New Fund issued transcripts!This kind of recovered

Author:China Fund News Time:2022.07.30

China Fund reporter Cao Wenzheng

Following the past three years, the newly issued fund has made a high progress, and the new Fund has encountered "Waterloo" since this year. In July of this year, the sales volume of the new hair fund of 811.846 billion yuan hit a new low since the second half of 2019, the lowest in the past three years. In July, the issuance scale of the new fund was 126.898 billion yuan, a 46%decrease from June. Among them, the issuance of bond funds in July to cool down, and the issuance of equity funds is heated.

Many people in the industry said that in the first half of the year due to the investment in equity funds suppressed by risk appetite, the issuance of equity funds in the second half of the year may be better than the first half of the year, and the issuance of the issuance of solidarium funds may fall.

In the first July, the number of new funds fell by nearly 60% year -on -year

Avy a new low in the same period since 2019

Wind data shows that since this year, the size of Xinfa Fund was 811.846 billion, a decrease of 56.47%from the same period last year. This number also reached a new low since 2019.

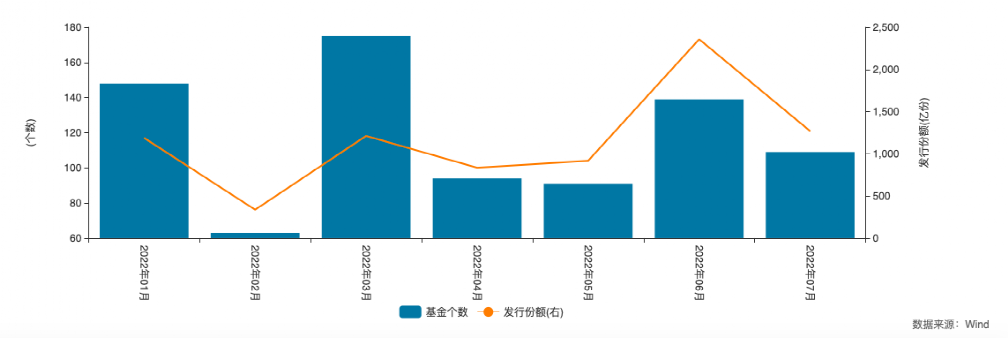

In July, the new fund issuance has a significant cooling from the scale and the number in June. According to the establishment date of the fund as the statistical caliber, the issuance scale of the new fund in July was 126.898 billion yuan, a decrease of 46.19%from June; 109 new funds were established in July, a 22%decrease from June.

Liu Yiqian, the person in charge of the business of Shanghai Securities Fund Evaluation and Research Center, believes that, as a whole, the new fund distribution market in the first seven months of this year presents a structural characteristics that first encounters cold and then repair. In the first half of the year, the scale of new funds was not good. The main reason was related to the poor market in the domestic A -share market. Due to the abnormally complicated domestic and foreign environment in the first half of the year, the investment risk preferences continued to slug. The pressure of new issues has risen sharply. In this context, bond funds have become the main types of funds issued by the fund company, especially the peer deposit fund as the innovation fund. In addition, the issuance of holding funds has also increased significantly. In the weak city, the issuing holding fund to experience the manager's hopes to hardly require the holder to invest in long -term investment from the perspective of product design, lock the customer investment time, avoid short -term short -term The emotional interference and inappropriate redemption brought by market fluctuations. However, since Shanghai announced its gradual resumption of work in May, the Xinfang Fund market has gradually recovered. From the perspective of the number of issuance and the scale of issuance, it has increased from May before May. It is also obviously improved.

The Debon Fund stated that the total raising scale of the 16 interbank deposit index funds established in June was close to 100 billion yuan, which contributed a scale of nearly half of June. reason. Looking back at the first half of the year, June was also the most raised month in the first half of the year.

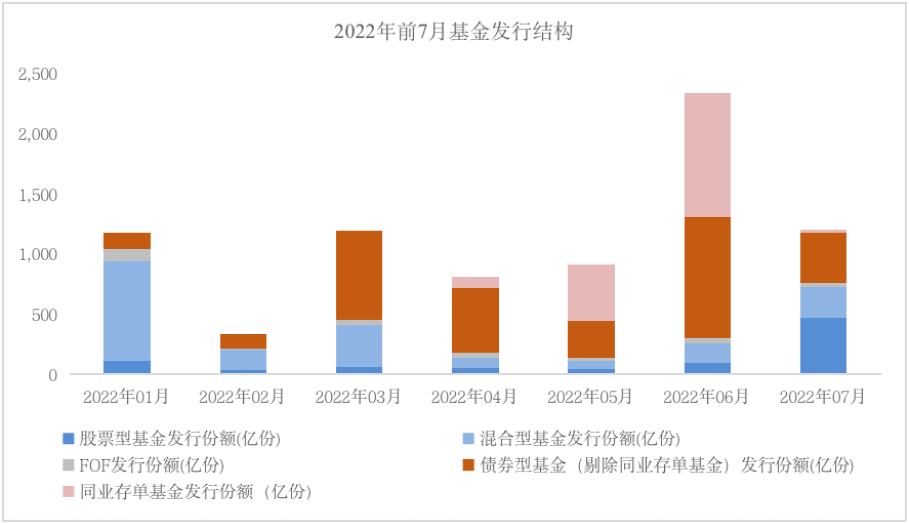

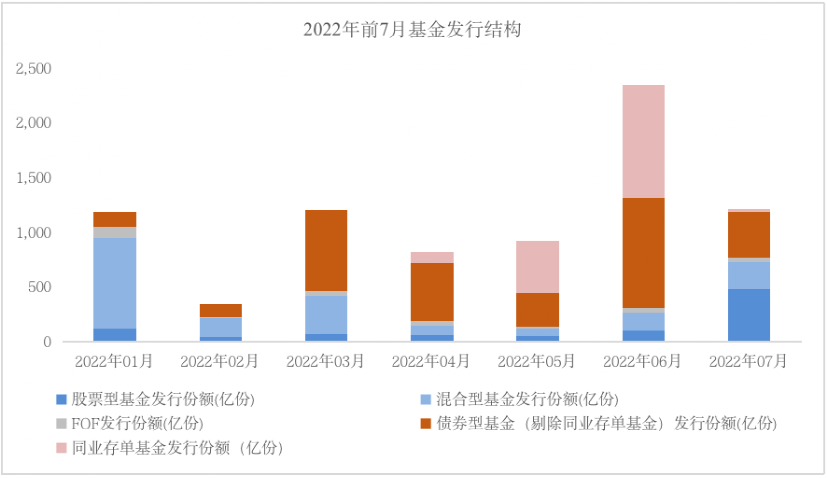

Judging from the overall structure of the new fund issuance this year, the reporter also noticed that the issuance share of equity funds in January to February this year has increased significantly, and the issuance of bond funds in June to June has increased significantly. The scale of issuance has expanded rapidly. In July, bond fund -type funds were issued to cool down, and the issuance of equity funds was heated.

In this regard, the Huicheng Fund Research Center stated that the equity market from January to February was relatively optimistic, so the issuance of equity funds was issued more; the external environment uncertainty increased from March to June, the spread of domestic epidemic, the suspension of key cities, and the expected extreme market expectations of the rights market. Pessimal, and the bond market has benefited a lot of monetary policy, and the market is relatively optimistic, so this stage of equity funds has less issued and bond funds have been issued more; since July, the external impact margins have decreased, the recovery after the epidemic has gradually begun, the rights market for equity, and the market for equity markets. Emotions are warmed, so the issuance of equity funds is smoother.

From the perspective of the segmentation, present several characteristics. The first, January-June equity fund is mainly mixed funds, and in July, it is mainly stock funds. This is mainly due to the issuance of multiple CSI 1000ETFs and carbon neutral and ETFs in July. Second, April-June, the issue of the issue of the same industry depository fund has increased sharply. This is because at this stage, the market for equity markets is poor, and on the one hand, the interbank deposit fund is expected to obtain a relatively stable income, and on the other hand Control, so it can meet investors' needs for lower risks and higher liquidity wealth management tools, so they receive market pursuits. As the market gradually turns better, the fund company has put the promotion energy on stock funds The issuance of bill deposit funds fell sharply in July.

In July, bond funds issued cooling

Equity fund issuance recovery

According to Wind data, from April to July 2022, the issuance share of new funds (stock type+hybrid) of equity (stock type+hybrid) was 14.065 billion, 11.835 billion, 26.275 billion, and 76.728 billion; the average issuance scale of the new funds alone was 663 million, 60 million, 862 million, and 2.443 billion were respectively showed a rise in shocks. The issuance of bond funds in July was 44.448 billion, a decrease of nearly 80%from June, and only decreased from 61 in June to 26 in July, a decrease of 57.37%.

Liu Yiqian, the person in charge of the business of Shanghai Securities Fund Evaluation and Research Center, said that this year's market has been in the market, because the domestic epidemic, overseas inflation, and the Russian -Ukraine conflicts have been in a downward trend. By the end of April, the market has bottomed out. From May Shanghai announced its gradual resumption of work and re -production, and the domestic capital market began to be in a period of warming. The current market index has basically returned to a level around March this year. With the brightness of the epidemic form and the gradual release of the profit expectations of the manufacturing industry, investors' investment in equity funds is being repaired. From the results of the issuance, the equity fund is more optimistic than the bond fund. According to the Huicheng Fund Research Center, the reason why the issuance of equity fund issuance is mainly because the issuance of the fund is closely related to the market trend. Since the beginning of this year, foreign factors have been complicated. The fundamentals of enterprises have gone, the Federal Reserve ’s interest rate hike is constantly improving, the market capital has weakened, and the market sentiment is extremely pessimistic. With the weakening of external shocks since July, domestic recovery expectations have continued to increase, and the market for equity markets has recovered, so the number and scale of equity funds have increased.

The reason for the "cold" of bond funds is that from the perspective of the market, the economic fundamentals are expected to turn well, the stock market recovery, and the decline in investment income of the bond market have all affected the scale of bond fund issuance to a certain extent. From the perspective of data, the issuance of bond funds in June expanded from the previous month. The issuance of bond funds in July returned to the normal state, so the "cliff -type" decline was produced. From a structural point of view, a total of 203.994 billion yuan was issued in bond funds in June, of which 103.359 billion yuan of interbank depository funds issued it, while the interbank deposit fund in July only issued 1.31 billion yuan, which is the main reason for the decline in bond fund issuance.

Debon Fund stated that the raising scale of equity funds is mainly due to the recovery of the equity market and the increase in the attention of equity products. Many equity products established in July have achieved good raising results; Opportunities, 3 CSI 1000ETF raised 24 billion. The issuance of bond funds is not cold but slowed down. The number of bond funds established in July is less than half of the June. The scale is the same as in June, and short debt funds are still sought after.

It is expected that the issuance of equity products in the second half of the year may be better than the first half of the year

As for whether the fund issuance market recovers next, Liu Yijian believes that the fund raising situation will still be mainly affected by the actual interpretation of the capital market. In China, with the bright and stable growth policy of the epidemic, the domestic economy is expected to gradually recover; overseas overseas; overseas In terms of the landing boots and the conflict between Russia and Ukraine may ease, they are all conducive to the repair of the capital market. Overall, we expect that the form of fund issuance in the second half of the year is expected to improve, which is especially conducive to equity funds. On the one hand, the market has rebounded strongly in the past two months, the emotions of the equity market have significantly improved, and market risk preferences are expected to continue to improve. On the other hand, the market valuation and historical average level are still in a lower position, and the investment cost is relatively high. Finally, the most important thing is that the value of public funds has been increasingly recognized by the public. In the first half of the year, the investment demand for equity funds suppressed by risks preferences in the first half of the year is expected to be quickly repaired in the second half of the year.

The Huicheng Fund Research Center stated that the issuance of the equity fund in the second half of the year may be better than the first half of the year, and the issuance of the issuance of solidaries will fall. On the one hand, the impact of the impact on the market weakened on the market for adverse factors such as epidemic disturbances, Russian and Ukraine conflicts, and the Federal Reserve ’s interest rate hikes. Domestic policy support has continued to increase. As the market has improved, the issuance situation of equity funds may be better than above. Half a year; on the other hand, the certainty of economic recovery has increased, industrial support policies have accelerated the landing, and the stock market emotions are better. They will suppress the market market in a certain extent, and the issuance of bond funds may fall.

Debon Fund said that the market recovery in the past two months has a role in recovery of investors' confidence. If the A -share market can continue enthusiasm in the second half of the year, it is expected that the sales volume of equity products in the second half of the year will be better than the first half of the year; The city's performance is related. If the macro policy in the second half of the year will still maintain easing and active help, the issuance of the debt base will be issued or stable in the second half of the year.

The company will actively seize the good opportunities brought by the market recovery in the future. While strengthening the layout of the theme fund layout of new energy, consumption, manufacturing and other relatively optimistic industry segmented tracks, it also makes the investment layout of the stock funds. Existing products are superior, bigger, and fine.

Edit: Captain

- END -

Panlong District Meteorological Observatory issued a yellow warning of geological disasters [Class I

The Meteorological Bureau of Panlong District, Kunming City, and the Natural Resources Bureau of Panlong District, Kunming City jointly issued a Grade III warning of geological disasters meteorologica

Wen Chen sent the "three initiatives" to protect the safety of enterprises

It's so hot in the sky, comrades from the police station came to our enterprise to help do a good job in summer fire prevention work, which strengthened the awareness of fire safety in the enterprise...