This type of ETF is hot, the most doubling one day, 4.5 times a week!

Author:Costrit Finance Time:2022.07.23

On July 22, the 1,000 -stock index futures and stock index options were officially launched. Not only did it bring fire to the release of the CSI 1000ETF new fund product, the hot reproduction of "sold out one day". At the same time, the CSI 1000ETF, which has been listed, has also welcomed a large amount of funds. Among them, the Southern CSI 1000ETF appeared nearly 1.7 billion net purchases in one trading day, with a single -day share of 40%; Huaxia CSI 1000ETF appeared nearly 1.2 billion net purchases in just one trading day. It has been over 4.5 times in it.

CSI 1000ETF share surge

The highest one -day double week increases by 4.5 times

Driven by the approval of the 1,000 -stock index futures and stock index options of CSI, the CSI 1,000ETF fund variety has also received unprecedented attention.

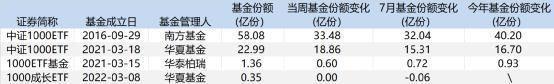

According to Wind statistics, as of the week of July 22, the Southern Fund's 1,000ETF single -week fund share increased by 3.348 billion, to 5.808 billion copies, a weekly increase of 1.36 times. It is worth mentioning that on July 22, the CSI 1,000 stock index futures and stock index options were listed on July, the ETF share increased by 1.656 billion, and the increase in the share of only one trading day was close to 40%.

1000ETF, a subsidiary of Huaxia Fund, is also favored by funds. As of July 22, a single -week fund share increased by 1.886 billion to 2.299 billion, and the fund share increased by 4.57 times in just one week. It is worth mentioning that on July 22, the ETF share increased by 1.190 billion yuan, more directly over the previous trading day.

In addition, Huatai Berry's 1000ETF's single -week share increased by 60 million copies to 136 million copies, with a single weekly increase of nearly 80 %. Among them, on July 22, the increase of 0.51 billion copies, a single -day share of 60 %.

However, among the CSI 1,000 related ETFs that have been listed on the market, the ETF share of the China Stock Exchange 1000 growth innovation strategy has not changed significantly. When the fund was listed in March this year, the fund share of more than 300 million copies, and the latest share is currently less than 35 million.

It is worth mentioning that on July 22, the 1,000 -stock index futures and stock index options of China Securities were officially listed, and the fund industry also ushered in the grand occasion of 4 CSI 1000ETFs. —— Yi Fangda, Guangfa, Faith, Huitianfu. All four products have set up the upper limit of 8 billion yuan. On the evening of the 22nd, the rich foundation funds announced that the Rich Central Certificate 1000ETF ended early. It can be seen that the market pays great attention to such products.

Small and medium -sized disk style dominant

CSI 1000 has performed in the past year

Since July, the A -share market has entered the stage of shock adjustment. Among them, in the past week, the mainstream market indexes such as the Shanghai Stock Exchange Index, the Shenzhen Stock Exchange Index and the GEM index rose, and the weekly increased increases reached 1.3%, 2.88%, and 2.62%, respectively.

However, the different style indexes in the broad -foundation index performed a lot last week. Among them, the Shanghai 50 index rose 0.32%weekly, the CSI 300 index fell 0.24%weekly, the CSI 500 index rose 1.50%, the CSI 1,000 index increased the weekly increase of the weekly increase It reaches 2.65%.

It is worth mentioning that since last year, the small and medium -sized style style has taken advantage of, and the size index of the small plate has also performed first.

Among them, as of July 22, the cumulative decline in the SSE small plate this year was -8.92%, which performed the best in each major scale index. From the perspective of a year's dimension, the accumulated decline in the index was 1.36%, and it also led other other than other other. Scale index. At the same time, the CSI 1,000 also showed ahead, and the cumulative decline this year was 12.18%, which was better than the Shanghai Stock Exchange 50, CSI 500, CSI 300 and other indexes. In the past year, the CSI 1,000 has fallen 3.43%, second only to the SSE small disk, innovation index, and Shanghai Stock Exchange 380 index.

Insiders believe that the target index of CSI 1000ETF tracking is the CSI 1000 index, and the CSI 1000 index selects 1,000 securities with small and liquidity as index samples with small size and good liquidity. Index 500 and other indexes are complementary. After the listing of 1,000 stock indexes and options of CSI, CSI 1000ETF is expected to become another important broad -foundation variety after the Shanghai Stock Exchange 50ETF, CSI 300ETF, and CSI 500ETF.

However, some fund managers believe that the China Securities 1000 Index industry is balanced and the growth industry accounts for relatively high. As of mid -2022, the top three industries of the CPC 1,000 index are pharmaceutical, new, and basic chemicals, all of which are industries with strong growth. However, in view of the large number of small and medium -sized stocks and the risk of volatility, many fund companies are even difficult to completely cover. Individual investors can consider choosing passive index funds for a package of investment in small and medium -sized investors.

- END -

Wuhan people pay attention!From July 2nd, these bus stops near Chuhe Han Street and Zhongnan Hospital have been adjusted

Due to the maintenance and construction of Donghu Road (Xinglin West Road-Swan Roa...

Technology Xingnong is in the field

Original title: Science and Technology Xingnong is in the field -Qingdao Agricultu...