728 million yuan in owed banks were sued for the important assets of Dou Shen education or auctioned

Author:Daily Economic News Time:2022.07.28

In the middle of the night on July 26, Dou Shen Education (SZ300010, a stock price of 4.04 yuan, a market value of 3.508 billion yuan) issued an announcement saying The total amount involved in the Beijing Financial Court was 768 million yuan.

For this loan, Dou Shen Education originally wanted to sell Sun Company to repay the debt, but the acquired party stopped. Although the company has negotiated with the acquirer many times, it has failed to change the attitude of the acquirer, and the transaction ended. In addition, the high -profile publicity live broadcast business is also difficult to become "cash cows" in the short term, and the pressure on the repayment of Dou Shen education can be imagined.

"Daily Economic News" reporter found that according to the agreement signed during the loan, the bank may auction guarantee. In addition to the existing office building of Dou Shen Education, two revenue in 2021 accounted for 80% of the total revenue of Dou Shen education. Important subsidiaries may also be auctioned together. For Dou Shen education, a greater crisis is far more than the debts in front of them.

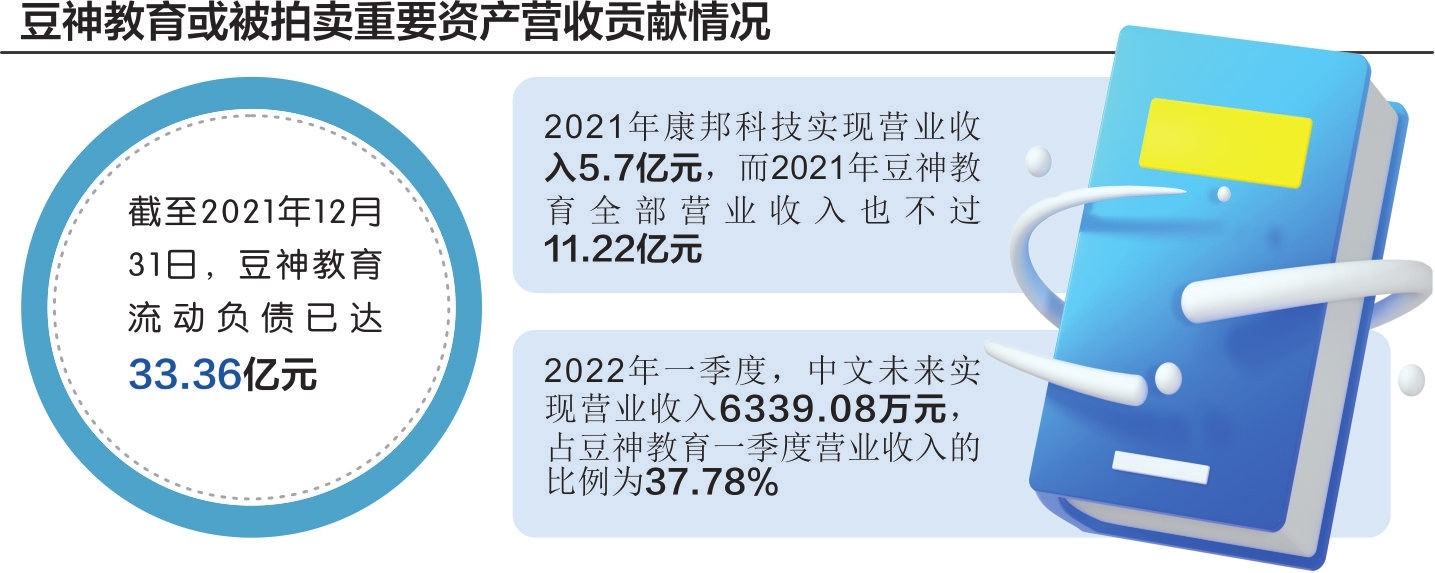

Data source: Reporter organized Liu Hongmei map

Stop selling Sun company stranded

The popularity of Zhanguang New Oriental's "live broadcast", and the bean god education, which has risen after the stock rises, has fallen into a crisis.

In the middle of the night on July 26, Dou Shen Education announced that the Bank of China Co., Ltd. Beijing Zhongguancun Sub -branch with Dou Xin, Chairman of the company, Dou Xin, and subsidiary Beijing Lichen New Technology Co., Ltd. (hereinafter referred to as Lishen Technology Technology ) Waiting for the financial borrowing contract dispute to a lawsuit against the court. As of July 26, the trial had not yet been tried.

The contract dispute originated in 2021. On June 24, 2021, Dou Shen Education signed the Credit Ending Agreement with the Zhongguan Village Sub -branch of the Bank of China. On June 29 of the same year, Dou Shen Education loaned a total of 728 million yuan under the "Credit Ending Agreement" item. However, during the performance period, Dou Shen education failed to pay interest on schedule; the original actual controller Chi Yanming was also listed as a dishonesty and was executed and restricted high consumption. Announced that the loan expired in advance.

As of now, Dou Shen education has not repaid the loan and paid interest, penalties and compound interests, and the guarantor has not fulfilled its guarantee responsibility in accordance with the agreement of various guarantee contracts. In this regard, the Central Bank of China Zhongguancun Sub -branch filed a lawsuit with the court, and the total claims involved the total amount of 768 million yuan.

This "Lai account" is a cause. For this loan, Dou Shen Education originally wanted to repay it by selling Sun Company. According to the previous announcement, the Dou Shen Education plans to sell Sun Company Lizhichen Technology at a price of 876 million yuan; among the income funds, 728 million yuan will be used to repay part of the liabilities of the listed company at Bank of China, which is just in line with the amount of the above loan.

In late June, the original trader proposed to terminate the transaction. Dou Shen Education's repeated negotiation and communication has not changed its final decision, and the sale of Sun company will be stranded. According to the regulations, Dou Shen Education cannot plan major asset reorganizations within at least one month from the date of disclosure of the transaction, which means that it cannot continue to find "lower home" for Lishen technology in the short term.

On the afternoon of July 27, the reporter of "Daily Economic News" repeatedly called the Dou Shen education to publicly call, and no one answered; as of press time, the interview email was not responded.

Support income of auction targets

The consequences of arrears of loans are not just lawsuits.

According to Dou Shen Education's announcement in the announcement, the Bank of China Zhongguancun Sub -branch may adopt property preservation measures including but not limited to auction guarantee, frozen assets, freezing bank accounts and other property preservation measures. This has led to an increase in the company's financial expenses and exacerbating the company's tension.

It is worth mentioning that the reporter of "Daily Economic News" noticed that in the above-mentioned guaranty measures, there are the company's office address that Dou Shen Education disclosed in the annual report: Building 25, Building, No. 8, Northeast Road, Haidian District, Beijing-2 To the 5th floor 101, all office (science and education) houses and underground garage houses, Dou Xin held 40.369 million Dou Shen Education stocks, Beijing Kangbang Technology Co., Ltd. (hereinafter referred to as Kangbang Technology) held by Dou Shen Education 48.5% Equity and Dou Shen Education held 100%of the equity of Chinese Future Education Technology (Beijing) Co., Ltd. (hereinafter referred to as the future of Chinese).

The above two subsidiaries have supported the overall income of Dou Shen education. Let's talk about the future of Chinese, the first quarter report of Dou Shen Education in 2022 shows that in the first quarter of 2022, the future of Chinese operating income was 63.3908 million yuan, accounting for 37.78%of the operating income of Dou Shen education in the first quarter. As for Kangbang Technology, in 2021, Kangbang Technology achieved operating income of 570 million yuan, and the total operating income of Dou Shen Education in 2021 was only 1.122 billion yuan.

For Dou Shen education, high liabilities are swords hanging above their heads. As of December 31, 2021, Dou Shen education liabilities have reached 3.336 billion yuan. On the other hand, it is difficult to say how much the live broadcast business that is regarded as "life -saving straw" can bring to the cash flow in the short term; instead, since the relevant risks of the live broadcast business are disclosed in detail, Dou Shen education has risen due to the popularity of live broadcast popularity. The stock price began to fall.

In the announcement, the attitude of Dou Shen education is still more optimistic, and it said that the above matters have not yet become a major adverse effect on the company's normal production and operation. It will maintain close communication with the Central Bank of China Zhongguancun Sub -branch. At the same timeThe impact of the above matters on the company.However, under the "crisis", whether shareholders and consumers "buy" still have to be observed.

Daily Economic News

- END -

Children's Book: Is Cinderella wearing golden shoes or crystal shoes?

Zhan Lu's college calendar, good -looking and good, exclusive museum around you.Th...

The realm of immersion 丨 heart flow experience brings different night tour charm

Zhejiang News Client planning Le Cuinen Sun Jinliang Reporter Zheng Pei Geng Qianj...