Hard -to -travel science and technology board help "hard technology" enterprises step by step

Author:Securities daily Time:2022.07.22

Our Market Research Department

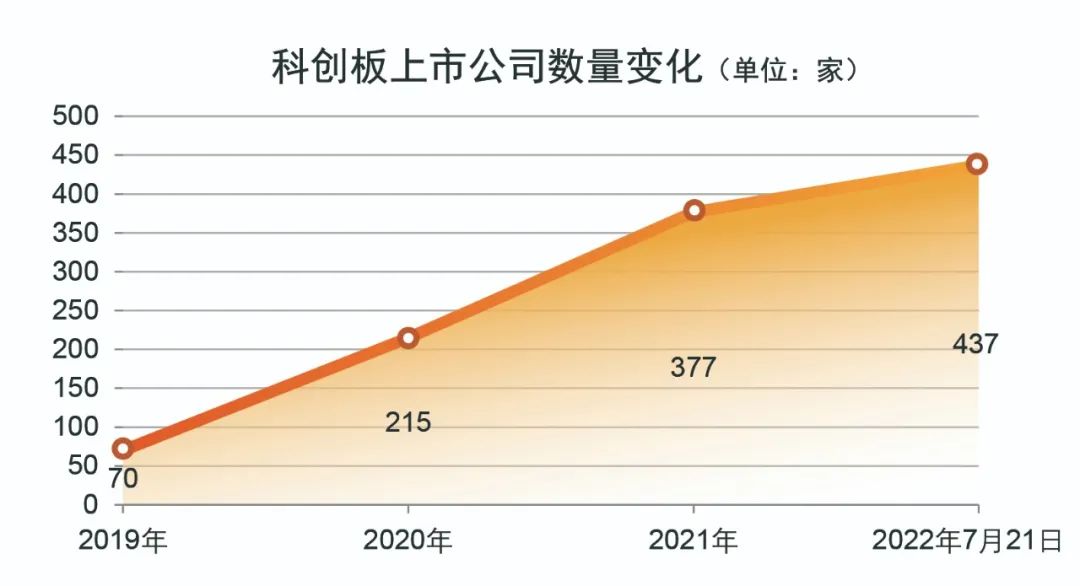

From the first batch of 25 companies listed on July 22, 2019, and 437 companies on July 21, 2022, with the support of various policies, the scale of listed companies in science and technology board continued to expand, and the "hard technology" became increasingly apparent. Essence In the past three years, the science and technology board has continuously promoted the gathering of financial resources in the field of "hard technology", helping science and technology enterprises to accelerate innovation, enhance core competitiveness, accumulate technological advantages for Chinese scientific and technological innovation, and promote industrial upgrading.

436 listed companies have a total fundraising of 634.538 billion yuan

Three years have moved forward, and teams of science and technology board listed companies have continued to expand. As of July 21, 2022, the listed company of Science and Technology Board has increased from the first batch of 25 to 437. Among them, on May 25, 2022, the "first share of the turn" was traded on the science and technology board. From July 22nd, 2019 to July 21, 2022, the total raised funds raised by 436 companies listed on the science and technology board of Science and Technology Board reached 634.538 billion yuan.

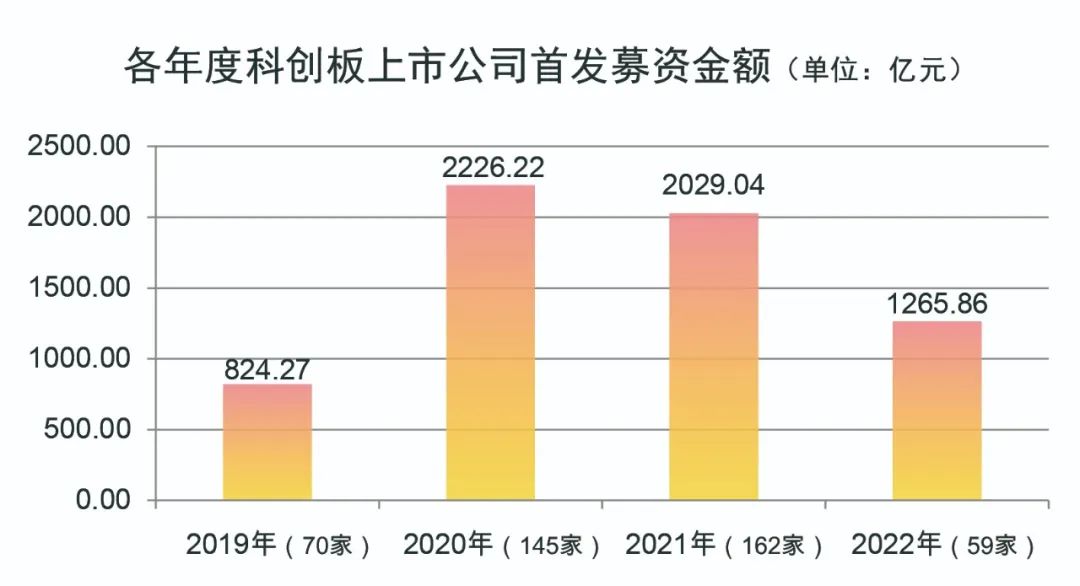

Specifically, on July 22, 2019, the first batch of 25 companies in the science and technology board was officially listed. As of the end of 2019, the number of listed companies listed in science and technology board reached 70, with a total of 82.427 billion yuan raised funds. As of 2020 At the end of the year, the number of listed companies in science and technology boards increased to 215, and the total amount of the total raised funds raised by 145 companies listed in 2020 was 222.622 billion yuan. As of the end of 2021, the number of listed companies in science and technology board rose to 377. The total amount raised by the home company was 202.904 billion yuan.

It is worth noting that as of July 21, 2022, the total number of listed companies listed in science and technology board has reached 437. Since 2022, 59 companies listed on the market have initiated the amount of funds raised by 126.586 billion yuan (excluding the Code of Code of the Turn on the board), which For the first time, it exceeded the Shanghai and Shenzhen Main Board (the amount raised by the first listed new shares was 109.893 billion yuan), ranking first, and the number of IPOs and first raised funds for science and technology boards accounted for 31.09%and 37.85%of all A shares, respectively. As the number of companies declared accepted exceeded 800, the science and technology board has become the main sector of the "hard technology" enterprise connected by the A -share market. Among them, the largest amount of funds raised is SMIC (53.23 billion yuan, after exercising the green shoe mechanism). The amount of funds raised by the three companies including Baiji Shenzhou, China Tong, and Jingke Energy also exceeded 100 billion yuan.

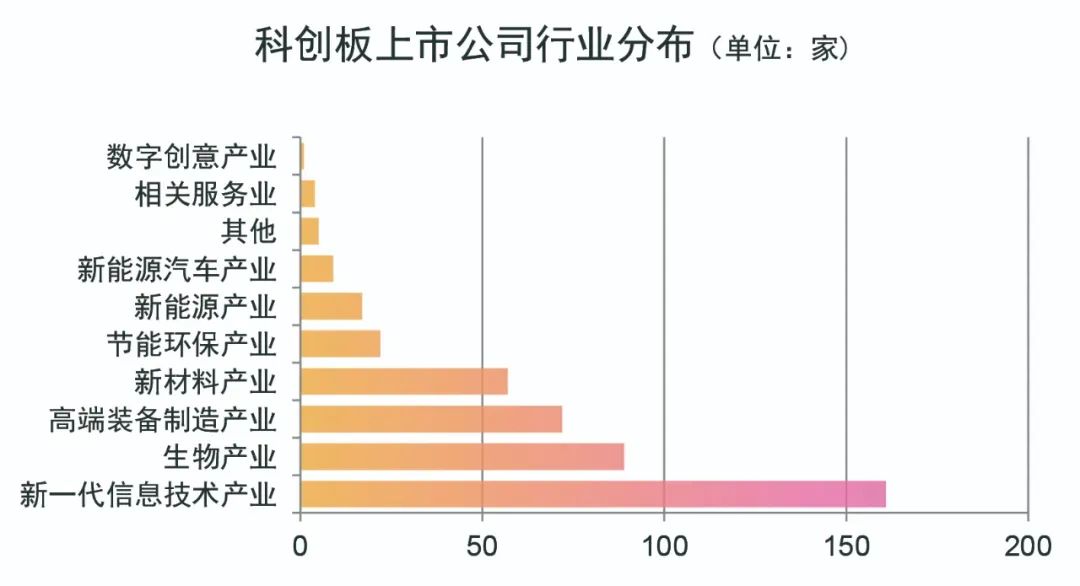

After three years of tempering, the "hard technology" of the science and technology board has been further appeared. From the perspective of the industry, the above 437 science and innovation board listed companies are concentrated in the four strategic emerging industries, including the new generation of information technology industry, biological industry, high -end equipment manufacturing industry, and new material industry. The number of related companies is 161 and 89, respectively. , 72, 57, accounting for 36.84%, 20.37%, 16.48%, and 13.04%, respectively.

It is worth noting that the stock price of most of the new shares of science and technology boards performed well on the first day of listing. According to data from the Shanghai Stock Exchange, 399 of the 437 science and technology board stocks rose on the first day of listing, accounting for more than 90 %. Among them, 242 stocks listed on the first day of the stock price increased by more than 100%, and Nawei Technology ranked first with 1273.98%, followed by Guobun quantum. The stock price increased by 923.91%on the first day of listing; The stock price fell on the first day, and 27 stocks fell more than 10%. As of the closing of July 21, 113 stock prices were in a state of breaking, accounting for 25.86%.

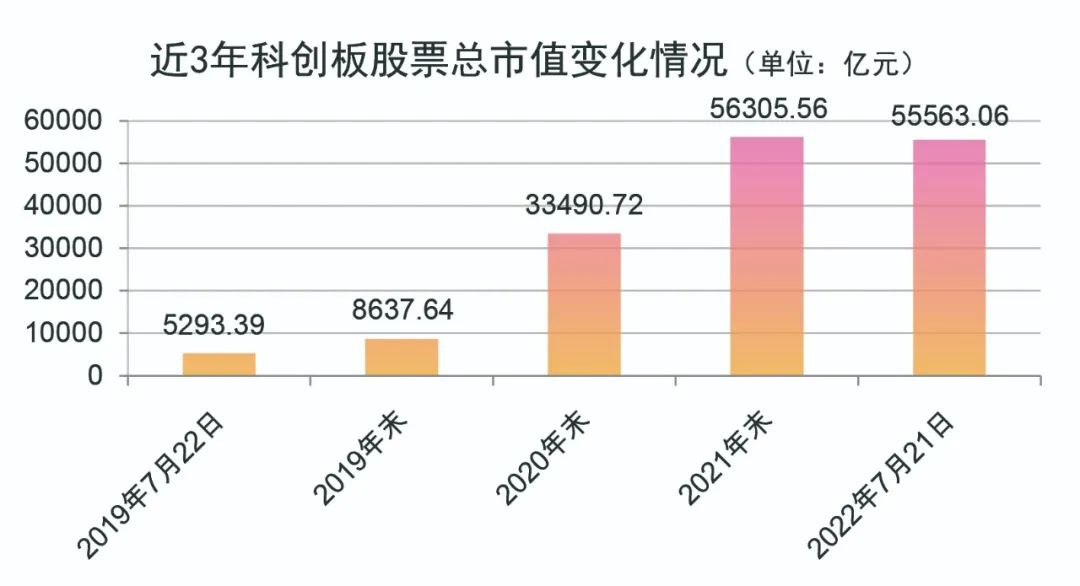

The total market value of 437 science and innovation board listed companies is as high as 5.56 trillion yuan

After three years of development, the market value of science and technology board has been very considerable. On July 22, 2019, the total market value of the first 25 companies listed on the list was only 529.339 billion yuan; at the end of 2019, the total market value of 70 science and innovation board listed companies was 863.764 billion yuan; The market value rose to 3349.072 billion yuan; at the end of 2021, the total market value of 377 science and technology board listed companies reached 5630.556 billion yuan.

At present (as of July 21), the number of listed companies in science and technology innovation board has reached 437, with a total market value of 5.56 trillion yuan. Among them, the total market value of 153 companies exceeds 10 billion yuan, including Tianhe Light Energy, Jingke Energy, and Crystal Energy, and Crystal Energy, and Crystal Energy, and Crystal Energy, and Crystal Energy, and Crystal Energy, and Crystal Energy. Daquan Energy is waiting for a market value of 100 billion yuan.

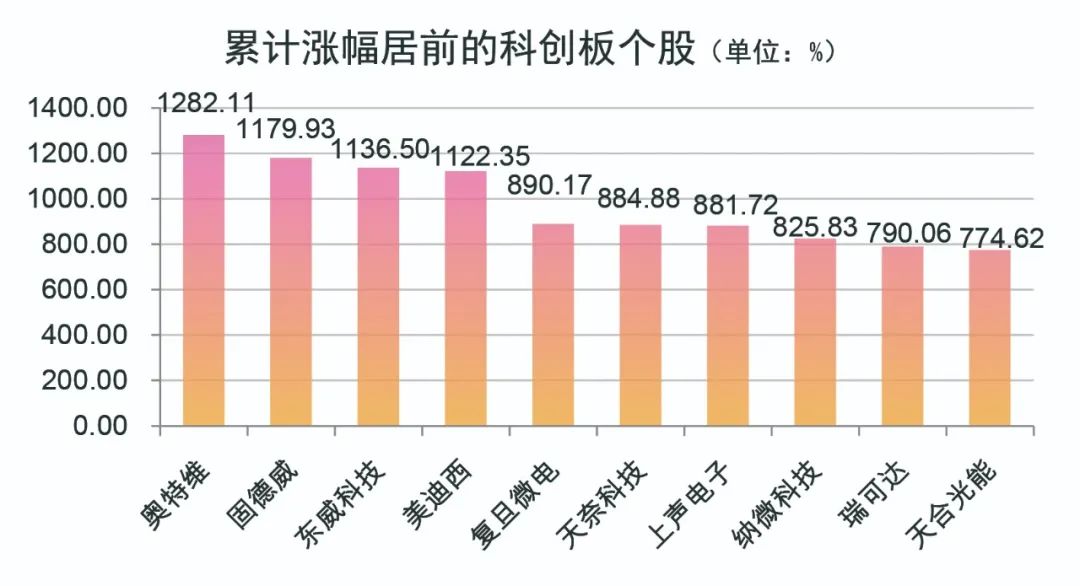

On the whole, the stock price of most science and technology board companies has increased considerable. Among them, the latest stock price of 23 stocks increased by more than 500%from the issue price. The latest stock price of 4 stocks such as Ultra, Gudewei, Dongwei Technology, and Midicei increased more than 10 times higher than the issue price.

With the help of the capital market, the performance growth of listed companies in the science and technology board has been significantly, and the performance center has shifted. However, since this year, the A -share market has increased, and the overall valuation level of the current science and technology board has dropped to low, and the investment value is prominent.

As of the closing of July 21, 2022, the overall average price -earnings ratio of the science and technology board was 46.33 times, which was equivalent to about half of the first batch of 25 science and innovation board companies' stocks on July 22, 2019.

In 2021, the top ten companies in R & D investment exceeded 1.4 billion yuan

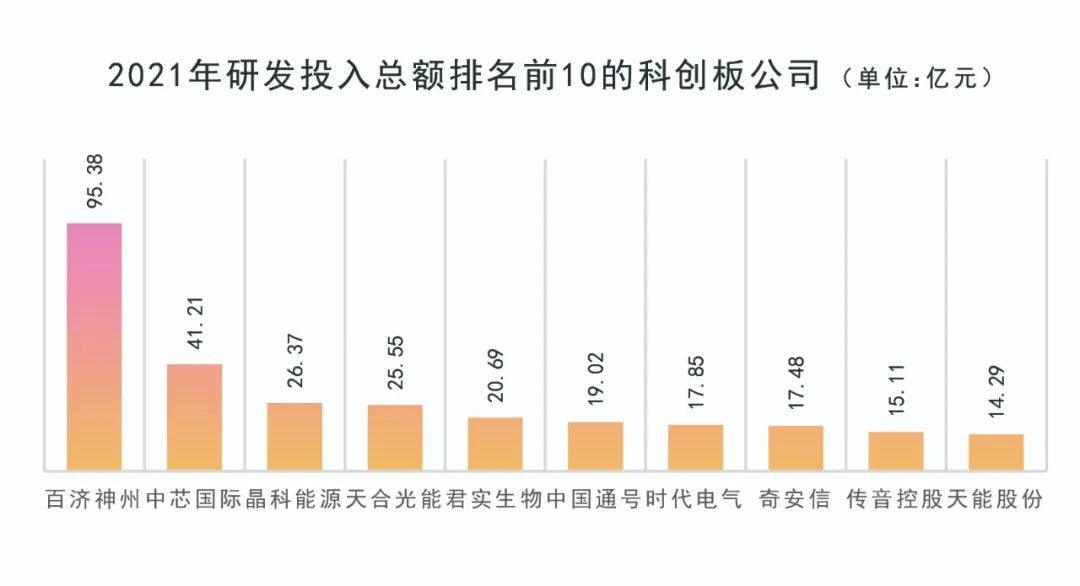

As of July 21, 2022, there were 437 listed companies in science and technology boards. In 2019, 2020, and 2021, the total R & D investment of the above companies was 53.563 billion yuan, 68.151 billion yuan, and 89.175 billion yuan. Total R & D investment in 2021 increased by 66.48%compared with 2019. From the perspective of R & D investment amount, 10 companies including Baiji Shenzhou, SMIC, Jingke Energy, Tianhe Light Energy, Junshi Bio, China Tong, Times Electric, Qi Anxin, Chuanyin Holdings, Tianneng Holdings, Tianneng Holdings, Tianneng The total annual investment in investment ranks among the top ten, both of which exceeded 1.4 billion yuan.

From the perspective of the number of R & D personnel, in 2021, the number of R & D personnel of 56 science and innovation board listed companies accounted for 50%or more, and the number of R & D personnel of 11 companies accounted for more than 80%.

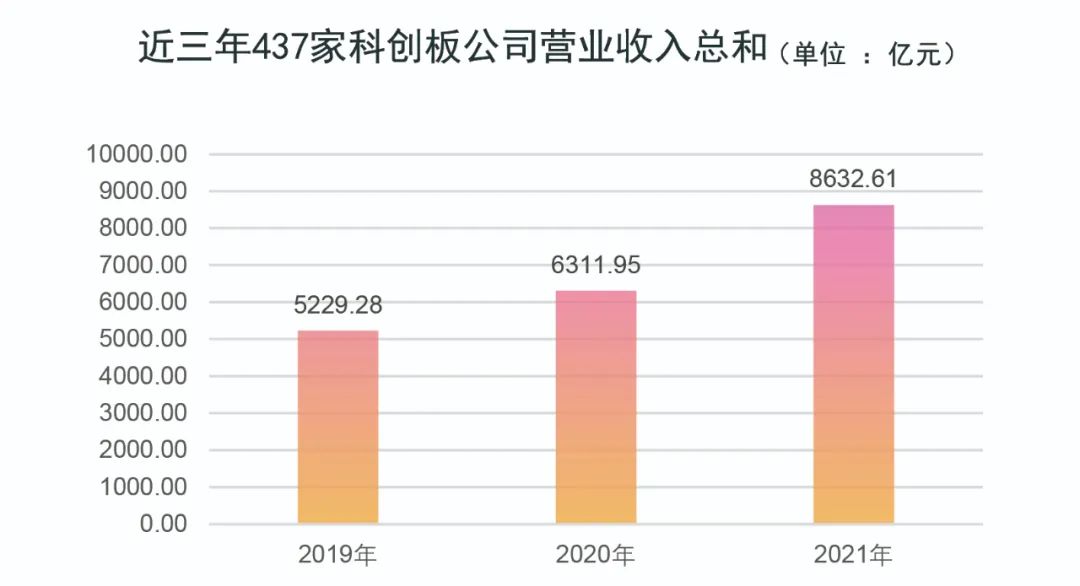

45 companies increased by more than 100% year -on -year revenue in 2021

In the past three years, listed companies in science and technology board have continued to show high growth. From the perspective of operating income in the past three years, the total operating income of 437 listed companies in the 437 listed companies in 2019, 2020, and 2021 was 522.928 billion yuan, 6311.95 billion yuan, and 863.261 billion yuan. Among them, the total operating income of 2021 in 2021 65.08%over 2019. Specifically, 389 companies operating income increased year -on -year last year, accounting for nearly 90%, and 45 companies operating income of more than 100%last year.

437 companies return to their mother's net profit and continuous growth

Judging from the net profit of the 437th science and innovation board listed companies in the past three years, the total net profit of the above -mentioned companies in 2019, 2020, and 2021 was 33.593 billion yuan, 55.304 billion yuan, and 98.315 billion yuan, respectively, of which The total net profit of the mother -in -law in 2021 increased by 192.67%compared with 2019. The reporter sorted out and found that 304 companies reached a year -on -year increase in net profit at 2021, accounting for nearly 70%, and the net profit of 65 companies in 2021 increased by more than 100%year -on -year.

As of the end of the first quarter, the market value of 330 stocks of the institution had a market value of 240.233 billion yuan

According to data from the official website of the Shanghai Stock Exchange, as of the end of 2021, the number of professional institutional investors of the Science and Technology Board Company was close to 50,000, a year -on -year increase of 63%; the proportion of professional institutional investors accounted for nearly 46%. More than 40 %.

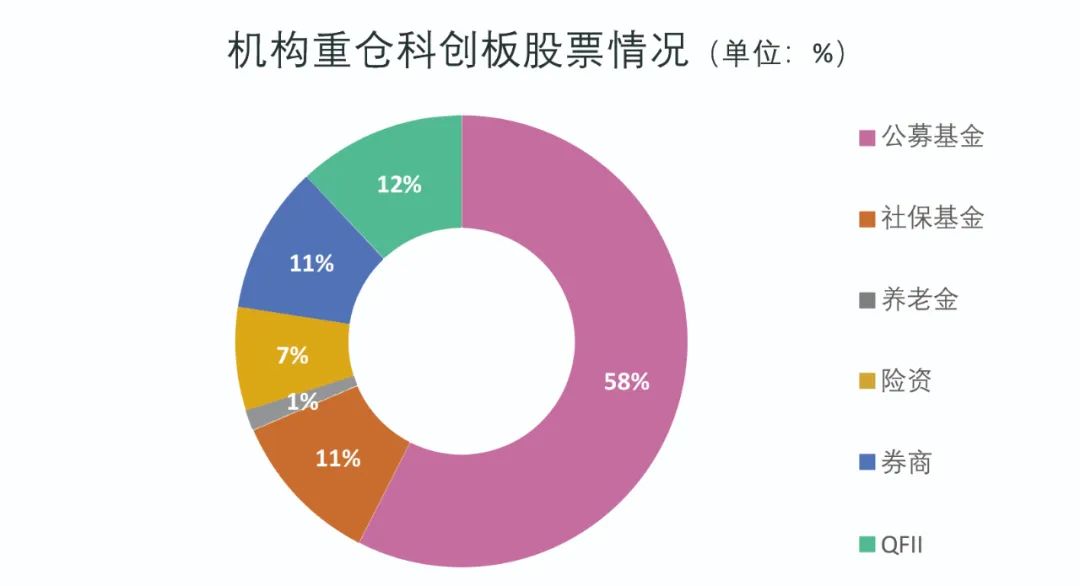

Judging from the latest positioning data, Oriental Fortune CHOICE data shows that as of the end of the first quarter of 2022, the number of public funds, social security funds, pensions, insurance capitals, brokers, QFII and other institutions reached 330 It was 240.233 billion yuan. Among them, the number of heavy stocks of public funds reached 311, with a total market value of 208.448 billion yuan; the number of heavy stocks of social security funds was 60, with a total market value of 9.398 billion yuan. The market value of the shares is 649 million yuan; the number of stocks of heavy warehouses is 40, and the total market value of the shareholding is 2.732 billion yuan; the number of stocks of heavy warehouses of securities firms is 57, with a total market value of 2.619 billion yuan; The total market value of 16.388 billion yuan.

ROE median is higher than the entire market 2.88 percentage points

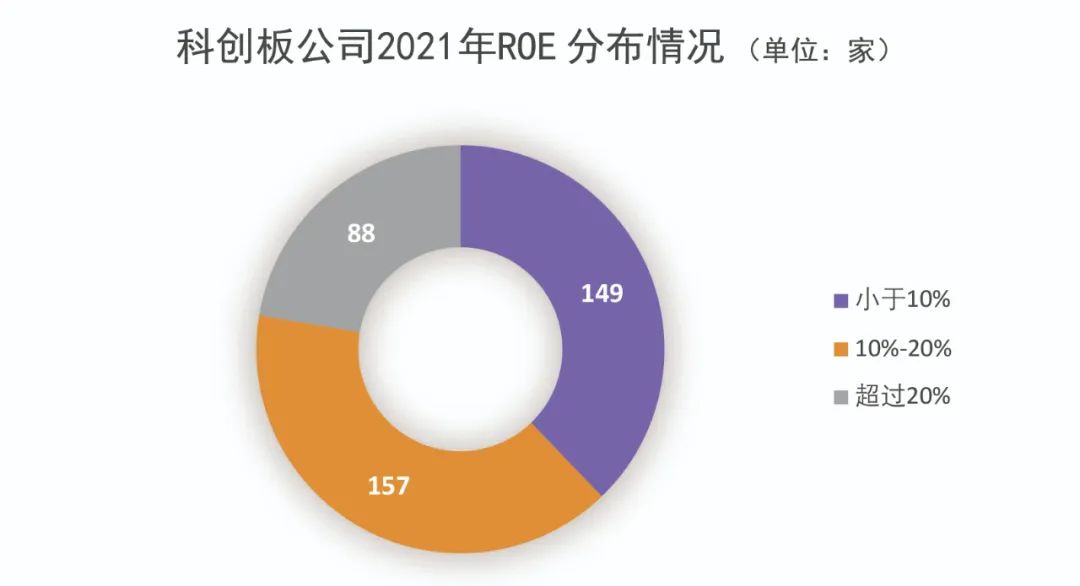

From the perspective of profitability, the science and technology board company also performed well. Data from Flush Shun shows that the median of the 437 Science and Technology Board Company in 2021 was 11.27%, which was 2.88 percentage points higher than the median (8.39%) of all A -share companies (8.39%). After eliminating the company's yields negative, among 394 companies, the number of companies with a net asset yield of 10%to 20%in 2021 is 157. It is worth mentioning that 88 companies have exceeded 20%of their net assets last year, showing strong profitability.

- END -

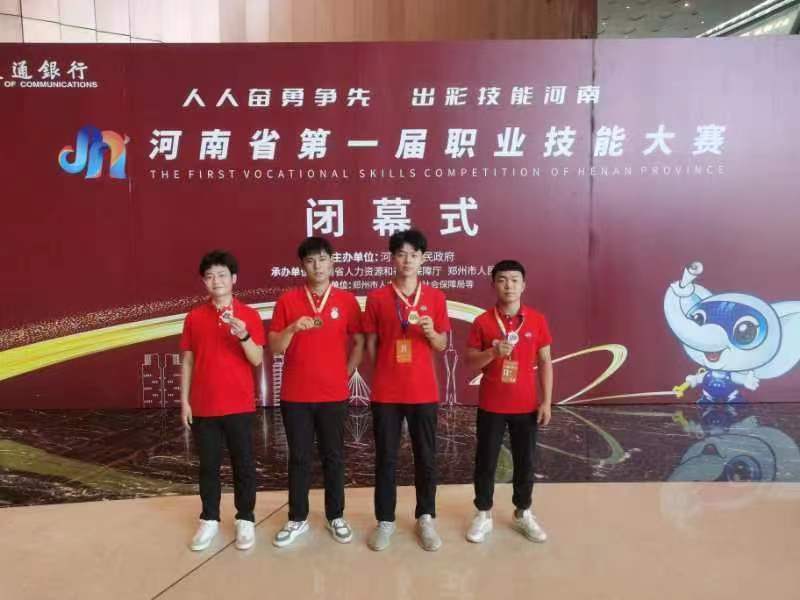

Luohe picked gold and silver in the first vocational skills contest of the province

From June 25th to 28th, the first vocational skills contest of Henan Province was ...

River water retreats, Hankou River Beach is busy and dredging

Jimu Journalist Li HuiRecently, the water level of Wuhan Yangtze River has continu...