New Oriental 2022 fiscal revenue fell by 56.8% in the fourth quarter.

Author:First wind Time:2022.07.28

On the evening of the 27th, New Oriental disclosed the performance. In the fourth quarter of fiscal year in fiscal year, the company's net revenue fell 56.8%year -on -year, and its operating loss reached 105.6 million US dollars. At the same time, the company launched a 400 million US dollar share repurchase plan.

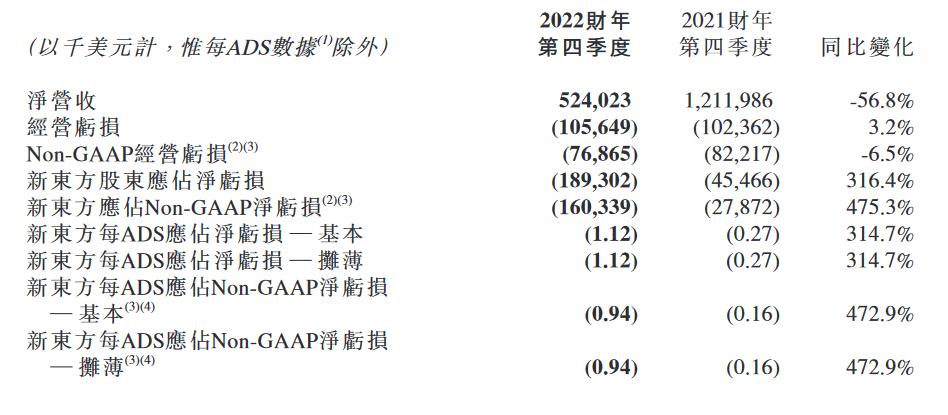

In the fourth quarter

The announcement shows that, as of the fourth quarter of May 31, 2022, New Oriental's net revenue fell 56.8%year-on-year to $ 524 million. Operating losses were US $ 105.6 billion, and Non-GAAP's operating losses were US $ 76.855 million; New Oriental shareholders should account for US $ 189.3 million.

Source: Announcement

From the entire fiscal year, the net revenue of New Oriental 2022 fiscal year was US $ 3.105.2 billion, a year-on-year decrease of 27.4%; the operating loss was US $ 982.5 million, and the operating profit of the previous fiscal year was US $ 117.3 million. New Oriental shareholders should account for $ 1187.7 billion.

Source: Announcement

Operating data shows that as of May 31, 2022, the total number of New Oriental Schools and Learning Center was 744, a decrease of 103 compared with February 28, 2022, and a decrease of 925 rooms from the same period of the previous fiscal year. Among them, the total number of schools is 107.

Yu Minhong, Executive Chairman of the New Oriental Board, said that the company reorganized the core business and operations in the 2022 Fiscal year, and has entered a new stage, and the remaining main business performance has stable. In the fiscal year, the preparations for going abroad and the consulting business abroad increased by 6%and 16%year -on -year, respectively. The domestic examination preparation business for adults and college students increased by about 30%year -on -year. In addition, non -disciplinary counseling businesses are carried out in more than 50 cities, and intelligent learning systems and equipment are also adopted and tested in nearly 60 cities. Both have received positive feedback from students, and the retention rate has also been improved. In terms of other businesses, including study and research camps, teaching materials and digital intelligent learning solutions, and preparation for the promotion of this examination, all made significant progress.

Yang Zhihui, CEO and Chief Financial Officer of New Oriental, pointed out that New Oriental has maintained a stable cash turnover during the reorganization process. As of the end of this quarter, the total amount of the company's cash and cash equivalents, regular deposits and short -term investment was about 4.2 billion US dollars. Most of the additional expenditures caused by the termination and layoffs involved in the shutdown learning center have been digested in fiscal 2022. New Oriental's management team will continue to work hard to reply to the overall profitability and actively seek profit growth.

Share price sluggish shares repurchase plan

In the secondary market, after the introduction of policies in the field of education, New Oriental's stock price has plummeted. In terms of Hong Kong stocks, the new Oriental stock price has fallen by nearly 90 %, and in March 2022, it hit a new low of HK $ 6.62.

However, it has benefited from the establishment of Oriental Selection Agricultural Live on Weibo hot search and subsequent popularity. In recent months, New Oriental's stock price has bottomed out. As of July 27, the company's stock price reported at HK $ 18.66.

However, when investors thought that New Oriental wanted to "transform", Yu Minhong recently posted on his personal WeChat public account "Lao Yu Gossip", "The selection of the East is a lively, everyone thinks that New Oriental is only agriculture." What is doing is education. Education is the main business of New Oriental.

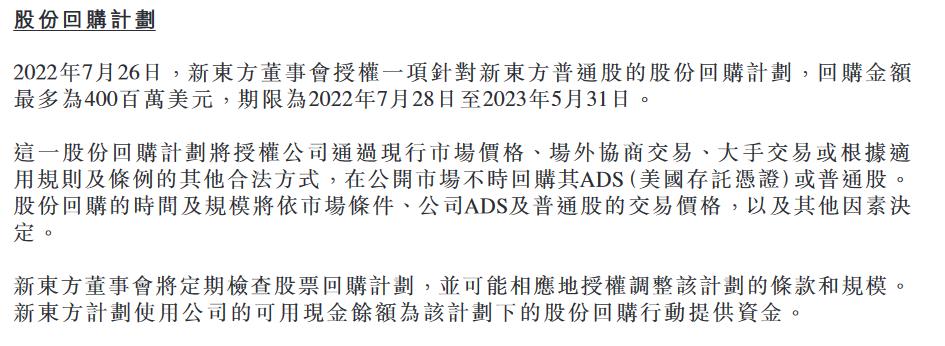

While disclosed the fiscal year of 2022, New Oriental also released a share repurchase plan.

The announcement shows that on July 26, the New Oriental Board authorized a share repurchase plan for New Oriental's ordinary shares, with a repurchase amount of up to 400 million US dollars and a period from July 28, 2022 to May 31, 2023.

Source: Announcement

The announcement pointed out that the above -mentioned share repurchase plan will authorize companies to repurchase ADS or ordinary shares from time to time through the current market prices, off -site negotiation transactions, etc. according to the current market prices and other legal methods of applicable rules and regulations.

- END -

Warm heart condolences to take care -the Water Resources Bureau of the Waitai County Water Conservancy Bureau launched the "Gulbang Festival" visiting campaign

(He Xiaodong) Recently, Zhang Bin, Secretary of the Party Group and Deputy Directo...