The scale of private equity management business reaches 15.4 trillion, in June, 819 products in June | News

Author:Huaxia Times Time:2022.07.28

Text/Song Jie

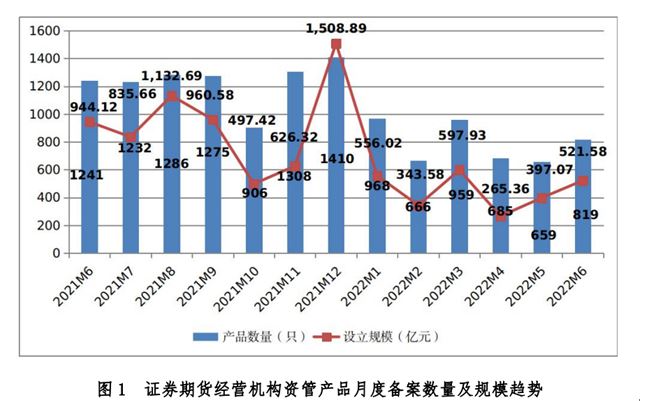

On the evening of July 28, the China -foundation Association latest disclosure that securities and futures operating agencies have registered 819 private equity management products in June, with a scale of 52.158 billion yuan. The establishment scale in June increased by 31.36%month -on -month, a decrease of 44.75%year -on -year. The average filing verification time of new products in the month was 1.90 working days.

From the perspective of institutional types, the largest number of private asset management products in June is securities companies and their asset management subsidiaries, and the largest scale is fund management companies. The 15 private equity funds recorded in the private equity subsidiary of the securities company in June are partnership funds, with no corporate and contract funds for record.

From the perspective of product types, the proportion of the setting of the marketing asset management plan for the record in June is higher than that of a single asset management plan; from the perspective of investment types, the largest number of private asset management products in June and the largest setting scale is a fixed income category.

As of the end of June this year, the scale of private equity management business totaling 15.40 trillion yuan (excluding social security fund and corporate annuity), a decrease of 272.703 billion yuan from the end of last month, and a decrease of 1.74%.

From the perspective of product types, the scale of single asset management plans in June accounted for 52.27%. From the perspective of investment types, the number and scale of fixed income products occupy the largest proportion of four types of products. The number of mixed products ranks second, and the number and scale of products and financial derivative products are relatively small.

As of the end of June this year, the average management of the private equity management business of securities companies and their asset management subsidiaries was 74.9 billion yuan, a decrease of 2.6 billion yuan from the previous month, and the median management scale was 24.1 billion yuan; 100 million yuan, the median management scale was 1.7 billion yuan; the average management of fund management companies management private equity management business scale was 40.9 billion yuan, an increase of 300 million yuan over the previous month, and the management scale was 10.5 billion yuan. The scale of management business was 31.2 billion yuan, a decrease of 800 million yuan from the previous month, and the median management scale was 8.7 billion yuan, a decrease of 700 million yuan from the previous month; the average management of private asset management business of futures companies and their asset management subsidiaries was 3.1 billion yuan. The median management scale is 300 million yuan.

Edit: Yan Hui

- END -

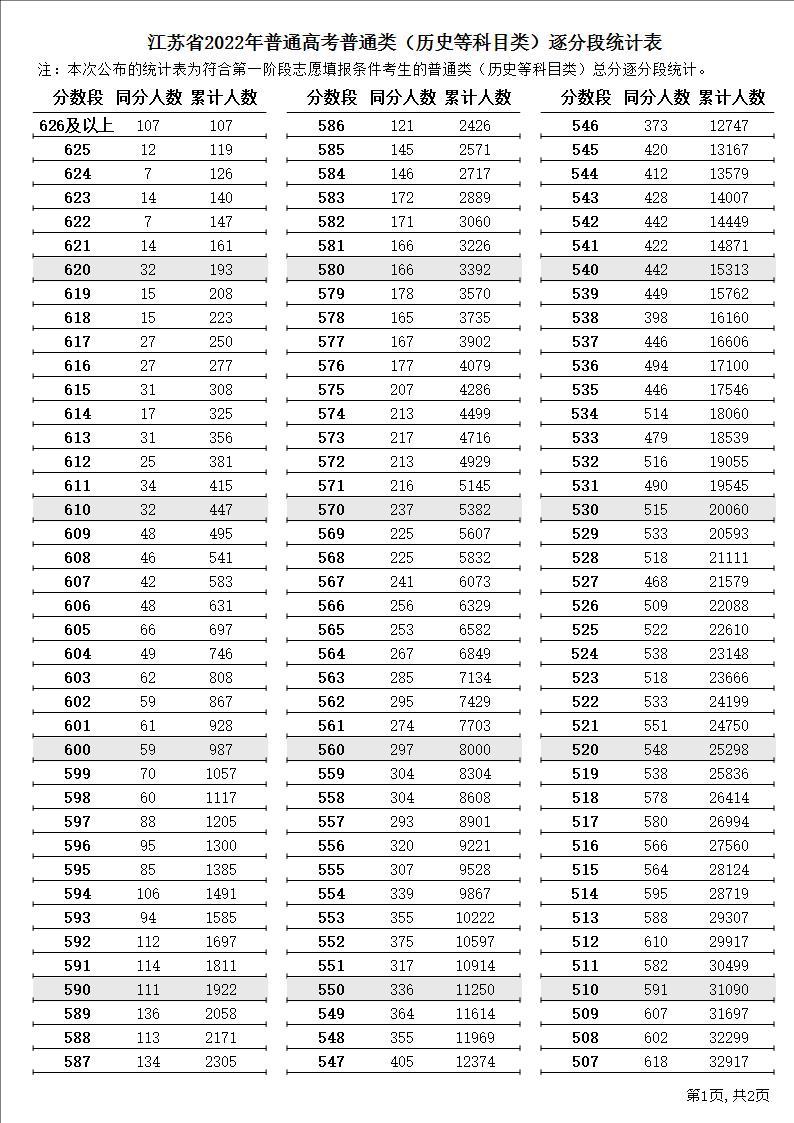

up to date!The statistical form of the Jiangsu college entrance examination one by one is announced

The Jiangsu Education Examination Institute announced on the 24th that the statist...

Tongxu County Meteorological Observatory lifted the thunderbolt and windy yellow warning [III class/

Tongxu County Meteorological Observatory, June 10, 2022 at 06:16 at 06:16 Tongxu County Meteorological Station, June 09, 2022, at 18:56 on June 09, issued a thunderstorm and yellow warning signal.