New crown vaccine leading performance thunderstorms, Kangtai Bio's net profit in the first half of the year premedcted 61%to 70%

Author:21st Century Economic report Time:2022.07.25

The 21st Century Business Herald reporter Tang Wei Ke Guangzhou reported that there was not much time to leave the new crown vaccine enterprise.

On the evening of July 24, Kangtai (300601) released a preview of the performance. It is expected to achieve operating income of 1.828 billion yuan in the semi-annual 2022 year, a year-on-year increase of 73.72%; net profit was 100 million yuan to 130 million yuan, a year-on-year decrease of 70.29%-61.37% Essence

The announcement said that as the market environment changes, the company's new crown vaccine sales have fallen rapidly, so the new crown vaccine related R & D expenditure and material products are prepared for asset impairment: the cumulative amount reached 555 million yuan. Affected by this impairment, Kangtai's net profit declined sharply by 70.29%-61.37%. This means that the new crown vaccine has become a "negative asset."

Researchers in a certain level of market industry in Shenzhen told the 21st Century Business Herald reporter: "As early as last year, the market was precisely to the high valuation of vaccine companies. On the one hand, star fund managers left the scene. On the other hand, The prediction of prediction also conveys the unobotyted emotions. The company that runs in front is good, obviously Kangtai is not the starting lineup. "

In terms of the secondary market, Kangtai Bio has continued to decline in recent years. As of July 22, the stock price was 38.2 yuan/share, which has fallen by more than 60 % compared to May 2021, and its market value is 42.8 billion yuan. On July 25, the opening was affected by the news. The stock price fell to 34.44 yuan/share all the way, and then rebounded slightly.

Increase income and do not increase the dilemma

Why not increase income?

In the announcement, Kangtai Biological stated that it was mainly due to the expenses of R & D expenditure related assets related to the new crown -related vaccine. Specifically, since the second quarter, the new crown vaccination environment at home and abroad has changed significantly, the demand for the new crown vaccine has decreased rapidly, and the company's new crown vaccine sales have fallen rapidly; Clinical data is delayed blindly, and subsequent sales have great uncertainty.

In view of this, Kangtai Biological New Crown Vaccine related inventory, raw and auxiliary materials, semi -finished products, and related development expenditures as of the end of March will be prepared for impairment of asset impairment. At the same time For expenses, the two items will reduce the total profit of 550 million yuan and reduce net profit by 450 million yuan.

New crown vaccine sales have declined, but the types of other vaccines in Kangtai have performed well, driving the company's revenue increase by more than 70 %. Among them, the sales revenue of the main products increased by about 60.13%compared with the same period of the previous year. The sales revenue of hepatitis B vaccine increased by about 20.76%compared with the same period of the previous year. The newly listed varieties 13 -valent pneumococcal polysaccharides were gradually capacity.

Back to February 2021, Kangtai Bio completed the clinical trials of Phase I and II of Phase I and II of Kangtai Bio, and was approved for emergency use in China in May 2021. In June of that year, it was sold in China to directly drive the company's performance. In the second and third quarters of 2021, Kangtai Bio achieved revenue of 775 million yuan and 1.325 billion yuan in a single quarter, an increase of 179.87%and 70.93%from the previous month; net profit was 311 million yuan, 700 million yuan, a month -on -month increase of 11.38 times and 1.25 times.

By the fourth quarter of 2021, as the vaccination rate increased from a high -speed growth rate, the company's performance declined from the previous month. Specifically, the revenue of 1.275 billion yuan and 227 million yuan in a single quarter were recorded in a single quarter. %, 67.5%. In the first quarter of this year, the company's revenue continued to decline by 31.6%to 871 million yuan, but the net profit index was repaired, specifically 274 million yuan, an increase of 20.4%month -on -month.

Judging from the impairment of assets in the trailer, the sales of the Kangtai Biological New Crown Vaccine are not dazzling, but the company had already submitted a re -bet in this field, and the subsequent market transformation still needs to be observed. Data show that Kangtai Biological R & D investment was 738 million yuan in 2021, an increase of 170%year -on -year, accounting for 20.22%of the revenue, mainly due to the large amount of clinical R & D investment in the third phase of the new crown and active vaccine, of which the capitalization rate was 52.03% Essence In July 2021, the company completed a fund -raising of 2 billion yuan in the issuance of convertible bonds, and all invested in the new crown vaccine project.

At present, the company's new crown and active vaccine overseas clinical trials are being implemented. Earlier, it has signed an agreement with Malaysia Yongda Group to conduct an agreement on phase III clinical trials and commercialization on the local area. Argentina, Colombia, Nepal, the Philippines and other countries carried out phase III clinical trials simultaneously; in addition, the new crown vaccine workshop project of the adenovirus carrier has been completed and put into use. The reorganization of the new coronary virus vaccine has been urgently authorized by the National Pharmaceutical and Food Regulatory Administration of Indonesia and Realized exports, but not listed in China.

New crown vaccine market shrinkage

Since the beginning of this year, the topic of overcapacity of the new crown vaccine has aroused heated market debate. According to the forecast data of Airfinity LTD., the output of global vaccines in 2022 may exceed 9 billion, but by 2023 and afterwards, the demand for vaccine may fall to about 2.2 billion to 4.4 billion doses per year. Industry insiders said that due to the increase in performance in the new crown vaccine may not be sustainable, in addition to the need to cope with multiple barriers such as technology, patents, and production capacity, the current new crown vaccine companies have also become a big test in time.

Hua'an Securities Research Report pointed out that Kangtai Bio's new crowned vaccine in 2021 and the revenue of the new coronary adenovirus vaccine accounted for a relatively high income. After entering 2022, the old product re -promotion+new heavy product contribution income increase. Products are mainly, and the rich R & D pipeline will also ensure that the company will continue to be listed on new products in the next 3 to 5 years. In 2022, pneumonia vaccines, four -united seedlings, and hepatitis B vaccine will be synchronized to create a stable cash flow for the company; at the same time, candidate products are about to be available in 2023. At present, only one domestic manufacturer is selling The same product is expected to contribute to nearly 1.5 billion yuan by 2025. However, it was also in early 2021 that the momentum of vaccine stocks began to change.

The rise of each head vaccine gradually saturated, and the decline trend appeared. After Hualan's biological stocks ushered in the highest point of 64.48 yuan in the fourth quarter of 2020, the season declined more than 25%, and continued to decline after the beginning of 2021; But in July, it also ushered in over 8%.

At present, the domestic vaccination rate has increased significantly, and the domestic market of vaccines has been reduced; and the international vaccine import and export situation is affected by various factors such as politics and technology, and domestic vaccine exports are not smooth.

Earlier, in the face of the decline in vaccine stocks, major fund companies have also reduced their holdings of vaccine stocks, which has made the vaccine stock market turn sharply.

As early as the second quarter of 2021, the Growth Small Drive Growth (LOF) had reduced the Kangtai Biosaired Warehouse to the fifth place and held 7.9406 million shares. Compared with the first quarter, it reduced its holdings of nearly 1 million shares. Compared with 8.03%, a decrease of 1%. The major institutions did not care about the cost of "cutting meat" without the cost, which caused a certain market panic. In the second quarter of 2022, Guangfa's small plate grew up and added 47.643 million shares in the tenth position of the top ten heavy warehouses.

In addition, it is worth mentioning that on the evening of May 16, Kangtai Bio disclosed that 5.24 million shares held by the actual controller Du Weimin were auctioned at the end of the month. According to the calculation of the shooting price, Du Weimin's auction of the company's shares was slightly higher than 43 yuan/share, which was equivalent to about 65%of the closing price on the previous trading day. The reasons for the auction of Du Weimin's shares, the main body of the application for the auction, and the involved in the listed company were not explained. There is no information about Du Weimin involved in litigation and debt disputes.

Since August last year, Du Weimin has pledged several small equity pledge. As of April 28, its cumulative pledged Kangtai Biological shares were 6.62 million shares. Public disclosure showed that in August last year, Du Weimin pledged 1.39 million pledged shares to Ping An Securities. On April 12 this year, after the pledge of 3.02 million shares expired, it pledged 4.23 million shares to Guojin Securities through replacement. At that time, Kangtai Bio's stock price was about 120 yuan and 90 yuan. On April 28, it supplemented 1 million shares.

- END -

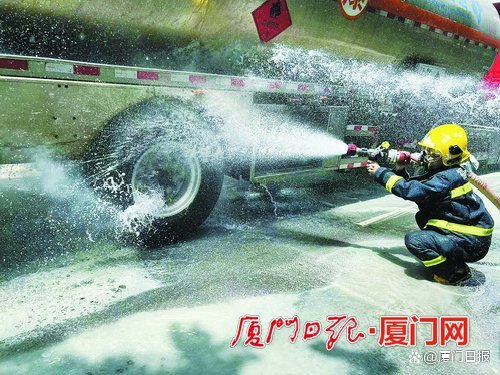

so close!The tanker suddenly smoked, and the firefighter happened to pass the decisive shot.

▲ Fire rescue workers dispose of vehicle smoke with water guns.The situation is n...

Fight for the "Five Models" to show your youthful power

On May 10th, General Secretary Xi Jinping delivered an important speech at the 100th anniversary of the establishment of the China Communist Youth League. He encouraged the majority of Communist Youth