Investment 100 million!Another brokerage firms: To set up an asset management subsidiary

Author:Dahe Cai Cube Time:2022.07.28

Great Wall Securities announced a plan to set up asset management subsidiaries, and brokers intend to set up a team of asset management subsidiaries to add another member! The latest market value of Great Wall Securities is nearly 30 billion yuan!

On the evening of July 27, Great Wall Securities issued an announcement, and its board of directors reviewed and approved the "Proposal on the establishment of asset management subsidiaries and changed the company's business scope", and intended to contribute to RMB 1 billion Name, hereinafter referred to as asset management subsidiaries), will inherit the company's securities asset management business and change the company's operating scope accordingly.

Regarding the purpose of establishing asset management subsidiaries this time, Great Wall Securities stated that the establishment of asset management subsidiaries is conducive to the company's development of asset management business, conform to the current supervision policy of the asset management industry, accelerate the transformation of wealth management, improve comprehensive wealth management service capabilities, and then realize the realization The asset management business is based on the waist force connecting the company's capital and the asset side. Based on the results of active management and transformation, it has become an important internal support wealth management business center and an important customer center for the company "14th Five -Year Plan" Target.

The announcement shows that the initial registered capital of the asset management subsidiary will be RMB 1 billion, which will come from Great Wall Securities' own capital cash. According to the regulatory requirements, Great Wall Securities will also provide a net capital guarantee commitment with a cumulative amount of no more than RMB 500 million (inclusive) depending on the situation of the risk control indicators of the capital management subsidiary. It can continue to meet the requirements of the regulatory authorities.

Asset management subsidiaries are engaged in securities asset management business, publicly raised securities investment fund management business, and other businesses allowed by regulators.

In 2021, the asset management business has increased significantly

Public information shows that Great Wall Securities was established in 1995 and the actual controller of China China Huaneng Group Co., Ltd. In October 2018, Great Wall Securities was traded on the Shenzhen Stock Exchange. Great Wall Securities Holdings Baocheng Futures, Great Wall Investment, Great Wall Changfu Investment and many other subsidiaries are also the main shareholders of the Great Wall Fund and Jingshun Great Wall Fund.

Great Wall Securities mentioned in the 2021 annual report that it must be deployed to the public offset management business: in 2022, the company's asset management business will focus on improving the strength of investment and research, consolidating the capacity of fixed income, strengthening multi -strategic investment capabilities, improving the ESG investment and research system Construction; stable development of public offering management business, use multi -party channels to promote the sales of two large -scale collection products, and promote the scale of asset management business to a new level through the growth of large -scale collection products.

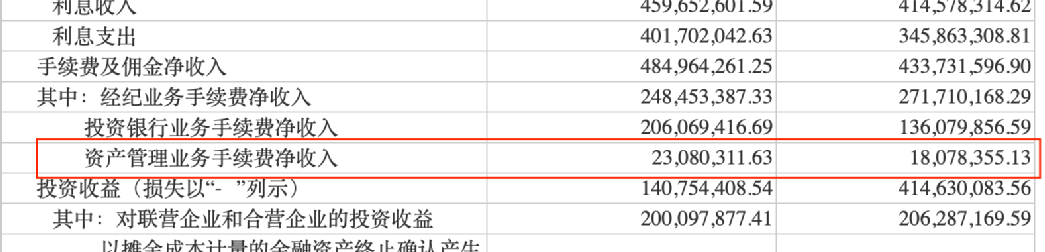

The financial report in 2021 shows that the total operating income of Great Wall Securities Asset Management Business is 140 million yuan, an increase of 32.91%year -on -year; in the first quarter report of this year, the net income of Great Wall Securities Asset Management Business Fee was 230.803 million yuan, compared with the same period last year's during the same period last year last year's period last year. 180.784 million yuan, a significant year -on -year increase.

In terms of asset management business, as of the end of the report of 2021, the net value of the asset -trusted assets of Great Wall Securities Assets Management Business was 77.279 billion yuan, of which the net value of public funds (including public offerings) was 2.178 billion yuan. For 100 million yuan, the net value of the single asset management plan's trusted assets was 43.013 billion yuan, and the net value of the special asset management plan for the special asset management plan was 29.033 billion yuan.

In addition, according to data from the China Securities Industry Association, Great Wall Securities ranked 37th in the industry in 2021 asset management business income.

Great Wall Securities released information on the outside world showing that in 2021, Great Wall Securities Asset Management's active management business revenue exceeded 100 million yuan, of which performance remuneration revenue accounted for over 60 %, and the transformation of asset management business achieved gratifying phases.

In 2021, the Great Wall Securities Asset Management Department established the seven major product systems of "Xin, Enjoy, Environment, Urban, Red, Ying, and Innovation". 10 rankings enter the top 16%of the market, 3 of which enter the top 4%, and 3 enter the top 8%(refer to Wind statistics, 2579 medium- and long -term pure debt funds in the market year -on -year), bringing rich compensation to investors. Pure debts, solidaries+, quantitative, FOF, and different strategies of special households are scattered.

On July 15, 2022, the Great Wall Securities Asset Management Department recruited notice. Recruitment positions include convertible debt researcher posts, interest rate researcher posts, risk management posts, credit rating posts, public offer REITS business posts, etc.

The recruitment notice said that the asset management department, as one of the important business departments of the Great Wall Securities, covers all -round asset management services such as investment research, market channels, energy finance, and real estate investment, and has an independent and perfect risk control, transaction, and operating system. Now recruit some posts on the society. The company will provide competitive treatment for excellent only, investment and management authority that matches its capabilities, and a broad development platform for self -worth.

Asset management will become important competitiveness in the future

Regulatory policy support and strengthen the team of public fund managers, and completely relax the restrictions of "one ginseng, one control one card", so that securities firms have begun to "grab the beach" public offset management business layout.

Prior to Great Wall Securities, three brokers have announced their plans to set up asset management subsidiaries this year. On April 29, Guolian Securities and Guoxin Securities issued an announcement on the same day that they planned to establish asset management subsidiaries; on June 16, Huaan Securities also issued an announcement saying that it was planned to invest 600 million yuan Management business. In April, the Securities Regulatory Commission issued the "Opinions on Accelerating the High -quality Development of the Public Fund Industry" and supported professional asset management institutions such as securities asset management subsidiaries, insurance asset management companies, bank wealth management subsidiaries and other professional asset management institutions to apply for public fund licenses in accordance with the law to engage in public fund management business Essence In May, the CSRC issued the "Measures for the Supervision and Management of Public Funding Securities Investment Fund Managers" and stated that under the premise of continuing to adhere to the policy of "one ginseng and one control" of the fund management company, it will relax the number of public offering licenses.

A person in charge of a securities management management in East China said in an interview with the China Fund, "The business of public funding is a vast deep sea, but it is also a fierce red sea." After a similar point of view, the public offering business contributes to the profit of brokers. This will be a very thick profit blessing for head brokers who have faced bottlenecks in recent years.

In addition, a person in Shanghai's head securities firm said that asset management can increase the value and valuation of the brokerage firms, and large securities company asset management companies should develop in public business licenses. The asset management industry is currently the fastest segment industry in the financial industry, and the development momentum is good. The brokerage holding fund company is also willing to have high willingness. From the current market performance, the valuation of the brokerage of the equity of the head fund company company It is also generally higher than the average level of the industry.

Responsible editor: Wang Shidan | Audit: Li Zhen | Director: Wan Junwei

- END -

Urumqi: High temperature is coming, the peak construction construction

Tianshan News (Reporter Qin Peng) On the morning of July 22, on the construction s...

Dong Xiaoping investigated Zhangjiachuan County's scientific and technological innovation work

Zhangjiachuan County Rong Media Center (Reporter Don Yingjie) On July 14, Dong Xia...