The performance changes!The profit of 40 billion vaccine giants has premedcted by more than 60 %, and the reasons are disclosed

Author:Daily Economic News Time:2022.07.25

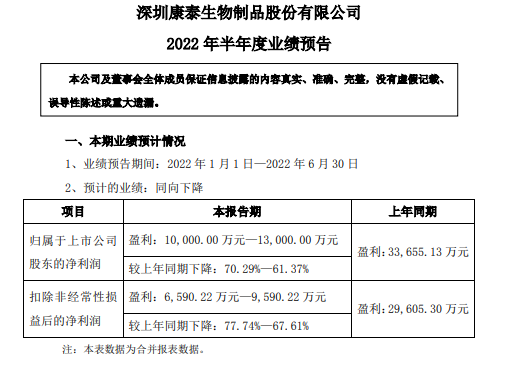

On the evening of July 24, Kangtai Biological (300601.SZ) disclosed the performance forecast of the first half of 2022 that the company's expected net profit was about 100 million to 130 million yuan during the reporting period, a year-on-year decrease of 70.29%-61.37%.

Regarding the reasons for changes in performance, Kangtai Bio said that it is mainly the fees for impairment of assets related to the new crown -related vaccine -related assets and the expenses of phase III clinical expenditure.

On the 25th, Kangtai Biological once fell more than 9%to 34.44 yuan/share. As of the decline in the release, the company's latest market value was 40.3 billion yuan.

Net profit pre -decrease over 60 %

The Kangtai creature, which started with vaccine, is the first vaccine company in South China. The main products include reorganized hepatitis B vaccine, type B influenzaessiae combined vaccine, non -cell thyroid B. Polysaccharide vaccine, pneumonia. The company's independently developed new crown vaccine was approved for emergency use in May 2021; the internationally introduced adenovirus carrier new crown vaccine is actively promoting domestic clinical registration, production and commercialization.

In the first half of this year, the company's main product four -link seedling sales revenue increased by about 60.13%compared with the same period of the previous year. The sales revenue of hepatitis B vaccine increased by about 20.76%compared with the same period of the previous year. The company is expected to achieve 1.828 billion yuan in operating income in the first half of 2022, a year -on -year increase of 73.72%. However, during the reporting period, the net profit is expected to be attributed to shareholders of listed companies by 70.29-61.37%compared with the same period last year. The main reason is the impairment of the new crown-related vaccine-related assets and the expenses of phase III clinical expenditures.

Historically, Kangtai's performance rarely declined with this level.

Kangtai Bio said that since the second quarter, the new crown vaccination environment at home and abroad has changed significantly, the demand for the new crown vaccine has dropped rapidly, and the company's new crown vaccine sales have fallen rapidly; The impact of conflict has caused blindness and delay in the clinical data of the phase III in the phase III, and subsequent sales have great uncertainty.

Therefore, Kangtai Biological, new crown vaccine -related inventory products, raw and auxiliary materials, self -made semi -finished products, and new crown vaccine development expenditure for the new crown vaccine development expenditure for the new crown vaccine development expenditure of 415 million yuan in the new crown of the new crown. In addition, the new crown in the second quarter The expenses of the R & D expenditure of the activated vaccine are 140 million yuan; the total amount of the expenses of asset impairment preparation and confirmation of the cost of research and development will reduce the total profit of 555 million yuan. Considering the impact of deduction and reduce net profit by 452 million yuan.

Last year's annual report data showed that Kangtai's operating income was about 3.65 billion yuan, an increase of 61.51%year -on -year; net profit was 1.263 billion yuan, an increase of 86.01%year -on -year. In the first quarter of this year, its operating income was 870 million yuan, an increase of 214.6%year -on -year, and net profit and non -net profit were 274 million yuan and 248 million yuan, a significant increase of 987.71%and 2763.78%year -on -year.

Last year and the first quarter of this year were better, but in the secondary market, Kangtai Bio has continued to decline in the past year. On May 17, 2021, Kangtai Bio set a high point of 221.90 yuan/share in the market. On the same day, Shenyin Wanuo and Soochow Securities all released research reports "Buy". Since then, Kangtai Bio has continued to fall. As of July 24 this year, it has fallen to 38.2 yuan/share, and the cumulative decline has exceeded 80%.

New crown vaccine sales are not dazzling

Judging from the impairment of assets in the performance forecast, the sales of the Kangtai Biological New Crown Vaccine are not dazzling.

According to Kangtai Biological reports in 2021, the company's independent biological products increased from 20.438 million doses in 2020 to 67.812 million doses in 2021, an increase of 231.79%year -on -year. Regarding the significant rise in inventory, Kangtai Bio said in the annual report that it was mainly caused by the new crown vaccine during the reporting period.

From the perspective of inventory, Kangtai Biological reportedly reported that the company's first inventory book value was 437 million yuan, of which 205 million yuan was inventory goods, but by the end of 2021, the company's inventory book value increased to 1.058 billion yuan, inventory goods products, inventory goods The book value has also increased to 466 million yuan.

This also laid the "foreshadowing" for the sharp shrinkage of Kangtai Bio -vaccine assets in the first half of this year.

Earlier, Kangtai Biosaids have made re -bets in the field of new crown vaccines. Data show that Kangtai Biological R & D investment was 738 million yuan in 2021, an increase of 170%year -on -year, accounting for 20.22%of the revenue, mainly due to the large amount of clinical R & D investment in the third phase of the new crown and active vaccine, of which the capitalization rate was 52.03% Essence In July 2021, the company completed a fund -raising of 2 billion yuan in the issuance of convertible bonds, and all invested in the new crown vaccine project.

In fact, in the first quarter of this year, from the year -on -year period of the R & D expenses of listed companies in 11 vaccines, over half of the listed companies increased their investment in R & D expenses.Since the beginning of this year, the topic of overcapacity of the new crown vaccine has aroused heated market debate.According to the forecast data of Airfinity LTD., the output of global vaccines in 2022 may exceed 9 billion, but by 2023 and afterwards, the demand for vaccine may fall to about 2.2 billion to 4.4 billion doses per year.Edit | Lu Xiangyong Dubo

School pair | He Xiaotao

Cover Map Source: Photo Network_501719412

Daily Economic News comprehensive from the announcement of listed companies, Zhongxin Jingwei, and Securities Times

Daily Economic News

- END -

"Financial Open and High -quality Development" cutting -edge forum online

On July 24, hosted by the School of Finance and Finance of Renmin University of China and the China Finance and Financial Policy Research Center, co -organized by the China Industrial Economic Magazin

The low -frequency noise of the water pump is not good at sleeping, and the mute water pump is changed to cure "troubles"

The Yangtze River Daily Da Wuhan Client News (Reporter Jin Wenbing Correspondent Y...