Investors "Emergency" do 40 billion market capitalization vaccine stocks Kangtai Biological performance plummeted and stock prices have plummeted

Author:Economic Observer Time:2022.07.26

On July 26, Kangtai Bio continued to decline and closed at 35.85 yuan per share, down 1.29%from the previous day. You know, in the first quarter of 2022, Kangtai's net profit reached 274 million yuan, an increase of 987.71%year -on -year. The performance changed only three months.

Author: Zhang Xiaohui

Figure: Tuwa Creative

Guide

One || In the eyes of some investors, Kangtai Bio has always been a white horse biological stock with excellent performance growth. In this way, a white horse vaccine stock was thunderous in performance, and almost no time to digest for investors. On July 26, the market value of Kangtai biological biology reluctantly won 40 billion yuan. If the stock price continues to fall, the market value may continue to shrink.

不 || Many investors dare not believe that Kangtai's performance will drop so fast. The anxiety of performance is not groundless. According to statistics from reporters from Economic Observation Network, at least five investors have raised the performance of the second quarterly report on Kangtai Bio in July, expressing concerns about the company's performance.

The performance of white horse biological stocks with a market value of 49 billion yuan suddenly changed, and the stock price plummeted!

On the evening of July 24, 2022, Shenzhen Kangtai Biological Products Co., Ltd. (300601.SZ, hereinafter referred to as "Kangtai Biological") released the semi-annual performance trailer for 2022 70.29%-61.37%.

As soon as the news came out, Kangtai biological stock price plummeted.

On July 25, the minimum of the Kangtai Biological plate fell to 34.44 yuan, the lowest decline reached 9.84%, and finally closed at 36.32 yuan, a decrease of 4.92%from the previous trading day. On July 26, Kangtai Bio continued to decline and closed at 35.85 yuan per share, down 1.29%from the previous day.

You know, in the first quarter of 2022, Kangtai's net profit reached 274 million yuan, an increase of 987.71%year -on -year.

The performance changed only three months.

The performance plummeted, the stock price plummeted

Kangtai's performance preview means that in the first half of 2022, the company's net profit was expected to be reduced by at least 60 %.

For the cause of a sudden drop in performance, Kangtai Bio explained:

The main reason is the impairment of the assets related to the new crown and the clinical expenditure of Phase III clinical expenditure. Since the second quarter, the new crown vaccination environment at home and abroad has changed significantly, the demand for the new crown vaccine has decreased rapidly, and the company's new crown vaccine sales have fallen rapidly; The blindness of clinical data in phase III in Ukraine is delayed, and subsequent sales have great uncertainty.

The company's new crown vaccine -related inventory products, raw and auxiliary materials, self -made semi -finished products, and the new crown vaccine development expenditure for the end of March 2022 will prepare for the asset impairment of 41,459,300 yuan; in addition, the new crowned vaccine in the second quarter The cost of research and development expenditure is 1402.22 million yuan; the total amount of asset impairment preparation and confirmation of the cost of research and development expenditure will reduce the total profit of 55,4809,300 yuan. Considering the impact of deduction and reducing net profit of 451.66 million yuan.

A brief attribution is: the company's performance has fallen sharply, affected by the decline in the demand for the new crown vaccine and the Russian and Ukraine War.

In the eyes of some investors, Kangtai Bio has always been a white horse biological stock with excellent performance growth.

According to the official website information, Kangtai Bio was established in 1992. It has focused on the development, production, and sales of people with vaccines for 30 years. It has now developed into an innovative biopharmaceutical company with a leading domestic and international layout. There are 10 products, of which 60 micrograms of hepatitis B vaccine and double -carrier 13 -valent pneumonia vaccines are the world's first. The four -united vaccine is the exclusive domestic and the world's first new crown vaccine with two different technical routes.

Kangtai Biological introduces himself. The company is one of the most abundant companies on the domestic vaccine research and development platform. It has research and development capabilities such as virus vaccines, bacterial vaccines, genetic engineering vaccines, combined vaccines, multi -price vaccines; More than 30 items, basically covering the world's mainstream varieties. In recent years, the company has actively increased the investment in R & D investment and strengthened the construction of talent teams. In 2021, R & D investment accounted for more than 20%of the revenue, and R & D personnel accounted for nearly 19%of the total personnel. Essence

In this way, a white horse vaccine stock was thunderous in performance, and almost no time to digest for investors.

On July 26, the market value of Kangtai biological biology reluctantly won 40 billion yuan. If the stock price continues to fall, the market value may continue to shrink.

In August 2020, two years ago, Taikang Biological's stock price was up to 250 yuan, and the market value once stood at 170 billion yuan.

Investors have already poured out performance anxiety

Many investors dare not believe that Kangtai's performance will drop so fast.

Before the Kangtai Biological semi -annual report, many investors have already asked the listed company through the interaction of the Shenzhen Stock Exchange.

On July 14, some investors questioned: "The stocks have fallen continuously, and the interim performance previews are not previewed. What do you want to do?" What do you want to do? "

Kangtai Bio has made a very official response to this. According to the "Shenzhen Stock Exchange GEM Stock Listing Rules", the listed company is expected to have a negative, net profit compared to the same period last year compared with the same period of the previous year. If you rise or fall by more than 50%, realize the profitability, and the net assets at the end of the period, the preview shall be conducted within one month from the end of the end of the accounting year; there are no relevant requirements for the semi -annual performance forecast and quarterly performance forecast. The company strictly perform information disclosure obligations in accordance with laws and regulations. The company's operating situation is normal, and the stock price fluctuations are affected by various factors. Please pay attention to investment risks. Thank you for your attention. On July 15th, investors followed up and asked: "Why don't the company issue semi -annual performance preview?" "Will the company issue a performance preview in the second quarter?"

Kangtai Biological A response to the previous content was consistent as a reply.

The anxiety of performance is not groundless. According to statistics from reporters from Economic Observation Network, at least five investors have raised the performance of the second quarterly report on Kangtai Bio in July, expressing concerns about the company's performance.

In addition, investors questioned Kangtai Bio: "The company's stock has become a garbage variety in the secondary market, will it be transformed into a lithium battery and photovoltaic?" Do new energy vehicles? "

Kangtai Bio responded that since its establishment, the company has been engaged in immune health for 30 years. With its strong research and development strength, rich product structure and layout, innovative technology platform, strict quality management system, safe and stable product quality, etc., it has created it. The solid market status and good brand advantages have developed into a leading enterprise in the field of vaccines in domestic people. The company's research and development capabilities and production scale are at the forefront of the domestic vaccine industry, especially the leading advantages of multi -joint and multi -price vaccine research and development. Thank you for your attention to the company!

There are also investors asking Kangtai Biological on July 4: "Hello, the secretary, I think the company's announcement basically reduces its holdings and has not increased its holdings. Are the executives who are so optimistic about your company?"

Kangtai Bio did not respond directly to this question. It only said that in May 2019, the company's controlling shareholder and actual controller Du Weiming completed the increase of the company's shares; and in November 2021, the company's controlling shareholder and actual controller Du Weiming issued an increase in the company's shares to increase the company's shares. Proposal announcement.

Although Kangtai Bio did not disclose the debt situation of the actual controller Du Weiming, some of the related situations were not very optimistic.

Announcement on May 17, 2022 shows that Du Weiming's 5.24 million shares held will be passively reduced due to judicial auctions. The executive court is the Sichuan Intermediate People's Court.

In the announcement, Kangtai Bio said that the company's controlling shareholder and actual controller Mr. Du Weimin held 182,878,125 shares of the company, accounting for 26.11%of the company's total shares. Except for 5,241,098 shares that will be auctioned by judicial, Mr. Du Weimin consistently consistent There are no acts where other shares have been auctioned.

The situation of the actual controller, and the rapid drop in the semi -annual performance of Taikang, made investors more anxious about the future of Kangtai Bio.

Disassembling the Shandong Economic Semi -annual Report: The upward chassis, kinetic energy, and fixed force are reduced for one year.

- END -

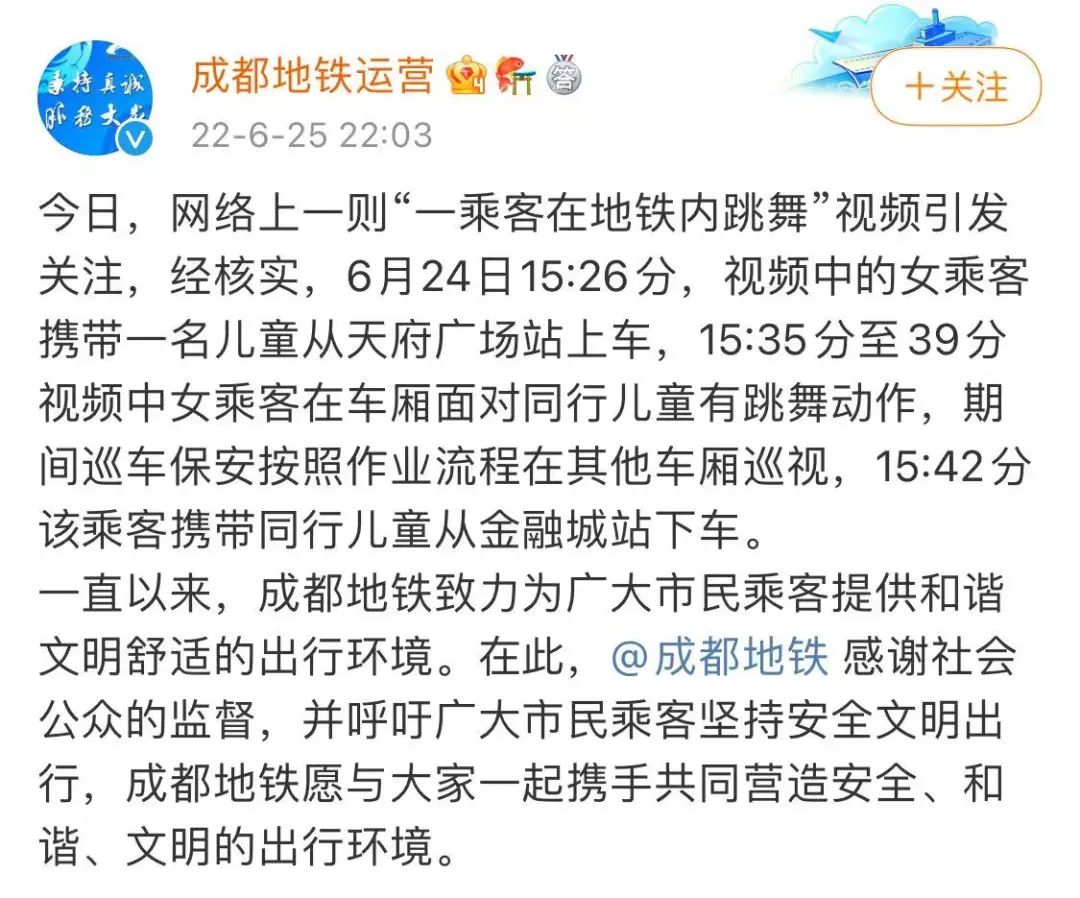

Female passenger's subway dances in children?Chengdu Metro Review

On the 25th, a video of one passenger dancing in the subway video attracted attent...

This summer, I encountered with Wu Le Shuishi lychee sweetly

Farewell to the rainy rainy weatherWelcome to the long -lost blue sky and white cl...