The American economy may have a hard landing.

Author:Xinhuanet Time:2022.07.30

Xinhua News Agency, Washington, July 29 (International Observation) The US economy may have hard landing

Xinhua News Agency reporter Xiong Maoling Xuyuan

According to data released by the US Department of Commerce on the 28th, the GDP of US domestic product (GDP) in the second quarter of this year calculated a decline of 0.9%at an annual rate. "Wall Street Journal" and Bloomberg News reported that after two consecutive quarters of shrinking, the US economy fell into a technical recession.

Many economists believe that after the impact of the new crown epidemic in early 2020, the "yellow light" in many key areas of the US economy is rapidly losing growth momentum. It will be a high probability event.

The beautiful people believe that it has fallen into a decline

In the second quarter of the United States, GDP calculated by 0.9%at an annual rate, which was shrinking again after the decline of 1.6%in the first quarter.

This is the US Department of Commerce, which was taken in Washington, the capital of the United States on July 28. (Photo by Liu Jie, a reporter from Xinhua News Agency)

A polls released by the Morning Consultation Company and the Political News website in mid -July showed that 65%of voters believed that the US economy had fallen into decline, which was significantly higher than 51%in March 2020. More than half of Democratic voters and nearly 80 % of Republican voters identify with decline.

Boston Consulting Partner Hadi Farach believes that for many American people, prices are soaring, the stock market plunge, the property market is weak, and the consumption is sluggish. Prepare for facts.

Fatigue appears in multiple fields

Consumption expenditures accounted for more than two -thirds in the US economy, and were considered an important pillar. The latest data show that consumption expenditure has declined on the driver of the US economy. In the second quarter of this year, the US personal consumption expenditure increased by 1%, the growth rate slowed down from 1.8%in the first quarter, and lower than the 2.5%of the fourth quarter of last year.

The slowdown in consumer expenditure is obviously closely related to the high inflation rate of new 40 years. The increase in wages cannot keep up with the increase in price. With the tightening of the Monetary policy of the Fed, the sharp decline in the stock market and the bond market has caused family wealth to shrink and weaken people's consumption power.

This is a fruit shelf shot in a supermarket in Eugene, Oregon on July 13. (Photo by Wang Ying, a reporter from Xinhua News Agency)

Recently, the research institution's World Society of Corporate Research announced that data showed that due to the continuous rise in inflation, American consumers were even more pessimistic about economic prospects. In July, the consumer confidence index declined for the third consecutive month and fell to the lowest value since February 2021.

The senior director of the research seminar Lynch Franco believes that high inflation and the Fed's further interest rate hike expectations may bring strong resistance to consumers' expenditure and economic growth in the next 6 months.

In addition to consumption expenditure, the investment in non -residential fixed assets that reflects the investment in the enterprise in the second quarter has changed from the growth of the first quarter to decline, and the investment in fixed assets of residential residential fixed assets plummeted by 14%, the largest decline since the second quarter of 2020.

The economy is afraid to land

Data from the US Department of Labor show that since April, the number of unemployed reliefs in the United States has risen for the first time every week, showing that the growth momentum of the labor market has weakened. According to statistics, companies such as Microsoft, Naiti, Tesla, JPMorgan, and Wells Fargo have recently announced the layoff plan, due to the slowdown in business growth and rising labor costs.

Fed Chairman Powell acknowledged that with the continuous interest rate hike of the Fed, economic growth will slow, and the labor market is likely to be softened. Some economists are more pessimistic about the employment market. Former US Treasury Secretary Samer pointed out recently that the United States needs to withstand the price of more than 5%of the unemployment in five consecutive years in order to curb inflation.

Sarl Guatier, an economist at the Montreal Bank Capital Marketing Company in Canada, believes that in the face of the financial environment of high inflation and the rapid rise in borrowing costs, the US economy is rapidly losing growth momentum.

American Enterprise Institute Economist Destmond Rachman told reporters that inflation erodes the purchasing power of the American people, and consumers are close to the historical low; the interest rate of mortgage loans is doubled, the real estate market is collapsed; Economic dilemma has caused US exporters to face strong backwind. "There are too many signs that the Fed's anti -inflation measures will make the US economy hard landing before the end of the year."

- END -

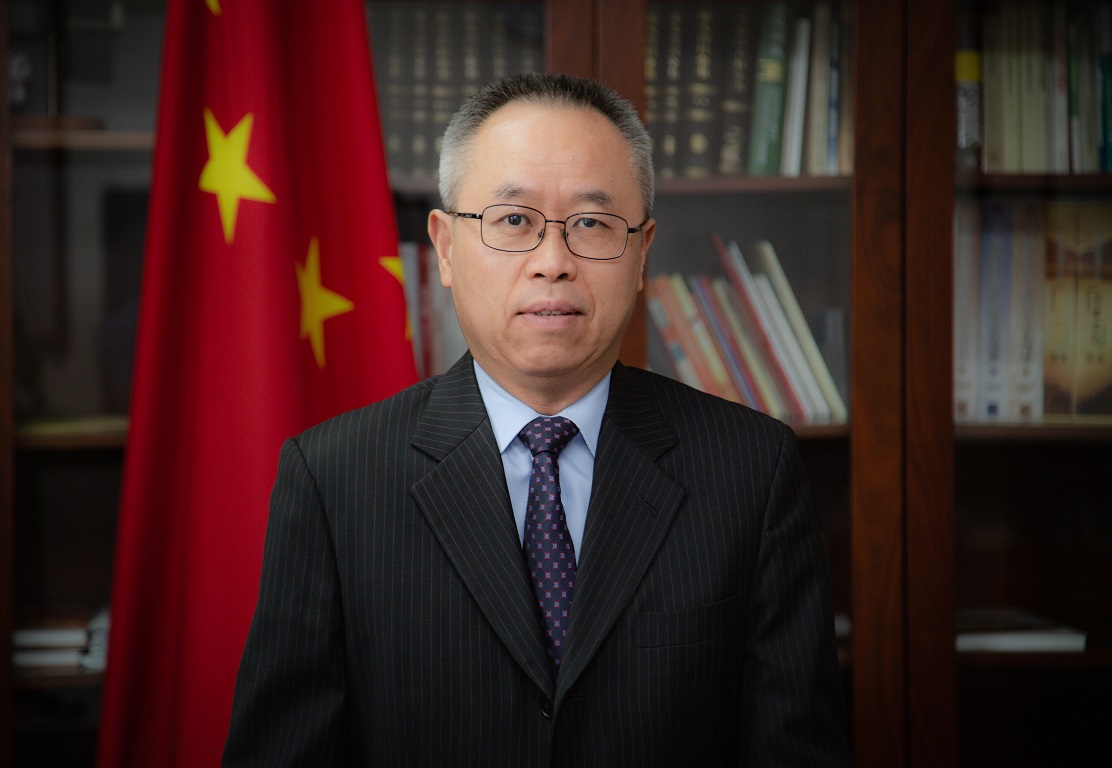

Chinese diplomat Li Junhua is the Deputy Secretary -General of the United Nations

UN Secretary -General Gutres announced on the 25th that Li Junhua, a senior diplom...

60+390 new homeland

At 00-24 on July 28, 31 provinces (autonomous regions, municipalities) and Xinjiang Production and Construction Corps reported 60 new cases of new crown pneumonia (21 cases in Gansu, 16 cases in Sichu