Fun Store CEO Luo Min Capital Past: Starting from "campus loan", the business model is frequently questioned, and "secondary entrepreneurial" prefabricated dishes are ridiculed by "cut leeks"

Author:Time data Time:2022.07.29

On the afternoon of July 26, the well -known "Qi Qi" debate#Fu Shier apologized#once rushed to Weibo hot search first, which aroused widespread attention from netizens.

Fu Seoul sent Weibo that the cooperation with Qundian prefabricated dishes is a single, and there is no depth and subsequent cooperation. They admit that they lack understanding of the predecessor of the brand. And apologize for this.

Subsequently, under the "crowd" of netizens, the well -known actor Jia Nailiang also had to stand up to apologize for "cooperation with the prefabricated dishes". On the evening of July 26,#Jia Nailiang apologized#7 7 7 7 7 No. 1.

Jia Nailiang issued Weibo, "The brand cooperation about Qudian has not been tuned to clearly clear the experience of the brand's predecessor.

It is reported that Fu Seoul and Jia Nailiang have successively lived in prefabricated dishes in the Boss Luo's Douyin live broadcast room. However, a flat live broadcast of the goods rose to the level of "cyber violence", more or less from the boss of the fun shop. And the Boss Luo, the founder and CEO Luo Min, the founder of the fun shop.

Luo Min's capital past, starting from "campus loan"

After the time returned to 17 years ago, in 2005, 22 -year -old Luo Min graduated from Jiangxi Normal University and came to Beijing alone to prepare to apply for graduate students across Peking University Guanghua School of Management. Essence After listening to 200 lectures in half a year, Luo Min resolutely decided to give up his postgraduate entrance examination and participate in entrepreneurship. That year, Facebook just emerged, and Luo Min first entrepreneurially aimed at the campus SNS, but soon ended in failure.

In 2008, Luo Min, 25, started a second entrepreneurial business, did a project similar to social e -commerce, and received 2 million yuan in investment from angel investor Bao Yueqiao, but eventually ended in failure. In 2010, Luo Min, who failed the second entrepreneurial, chose to join Holy Buy and serve as vice president to be responsible for promoting business related to campus.

At the beginning of 2013, Internet finance quietly emerged, Luo Min left Holy Buy to start a business again, set up Sanhuo Century Network Technology (Beijing) Co., Ltd. Angel round investment, but business development is not smooth.

In March 2014, Luo Min quickly switched the entrepreneurial track, targeting the campus again, and launching fun stages. It mainly provided shopping installment services for college students, giving college students' credit quota to purchase iPhone and other electronic products in installments, so -called so -called so -called so -called so -called so -called "Campus Loan".

Luo Min, who was born in business expansion, led the team to quickly enter the campus, promote the consumption stages of major students, develop students' agents, and quickly occupy the "campus loan" market with a crazy push mode. At that time, there was neither ant flower tadpole nor JD.com. Once the fun stages were launched, it quickly became the mainstream consumption installment platform in the market. After three months of launch, the transaction volume reached tens of millions of yuan. By 2015, the fun installment business has covered more than 3,000 universities across the country, with more than 5,000 campus agents and tens of thousands of part -time employees.

After eight rounds of financing, the listing of fun stores is the peak

On April 9, 2014, Luo Min officially established an Internet financial company Beijing Happy Times Technology Development Co., Ltd. (hereinafter referred to as "Beijing Happy Times Technology"). A round of financing.

At that time, Zhu Tianyu and Luo Min, a partner of Lanchuang Venture, had known each other for many years. They recognized that Luo Min had previously managed the experience and style of the campus promotion team in Holy Buy. Help Luo Min solve the company's operating funds. Not only that, Zhu Tianyu also contacted a few Lan Chi to be invested in the company to help Luo Min find a stable fund to return the channel.

In August and December of the same year, there were two rounds of B and C of Lanchi Venture Capital and Source Capital Capital in the "campus loan" market. Before investing, Cao Yi, the founder of the source code capital, talked to Luo Min for half an hour and decided to invest in interesting stages. He believed that there was an excellent customer base in the fun storage period, that is, college students with no source of income.

Soon, fun installment began to plan the white -collar market installment business, and it was urgent to "nourish blood" in financing. Luo Min once again found Cao Yi, but because the amount was too large, the source code could not follow up. So Cao Yi found Kunlun Wanwei CEO Zhou Yahui and recommended it to him. He hoped that Zhou Yahui would participate in the interest installment. At that time, during the winter vacation of college students, the "campus loan" business decreased sharply, and the white -collar staging field was as high as 13%of the bad debt rate.

On January 21, 2015, Kunlun Wanwei successfully listed on the GEM of the Shenzhen Stock Exchange, raising funds of 1.33 billion yuan, and about 2 billion yuan on the account after listing. At this time, Zhou Yahui was still watching. Soon, the main competitors in the fun installment received a new round of financing of 50 million US dollars, and the valuation before financing reached US $ 250 million. After learning about it, Zhou Yahui decided to lead the interesting stream of only $ 100 million at that time.

In early April 2015, Fun made up the completion of nearly $ 100 million in Series D financing, of which Kunlun Wanwei led a investment of 62 million US dollars. Old shareholders such as Lanchi Venture Capital and Source Capital all followed all the investment. At the same time, fun installment has launched fun payment and fun shop app equivalent to credit cards, allowing college students to open up sales and purchase daily necessities and retail through the fun shop app, and provide subsidies and offline resource assistance, saying that they will be within three months. At least 100,000 college students have opened more than 100,000 "fun shops". Soon, the Baidu index of the fun stages exceeded 30,000, far exceeding the main competitors' staging. However, Luo Min is not satisfied. He wants to carry out a new round of financing at a valuation of $ 600 million to further expand its business. At this time, Ant Financial took the initiative to find Luo Min, hoping to cooperate with fun stages to allow fun installment users to register for sesame credit, so they proposed a new round of financing.

In August 2015, the Ant Financial Services led the Institute of Institution of about $ 200 million in round E financing, and old shareholders such as Kunlun Wanwei, Lanchi Venture Capital, and source Capital followed the investment again. In this way, the fun installment has successfully launched a staging platform for the white -collar market. With the powerful traffic support and pre -risk control management of Ant Financial platforms, the business development is rapid.

After this round of financing, Luo Min stared at the A -share capital market and plans to demolish the interest staging VIE architecture (variable interest entities, a way to take the overseas listing abroad). Wu Shichun, the founder of the investment, met Du Li, a post -80s mysterious capital leader. Du Li took out 2 billion yuan in the first quarter of 2016 to demolish the interesting staging VIE architecture and prepare to go public for backdoor.

The good times did not last long. Just after the interest scores, the VIE architecture was just removed. Fun stages attempts to be suspended in the capital of A -share backdoor listing.

In April 2016, the Ministry of Education and the China Banking Regulatory Commission jointly issued the "Notice on Strengthening the Risk Prevention and Education Guidance of Campus Bad Network Lending Risks and Education Guidance" to comprehensively prohibit campus loans. Soon, the campus loan business of Fun storing was suspended, and the campus loan team of more than 1,000 people was forced to lay off for layoffs.

On the other hand, the interesting planning plan is still in full swing. On July 7, 2016, Fun High-profile announced the completion of the Pre-IPO round of about 3 billion yuan in financing. This round of financing was led by the Phoenix Xiangrui Internet Investment Fund and the A-share listed company. The old shareholders followed the investment again. At the same time, the Fun installment was officially promoted to Qubian Group. Fun Store Group, which exited the "campus loan" market, began to shift target borrowers from college students to young people, and develop in the field of cash loans and consumer stages of non -credit card groups.

In November 2016, Shenzhen Huasheng Qianhai Investment Co., Ltd., a wholly -owned subsidiary of A -share listed company, raided the shares of the Ethics Group for a 5%equity of Beijing Happy Times Technology for 375 million yuan. In December 2016, Beijing Happy Times Technology completed the construction of VIE architecture and planned to go public abroad.

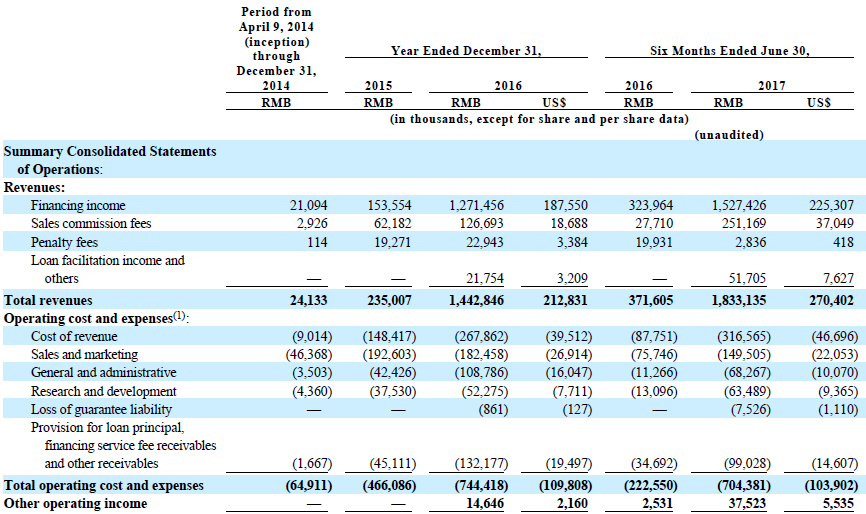

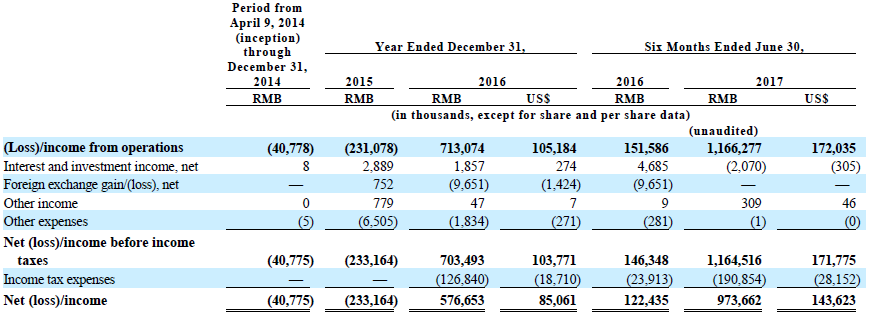

On September 18, 2017, the Eastern Time, the Qudian Group publicly submitted the prospectus to the US Securities and Exchange Commission (SEC) for the first time. It is planned to be listed on the New York Stock Exchange. The stock code is "QD" and the IPO plans to raise $ 750 million. According to the prospectus, the revenue increased in 2014-2016 and January-June 2017, respectively, with 24.133 million yuan, 235 million yuan, 1.443 billion yuan, and 1.833 billion yuan. They were -40.775 million yuan, -233 million yuan, 577 million yuan, and 974 million yuan, respectively.

In just one month, on October 18th, the Mochian Group successfully listed on the NYSE. The company's stock price was as high as US $ 35.45 per share on the first day of the listing, and the market value once exceeded 10 billion US dollars. However, after the listing, the Qudian Group quickly fell into the vortex of public opinion. The company's stock price turned sharply and did not touch the high level of $ 35.45/share.

The business model is questioned, and the original sin of "campus loan" cannot be separated from

On the night of October 18th, the New York Stock Exchange was listed on the market, and many questioning voices appeared on the market. On the one hand, it was questioned that Qudian mainly relied on the traffic entrance and pre -risk control management of the major shareholder Ant Financial; on the other hand, on the other hand, Questioning the business model of Qudian is inseparable from the "campus loan" that is frequent, and its high cash loan interest rate will also face the strictest policy supervision.

According to the prospectus of the fun store, the company mainly serves young people who have no credit records in traditional financial institutions, and said that the target group is very valuable and growing. Obviously, "young people without credit records" cannot prevent students and users. In the six months as of June 30, 2017, about 90.8%of active borrowers aged between 18 and 35.

At the same time, the prospectus of the Qudian also showed that after it was announced in September 16th that it was fully withdrawn from the campus loan, there was no sign of significantly reduced or weakening the number of monthly active users and the increase in the number of active borrowers.

In addition, Qudian mentioned in its prospectus that the actual annual interest rate of 59.5%of the borrowing transactions of Qudian in 2016 was a statutory limit of 36%of the annual interest rate.

Faced with doubts, two days later, Luo Min responded, and at the same time claimed that Qudian would not teach users to borrow money from relatives and friends to pay back to installments, and said that all those who do not pay back the deadline are bad debts, and bad debts will not urge them to urge them to urge They came to pay back the money, and they would not even call them even the phone. However, regarding the overdue collection of loans, in detail in the prospectus of the fun shop, the Fun Store will collect the text messages and automatic voice calls to the borrower. If it is not successful, the collection staff of the Qudian will call the borrower to collect the phone call; If the user is more than 20 days of time, it will take the initiative to disclose to Sesame Credit.

With the continuous fermentation of the incident, on December 1, 2017, the Office of the Leading Group of the Internet Financial Risk Special Rectification Work and P2P Online Loan Risk Special Rectification Work Office jointly issued the "Notice on Regulating the" Cash Loan "business" It is pointed out that various institutions should comply with interest rates and various expenses for comprehensive capital costs received by borrowers in compliance with the Supreme People's Court's regulations on private lending interest rates; at the same time, banking financial institutions shall not outsourcing credit review, risk control and other core business. It also pointed out that the "loan -aid" business should return to the origin.

"Secondary entrepreneurial" prefabricated dishes, once again trapped the vortex of public opinion

Seeing that the development of the cash loan business of Qubian was hindered, Luo Min quickly launched the "Dabai Automobile" automobile financial leasing business, claiming that 100,000 cars will be sold in 2018 to enter the TOP5 across the country.

However, the automotive financing leasing industry is a heavy asset industry, and fun stores need to bear greater capital pressure. At the same time, the rise of the car consumer financial platform with the main car financial leasing model has formed a market "encirclement and suppression" for "Dabai Automobile". In the end, it only maintained for more than a year, and the first quarter of 2019's financial report said that it had ended Dabai Automobile's business.

On the other side, Ant Financial cleared the stock stock in April 2019, withdrawing from the shareholders of the Fun Store Group, and completely clarified the relationship with Qudian.

In March 2020, Luo Min launched the "Wanli" cross -border luxury e -commerce platform, and announced in June to announce that it would enter the monk of more than $ 100 million, becoming its largest shareholder, trying to transform luxury e -commerce. At the same time, with the rise of short video live broadcasts, "Wanli Mu" successively invited Zhao Wei, Huang Xiaoming, Lei Jiayin, Zheng Kai, Jia Nailiang and other stars to endorse, and conducted live and cargo on the short video platform.

However, the luxury e -commerce business has not brought performance growth to Qudian. The revenue of Qudian Group in 2020 was 3.688 billion yuan, a decrease of nearly 60%year -on -year; net profit was 959 million yuan, a year -on -year decrease of about 70%. In January 2021, Siku announced privatization, and "Wanli" also began to clear the stock.

At this moment, Luo Min stared at the online education of the righteousness at that time, launched the Growth Center of Wanli Miles, and tried to cut into the field of quality education in children aged 0-9. However, the incident is contrary to his wishes. With the "double reduction" policy in July 2021, the Growth Center of Wanli Muzi Children's Growth was forced to end in advance.

This time, a few months after silence, Luo Min stepped on the outlet of the live broadcast and launched the prefabricated dishes of the shop, and called it "secondary entrepreneurial".

On July 17, 2022, Luo Min and Jia Nailiang collaborated in the live broadcast room with "1 point of money grabbing sauce fish" to bring the prefabricated dishes to attract nearly one million people to grab it, and shouted crazy about Bao Ma joining the fun shop prefabricated dishes. State the mothers to open a prefabricated store near the community, as long as 50 dishes are sold every day, they can enter a few thousand a month. The next day at the "Fun Store Prefabricated" brand strategy press conference, Luo Min also said that in the next three years, it will support 100,000 users to start offline stores.

Subsequently, Luo Min once again publicly stated that joining the store's entrepreneurial planning store is small and low in investment, will not charge franchise fees, and can also provide interest -free loan support for a year.

For a while, the entire network "exploded the flowers", some netizens said that the fun shop "eats people blood buns", "harvesting college students, harvested Baoma"; some netizens even admitted that "those college students were growing up that year, and now they have changed. Cheng Bao Da Bao Mom "," It's the same boss, cut the same shift ".

With the original sin of "campus loan", Luo Min, who was supposed to act in low -key, was once again fell into a vortex of public opinion because of the prefabricated dishes.

Regarding issues such as the joining of Fun Store prefabricated dishes, Time Data sent an interview letter to Qudian Group on July 21.

At the same time, Time Data has called the Fun Store Group many times, but no one has been answered. Subsequently, Times Data Contact Consultant Consultant Consultant Relationship Consultant Relationships, showing the intention of the interview, the other party stated that they could send another interview letter to them, and they were transferred to Qudian Group to follow up. As a result, Time Data issued relevant interview issues to the investor relationship consultant, but as of press time, it has not received the response to the interview issue by the Qudian Group.

Reference materials: :

[1] Chen Guang's black and white. Business observation, 2017, (11)

[2] Feng Shanshan. Qudian invests in "fun". Chief Financial Officer, 2017, (21)

[3] Peng Yanfeng. Fun Store Storm. Business Review of the 21st Century, 2017, (11)

[4] Qian Yujuan. The development and hidden concerns of Qudian. China Economic Information, 2017, (21)

[5] The story of Wang Qian. Wanli is round? . Business School, 2020, (07)

[6] Xia Yiming. Yahui Investment Notes 6: Ten billion U.S. dollars. Venture State, 2017, (11)

[7] Peng Xiaofan. Fun Store: After 1278 days of birth, go public in the United States. Business culture, 2017, (28) [8] Listing "happy events" to become "sorrow" fun shop and its cash loan still go? ChinaStrategic emerging industry, 2017, (43)

Author | Zhang Zhao

Edit | Zhang Zhao

—————

- END -

[Welcome to the Provincial Travel Development Conference] Qufu: Enhance the level

[Welcome to the Provincial Travel Development Conference] Qufu: Enhance the levelI...

Mortal Song | Women's Water Crossing the Road Electric!At the critical moment, the two subway workers rushed out ...

On the morning of July 12, the rainstorm of Jinan,Multiple roads accumulate waterN...