How to enjoy research and development expenses plus deduction policy?This article tells you

Author:State Administration of Taxati Time:2022.07.28

In 2022, after the Party Central Committee and the State Council issued a new combined tax support policy based on the economic development situation, the State Administration of Taxation combed relevant tax and fees policies and measures around the main links and key areas of innovation and entrepreneurship, covering the entire life cycle of the enterprise. Take you today: R & D expenses plus deduction policy

R & D expenses plus deduction

Enjoy the subject

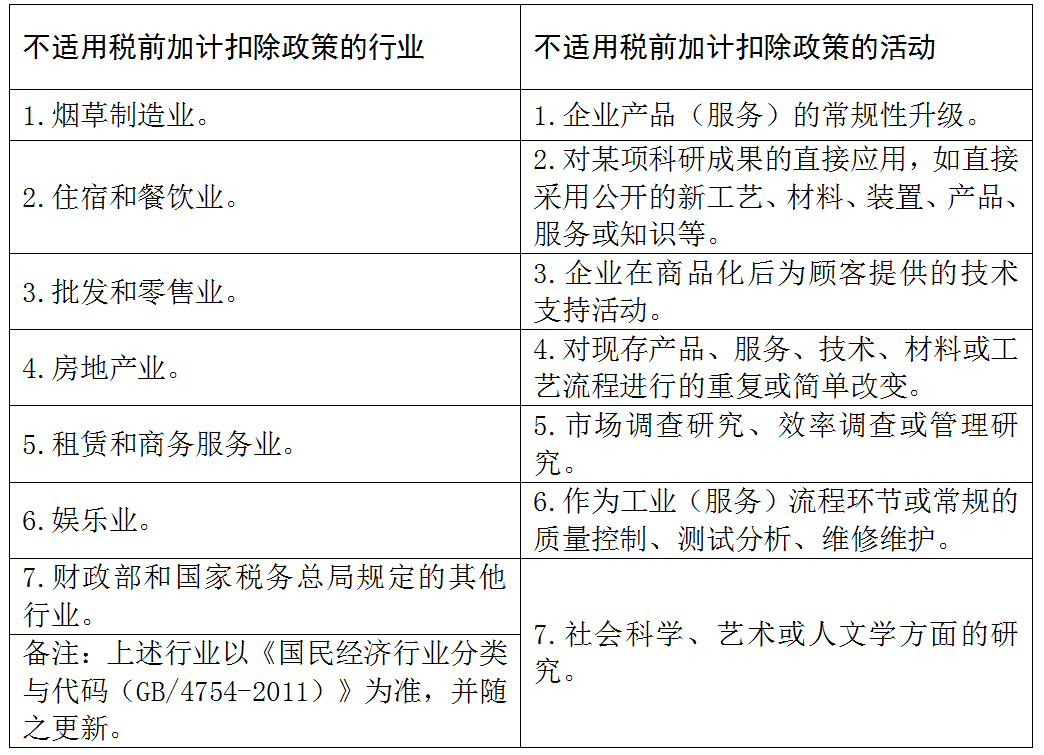

In addition to manufacturing and technology -based small and medium -sized enterprises, the accounting accounting is sound, the implementation of account checks and can accurately collect research and development costs.

Content

1. From January 1, 2018 to December 31, 2023, the actual R & D expenses incurred in the company's research and development activities without forming an intangible asset into the current profit or loss, on the basis of the deduction in accordance with regulations, in accordance with the actual reality, in accordance with the actual situation 75%of the incurred amount, extracted from the tax before tax.

2. From January 1, 2018 to December 31, 2023, if an enterprise actual R & D expenses incurred in R & D activities form intangible assets, 175%of the cost of intangible assets are amortized before tax.

Enjoy condition

1. Enterprises shall conduct accounting treatment of R & D expenditure in accordance with the requirements of the financial accounting system; at the same time, the research and development expenses that enjoy the deduction shall be set up in accordance with the research and development projects, and the various R & D expenses that can be deducted in that year can be accurately collected. Forehead. If a number of R & D activities conduct a number of R & D activities within a tax year, the R & D expenses that can be deducted according to different R & D projects should be collected according to different R & D projects.

2. The enterprise should calculate the R & D expenses and production and operation costs, and accurately and reasonably collect various expenses. If the division is unclear, the additional deduction shall not be implemented.

3. The expenses incurred by the enterprise entrusted external institutions or individuals to conduct R & D activities will be included in the R & D expenses of the commissioner according to 80%of the actual amount of the cost and calculate the deduction. Regardless of whether the entrusting party enjoys the pre -tax deduction policy for R & D expenses, the trustees shall not be deducted.

The actual amount of external research and development costs should be determined in accordance with the principle of independent transaction. If there is a relationship with the entrusting party and the trustee, the trustee shall provide the client with the details of the expenses of R & D project expenses.

4. The projects developed by the enterprise shall calculate the deduction of the projects jointly developed by the cooperation parties on their own research and development expenses.

5. According to the actual situation of production and operation and scientific and technological development, the corporate group has high technical requirements and large investment amounts. It requires centralized research and development. The principle of comparison, reasonably determine the amount of R & D expenses, sharing among the beneficiary members, and the relevant member enterprises calculate the additional deduction.

6. Enterprises related costs incurred in order to obtain innovative, creative, and breakthrough products can be deducted before tax in accordance with regulations.

Policy basis

1. Article 30 (1) of the "Enterprise Income Tax Law of the People's Republic of China"

2. Article 95

3. "Notice of the Ministry of Finance of the Ministry of Finance's Science and Technology of the State Administration of Taxation on improving research and development expenses before tax deduction policy" (Cai Tax [2015] No. 119)

4. The "Notice of the Ministry of Taxation of the Ministry of Finance on improving the proportion of deduction of research and development expenses before tax" (Cai Tax [2018] No. 99)

5.

6.

7.

8.

R & D expenses of manufacturing enterprises for income tax of 100%plus deduction

Enjoy the subject

Manufacturing enterprise

Content

Since January 1, 2021, the actual R & D expenses incurred during the development of manufacturing enterprises will not be included in the current profit or loss of intangible assets, and on the basis of the deduction according to regulations, from January 1, 2021, from January 1, 2021, from January 1, 2021 Then, according to the actual amount of the actual amount of incidence, it will be deducted before tax; those who form intangible assets will be amortized before the tax of 200%of the cost of intangible assets from January 1, 2021.

Enjoy condition

1. The above -mentioned manufacturing enterprises refer to enterprises with the main business of the manufacturing business as the main business and enjoy the proportion of the total business income of the main business that year to reach more than 50%. The scope of the manufacturing industry is determined in accordance with the "Classification of the National Economic Industry" (GB/T 4574-2017). The total income is implemented in accordance with Article 6 of the Enterprise Income Tax Law.

2. Manufacturing enterprises to enjoy other policy caliber and management requirements for research and development expenses plus policy, and in accordance with the "Notice of the Ministry of Finance of the Ministry of Finance of the Ministry of Finance of the Ministry of Science and Technology of the State Administration of Taxation of the Ministry of Taxation" (Cai Tax [2015] No. 119 No. 119 ), The "Notice of the Ministry of Taxation of the Ministry of Finance's Science and Technology of the Ministry of Taxation on Entrusted Overseas Research and Development Expenses In addition to deducting relevant policy issues" (Cai Tax [2018] No. 64) and other documents shall be implemented.

Policy basis

"Announcement of the General Administration of Taxation of the Ministry of Finance on Further improving the Deduction Policies of Research and Deducting the Deduction of R & D Costs" (No. 13, 2021)

R & D expenses of technology -based SMEs Enterprise income tax 100%plus deduction

Enjoy the subject

Science and technology small and medium -sized enterprise

Content

The actual R & D expenses incurred during the research and development activities of science and technology -based small and medium -sized enterprises shall not be included in the current profit or loss of intangible assets, and on the basis of the deduction according to regulations, from January 1, 2022 %Deduction before tax; those who form intangible assets, starting from January 1, 2022, at 200%of the cost of intangible assets, amortized before tax.

Enjoy condition

1. Conditions and management measures for science and technology -based small and medium -sized enterprises shall be implemented in accordance with the "Notice of the State Administration of Taxation of the Ministry of Science and Technology of the Ministry of Finance of the Ministry of Science and Technology of the State Taxation of the Ministry of Science and Technology" (National Science and Technology Evaluation Methods "(Guoshi Fazheng [2017] No. 115).

2. Science and technology SMEs enjoy other policy caliber and management requirements for the pre -tax deduction policy of R & D expenses, and in accordance with the "Notice of the Ministry of Finance of the Ministry of Science and Technology of the Ministry of Finance on improving research and development expenses before tax deduction policy" (Cai Tax [2015 [2015 〕 119), the "Notice of the Ministry of Finance of the Ministry of Taxation of the General Administration of Taxation of the Ministry of Finance's entrusted to overseas research and development expenses to deduct relevant policy issues" (Cai Tax [2018] No. 64) and other documents and other documents.

Policy basis

"Announcement of the Ministry of Taxation of the Ministry of Taxation on Further Increasing the Proportion of Deduction of R & D Expenses for R & D Costs for Science and Technology SMEs" (2022 No. 16)

Entrusted overseas R & D expenses plus deduction

Enjoy the subject

Resident enterprises with a sound accounting accounting, the implementation of the account check collection, and the accurate collection of R & D expenses.

Content

The expenses incurred by the commissioned overseas research and development activities are included in the commissioner's commissioned overseas R & D expenses at 80%of the actual amount of cost. Entrusted overseas R & D expenses that do not exceed two -thirds of R & D expenses that meet the conditions in the country can be deducted before the corporate income tax.

Enjoy condition

1. The actual amount of the above expenses shall be determined in accordance with the principle of independent transaction. If there is a relationship with the entrusting party and the trustee, the trustee shall provide the client with the details of the expenses of R & D project expenses.

2. Entrusting overseas research and development activities shall sign a technical development contract, and the commissioner will be registered with the science and technology administrative department. Related matters shall be implemented in accordance with technical contract identification management measures and technical contract identification rules.

3. Entrusted overseas research and development activities does not include R & D activities entrusted by individuals to conduct overseas individuals.

Policy basis

"Notice of the Ministry of Taxation of the Ministry of Taxation on the Corporate Entrusted Overseas Research and Development Cost Taxation Examination Course Credit Research on Related Policy Issues" (Cai Tax [2018] No. 64)

- END -

Qinghai Province issued a marriage registration work rules

Qinghai News Network · Damei Qinghai Client News On June 14, the reporter learned from the Provincial Department of Civil Affairs that in order to further strengthen the standardized management of ma

Announcement on delineating the epidemic risk zone in Chengdu High -tech Zone

Regarding the delineation of Chengdu High -tech ZoneNotice in the epidemic risk zoneAccording to the current needs of the epidemic prevention and control work in our district, in accordance with the p