Baili Tianheng: The performance has fallen sharply, the innovative drugs cannot be listed in the short term | IPO observation

Author:City world Time:2022.07.30

The pharmaceutical sector was a bit unlucky recently. First, Kang Longhua was not as good as expected. Later, the leading medicine Ming Kangde continued to fall in a consecutive years when the profit of the semi -annual report rose. The performance of good performance is falling sharply, indicating that market funds are extremely disturbed by the pharmaceutical sector.

In the context of the coldness of the pharmaceutical sector, Pharmaceutical Baili Tianheng successfully met on July 28. This IPO is also a second barrier in Belle Tianheng. As early as 2014, Belle Tianheng submitted a prospectus to the CSRC to list on the GEM. Later, because some bank accounts in the company opened in private names, the decline in the average price of the main products caused the IPO to terminate the censorship.

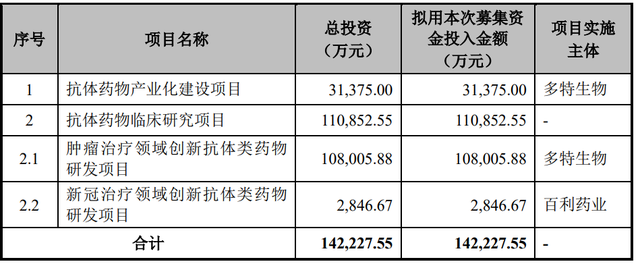

In this IPO, Baili Tianheng aimed at the science and technology board. The prospectus showed that Belle Tianheng plans to issue no more than 40.1 million shares, and it is planned to raise 1.422 billion yuan.

From the GEM to the science and technology board, Baili Tianheng also had a last resort. Even though the GEM has implemented the registration system, there is still profit requirements for IPO companies. According to regulations, the cumulative net profit of the GEM IPO company in the past two years is not less than 10 million yuan, or the net profit of the past year is not less than 5 million yuan. The science and technology board has no clear requirements for profit.

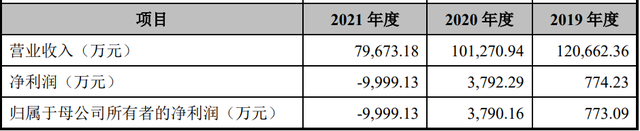

The prospectus shows that from 2019 to 2021, Baili Tianheng achieved revenue of 1.206 billion yuan, 1.012 billion yuan, and 796 million yuan. The net profit of returned to the mother was 7.7309 million yuan, 37.9016 million yuan, and -999.99 million yuan, and did not meet the listing conditions of the GEM. Belle Tianheng could only choose to go public on the Science and Technology Board.

Although the net profit of Baili Tianheng's home in 2019 and 2019 and 2019, they all come from government subsidies. The prospectus shows that the company's government subsidies received government subsidies of 71.916 million yuan and 85.689 million yuan in 2019 and 2020. After deducting government subsidies, the company's deductible net profit was -38.107 million yuan and -250.405 million yuan, respectively. In 2021, the company's government subsidies fell to 68.113 million yuan, and the non-net profit was -154 million yuan.

For a few reasons for the decline in revenue and the expansion of losses. The first is: The company's main product chemical drugs and the proprietary patent agent's business have not passed the collection, resulting in a big problem in sales. The second is: the company's innovative drugs cannot be listed in the short term. Third, the company's research and development investment has increased.

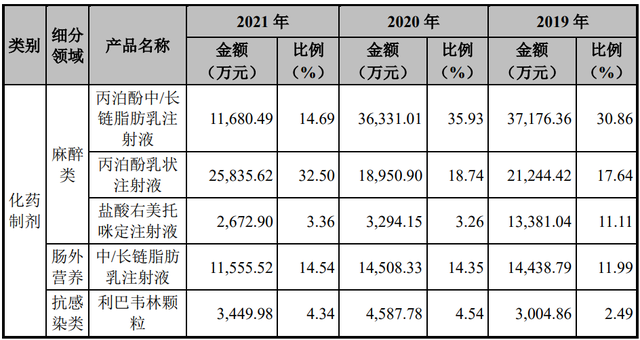

The main products of Bleitian Heng are the propylene phenol injection and right gaulem hydrochloride. In 2019, the two revenue accounted for 59.61%of the company's total revenue. After starting the collection in 2019, the company's right meteri hydrochloride injecting liquid first entered the pilot pilot of the city collection of "4+7". Product sales also decreased from 186,3900 in 2019 to 524,900 in 2021, and the relevant revenue also decreased from 133 million yuan to 26.729 million yuan.

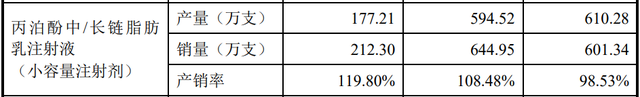

Another main product of the company's main product of proprotoxin /long -chain fat milk injection (small capacity injection) did not enter the national collection in 2021, and product sales decreased from 6.4495 million in 2020 to 2.123 million. In the same period, the overall income of propyol /long -chain fat milk injection also decreased by 116 million yuan from 363 million yuan.

Jeta usually means absolute market share. Therefore, Baili Tianheng's main products have not entered the collection of collection in the past two years and lost most of the market share. In 2022, Bailianheng has passed the consistency evaluation of the above products. However, there is still a lot of distance from the formal collection of consistency evaluations. Hengrui Pharmaceutical and Kelun Pharmaceutical related products have also passed consistency evaluation. It is not easy to enter the top three.

In terms of innovative drugs, Baili Tianheng began innovative drug research and development in 2011. As of the end of 2021, innovative drugs have not brought any income to the company. At present, 8 innovative biopharmaceuticals are developed in the research product, and the fastest are only in the clinical phase 2 stage. There is still a very distant distance on listing.

The listing of new medicines is far away, and Baili Tianheng R & D investment has also continued to increase. Baili Tianheng R & D investment increased from 181 million yuan in 2019 to 278 million yuan in 2021, most of which were invested in the research and development of innovative medicines. However, although R & D investment increases, the actual effect is not very good. The company also clearly stated that the incomplete research and development of innovative drugs caused the risk of being unable to go public.

The sales volume of the original products has fallen sharply, and the investment in R & D investment has increased significantly, resulting in deterioration of the company's liquidity. Judging from the current financial indicators, Baili Tianheng's mobile ratio in 2019-2021 is 1.07, 1.07, and 0.90, respectively, and the mobile ratio of 20121 fell below 1.

The pharmaceutical industry itself is light assets and re -research and development industries, and liquidity is a lifeline for pharmaceutical companies. Therefore, the mobile ratio of general pharmaceutical companies will be above 2. Choice data shows that the average flow ratio of pharmaceutical companies in the same period is 2.85, and the average flow ratio of the CRO enterprise listed CRO is as high as 5.82.

With the opening of the new production line and new R & D projects, Baili Tianheng's capital demand will also increase. For a period of time, Baili Tianheng has not been able to introduce new investment for four consecutive periods.

Faced with liquidity dilemma, Baili Tianheng can only solve the funding gap through IPO financing.

(Author: Duan Nannan)

- END -

Convenience reminder: Multi -provinces will announce the college entrance examination for time, and the adjustment of the national medical insurance directory will be opened ...

Reminder@, These provinces have announced their scores and volunteers, so far, except Shanghai, the remaining provinces and cities have ended. After the exam, Beijing, Tianjin, Shandong and other plac

Inner Mongolia Tongliao City Kuron Banner Meteorological Observatory to lift the wind blue warning [

The Kulun Banner Meteorological Station, Tongliao City, Inner Mongolia, was lifted at 11:39 on June 13, 2022 to relieve the Kuron Banner Blue Early Warning signal released by June 12, 2022 at 12:26.