The honey bud APP will shut down, where is the road of trillions of maternal and infant games?

Author:China News Weekly Time:2022.07.24

It's already a stage of burning money and changing traffic

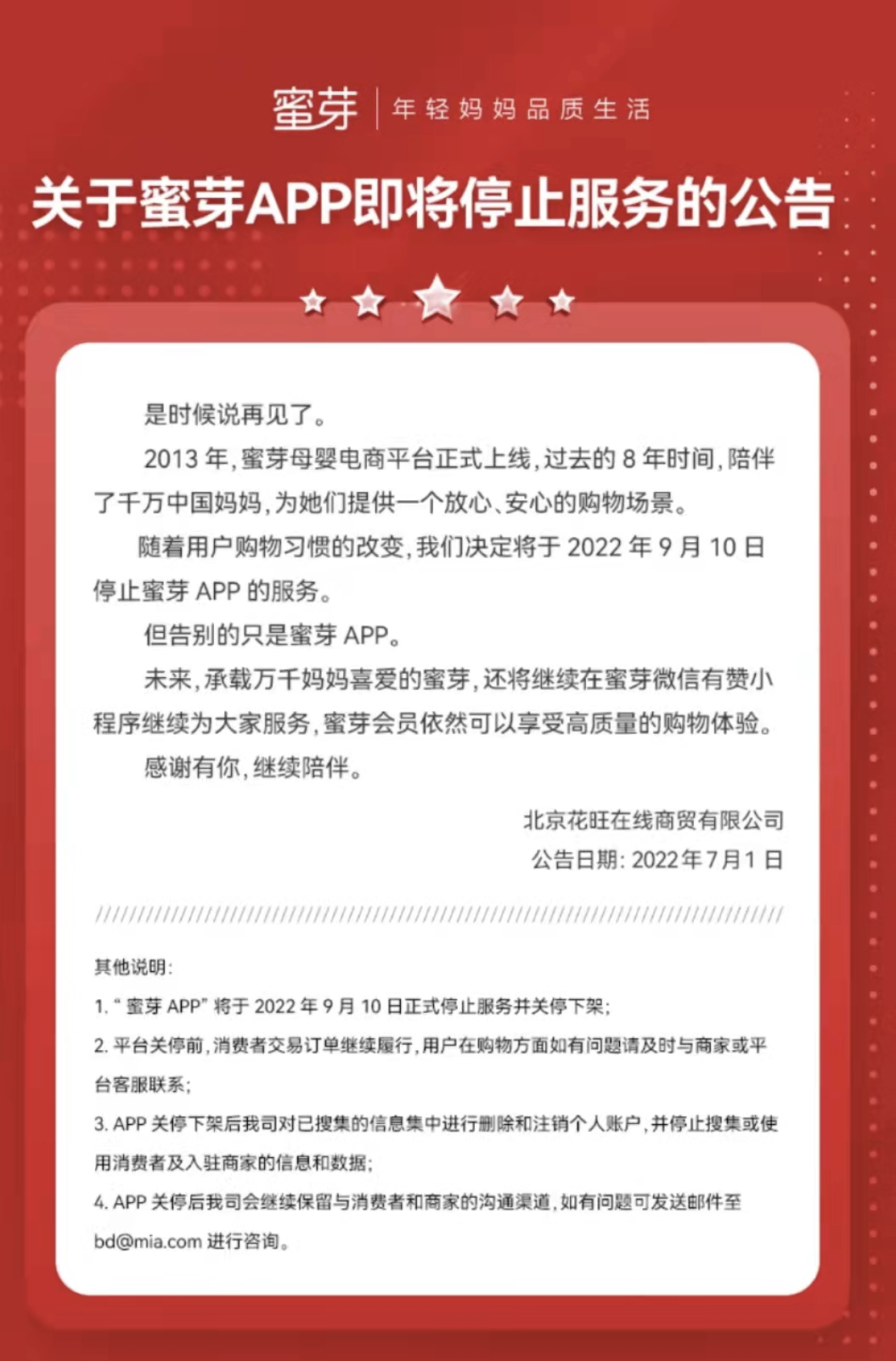

Recently, Zeng Hong's extremely maternal and infant e -commerce Milk buds issued an announcement saying that the honey bud APP will officially stop the service on September 10 and shut down the shelves. This means that the 8 -year -old star e -commerce platform has come to an end.

Including honey buds, there have been many popular websites and platforms on maternal and baby tracks, such as Beibei.com, baby tree, etc. They jointly exert their maternal and baby consumer markets and penetrate the development of online. However, the good times have not been long. In the past two years, the funds of the mother and baby e -commerce platform Babe.com have decreased, the mother and baby home run, and the lottery parent -child closure of the lotus. Not optimistic.

According to public data, the size of the mother and infant market in 2021 reached 4.8 trillion yuan, and the size of the Chinese maternal and infant market in 2022 was expected to reach 5.7 trillion yuan. In 2024, this number will exceed 7.6 trillion yuan. The scale of the mother and baby market is continuously expanded, but none of the maternal and baby e -commerce tracks have a bigger and stronger enterprise. What are the reasons behind this? Does the mother and baby e -commerce become a pseudo -proposition?

Relying on diapers to set off the price war in the mother and baby industry

11 years ago, Liu Nan gave birth to a daughter and became a full -time mother. Due to the anxiety of novice mothers, Liu Nan began to study various types of maternal and infant products at home and abroad, and gradually sought after by a group of mothers. At that time, the Taobao shop rose, and Liu Nan opened a Taobao shop called "Honey Baby Baby". In just two years, sales exceeded 30 million.

In 2013, Liu Nan met Xu Xiaoping, the founder of Zhenge Fund, and then received financing. Since then, he began to make a big cross -border e -commerce business. From 2014 to 2016, Mi Na received 5 rounds of financing, with a cumulative amount of financing exceeding 2 billion. Real -well -known investment institutions such as Shige Fund and Sequoia China saw the prospects of this maternal and baby vertical e -commerce platform and injected money for them. And confidence.

"Japanese diapers, in Japan's supermarkets, the price is 60 yuan, and it sold for 180 yuan in China. The increase rate reached three times. Why should Chinese consumers spend so much money to buy high -quality foreign products?" Initially, Liu Nan Position the honey bud to imported maternal and infant e -commerce. In order to open sales and win market share, Liu Nan fought a price war.

In March 2015, the honey bud with sufficient ammunition held a "diapers crazy seller". Through direct mining, bonded plus 100 million yuan subsidy, etc., the flower pants were reduced to 58 yuan. Previously, this diapers were on various platforms on various platforms. The price is more than 100 yuan. Liu Nan believes that the price war is a lesson that cannot be avoided in the Chinese e -commerce industry, and fights with competitors, and their bleeding speed is faster. She also said more: "Diab trousers must not only fight a price war, but also continue to fight. Do not make profits throughout the year in 2015."

At that time, it was the cross -border e -commerce air outage period, and the favorable two -child policy, the various factors affected the event and sold 30 million in 3 days. Subsequently, Mi Na also successfully obtained the authorization of many international maternal and infant brands, and Nestlé, Danone, Mead Johnson and others were listed. At that time, Honey Bud also launched two brands of Honey Bud Paradise and Rabbit Touta Mom, which began to expand online retail, offline experience and franchise, self -employed brand, and infant industry investment. As a darling of capital, the valuation of Mi Na was valued at tens of billions of market value in that year.

However, Mi Na has no progress after completing the E round of financing in 2016. In addition, cross -border e -commerce has experienced a difficult year in 2016. Affected by tax policies, the operating costs have increased significantly. Liu Nan, who has the concept of cross -border e -commerce concepts, began to talk about "cross -border e -commerce is a pseudo -proposition" in public. Essence At that time, Millet was tightly rumored, and the flow and transaction volume by the price were not stable. The outside world had doubts about the number and turnover of the users disclosed.

"In 2016, 500 stores were opened and found purely agent overseas brands. The price system is very transparent. It is difficult to make money from the store to the company. At that time Similarly, there is no differentiation, you can only fight the price war. In the end, the boss changed waves after the wave. "Mikibobo founder Zhao Zhe recalled the founding company and imported the import of maternal and infant retail.

Zhuang Shuai, the founder of Bailian Consulting, told China News Weekly that the honey buds were the products of the PC (computer) era to the mobile Internet era. The honey buds can develop in the form of an independent app. However, there are more difficulties in the subsequent development process, facing test costs and platform operations.

Doubt in pyramid schemes and fake sales, difficulty in the predicament

Beginning in 2016, honey buds tried to make many ways of hematopoietic, but in the development process, many problems encountered.

As early as the end of 2015, the Miya aimed offline, established a joint venture with the parent -child early education brand, and has since invested in the domestic children's player brand "Youyou Hall". Liu Nan announced that it would open up and offline, and opened more than 200 honey bud parks across the country, but it was almost not implemented in the future. Now there are few offline stores.

At that time, Mi Na launched the city partner franchise mechanism, which covers the qualifications of three hundred mature partners in the two to four lines. Each city is open to a place. No. However, many franchisees eventually lost their blood.

In 2017, social e -commerce wind rose, and Honey Bud launched PLUS members to drain through social e -commerce by self -use saving money and sharing money. Many users were used by the sisters around them at that time. Pay a member fee of 399 yuan. At that time, the member system was divided into PLUS members, platinum trainers and diamond service providers. Different levels corresponding to different performance indicators and new indicators. In addition, the company would also give relevant rewards. Paying and inviting friends became the main means of social e -commerce at that time, and the voice of "pulling people and engaging in MLM" made Honey buds in doubt. In addition, there are many complaints on the quality of honey buds. As early as 2014, Maclaren Quest Children's Trip, Hua Kao diapers, and Japanese Betta gem series bottle were questioned as fakes by consumers, and the products were inconsistent with the official website products. At that time, the honey bud response said that there was a problem with the product during transportation, but this did not convince users.

In 2017, the China Consumers Association named Mi Na.com for selling fakes, and some products also involved self -employment. According to public information, the operating entity of Mi Na Beijing Huawang Online Trading Co., Ltd. is punished by multiple punishment information, as well as multiple cases of "online shopping contract disputes". According to the "Big Data Report of Maternal and Baby E -commerce Complaints in 2021", the number of complaints for honey buds is the first list, and "false promotions, fakes, and sales awards are invalidated" as the main reason for complaints.

The transformation and self -rescue are essentially anxious about traffic. Many honey buds have revealed to the media that there are not many people left now, and the app daily life is not much.

From the perspective of the industry, the business of maternal and infant e -commerce is not easy to do. On the one hand, the traffic problem is on the one hand, and on the other hand, it is the problem of quality control.

Zhang Yi, CEO of Ai Media Consultation, pointed out that the platforms such as Honey Bud have been burning money by capital, and the cost of traffic is too high. Whether it is offline or to turn to social e -commerce, it is a change made by drainage, but the effect is not great. Zhao Zhe revealed that the highest peak of vertical e -commerce SKU reached 20,000, and the supply chain was very complicated. The TOC platform needs a lot of stocking for user experience, but the market has changed rapidly, and the risk of choosing products is too great. In this case, costs are difficult to control.

According to public reports, the size of the mother -to -child e -commerce market in 2021 was 1100 billion yuan, an increase of 9.99%year -on -year. In 2014, the year-on-year increase of 111.39%, and the growth rates in 2015-2020 were 98.34%, 38.9%, 27.29%, 20.37%, 18.67%, 9.79%, and the growth rate slowed down. It can be seen that the mother -to -child e -commerce market is still growing, but platforms such as honey buds are not good.

"Competition with opponents, it still depends on capital. However, at this time, it has been different in the past, and it has already passed the stage of burning money and changing traffic." Zhang Yi further analyzed.

What's wrong with vertical mother and baby e -commerce

Beibei.com was a maternal and infant e -commerce platform that was successful than Mi Na. The annual transaction value once reached 10 billion yuan. It was almost the same period as the same period as Mi Na. However, this model is also suspected of being suspected of MLM, and the quality of goods is also questioned. In August 2021, Beibei Group was suspected of breaking the capital chain, arrears of supplier accounts, and the founders disappeared. In addition, multiple maternal and infant e -commerce platforms are not developing smoothly.

Zhang Yi told China News Weekly that in recent years, the mother and infant market have changed very much. On the one hand, the head e -commerce platform has become more and more concentrated. These platforms have a strong traffic advantage, and they have cultivated a group of loyal consumers; another In terms of the rise of short video platforms, it has also been diverted through the live broadcast room and various promotional methods.

According to public data, the active penetration rate of the shopping channels for maternal and infant products is the TOP10 APP. The business platform is rarely mentioned. As the birth rate continues to decline, the three -child policy and subsequent supporting policies are introduced, the mother and infant supplies industry is innovative, and the demand for quality of maternal and infant consumption people has improved, and many domestic maternal and infant brands have gradually occupied the market.

On September 19, 2020, Liu Nan opened the first show of Douyin's live broadcast to achieve 40 million sales. Liu Nan publicly stated that the long board and power point of honey buds have been on the supply chain, and the short board has been on the traffic. Finding a public domain platform with abundant traffic but a relatively short supply chain is a more adapted strategy.

According to Liu Nan's profile on Douyin, she founded a rabbit head mother to study children to wash and take care of them. According to a third -party data platform, the sales room for the live broadcast room for the live broadcast room for the live broadcast room for nearly three months on the mother -in -law and baby flagship store of Rabut Toto Mother and Baby Baby Washing and Boyfunction Store was about 10 million yuan, respectively. In terms of own brand sales, Liu Nan obviously attached more attention. She revealed that last year, the honey buds and rabbit head mothers were split at the board level, belonging to two completely independent companies.

Zhuang Shuai suggested that maternal and infants' vertical e -commerce companies abandon their independent apps, because the cost of customer acquisition and personnel cost is relatively high, and the input -output ratio is relatively low. Diversion from the entrances such as JD.com, Tmall, Douyin and Kuaishou, and even small programs are conducive to the development of the enterprise itself. As long as companies have polished their supply chain system, it is easier to survive on the platform.

In 2017, Zhao Zhe has started its own brand business. Through linked factories and users, it enriches products, improves supply chain efficiency, and serves offline franchisees and online channels."If a product is good and the price is low, we should be able to survive." In Zhao Zhe's cognition, the number of newborn births will decline, and the maternal and infant industry will have an impact on the maternal and baby industry in the future.However, his view of vertical maternal and infant e -commerce is still optimistic. He believes that in the past, the practitioners had taken too much money and had too high valuations, which caused the situation of only GMV to appear.In terms of improvement."Comprehensive e -commerce cannot meet the needs of all users, and maternal and infant e -commerce will come back again, but the shape may change."

Author: Meng Qian ([email protected])

Edit: Li Zhiquan

- END -

The White House has a damage again, "History Unprecedented"

According to the United States Washington Post reported on the 13th, after more th...

Civil affairs of small schools know one minute (July 1, 2022)

Hello everyone! Today is July 1, 2022, on the third day of June of the lunar calen...