Jinshan Cloud has submitted a listing application to the Hong Kong Stock Exchange for three consecutive years for a net loss

Author:Cover news Time:2022.07.28

Cover reporter Ma Mengfei

On July 27, the documents of the Hong Kong Stock Exchange showed that Jinshan Cloud Holdings Co., Ltd. (hereinafter referred to as "Jinshan Cloud") submitted a listing application. After completing the audit procedure in the Hong Kong Stock Exchange, Jinshan Cloud will be listed on the main board of the Hong Kong Stock Exchange, while continuing to maintain a major listing position and trading in the Nasdaq market in the United States.

Public information shows that Jinshan Cloud was founded in 2012. Relying on Jinshan Group's enterprise -level service experience, Jinshan Cloud has gradually constructed a complete cloud computing infrastructure and operating system, and organically combined with advanced technologies such as the Internet of Things, blockchain, edge computing, big data, AR/VR, etc., providing more than more than more than exceeding 150 types are suitable for video, games, digital health, finance, public services, communities, parks, education, industrial, e -commerce retail and other industries.

In May 2020, Jinshan Cloud was split from the Internet software company Jinshan Group to Nasdaq's listing trading. The IPO issuance price was $ 17 per share, and a total of 510 million US dollars raised funds.

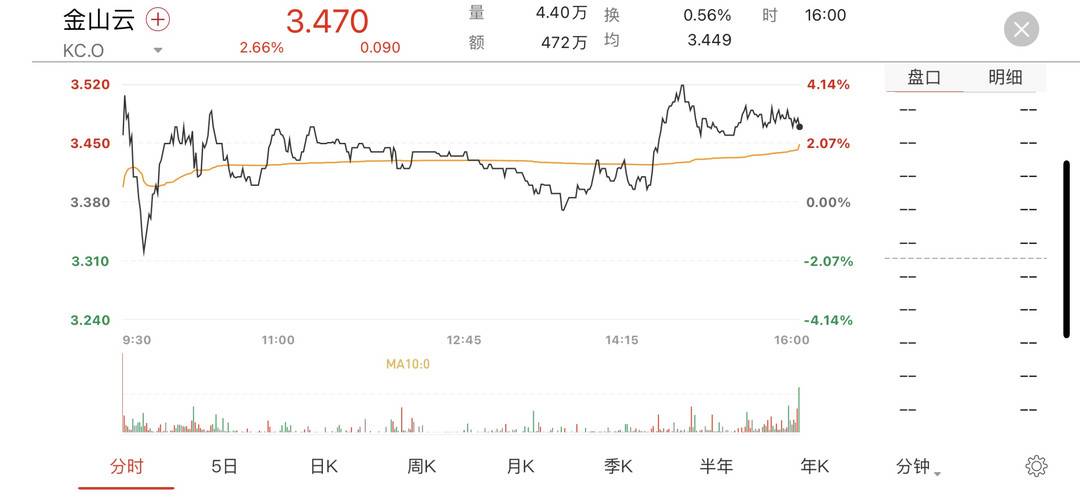

However, in terms of stock prices, Jinshan Cloud's stock price once soared to $ 74.67, but since February 2021, it has fallen all the way, and it has significantly fell below the issue price of $ 17. On March 14, 2022, the stock price of Jinshan Yunpan hit a new low of $ 2.5. At present, Jinshan Cloud's latest stock price is $ 3.47/share.

The financial report shows that in the first quarter of 2022, Jinshan Cloud's net loss was about 554.8 million yuan, a loss of 45%year -on -year. In addition, from 2019 to 2021, Jinshan Cloud's net losses were 1.111 billion yuan, 962 million yuan, and 1.591 billion yuan, respectively.

The prospectus mentioned that according to the information of Fhstri Lavin, the scale of Jinshan Cloud from 2021 to 2026 is expected to grow at a compound annual growth rate of 20.6%.

Jinshan Cloud said that since 2018, according to income, China has become the world's second largest cloud service market after the United States.

The prospectus also shows that Jinshan Software, Xiaomi Group, and Lei Jun are the three major shareholders of Jinshan Cloud, with a shareholding ratio of 37.4%, 11.82%and 11.82%, respectively. It is worth noting that Jinshan Software and Xiaomi Group are existing customers of Jinshan Cloud. In 2021, the revenue from the two companies accounted for 10.9%and 2.2%of Jinshan Cloud's total revenue, respectively.

- END -

Poster 丨 war high temperature guarantee power supply and stable economy to protect summer cooling

The strongest high temperature since this year is coming!From June 15th to 22nd, Z...

Double pain!Men infected with new crowns and monkey acne at the same time

According to the United States New York Post reported on July 22, a man in Califor...