Tongrun Equipment 6 consecutive boards, 14 electronic stocks have a collective daily limit, A -share transactions have exceeded trillions of dollars

Author:Securities daily Time:2022.07.29

Our reporter Zhang Ying, on April (July 28), the three major A -share indexes fluctuated and rose, rising and falling. The amount can be magnified, and the turnover exceeds the trillion yuan mark. How will the A -share A shares run in the market? Securities Daily, praise on July 28th, the three major stock indexes fluctuated and rose. As of the close, the Shanghai Stock Exchange Index rose 0.21%to 3282.58 points, the Shenzhen Stock Exchange Index rose 0.23%to 12428.7 points, the GEM index fell 0.31%to 2705.90 points; The net funds bought 2.733 billion yuan; in general, the stocks of the two cities rose more and less. From the perspective of Shen's one -level industry, 19 industries have achieved rising today. Among them, the electronics industry rose 3.19%, and coal, defense military workers, machinery and equipment, petroleum petrochemical, business retail and other industries increased by more than 1%. In addition, the beauty care industry has fallen first, reaching 1.28%. In terms of daily limit board, on July 28, 103 stocks rose daily limit. Among them, there were 14 daily limit stocks, and the stock price had risen more than 5 consecutive trading days. From the perspective of the industry, the mechanical and equipment industry has the largest limit, reaching 19, followed by the industries such as electronics (14), automobiles (12), and the number of daily limit shares is more than 10. Table: Today's daily limit and more than 5 days of stocks, the situation of the stock production: Zhang Ying's market performance today, Wang Lei, director of investment director of Zirong assets, believes that today's market emotions are stable, the market fluctuates upward, the end is closed, the consumption sector performance is more than the performance of the consumer sector is compared Well, investors' concerns about the stock market have weakened. Looking forward to the future, there is still room for upward in the market. The core logic is that the current valuation of A shares is still low. In the context of the liquidity between banks and the continuous decline in financial interest rates, the investment of the equity market is prominent. Overall better than the first half. In terms of rhythm, in the third quarter, it is necessary to alert the Fed's interest rate hikes and the outbreak of overseas epidemic forming a short -term impact on A shares. It is expected that the consumption and high prosperity sector will dominate. In the fourth quarter, the stock market is expected to rebound generally, and the growth of stocks will be greater. Regarding the market outlook, Liu Jixin, assistant to Rongzhi Investment Fund Manager, believes that the main reason for A -share shrinkage recently is that after the rapid rebound in May, the market takes time to digest. After entering the financial report season, all parties chose to wait and see because they were worried that the valuation was too high and the financial report data was not as expected. At present, the A -share market has had good expectations for the Fed's policy. Therefore influences. We believe that the future configuration direction is still mainly based on policy support, such as photovoltaic, wind energy, and new energy vehicles; in addition, it can lay out some high -quality consumer companies that can lay out of high -quality consumer companies and high -quality medical leaders. In terms of operation, Guotai Junan suggested that the layout is mainly due to dips. From the perspective of the mid -line, the good trend of A shares has remained unchanged. Previously, the major indexes have generally been adjusted for nearly a month. New energy, large consumption, medical care and other tracks have sufficient callbacks. With the brightness of the news, off -site funds are expected to gradually enter Field layout. At present, it is recommended that the layout is mainly based on dips. It is recommended to pay attention to growth and consumption. In the current trendy market, investors can focus on the two directions according to their own risk preferences: high growth (photovoltaic, wind power, new energy vehicles, etc.) and good tracks (consumption, medicine, etc.) in the medium and long -term performance growth. Leading company. Tongrun Equipment 6 consecutive boards soared nearly 80%. On July 28, the popular stock Tongrun Equipment rose the daily limit again. As of the close, it was reported at 13.27 yuan. The daily limit of 6 consecutive trading days, with a cumulative increase of 77.41%. According to the data of the Dragon Tiger List, the total of 86.1201 million yuan was bought, accounting for 5.79%of the total turnover, and the total sold of 143,480,200 yuan, accounting for 9.64%of the total turnover. The amount ratio is 24.98%. Recently, the company disclosed the preview of the first half of the year that it is expected to achieve net profit of 73.0951 million yuan to 83.5373 million yuan in the first half of the year, a year -on -year increase of 40%to 60%. Public information shows that the main business of the company is: metal tool box cabinet business, electromechanical sheet metal, transmission and distribution control equipment business. The company is the first large -scale enterprise in the steel tool box cabinet industry in China. It is a leading enterprise in the domestic steel tool box cabinet industry. It also has a high reputation in the international tool box cabinet industry. Tongrun brand high and low voltage switch cabinet and electrical component products have also accumulated high brand awareness in the industry with stable quality and good services. The electronics industry rose 3.19% of the 14 -share collective daily limit on July 28, and the electronics industry rose to the top of 3.19%. Among them, 14 electronic concept stocks including Huanxu Electronics, Furong Technology, Junya Technology, Limu Co., Ltd., Xiehe Electronics, Dagang, Tongfu Microelectronics, Dongjing Electronics, Zhuoyi Technology, etc. Collective daily limit. In this regard, AVIC Securities believes that in the next few years, the foundation capacity of mainland China will grow at a trend far exceeding the global growth rate. The amount of upstream orders in semiconductors is expected to continue to be full, and semiconductor equipment and electronic chemicals will not decrease.

Thanks to the rapid development of Xinchuang Industry, the wave of self -sufficiency in domestic chips, and the extensive layout of relevant enterprises in the fields of automobiles, industry, the Internet of Things, consumer electronics, etc., the performance of digital chip design in semiconductor midstreams is bright.Changjiang Securities said that in the second quarter, the prosperity of the track of electronic products & parts and components was the core key to the change of the fund's heavy stock allocation.In the context of the number of mobile phone shipments, consumer electronics stocks have been reduced more; benefiting from the certainty of new energy vehicles, photovoltaics, and wind power, companies such as Xinwangda, Pengding Holdings, Dongshan Precision, Jianghai Co., Ltd.match.Picture | Site Cool Hero Bao Map Network Review | Editor Zhao Ziqiang | Bai Baoyu Final Audit | Li Hui

Recommended reading

The latest voice of the Ministry of Transport!The main indicators are gradually recovering, and the recovery trend will continue in the second half of the year

The northbound capital poured in nearly 5 billion yuan in half a day, and the electronic equipment sector rose to rise in 13 stocks. The institution: The market is expected to regain the rise!

- END -

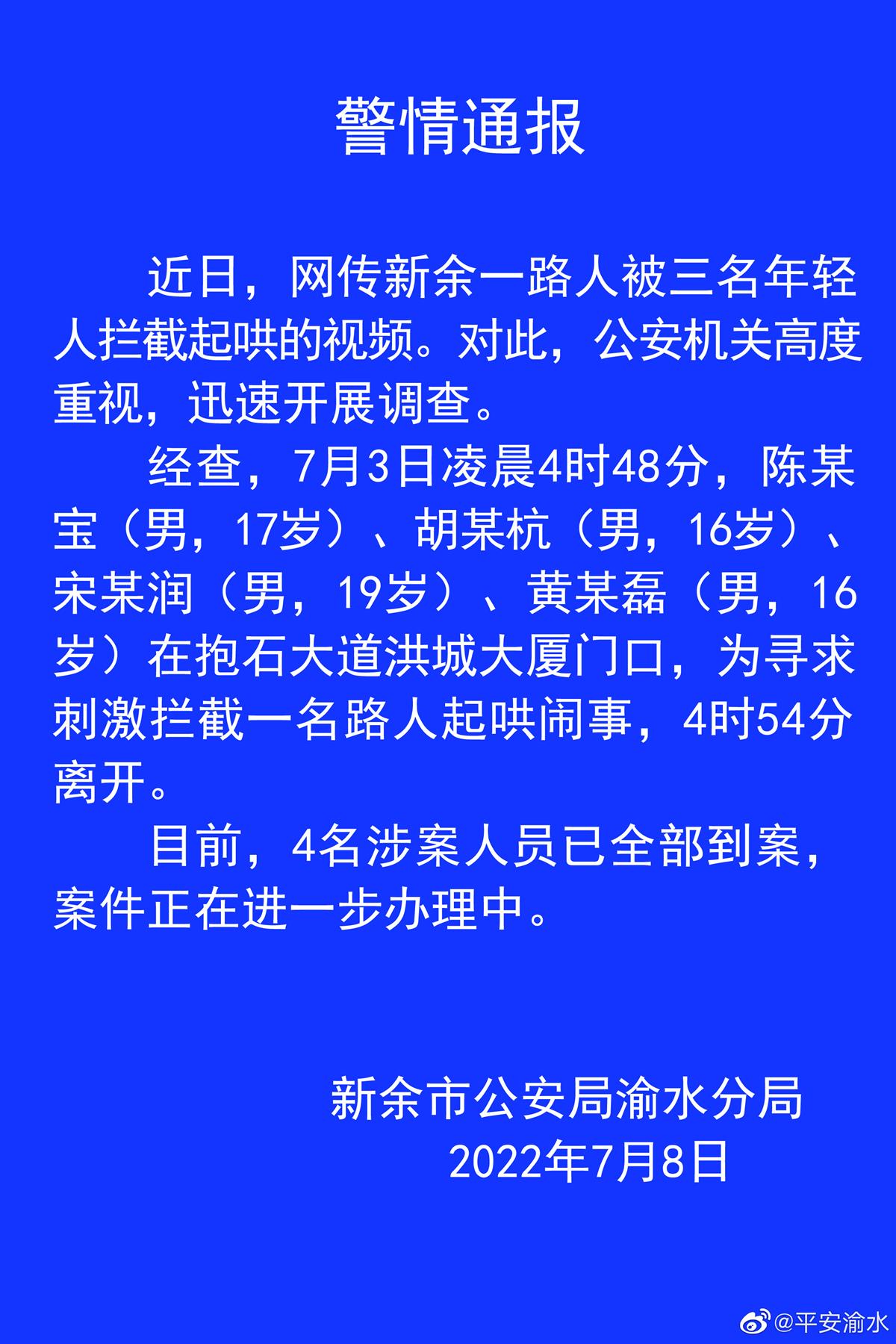

The four men in Jiangxi were scaring the elderly for stimulation.

Jimu Journalist Liu YiIntern Gong ZhenyuRecently, several young people in Xinyu, J...

"Mainland military attack Taiwan's army can't support a hundred days." The Taiwan Affairs Office responded

The poll on the island claims that more than half of the people believe that the m...