Energy sanctions on Russia weaken the competitiveness of European manufacturing, industry insiders: European economic exposure is fatal weaknesses!

Author:Global Times Time:2022.06.16

[Global Times Li Linjia Zhaodong, a special reporter in Russia and Germany] "The rise in industrial energy is soaring in weakening the global competitiveness of European manufacturing." The Wall Street Journal reported on the 13th that European factories are fighting for the alternative of Russian energy to alternatives. Taste. After initiating sanctions against Russia, the cost of European manufacturing costs that had lost cheap energy support in the past "sat on the rocket". According to data from the EU Statistical Bureau on the 15th, the industrial output value of the euro zone decreased by 2.0%year -on -year, and the deficit of commodity trade was innovative. Some industry leaders bluntly stated that the fatal weakness of the European economy has been exposed -the highly developed manufacturing industry is based on lack of energy and raw materials.

Import growth is far beyond export

Russia's Natural Gas Industry Co., Ltd. announced on the 14th that due to the failure to return the repaired natural gas compression unit in time, Russia will be forced to reduce the natural gas supply to the "Beixi" pipeline. According to the Russian News on the 14th, Siemens confirmed that "due to technical reasons, the gas turbine can only be repaired in Canada. However, due to Canada's sanctions, the company can not deliver and repaired equipment to customers." At present, the Russian gas company has passed "North Northern" Northern "North. The natural gas transmitted to Germany was reduced to 100 million cubic meters per day, a decrease of 40%. After the news of Russia's production reduction was issued, the price of natural gas in Europe rose more than 3%, and the TTF benchmark Dutch natural gas July futures price reached $ 993 per cubic kilometer.

Modvedev, vice chairman of the Russian Federal Security Conference, said in social media on the 14th that Europe is in the energy crisis. As the West tries to prohibit Russia's energy imports, the situation will only become worse.

From the perspective of trade data published by EU member states, the increasing and higher energy costs have increased imports significantly, while severely dragging out export profits. According to the latest data from French Customs, trade deficits were hit in April, of which imports increased by 7%to 58.5 billion euros. Exports increased by 4%to 46.4 billion euros.

Germany is the largest economy in the European Union and the largest imported country in Russia. EU EU Council's economists predict that under the pressure of high energy prices, the economy of Germany will shrink in the second quarter of 2022. According to Germany's "Economic Weekly" report on the 13th, Germany's exports in April reached 126.4 billion euros, an increase of 12.9%year -on -year, but the import volume soared 28.1%year -on -year to 122.8 billion euros. According to data released by the Bavarian Statistics Bureau on the 13th, the state exports increased slightly by 0.4%to 16.1 billion euros in April. Imports increased significantly by 16.5%to 20 billion euros. Among them, energy prices have become a key factor: Although the import volume of oil and natural gas in the state decreased by 3%year -on -year, the import bills rose by 134%to nearly 2 billion euros.

The European economy is exposed "fatal weakness"

"The European economy must maintain its status in the world market." Austrian News Agency quoted the German Industry Federation Chairman Ruswum at a meeting at a meeting at the German Chamber of Commerce in Austria. The "fatal weakness" of the European economy -shortage of energy and raw materials.

"Many European factories that rely on Russia's energy for a long time are suspending production." The Wall Street Journal reported on the 14th that for decades, European industry has relied on low -cost oil and natural gas maintenance factories for Russia. After the outbreak of Russia and Ukraine's conflict, the cost of industrial energy soared weakened the competitiveness of European manufacturing companies in the global market.

In fact, since the end of 2021, producers in chemicals, fertilizers, steel and other energy -intensive industries in Europe have been under pressure. The price of natural gas in Europe is currently three times that of the United States. In the face of competition from the United States, the Middle East and other regions, some European manufacturers have discontinued production because the energy cost of these regions is much lower than that of Europe.

OCI NV is a fertilizer producer in Amsterdam, the company's chief executive officer Ahmed Elhos, said that the factory has reduced ammonia output and instead imports ammonia from the company in the US, Egypt and Algeria, OCI NV is still the last step of completing the production of chemical fertilizers in the Netherlands. Marco Mendonic, the director of the European Chemical Industry Council, said: "On the whole, the biggest concern in Europe is to increase imports and decline in exports." As of 2021, about 40%of the natural gas supply of the EU relies on Russia.

Since October 2021, European steel manufacturers have continued to reduce production, and this year's energy supply crisis has brought more direct blows. The Wall Street Journal stated that Spain's Acenix is one of the world's largest steel companies. In March of this year, Spain's electricity prices soared that the company was forced to close the production line. It is reported that the gradual decrease in Russia's supply may allow the European industry to be in a competitive disadvantage for a long time, unless manufacturers can deploy technologies that significantly reduce fossil fuel consumption. However, executives said that many of these technologies take several years to achieve business feasibility and will need to invest a lot.

Germany enables "combat room" to deploy energy

"In Germany, who can get the decision -making power of natural gas deployment in the hands of the energy regulatory agency in Bonn." The Wall Street Journal said that the agency has established a "combat room" equipped with diesel reserve, shower, canvas bed and food supply. Essence In emergency situations, a 65 -member crisis team will work around the weather, based on the data collected from each company to make energy deployment decisions. The chairman of the agency Mueller said that it would supply the company's "inventory ability" to supply natural gas under the "inventory ability" of the enterprise in the case of natural gas interruption and reduction. According to Germany, the German Federal Government hopes to prevent bankrupt energy -intensive companies through national subsidies in view of the sharp rise in energy costs. The Federal Ministry of Economic Affairs of Germany stated that it would invest 5 billion euros for this. The guidelines of the plan pointed out that the sharp rise in natural gas and power prices is a special burden on many trade and energy -intensive companies. Especially chemical, glass, steel or metal industries.

In the German chemistry and pharmaceutical industries, prices have risen amazing. A German TV report said that compared with the same period last year, the company's companies in the first quarter of 2022 increased their prices by about 22%. According to data from the industry association VCI. Christian Kurman, the owner of the German chemical company, said that the prospect of the industry was "more and more dull." Natural gas embargo or "disconnection" of Russia will have a "destructive effect". Chemical and pharmaceutical companies have discovered that it is increasingly difficult to pass higher costs to customers.

This situation prompts Germany to increase the hope of chemical supply to China. According to data released by the German Federal Bureau of Statistics on the 13th, due to the increase in demand for chemical products, Germany's imports from China increased strongly. In April, Germany's imports from China rose sharply, an increase of 52.8%over the same period last year to 16.7 billion euros, of which also, of which also, of which also, of which, also, also of which also, of which also, of which, also, also of which also, of which, also, also of which also, of which, also, also, also of which also, of which, also, also, also of which also, of which, also, also, also of which, also, also, also, also of which also, of which, also, also, also, also, also, also, also. Including pharmaceutical raw materials.

A survey by German Fuxing Credit Bank shows that nearly 40%of SMEs in Germany have increased the prices of products and services to offset rising costs. Another 33%of medium -sized enterprises plans to premise at the end of the year. The survey also shows that one of each company on average will "pass the increasing energy cost to customers." German SMEs have long been the main force of export economy, which will greatly affect Germany's global competitiveness.

- END -

Shanxi people traveling Taiyuan boutique tourist route (2) -NewSCC Taiyuan Day Tour

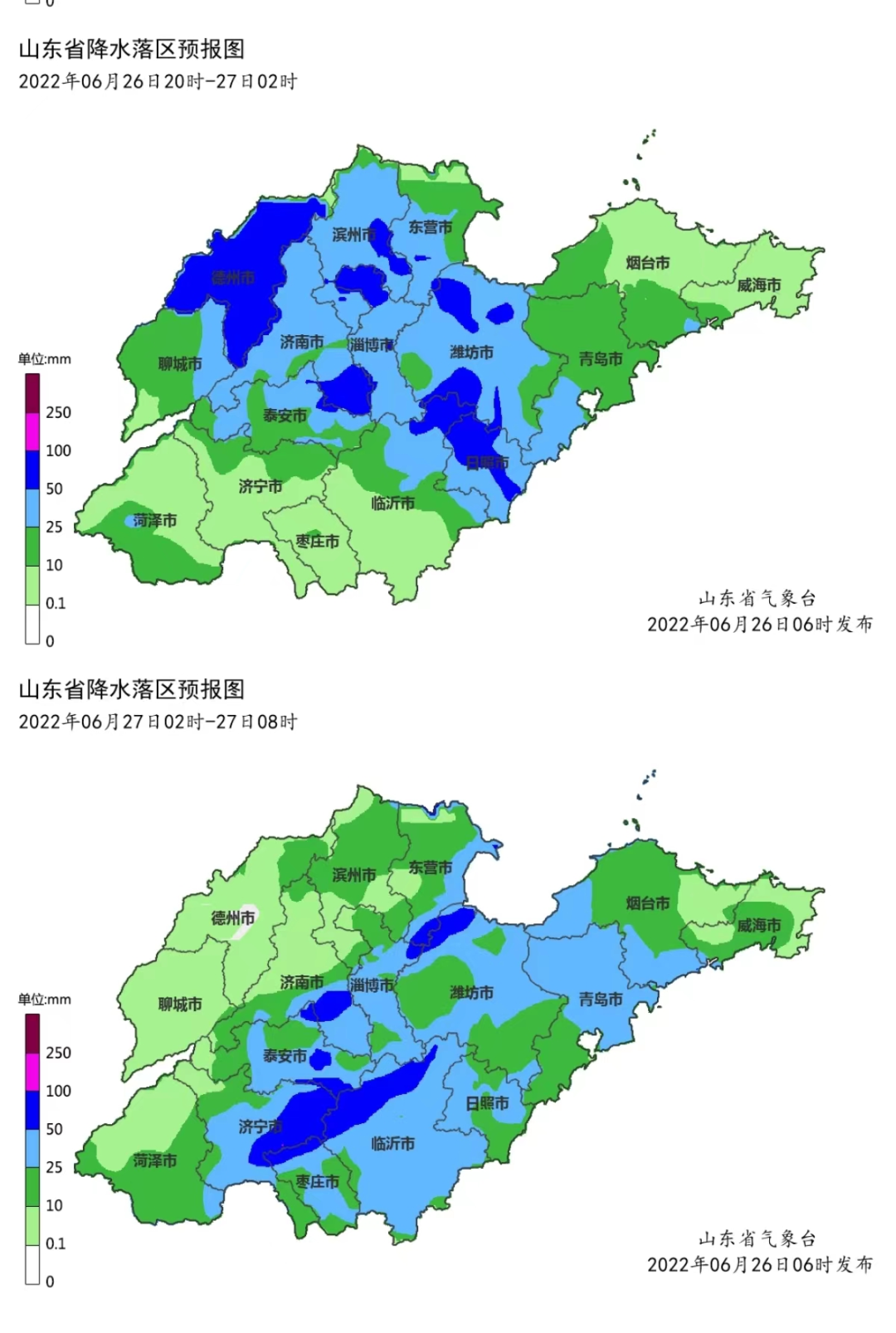

Level 11 gusts and heavy rain are coming soon!Shandong starts the fourth level of flood prevention!These 10 cities pay special attention!

At 11:00 on June 26, the Shandong Provincial Department of Water Conservancy and t...