Seeking Hong Kong as the main place of listing, in detail

Author:Economic Observer Time:2022.07.26

Alibaba went to the New York Stock Exchange in September 2014; completed the second listing on the Hong Kong Stock Exchange in November 2019. At present, Alibaba is the second listing position in the Hong Kong Stock Exchange. The latest partner list disclosed by Alibaba Annual Report shows that the Ant Group includes the chairman and CEO Jing Xiandong with many executives withdraw from the Alibaba partner sequence.

Author: Liang Ji

Figure: Tuwa Creative

Guide

One || companies that are listed in Hong Kong for the second time must be retained in the listing status of other exchanges recognized by the Hong Kong Stock Exchange, otherwise their Hong Kong stock market status is uncertain; the two major listed companies are not subject to this constraint.

团 || The management of Ant Group withdraws from Alibaba Partner Sequences. The Ant Group continues to improve another measure of corporate governance. It aims to further enhance the transparency and effectiveness of corporate governance and strengthen the isolation with major shareholders Alibaba.

On July 26, BABA.N, 9988.HK) issued an annual report of 2022 and seeking to complete the main listing on the Hong Kong Stock Exchange.

Earlier, Alibaba went to the United States in the United States in September 2014; in November 2019, it completed the second listing on the Hong Kong Stock Exchange in November 2019. At present, Alibaba is the second listing position in the Hong Kong Stock Exchange.

In addition, the latest partner list disclosed by Alibaba Annual Report shows that the Ant Group includes the chairman and CEO Jing Xiandong with many executives withdraw from the Alibaba partner sequence.

Seeking the major listing status in Hong Kong

The announcement shows that Alibaba's board of directors has authorized its management to apply for the change of listing status in the Hong Kong Stock Exchange. Alibaba is currently listed on the second listing of the Hong Kong Stock Exchange. It will apply for Hong Kong in accordance with the relevant listing rules as the main list of listing. It is expected to take effect by the end of 2022.

It is reported that Alibaba intends to log in to the Hong Kong Stock Exchange in 2014, but in the latter, the latter did not accept the rules of the listing structure of the "same stocks", and finally went to the United States to complete the listing in the United States in September of the same year. In November 2019, Alibaba returned to Hong Kong to complete the second listing.

This time, what exactly is Alibaba's "double main listing"?

PRIMARY Dual Listing refers to the first listing of two capital markets. When listed companies are listed in the US market, they need to be released and listed in accordance with the rules in the Hong Kong market. The request is completely consistent; the second listing (Secondary Listing) refers to the same type of stocks listed in the same type of listed companies in the same type of shares through the international custodian bank and securities brokers to achieve cross -market circulation.

At present, the Hong Kong Stock Exchange accepts the second listing standard that the company must be an innovative industry company, and has been listed on the NYSE, the Nasdaq and the Lun Stock Exchange for 2 years, and the market value has reached a certain standard (the market value of the 40 billion Hong Kong dollars, or or the market value The market value of 10 billion Hong Kong dollars and revenue exceeds 1 billion Hong Kong dollars), and companies that listed for the second time do not need to meet the standards of the Hong Kong Stock Exchange's own listing.

It is worth noting that companies that are listed in the second time in Hong Kong need to be retained in the listing status of other exchanges recognized by the Hong Kong Stock Exchange, otherwise their Hong Kong stock market status is uncertain; the two major listed companies will not be subject to this constraint.

In addition, companies that are listed in the second time in Hong Kong can be converted to each other and Hong Kong stocks, and they are not available for double listed companies; and companies that are listed in the second time in Hong Kong, their stocks cannot be listed as interconnected bids, and companies with double listed companies can Essence

China Merchants Securities Report pointed out that enterprises that are listed in the double listed in Hong Kong are more likely to meet the requirements of the A -share market supervision. After the double major listing of the Hong Kong Stock Exchange and the New York Stock Exchange, Alibaba is expected to meet the qualifications of the Hong Kong Stock Connect. , Bring new liquidity.

Alibaba said in the announcement that since its second listing in Hong Kong, the company's public circulation in the Hong Kong Stock Exchange has increased significantly. Data show that in the first half of 2022, the average daily transaction volume of the company's shares in the Hong Kong market was about $ 700 million, and the average daily transaction volume in the US market was about 3.2 billion US dollars. Alibaba said that, given that the company has a large number of operations in Greater China, the company expects the dual major listing status to help expand its investor foundation and bring new liquidity, especially to reach more other in China and Asia. Regional investors.

Partnership list changes

In addition to seeking dual listing status in Hong Kong, the change of Alibaba partners' list has also attracted much attention from the outside world.

According to Alibaba Annual Report, according to the company's recent revised "Partnership Agreement", partners should be held by Alibaba Group. From May 31, 2022, the related parties of the Alibaba Group no longer served as partners.

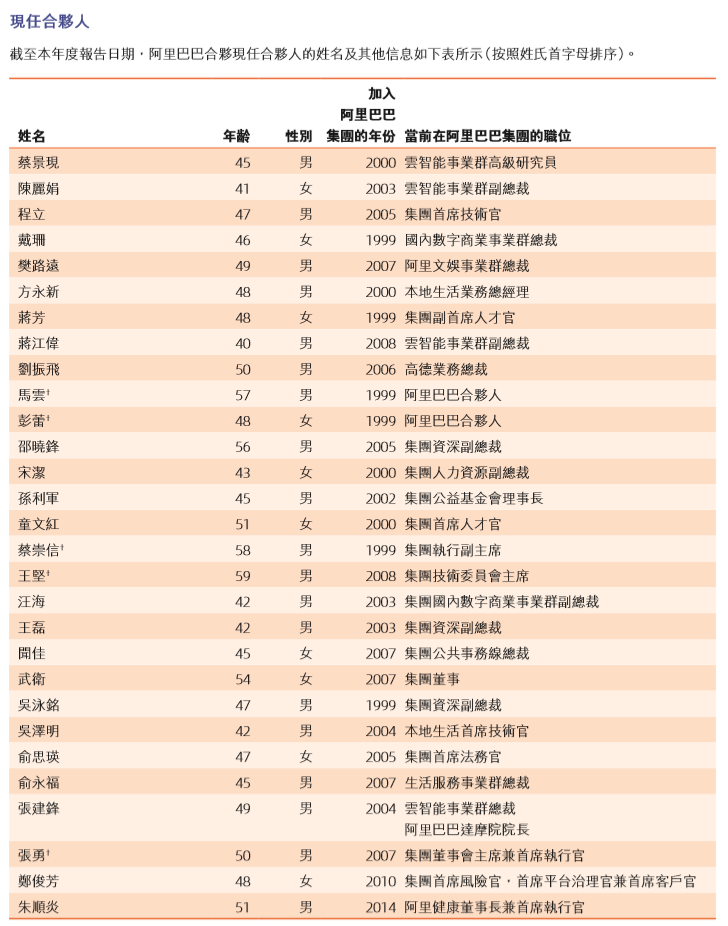

Alibaba Partner List Source: Alibaba 2022 Report

The annual report shows that the latest partnerships have a total of 29 people; while the Chairman and CEO of Ant Group, CEO Jing Xiandong, Chief Technology Officer Ni Xingjun, Chief Talent Zeng Songbai, Vice Chief Talent Wu Minzhi, Chief Sustainable Development Officer Peng Yijie, Vice President Shao Wenlan Shao Wenlan Zhao Ying, president of the International Business Group, and former CEO Hu Xiaoming are no longer on the list of partners.

The Economic Observation Network learned from a person who knows the matter that the management of the Ant Group withdrew from the Alibaba partner sequence. The Ant Group continued to improve the company's governance. isolation.

The person also said that the relevant members of the Ant Group's management no longer serve as Alibaba partners, and the isolation of Ant and Alibaba will be further strengthened. Independent decision. The above -mentioned shareholders 'level improves the arrangement of the company's governance system, combined with the previous measures of the board structure upgrades and 50%of the independent directors' ratio, etc., it reflects the continuous improvement of the overall company governance of the Ant Group. The annual report also showed that Alibaba's net profit in fiscal year in 2022 fell sharply. Data show that during the reporting period of Alibaba, the total revenue achieved a total revenue of 85.3062 billion yuan, a year -on -year increase of 19%; net profit was 47.079 billion yuan, a year -on -year decrease of 67%; the net profit of non -recognized accounting standards was 136.388 billion yuan, a year -on -year decrease of 21%.

The annual report shows that Alibaba's income is mainly composed of seven parts. Among them, China's commercial revenue was 575.993 billion yuan, accounting for 69%; the revenue of international business realization was 61.78 billion yuan, accounting for 7%; these two revenue increased by 18.14%and 25.03%year -on -year, respectively.

In addition, five parts of local life services, rookie, cloud business, digital media and entertainment and innovation business, and other parts, including 43.491 billion yuan, 46.107 billion yuan, 74.568 billion yuan, 32.272 billion yuan, and 2.841 billion yuan, respectively. It is 5%, 5%, 9%, 4%, and 1%.

As of July 26, Alibaba-SW reported to HK $ 104.4/share, up 4.82%.

Disassembling the Shandong Economic Semi -annual Report: The upward chassis, kinetic energy, and fixed force are reduced for one year.

- END -

After growing up, the head teacher in the junior high school class became the same table

Source: CCTV NewsThe copyright belongs to the original author, if there is any inf...

The Business Bureau of Zhixi District, Yantai City vigorously promotes the butterfly change of the regional business center

In order to serve business activities, promote the economic development of Zhizheng District and the update of urban style, the Commercial Bureau of Zhizheng District has continued to work hard, conti