AI Pharmaceutical?Huawei joined hands with Yunnan Baiyao to enter the game

Author:Chinese brand Time:2022.07.26

The technology and traditional Chinese medicine giants joined forces to add another case. The intersection of the two sides was an artificial intelligence (AI) pharmaceutical track.

On the afternoon of July 25, Yunnan Baiyao (000538) announced that the company signed the "Artificial Intelligence Drug Research and Development Comprehensive Cooperation Agreement" with Huawei Technology Co., Ltd. ("Huawei") on the 23rd. According to the agreement, the two parties will carry out exchanges and cooperation in the field of artificial intelligence drug research and development, including but not limited to large and small molecular design, related diseases, database development, etc.

In recent years, the enthusiasm for domestic AI pharmaceutical investment has gradually heated up. In addition to traditional AI pharmaceutical players, Internet giants including Tencent, Alibaba, Baidu, and byte beating have also tried the track. However, insiders in the industry said that the industry is still early in the early stage. This time Huawei and Yunnan Baiyao cut into this track, which is expected to play a catalysis.

Start up early

Data show that AI Pharmaceutical is a significant shortening time for drug research and development by integrating artificial intelligence technology with biopharmaceutical technology, saving R & D costs, and improving efficiency. According to institutional statistics, using AI technology can shorten 40%of drug discovery time, saving 50%-60%of the clinical trial time of drugs, thereby saving drug research and development costs. Therefore, AI Pharmaceutical is a popular area that has received much attention in recent years.

Yunnan Baiyao also stated in this announcement that Huawei has rich experience and cases in AI auxiliary drug research and development, cloud computing, artificial intelligence and other aspects. Advantages to promote the deep integration of artificial intelligence technology and great health.

In fact, Huawei has already been layout on this track. Last September, Huawei released a large model of "Huawei Yunpan Ancient" drug molecular model. Huawei said that the "Pangu Drug Molecular Model" has learned a total of 1.7 billion pharmaceutical molecular chemical structures, which can help the small molecular compound calculation and match the target protein, predict the new molecular biochemical attributes, and thus generate new drugs efficiently; in addition It can also be optimized for the screening pilot drugs.

It is understood that the model has developed a broad -spectrum antibacterial drugs with the first affiliated hospital of Xi'an Jiaotong University. The results show that the research and development cycle of pilot drugs can be shortened from several years to one month, which means that the efficiency of new drug research and development has been greatly improved.

"AI Pharmaceutical is currently in the early early stages. The industry has high entry thresholds and has high requirements for technology maturity," an executive of a head listed pharmaceutical company told reporters. However, the person said that the two giants joined forces to join the market may play a catalysis in the market.

Circuit investment and financing gradually heat up

In recent years, investors' enthusiasm for investment in AI pharmaceuticals has gradually increased, and the global and China AI pharmaceutical investment and financing market has become increasingly active. From 2016-2021, the total global and China's total investment and financing volume showed an upward trend, and the average annual compound growth rate reached 56.3%and 50.9%, respectively.

According to CITIC Securities Research Report, the investment and financing of the domestic AI pharmaceutical track in 2020 exceeded 3.1 billion yuan, an increase of nearly 7 times year -on -year. According to incomplete statistics, in 2021, a total of 34 financing incidents occurred in the domestic AI pharmaceutical field, involving a total amount of financing of about 8.4 billion yuan, an average single financing amount of about 250 million yuan, and more than 70 % of the investment companies were in early rounds of rounds. Essence

Among them, start -up AI drug research and development companies represented by Yingsilian Smart, Jingtai Technology, Bingzhou Stone Biotechnology, etc. have developed rapidly, and they have been favored by capital. In the past few years, they have frequently obtained financing. Both Yingsilia Smart and Jingtai Technology have received round D financing, and the financing amount has exceeded US $ 379 million and $ 800 million, respectively.

However, most AI pharmaceutical companies currently choose one or two segmented links or fields to build their own differentiated barriers. For example, Jingtai Technology mainly focuses on the research and development of drug solid state, including crystal prediction, solid -state screening, structured determination, etc.; Unknown kings are mainly focused on intestinal microbial AI pharmaceutical companies, and products include allococcus and formula bacteria capsules.

In addition, Internet technology companies are also cross -border AI pharmaceuticals. Alibaba Cloud cooperated with the Global Health Drug R & D Center. Tencent released the AI -driven drug research and development platform "Yun Shenzhi Pharmaceutical". Li Yanhong personally led the team to establish a Bailu Shengke. Recruit the AI-DRUG team at home and abroad.

There is no medicine to go public so far

Although AI Pharmaceutical Investment and financing has gradually heated up in recent years, the actual implementation of drugs still needs to be tested.

The aforementioned pharmaceutical companies told reporters that the current research and development of AI Pharmaceuticals is relatively slow, and there is no particularly successful business model. More is the supplement or parallel tool of traditional pharmaceuticals.

A report from Cisics Counselor showed that AI pharmaceuticals have formed three development models, one is the AI-CRO model to provide outsourcing services for pharmaceutical companies and CRO companies; It is a platform service mode, setting up the AI technology platform and providing technical services. But the settlement of the three business models depends on the implementation of the product.

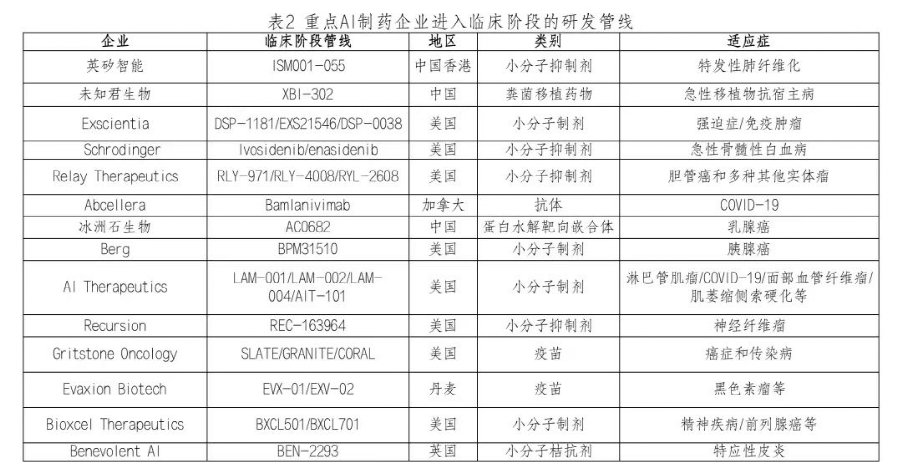

The report shows that as of the end of 2021, more than 40 AI participating in R & D pipelines worldwide entered the clinic. Among them, the pipelines of eight foreign companies and two Chinese companies have entered the clinic period, but because of the high difficulty of AI pharmaceutical technology, there is no AI predictive structure to go public. As of the end of April 2022, the number of Chinese AI pharmaceutical companies exceeded 60, and the company was listed and profitable.

AI pharmaceutical products have been unable to go public, and companies cannot monetize products and technology, challenging investors' confidence and patience.For example, Schrodinger, previously popular with funds, has shrunk to the current $ 2.2 billion from the $ 6 billion market value at the end of 2020.The above report predicts that by 2023-2025, a number of AI predicted drugs will enter the second phase of the "Valley of Death", and the first AI pharmaceutical products will only appear until 2026-2027.

Comprehensive: China Fund News, CITIC Securities Editor: Gao Wanpeng

- END -

From June 23rd to June 24th, there are local disaster risks in Panzhihua and Liangshan Prefecture in Sichuan

Cover reporter Yang Jin Zhu Luo TianyiOn June 23, the reporter learned from the Si...

In 7 years, more than 200 college students were funded and sent the "No. 1 plaque" to the students' homes. There is a high -profile individual household in Tongcheng.

Jimu Journalist Zhao BeiPhotography reporter Liu Zhongcan2.4 meters long, 0.8 mete...