural air conditioner"!

hot! hot! hot!The weather is extremely hot this yearEach place has entered the coo...

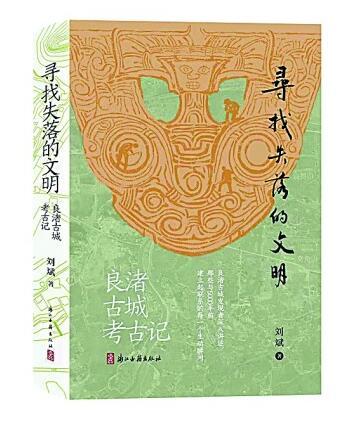

Interpretation of Liangzhu Civilization's Rise and Decreased Key

Looking for Lost Civilization Liu Bin is the Zhejiang ancient book publishing hous...