"Finance+Innovation" creates the "Dream Team" of the Bingcheng Enterprise

Author:Harbin Daily Time:2022.07.30

This is a "hero list" for Harbin Science and Technology Risk Fund to support the development of enterprises. It is full of "first time" that is full of Harbin Innovation Investment Co., Ltd. to bear the mission and dare to try.

Taifu Industry, the first enterprise case of the first equity withdrawal of the three provinces in Northeast China; Jiuzhou Electric, the first GEM listed enterprise in Heilongjiang Province; the first batch of new optical electricity, the first batch of science and technology board, and the first science and technology board listed enterprise in the three provinces of Northeast China; , The first Hong Kong Stock Exchange listed enterprise in the three northeast provinces; Huida Technology, the first technological project supported by the first insurance loan linkage in Heilongjiang Province ...

Born by reform, it is prosperous by innovation. In the 20 years since the establishment of Harbin Innovation Investment Co., Ltd., focusing on the overall requirements of "government -led, market -oriented operations, and professional management", it not only trains a professional investment management team that is brave and dares to take responsibility, but also uses the municipal science and technology risk fund to accurately use the municipal science and technology risk fund to use it to use it. "Equity investment+value -added service" has cumulatively supporting 72 technology "little giants", promoting 9 companies to successfully list, and creating a "Dream Team" of Bingcheng Science and Technology Enterprise.

Opportunities are wonderful and innovative achievements. In the new journey, focusing on the construction of the "six Longjiang" and creating the new goal of the "seven metropolis", the Municipal Science and Technology Risk Fund continued to use the transformation of scientific and technological achievements into a mission, to help technology -based SMEs take off as its mission, and to strive to the future to the future , I do n’t take it anymore.

Photo source: Photo.com

1

--- Ju Zhi'an Enterprise

Government venture capital retains technology "unicorn"

At the construction site of the Kochiyou Semiconductor Industry -Research and Research Research District of Harbin New Area, the mechanical roar was endless, the infrastructure was hot, and the various equipment was being installed nervously. In a few days, the first third -generation semiconductor substrate production line in our province will be put into production here.

"Harbin's meticulous scientific and financial services have made me determined to stay. Now, this is a correct choice." Said Zhao Lili, chairman of Harbin Keyou Semiconductor Industry Equipment and Technology Research Institute Co., Ltd. During the period, the equity investment of the Harbin Science and Technology Risk Fund was called charcoal in the snow, and we had the greatest crisis. "

Science and technology achievement transformation project of Harbin Institute of Technology, Professor Zhao Lili, Harbin University of Technology. In order to keep this high -tech achievement in Harbin, the Harbin Science and Technology Risk Fund team conducts long -term tracking services to help enterprises make strategic plans with "Industrial Research Institute" as the main body, continuous research and development and incubation semiconductor -related industries. In May 2018, Harbin Keyou Semiconductor Industry Equipment and Technology Research Institute Co., Ltd. was established. Within a month, 10 million yuan of technology risk investment was in place.

After the funds are in place, the "Keyou" has continued to make major breakthroughs in key equipment and substrate manufacturing in the third -generation semiconductor. Up to now, 49 third -generation semiconductor equipment and key technical authorization patents that have received international barriers have been obtained. The independently developed 6 -inch silicon carbide crystal breaks the international monopoly. It is expected to become the first company in China to overcome the 8 -inch third -generation semiconductor superlator. , Fill in domestic gaps.

The led investment of the Municipal Science and Technology Risk Fund has highly recognized the "Keyou" by the provincial and municipal governments and the capital market. The "Keyou Semiconductor Industry, Studies Research Research Zone Project" was selected into the Hundred Congress of Heilongjiang Province in 2020, becoming the first beneficiary of Harbin New District to encourage industrial agglomeration to promote high -quality enterprise policies. And Harbin High -tech Industrial Development Zone Infrastructure Development and Construction Co., Ltd.'s equity investment of 70 million yuan and debt of 150 million yuan.

In order to improve the equity structure of "Keyou", to release space to market -oriented investment institutions, so that it has sustainable development. After the corporate research and development achieves breakthrough results, the Municipal Science and Technology Risk Fund will put it on the premise of realizing state -owned asset preservation and appreciation. The proportion of shares dropped to 5%. At present, the valuation of "Keyou" has reached 1.12 billion yuan, and the municipal scientific and technological risk fund has not withdrawn some of the equity valuation of 57 million yuan, an value -added 19 times.

"The excellent development environment of Harbin New District has made us decide to settle the production line here." Zhao Lili said. At present, the third -generation semiconductor industry equipment and technology of "Keyou" is at the international first -class level, and the industry market development prospects are broad. It is expected to be listed in the next 3 to 5 years, becoming a "unicorn" enterprise with a market value of 10 billion yuan.

The "inlet" of the Municipal Science and Technology Risk Fund into the "Keyou" into the financial wings into the "Keyou", which realized the value preservation and appreciation of the risk fund. It also left Harbin a technology "unicorn beast "".

"The original intention of the establishment of the Harbin Science and Technology Risk Fund was to promote the transformation and industrialization of scientific and technological achievements in the region, support direct financing of primary and technological enterprises, solve the financing problem of science and technology -based SMEs, and help promote local economic development." Harbin Innovation Innovation Liu Ran, deputy general manager of investment Co., Ltd., said, "The Municipal Science and Technology Risk Fund has public welfare attributes, mainly social benefits. The fund is mainly invested in the Harbin Administrative Region. Technology -based enterprises focus on the seedling period and initial period during the investment stage. "

Focusing on the industrial chain, the deployment of innovation chain, setting up a service chain, and configuring the capital chain. Harbin Science and Technology Risk Fund has given full play to the guidance and leverage of financial science and technology funds through the support method of "equity investment+value -added service", injecting the endless financial "living water" for Bingcheng Shuangchuang, and promoting a group of scientific and innovative enterprises With the help of capital power, the rise of capital has risen rapidly.

Picture Source: Photo Network 2 2

--- jump up and touch high

Precision equity investment to cultivate the "Dream Team"

In 2002, Harbin Innovation Investment Co., Ltd., as a science and technology risk fund, came into being at the time of the main body of the capital. This is one of the earliest professional entrepreneurial investment institutions established in China.

"Harbin Investment" is the ownership of Harbin Technology Finance Service Center Co., Ltd. As a government -funded subject, it is mainly responsible for the operation and management of the Harbin Science and Technology Risk Fund. Through the support methods such as equity investment, shareholding funds, and risk borrowing, a number of scientific and technological SMEs have developed rapidly with the power of capital, giving full play to the guidance and leverage of financial science and technology funds.

"Under the dual pressure of primitive investors' withdrawal and epidemic, the injection of" Harbin Innovation Investment "is called" timely rain ", which pulls us out of the predicament." Zhang Qi, general manager of Harbin Jixianglong Biotechnology Co., Ltd. "Now, the number of polypeptide drugs we declare has ranked third in the same industry in China. The company will enter the fast lane in the next five years. The profit tax is expected to exceed 100 million yuan.

Established in 2011, the "Geng Xianglong" is the only company in the three northeast provinces that specialize in the research and development of polypeptide drugs. In the early days of the company's no profit, the "Harbin Innovation Investment" was judged that the company could fill Harbin biotechnology gaps and have growth potential, quickly start investment decisions, and complete 5 million yuan in equity investment.

Government venture capital has played a demonstration role of led investment. Three months later, Fude Venture Capital and Zhongling Yanyuan Venture Capital successively invested 35 million yuan in "Geng Xianglong". The funding problem also provides the company with subsequent research and development funds. When "Geng Xianglong" was affected by the impact of the epidemic, "Harbin Investment Investment" continued to support 5 million yuan through the "debt -to -equity swap" method, which has played a vital support for the risk of "Geng Xianglong" to resist the risk of the epidemic situation. effect.

At present, "Geng Xianglong" has become the Heilongjiang Synthetic Polypeptide Technology Innovation Center, 16 patents, completed 10 raw materials declarations, and obtained 6 raw materials production approvals, filling the gap of large -scale production of peptide raw materials in Heilongjiang Province. The current market valuation of the enterprise has exceeded 500 million yuan, which means that the original venture capital fund of 10 million yuan has increased 5 times.

The high -quality growth of "Geng Xianglong" is a microcosm of the Harbin Science and Technology Risk Fund vigorously supporting local technology companies. As of the end of 2021, the size of the "Harbin Innovation Investment" management fund was nearly 1.5 billion yuan. Through direct investment and driving investment fund investment support projects, the cumulative investment amount was 1.194 billion yuan.

Over the past 20 years, "Harbin Investment" has closely focused on the preliminary and initial projects of the "4+4" modern industrial system in Harbin's "4+4" modern industrial system, modern biomedicine, information, new materials and other industries. Excellent teams with rich experience in investment and management of small and medium -sized enterprises in technology -based small and medium -sized enterprises, with the spirit of "breaking", "creation", and "dry" style, they have completed the "jumping high" of financial empowerment technology. The number of investment companies and the successful exit number of cases ranked among the top in the province, creating a "Dream Team" for Harbin.

In recent years, the projects supported by "Harbin Innovation Investment" have been launched, and Huida Technology has launched the listing process. Nearly 20 high -tech enterprises such as northern defense and astronomical creation have grown into leading enterprises or pillar enterprises in related industries in the region and even in China.

At present, "Harbin Innovation Investment" is the chairman unit of the Harbin Entrepreneurship Investment Association, the Deputy President Unit of the Equity and Entrepreneurship Investment Professional Committee of the China Investment Association, and the chairman of the Harbin Angel Investment Alliance. Entrepreneurship investment enterprises.

Donate does not donate, Yu Ru is Cheng Cheng. With excellent investment performance, "Harbin Innovation Investment" has won honors such as the "Excellent Science and Technology Investment Management Team Award", "Best Revenue Project Award", "Excellent Entrepreneurship Investment Award" and "Excellent Science and Technology Industry Investment Award".

Photo source: Photo.com

3

---

Financial empowerment technology creates a new engine

Entering the Digital Innovation Design Center of Harbin Institute of Technology's School of Architecture, the architectural design models and creative design works are shining. In this laboratory based on VR technology, the technical support of the equipment and systems of sports cameras, motion, and noodle capture is provided by Harbin Aiwell Technology Co., Ltd.

"Our company can come to this day, benefiting from the strong support of the Harbin Science and Technology Risk Fund." Said Xiang Zheng, Chairman of Harbin Aiwell Technology Co., Ltd., said, "When other investors feel strange to the new science and technology field of the Yuan universe, '' Harbin Innovation Investment 'has become our firm strategic partner. "

"Ailwell Technology" was established in September 2016. It is a leading virtual reality technology industry application service provider in the province. It began to deploy the business in the field education field in the second half of 2021. Just when they urgently needed funds for the research and development of the VR standardized curriculum system, the "Harbin Investment Investment" extended a helping hand and provided 5 million yuan of equity investment.

Not only that, "Harbin Innovation Investment" also actively provides value -added services for enterprises. Help enterprises to improve the equity structure, provide development planning suggestions, and promote the joint establishment of the Virtual Reality Technology Research Institute with the "Aville Technology" and the Provincial Institute of Industrial Technology. Carry out technical research and technological innovation. Under the support and service of "Harbin Innovation Investment", "Aiwell Technology" has grown rapidly, making great progress in technological innovation, business expansion, industrial chain collaboration, and talent attraction.

"Harbin is a city with a blend of Chinese and Western culture, a sense of history and a sense of modern fashion. It has a number of colleges and universities with innovative genes and creative vitality in Harbin Institute of Technology. Zhu Shuyuan said, "With the accelerated evolution of a new round of technological revolution and industrial changes, the creative design industry has become an emerging industry with vibrant and development prospects. The difficulty of financing is to empower Harbin's "creative design capital". "

Support Harbin to build a new highland and build a new overtaking engine, which is only one of the new measures for the "Harbin Investment" for the future. In the next five years, "Harbin Investment Investment" will continue to escort financial innovation with financial support to supplement the endless new forces for the "Dream Team" of Bingcheng Science and Technology Enterprise.

In the next step, the "Harbin Investment" will continue to strengthen the cooperation with the competent authorities, the University of Harbin University, the incubator, the science and technology park, the industry association, the same industry and the technology and financial service platforms to make a good reserve of high -quality projects. Firm confidence to invest early, small, and investment technology. Through the equity investment of science and technology risk funds, it has continuously improved the independent innovation capabilities of Harbin College and scientific research institutes, science and technology, and high -tech enterprises, accelerate the transformation and industrialization of scientific and technological achievements and industrialization The process, make every effort to build an important source of independent innovation and the main source of original innovation.

"'Harbin Innovation Investment' must be firmly focused on the digital economy, biotechnology, artificial intelligence and other innovations leading industries and strategic emerging industries, and give full play to the leading and demonstration role of policy financial institutions in the first array, heavy burden, the main force, and contribution." Zhu Shuyuan said, "The continuous and multi -gradients of scientific and technological finance products expand new momentum, enhance new driving force, and enhance new impetus, and contribute scientific and financial power to the construction of the" six Longjiang 'and the "seven metropolis". "

Source: Bingcheng+Client

Reporter Jiang Xuelong King Yue

PSAs

- END -

The first trial of Fu Zhenghua was charged with more than 117 million yuan in bribes

Today, the first trial of the Changchun Intermediate People's Court of Jilin Provi...

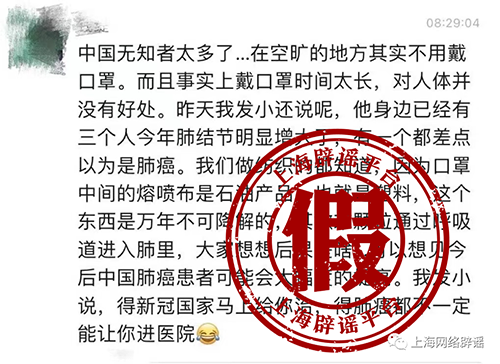

Will wearing a hood for a long time to inhale micro -end particles can induce lung cancer?rumor!

Recently, the Shanghai rumor platform received a message from netizens, hoping to ...