There are counts | Bank wealth management market 2nd quarter report: product circulation stops falling down

Author:Cover news Time:2022.07.25

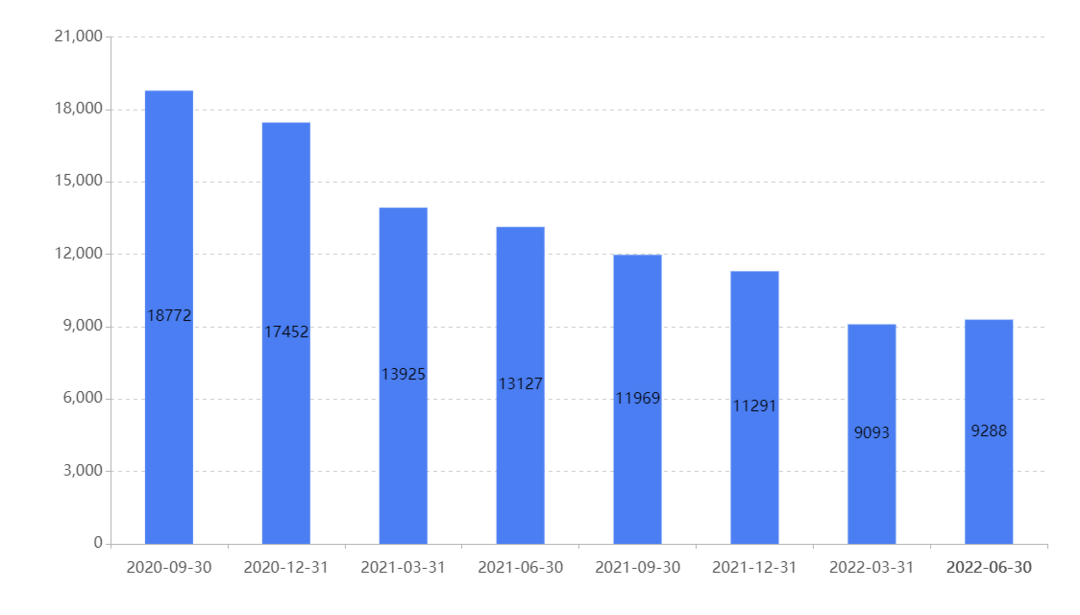

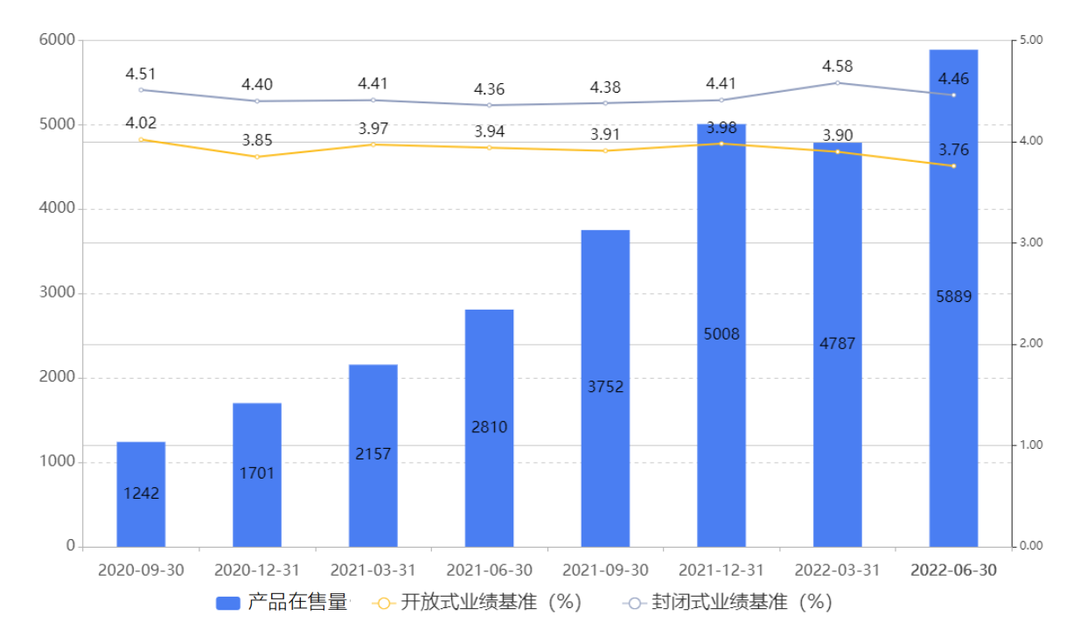

According to the monitoring data of the Puyi Standard, the circulation of bank wealth management products in the second quarter stopped falling and stabilized, about 9288 models, with a slight increase of 2.14%month -on -month, of which 9031 were newly issued in net worth products, accounting for 97.23%, and the transformation of net worth of wealth management products The results are significant. In terms of performance comparison, the average level of closed and open net worth wealth management products has declined to varying degrees. In terms of wealth management subsidiaries, the amount of products of wealth management subsidiaries has risen significantly, the performance comparative reference is downward, and the average performance comparison of closed products and open products has expanded.

According to the Monitoring data of the Puyi Standard, a total of 9288 bank wealth management products were issued in the second quarter, and the product distribution was increased by 195. Among them, the net value products were issued 9031, accounting for 97.23%, and the proportion of net worth products continued to increase.

Figure 1: Recently

Source: Puyi Standard. The differences between historical data and previous reports are caused by the replenishment of product data in the later period. In addition, in addition to another instructions, all statistics results in this report do not include structural products and foreign currency products.

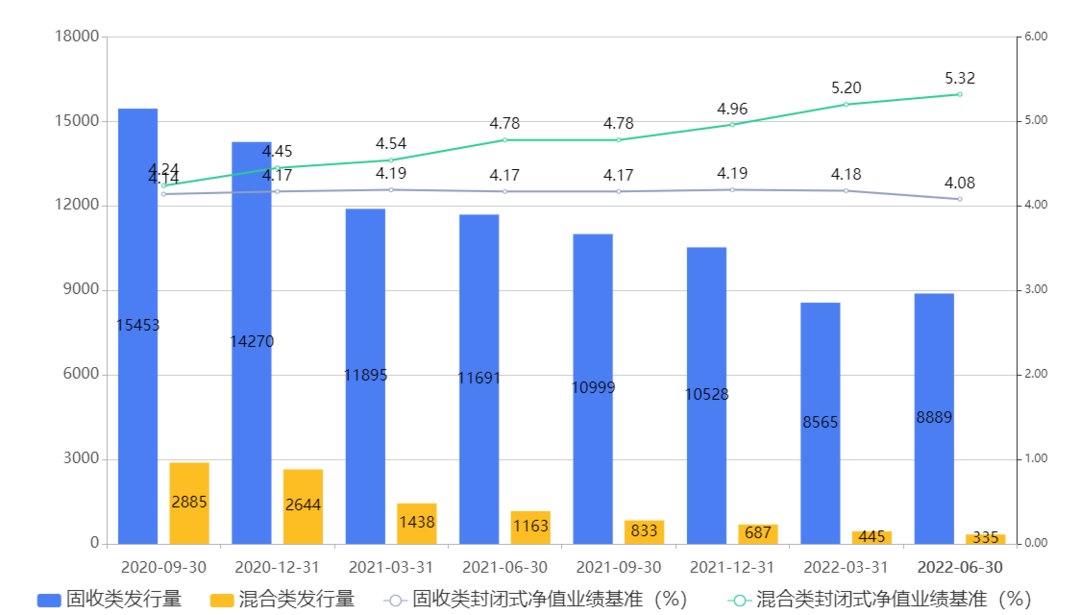

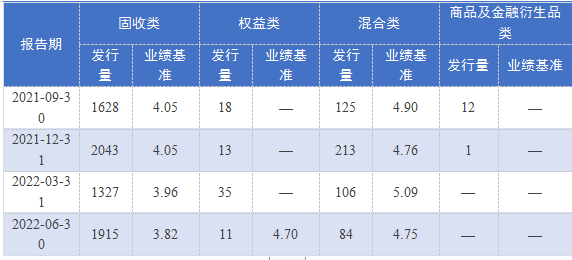

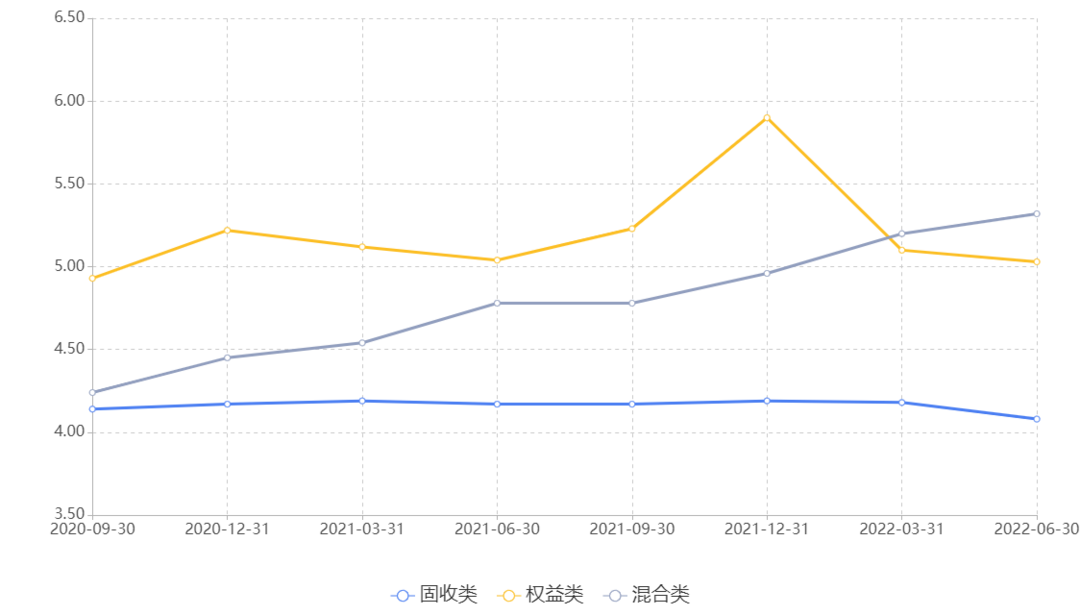

From the perspective of product types, the new product in the second quarter is still based on solid income, accounting for 95.70%, and the average performance comparison of its closed net value products is 4.08%, a decrease of 0.10 percentage points from the previous month; The next 335 models, the average performance comparison of its closed net worth products is 5.32%, an increase of 0.12 percentage points from the previous month; there are fewer equity products, only 61 new issues, and the average performance of closed net value products The reference benchmark was 5.03%, a decrease of 0.07 percentage points from the previous month.

Figure 2: Recently, the major category of new wealth management products and the benchmark trend of performance comparative performance

In the second quarter, a closed net worth wealth management product situation

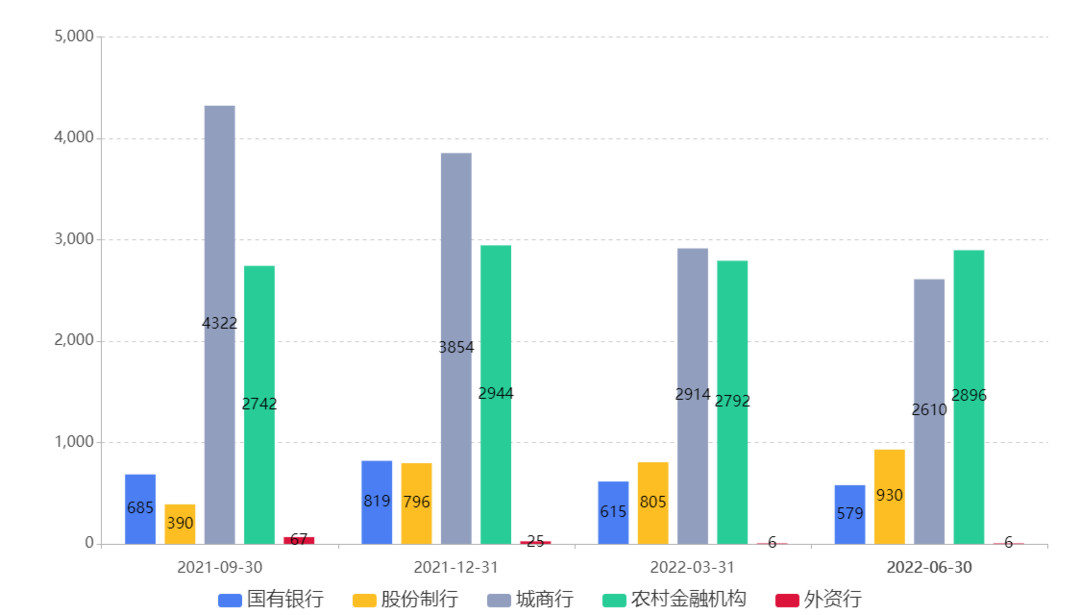

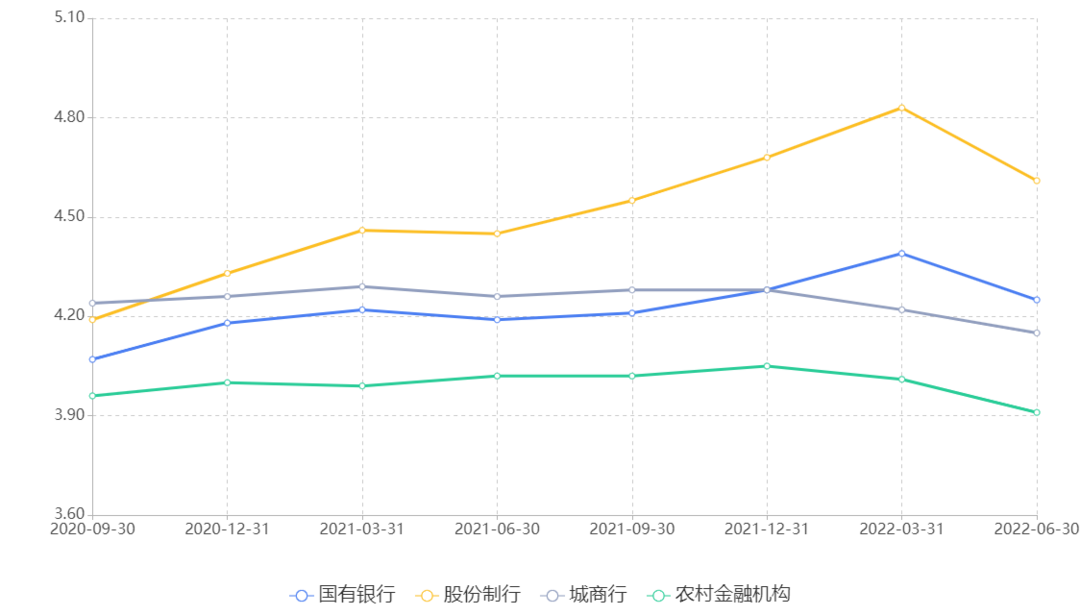

In the second quarter, a total of 7021 new closed net worth wealth management products were reduced, and 111 models were reduced month -on -month, accounting for 75.59%of the newly issued wealth management products in the season. From the perspective of bank types (including its financial management subsidiaries), the number of rural financial institutions has the largest number of issuance, and a total of 2896 closed net worth wealth management products have been issued, accounting for 41.25%. Essence

Figure 3: Recently, the distribution of newly closed net worth net worth wealth management products

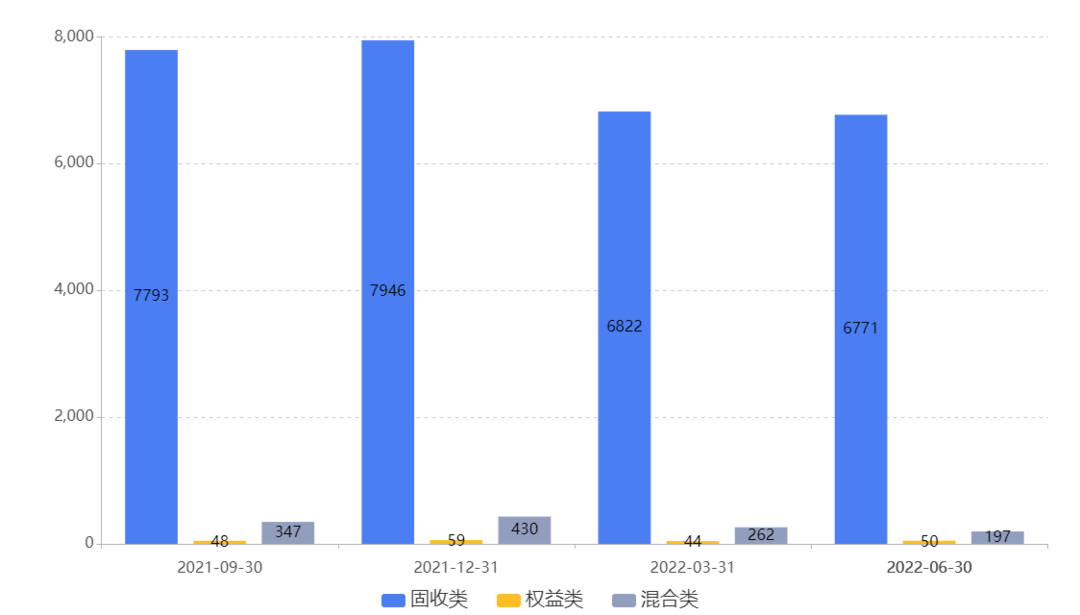

From the perspective of product types, of the newly closed net value -type wealth management products, the most solid -income products have the most, with a total of 6,771 models, a decrease of 51 models from the previous month. There are only 50 models, an increase of 6 models from the previous month.

Figure 4: Recent distribution of newly closed net worth net value wealth management products

In terms of performance comparison, the average performance comparison of newly closed net -closed net worth products in the second quarter was 4.12%, a decrease of 0.10 percentage points from the previous month. Among the various banks (including their financial management subsidiaries), the average performance of joint -stock banks is relatively high, reaching 4.61%; the average performance comparison of rural financial institutions is lower, with a lower benchmark at 3.91%. Among all types of products, the average performance of hybrid products is relatively high, reaching 5.32%, an increase of 0.12 percentage points from the previous month; the average performance of equity products compared with 5.03%, down 0.07 percentage points from the previous month; The average performance of the product is low, with 4.08%, a decrease of 0.10 percentage points from the previous month.

In the second quarter, open net worth net wealth management products

In the second quarter, a total of 2010 open -end net worth wealth management products were issued, with an increase of 542 models from the previous month. The average performance comparison benchmark reached 3.85%, a decrease of 0.17 percentage points from the previous month. , Up to 1057 models, an increase of 351 models from the previous month. In terms of performance comparison, the overall performance level of joint -stock banks (including its financial management subsidiaries) is relatively high, reaching 3.95%, a decrease of 0.22 percentage points from the previous month.

Table 5: Recently open open net worth wealth management products (classified by institutional types)

As far as the product type is concerned, in the second quarter, the new open open net worth wealth management products were mostly solid -income, with a total of 1915 models, an increase of 588 models from the previous month. The next time, there were 84 models, a decrease of 22 models from the previous month. The average performance comparison benchmark was 4.75%, a decrease of 0.34 percentage points from the previous month.

Table 6: Recently open open net worth wealth management products (classified by product type)

Open net worth wealth management products are on sale

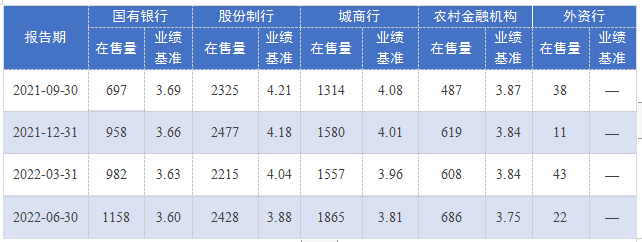

In the second quarter, a total of 6159 open net worth wealth management products were on sale, an increase of 754 models from the previous month, and the average performance comparison benchmark reached 3.79%, a decrease of 0.12 percentage points from the previous month. It reached 2428 models, an increase of 213 models from the previous month. In terms of performance comparative benchmark, the average level of joint -stock banks (including its financial management subsidiaries) is relatively high, reaching 3.88%, a decrease of 0.16 percentage points from the previous month.

Table 7: Recently open net worth wealth management products in sale (classified by institutional types)

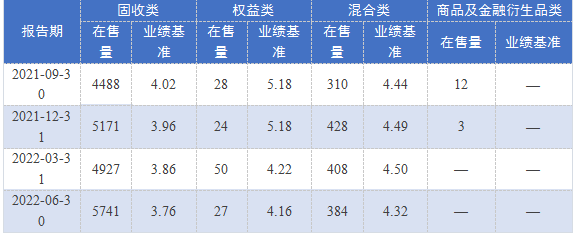

From the perspective of product types, in the second quarter, among the open net worth wealth management products, most of the solid income categories have a total of 5741 models, an increase of 814 models, and the average performance comparison is 3.76%, a decrease of 0.10 percentage points from the previous month; mixed categories; mixed categories; mixed categories; The next time, there were 384 models, a decrease of 24 models from the previous month. The average performance comparison benchmark was 4.32%, a decrease of 0.18 percentage points from the previous quarter. , Falling 0.06 percentage points from the previous month. Table 8: Recently open net worth wealth management products in sale (classified by product types)

In the second quarter, the product situation of bank wealth management subsidiaries

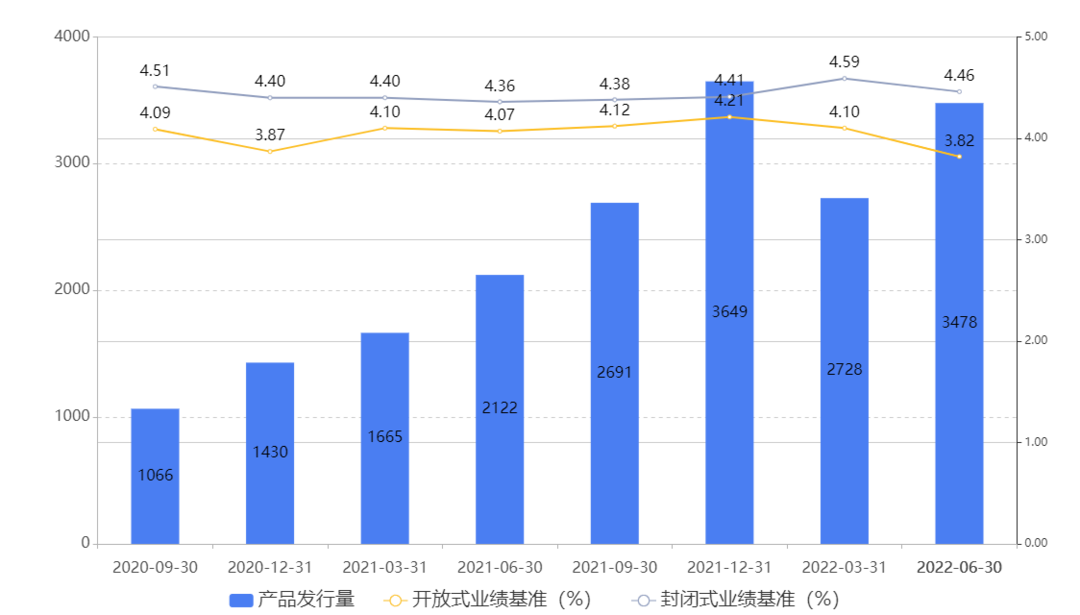

In the second quarter, the bank wealth management subsidiary issued a total of 3478 wealth management products, an increase of 750 models from the previous month. Among them, the average performance comparison of open products was 3.82%, a decrease of 0.28 percentage points from the previous month; %, A decrease of 0.13 percentage points from the previous month. Recently, the quarterly distribution volume of the products of wealth management subsidiaries has fluctuated, and the average performance comparison of closed products and open products has expanded.

Figure 9: Recently

Bank wealth management subsidiaries are selling product statistics

In the second quarter, bank wealth management subsidiaries had a total of 5889 wealth management products on sale, an increase of 1,102, of which the average performance comparison of open products was 3.76%, a decrease of 0.14 percentage points from the previous month; %, A decrease of 0.12 percentage points from the previous month. Recently, the overall sales of wealth management subsidiaries have been on the rise, and the average performance comparison of closed products and open products has expanded.

Figure 10: Recently, the products of bank wealth management subsidiaries are on sale

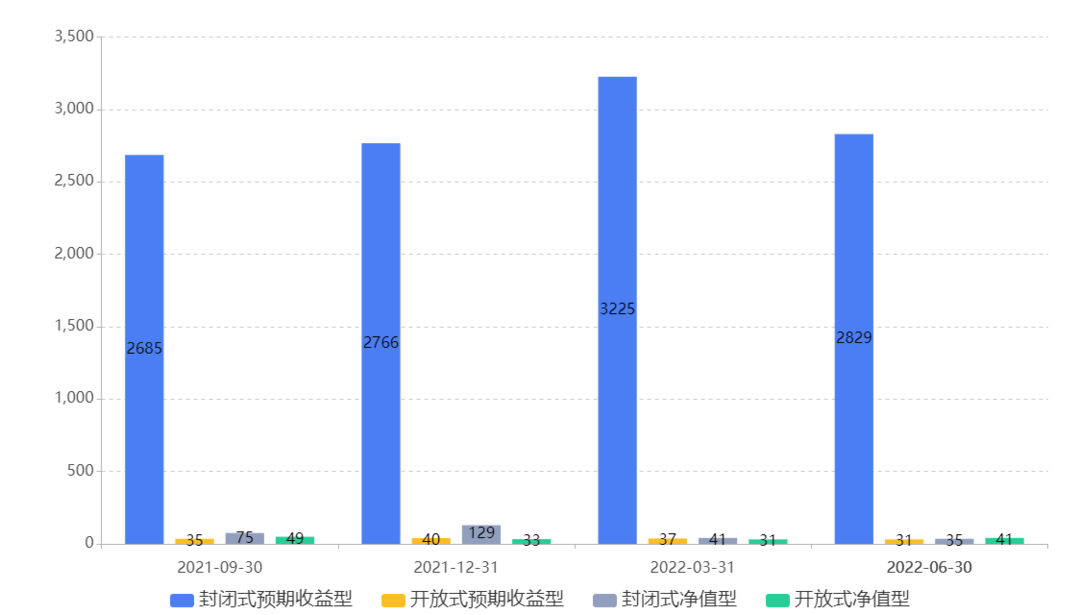

Structural products in the second quarter are selling situations

In the second quarter, a total of 2936 structural products (including structural financial management and structural deposits) were on sale, and 398 models were reduced month -on -month. Among them, 2829 models were closed -end expected income products, 41 were open net worth products, 35 models, 35 models, 35 models, 35 models For a closed net value product, 31 models are open expected benefits products. From the past four quarters, although the sales of various structural products have fluctuated, the overall as a whole is still relatively stable.

Figure 11: Recently in the distribution of structural product types in sales

Source: Puyi Standard. Tip: According to relevant regulations, structural deposits do not belong to bank wealth management products.

Figure 12: Recently, the performance comparative reference of the newly closed net worth net value wealth management products (classified by institutional type)

Figure 13: Recently, the performance comparative reference of the newly closed net worth net value wealth management products (classified by product type)

Cover reporter Dong Tiangang

- END -

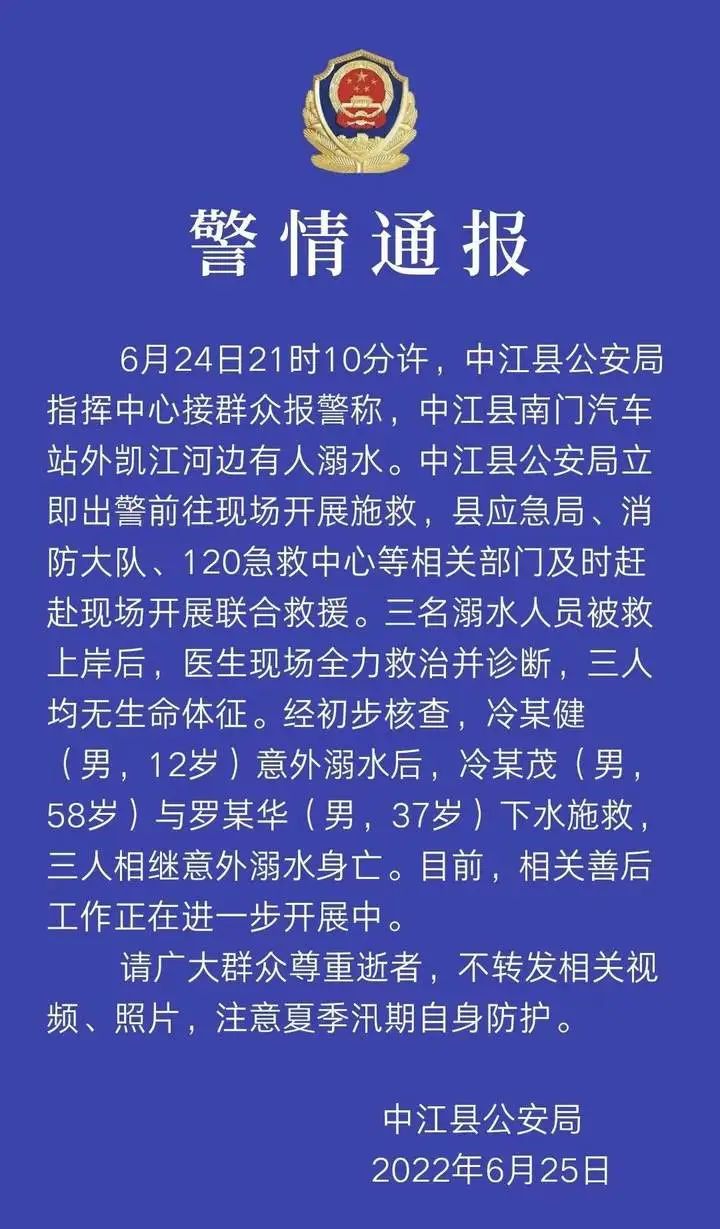

After the 12 -year -old boy drowned, the two adults were rescued, and the three were unfortunately died!

Sichuan Deyang Zhongjiang County Police issued a notice on the 25th:At 21:10 on Ju...

Weihai City's "Chinese Dream · New Era · New Journey" People's preaching contest was held

In order to welcome the 20th National Congress of the Communist Party of China, th...