40 ° C High temperature stimulates the summer war, but the "summer must -have artifact" is cold?

Author:Starting line of entrepreneurs Time:2022.07.28

Produced | The front line of entrepreneurship

Author | Huang Yanhua

Edit | Egg

This summer, the country has become a "big furnace" in many places in the country. The high temperature approaching 40 ° C allows#how to escape from the 40 -degree high temperature circle#and rush on the Weibo hot search list. People have opened a "summer war" - Eat ice cream and ice watermelon, drink cold drinks and mung bean soup, play underwater mahjong, remove the water park, open all night air conditioners, open the refrigerator to cool ...

In these summer avoidance tricks, most of them are inseparable from refrigerators and air conditioners, and these two home appliances can be called "a must -have artifact for summer home". Even if there are 618 major measures and new and new measures, it has not been able to restore the domestic refrigerator's sales trend.

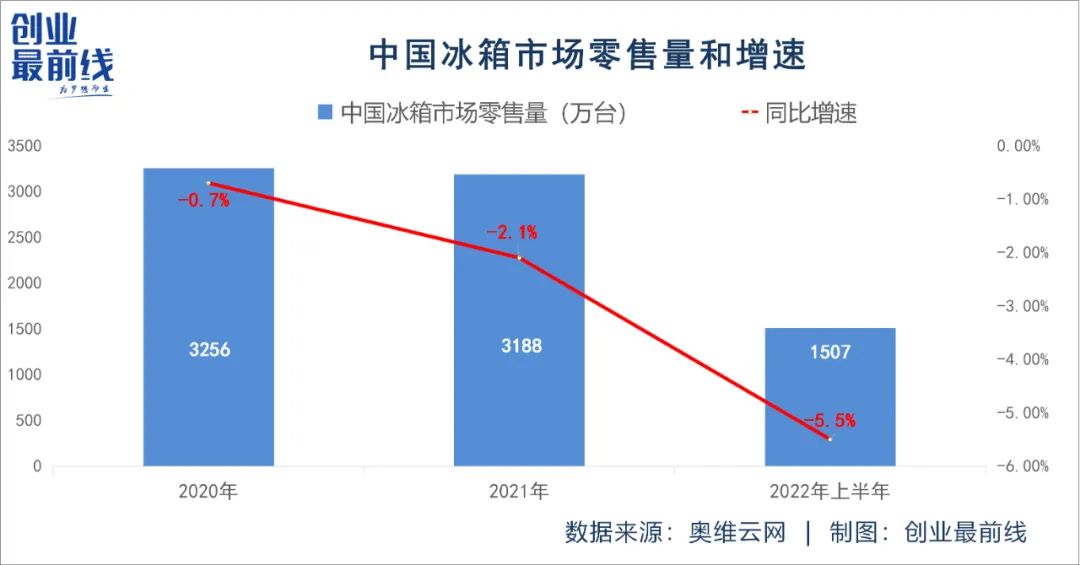

On July 13, Aowei Cloud Network released a summary of the Chinese refrigerator market in 2022 H1 (the first half of the year). The overall channel of Ovi Cloud.com showed that the retail volume of the H1 refrigerator market in 2022 was 15.07 million units, a year -on -year decrease of 5.5%; retail sales were 45.6 billion yuan, a year -on -year decrease of 3.4%.

It is worth noting that the growth rate of retail sales in the refrigerator market in the past two years was negative, respectively -0.7%and -2.1%, respectively.

So, why does the retail sales of the domestic refrigerator continue to decline? What are the current challenges in the refrigerator market? Is this "summer must -have artifact" popular in the future?

1. One of the former "three major home appliances"

As a hot summer removal artifact, there are ice books in ancient times, there are refrigerators today, and the birth of the refrigerator can be traced back to 1834. This year, American engineer Jacobu Parkins made the first compression type Refrigerator refrigerator.

Until 1910, the world's first compressed home refrigerator came out in the United States. Three years later, the "Du Mela" brand of refrigerators produced in Chicago, the United States, which is the world's first practical home refrigerator. In 1918, the Cobrando engineer in the United States designed and manufactured the world's first home automatic refrigerator.

The first refrigerator in China was successfully developed by the Beijing Snowflake Refrigerator Factory in 1956. At that time, the Dutch Philips technology was introduced.

(Figure / Network)

By the 1980s, the refrigerator became one of the "three major pieces" of ordinary Chinese families.

According to the "front line of entrepreneurship", before the large number of factories transformed and produced refrigerators in 1984, the total sales volume of refrigerators in the country was only 250,000 units. By 1985, this value was updated to 1.5 million units. Three years later, the total domestic refrigerator sales were even more even more. It was once soaring to 7.35 million units, with an average annual growth rate of 96.6%, which will double every year.

It can be said that the Chinese refrigerator industry has ushered in the first golden period for development.

However, after 1988, after the increase in production and sales, China's home appliance industry entered a "small cold wave", and the entire refrigerator market began to shrink. In 1990, the total sales of refrigerators in the country were only 4.36 million units, a shrinkage of more than 40%from 7.335 million units in 1988.

With the increasing level of living standards, the post -80s generation gradually became the main consumer. In addition, the development of young consumption concepts, people's personalized demand for refrigerators has become increasingly prominent. This has also further stimulated the heating of the high -end refrigerator market.

High -end refrigerators have become the focus of the development of many home appliance companies since 2009.

In January 2010, Haier released the world's first "IoT refrigerator", which can not only store food, but also link to the network through linking with the network, "identify" the relevant information stored in the refrigerator, and timely feedback information to consumption in time For those, help consumers targeted food. At the same time, it can also link to the supermarket database, so that consumers know the product information of the supermarket without leaving home.

(Figure / Network)

By 2013, high -end development has become the top priority of the development of refrigerators. The following year, domestic brands competed to launch smart refrigerators, and foreign companies also entered smart products and technology into the Chinese market. A domestic and foreign brands started to compete around the high -end market.

However, in 2016, foreign brands gradually retreated from the Chinese market or were acquired by Chinese companies. For example, Haier acquired GEA, Midea acquired Toshiba Home Appliances, and Foxconn acquired Sharp.

It is understood that from 2017 to the first half of 2018, among the top ten online retail brands of domestic refrigerators, overseas brands are overwhelmed by the entire army except Siemens, and the rest are domestic brands. It can be seen that the market share and brand influence of domestic refrigerators have improved.

At that time, the global refrigerator industry chain divided the division of labor in the three -legged trilateral momentum: Chinese companies controlled manufacturing, European and American giants controlled core technology, and Japan and South Korea controlled brands and markets.

The overall channel of Ovi Cloud Network shows that the retail sales of the Chinese refrigerator market in 2019 reached 32.78 million units. Although it only increased by 0.2 percentage points year -on -year, it was the first increase in retail volume within 6 years.

During this period, it coincided with the continuous rise in the trend of consumption upgrade. People also had the need for upgrading of home appliances. Intelligent, aesthetic, and functions have become considered factors in people's consumer decisions. The refrigerator market also welcomes the refrigerator market. A new climax of development.

2. Behind the decline in sales year after year

However, the good times did not last long. After 2019, the domestic refrigerator market has fallen into the dilemma of retail volume.

The general data of Ovi Cloud Network's omni -channel push shows that in the first half of 2021, 2021, and the first half of 2022, the domestic refrigerator market retail volume was 32.56 million, 31.88 million, and 15.07 million units, respectively. %. The reason why the retail volume of the domestic refrigerator market continues to decline is that the "front line of entrepreneurship" believes that it is mainly related to the demand for refrigerators.

According to data from the National Bureau of Statistics, in 2020, China's overall refrigerator (cabinet) 100 households have 101.8, of which 100.1 in rural markets is 100.1, and the number of hundred households in the urban market is 103.1. Essence

Such a high market preservation indicates that the domestic refrigerator market has entered the stock period, which also means that the sales of the domestic refrigerator market will mainly rely on the new needs of users to change.

But the problem is that the demand for the renewal of the refrigerator has been low.

According to the series of "Household Electric Safety Usage" series released by the China Household Electric Association, the safe use of the refrigerator does not exceed 10 years. From 2019 to 2021, it is the theoretical replacement period of the refrigerator sales from 2009 to 2011. However, the new demand for refrigerators has not been fulfilled from 2019 to 2021, which means that there are a large number of refrigerators.

Pei Dongmin, researcher at Ovi Cloud Network Dadding Division, also expressed a similar point to "the front line of entrepreneurship". She mentioned that many consumers' new attitudes to household appliances such as refrigerators are often "the product is not bad if it is not bad."

"For durable products, consumers' initiative to change new awareness is not strong, and most of them are consumer habits that are not bad." Pei Dongmin said.

The repeated epidemic situation will obviously make the new rhythm of many consumers change slower.

Under the influence of the epidemic, many companies conduct salaries or layoffs for survival, and some companies have declared bankruptcy or running. Regardless of what kind of behavior of the company is, the revenue is inevitable for its employees. Once the income declines, their consumption power may decline.

To a certain extent, this suppresses their needs for new home appliances.

In addition, the decline in sales of the domestic refrigerator market is also related to the environment. You know, in the case of the overall environmental downturn, many consumers will respond to future uncertainty by increasing savings. After all, "there is food in the family, and the winter is not panic" is the creed that most people have always believed.

As a large -piece durable consumer product, the refrigerator's consumption attractiveness is obviously insufficient.

In fact, factors affecting the retail volume of the domestic refrigerator market not only change new demand, but also include new demand brought by consumers decoration and marriage.

Take decoration, in recent years, the decline in real estate has fallen and the impact of the epidemic has caused the entire decoration industry to fall into a downturn. According to the monitoring data of Aowei Cloud Network, the newly opened project of China's real estate refinement market in 2021, a year -on -year decrease of 6.8%, and the market size was 2.861 million units, a year -on -year decrease of 12.1%.

Another example is marriage. In recent years, the marriage situation in China is not optimistic. According to data previously released by the Ministry of Civil Affairs, in the first quarter of 2020, 2021, and 2022, the number of marriage registrations in my country was 8.131 million, 7.636 million, and 2.107 million pairs, respectively; 12.2%, 6.1%, and 1.2%year -on -year were declining year -on -year.

Obviously, the new demand brought by consumers decoration and marriage in recent years is also low, and it is finally reflected in the domestic refrigerator market sales.

3. Five major problems to be cracked

It is true that the domestic refrigerator market's sales continuously declined, but the challenges in front of the refrigerator industry should not be ignored.

The first challenge is how to create differentiated products. Pei Dongmin said that as a functional product, the refrigerators on the market are currently in a serious lack of update from consumers from product form to product performance.

Regardless of the division of storage space, or in the management and control of the storage environment such as temperature, humidity, oxygen, and water, the technical level of many refrigerators is almost the same, and the performance in these areas is also good. In addition, as far as the refrigerator itself is concerned, after a series of technologies such as air -cooled and frequency conversion are mature, the current technology iterative process is not significant.

If refrigerators want to dig out the hidden needs of consumers on this basis, and achieve new breakthroughs in technical, and then create a differentiation of products, it can be said that it is not easy.

Faced with this challenge, Midea Group's refrigerator division general manager of the domestic marketing general manager told the "front line of entrepreneurship" on Monday that at the brand level, Midea's choice was undertaken by many brands such as Colmo, Toshiba, Midea, Little Swan, Hua Ling and other brands, and and of. Different technical main lines, appearance design and functions are defined to each brand to meet the differentiated needs of different consumers.

At the product level, Midea is in line with the trend of home improvement prefix and home sceneization. This year, the ultra -thin cross door refrigerator with a thickness of only 60cm was launched this year. Once the refrigerator was launched, the sales volume soon exceeded 200,000. In addition, Midea Colmo also launched AI nutrition refrigerators. Its photovoltaic AI suppression purine technology can inhibit the increase of food purine by more than 40%, and the optical quantum increase technology can multiply the anthocyanin ingredients of berry -based ingredients.

For the above challenges, Haier has given different solutions. It has launched high -end refrigerators such as Bo Guan series, giant energy frozen series, and zero -embedded series. The gap, truly realize the integration of kitchen. Secondly, "how to improve consumers' new needs" has become another difficulty in front of the refrigerator companies.

According to Pei Dongmin, consumers' new motivation usually comes from the better experience of new refrigerator products and more complete technical functions. At present, each family has encountered a certain bottleneck at the technical level. It is not as simple as driving consumers to change the refrigerator.

However, it is difficult to return. In the face of this challenge, the refrigerator companies are actively acting and seeking a strategy of response. According to the "front line of entrepreneurship", Midea's current category such as refrigerators has launched a "replacement of new new" activities in China.

According to the activities, if you participate in the old replacement, consumers can enjoy free valuations for old machines, unlimited brand recovery and other services. At the same time, with the recovery of old home appliances, it can be reduced by up to 1,000 yuan. It can be said that these relatively "seductive" benefits with new activities will inevitably stimulate some consumers' new needs to a certain extent.

In addition, "how to further increase the amount of refrigerators" has also become a big mountain that refrigerators are difficult to pass.

As we all know, many consumers are still accustomed to stored meat, vegetables, drinks, beverages, etc. in a refrigerator, and have not separated cooking and leisure.

(Figure / Photo Network, based on VRF protocol)

Therefore, in order to increase the amount of refrigerators, companies need to help consumers to establish awareness of "different scenarios with different refrigerators". The establishment of this consciousness is obviously not achieved overnight. It is a relatively long process.

Not only that, refrigerators also need to think about how to achieve scale and operation.

The emperor mentioned on Monday that as a large appliance, the refrigerator's expenditure in mold investment, development cycle, and logistics costs far exceeded other home appliance categories. Nowadays, the market demand has declined, and consumption confidence is insufficient. It is obviously not easy for refrigerators to achieve "large scale and operations". "Especially the business problem, extending is the transformation of the structure, and the average price is increased." He said.

Finally, refrigerators also need to overcome the challenge of "how to balance the development relationship between various channels".

"The domestic market is changing rapidly, and there are many household appliances formats. With the continuous increase of consumer purchasing channels, refrigerators need to do well in old channels and maintenance in advance. . "Monday Emperor said.

4. Conclusion

Thanks to the continuous high -speed growth of the domestic economy since the reform and opening up, my country's refrigerator industry has shown a leap -up development situation.

However, the domestic refrigerator market has continued to be sluggish, technological innovation is facing bottlenecks, and many uncertain factors such as overlapping the environment means that the survival and development of each refrigerator company is difficult to speak.

It can be said that the competition between refrigerators is far from over, and the rankings are still continuing. The leading lead does not mean forever. Whoever can always make product iteration and technological innovation around the needs of users, who is expected to continue to eat the dividend of industry development, and this "summer must -have artifact" will also develop a wider imagination space for enterprises to occupy smart home scenarios.

*The title diagram in the article comes from visual China, based on the RF protocol.

- END -

"Daily Car Popular Pocket Dictionary": catalyst

catalystThe catalyst is the core part of the fuel cell pile and is the key to the ...

Seven children drowning in Gansu Province Gannan Prefecture, 5 people have no life signs, and 1 person lost contact

The reporter verified from multiple parties, such as the Propaganda Department of ...