$ 46 billion!The three major energy giants in the West earlier: The voices of huge profits and taxes are getting bigger and bigger: more earnings than God

Author:Red Star News Time:2022.07.30

Affected by the rebound of Russia -Ukraine's conflict and energy demand, the three major oil giants in the West -Exxon Mobil, Chevron and Shell's total profits in the second quarter of this year reached a record 46 billion US dollars. Among them, as the largest oil company in the United States, ExxonMobil's quarterly profit was more than three times the same period last year, mainly due to the most expensive energy prices in more than 10 years.

▲ The total profit of the three major oil giants Exxon Mobil, Chevron and Shell Company reached a record 46 billion US dollars in the second quarter of this year.

It is reported that huge profits have led energy companies to face greater "political pressure". Last month, US President Biden had accused major oil refineers in use the Russian -Ukraine conflict and inflation to earn huge profits, saying that Ex SenMobil made money this year "more than God." At the same time, American politics requires the voices of "huge profits taxes" for energy companies.

Energy giant profit hitting a record high

On the 29th local time, the two largest energy companies in the United States, Ex Sen Mobil and Chevron, said that due to the continued soaring oil and natural gas prices and the reduction of refining costs, the profit in the second quarter rose to a record level. Among them, ExxonMobil's in the second quarter was as high as $ 17.9 billion, nearly 4 times the same period last year. Its competitors, the rival Chevron's second quarter, reached $ 11.6 billion, much higher than the US $ 3.1 billion in the same period last year.

▲ The two largest energy companies in the United States have risen to a record level in the second quarter

One day ago, the European Energy Giant Shell Company also announced a generous quarterly income. The adjustment of net profit after adjustment in the second quarter reached nearly 11.5 billion US dollars, an increase of 26%month -on -month. This data not only exceeds analysts' generally expected $ 11.2 billion, but also achieved a record of a record of the second quarterly report. In addition to the above three energy giants, the quarterly profit of French energy company Da Dal also soared to a record level.

Faced with a record profit, Ex SenMobil and Chevron promised to use oil refining capacity and increase energy supply. Some analysts pointed out that the huge cash flow of these companies marked a major turnaround in the oil industry. After the outbreak of the new crown epidemic in early 2020, the oil industry lost a lot of cash, and dozens of companies applied for bankruptcy. At that time, even the two American giants had historic losses. At the same time, refineries have closed down the United States' refinery capacity.

▲ Since breaking through the $ 5 mark last month, US gasoline prices have fallen recently.

According to Bloomberg's data, the average price of US crude oil benchmark in the second quarter of this year was about $ 109 per barrel, an increase of 64%over the same period last year. Last month, the average US gasoline price exceeded $ 5 per gallon, and recently fell. Nevertheless, refining profits far exceed expectations. "The strong second quarter performance reflects that the demand has returned to the level near the epidemic." Darren Woods, CEO of Ex Sen Mobil, said that this also reflects the tight global market environment. Before the new production capacity is put into operation, Creating a record of refining profit may last for several years.

The call for "huge profits tax" is getting louder

It is reported that with the gradual deepening of high oil prices to consumers, the high profits of energy companies have become a "political detonation point." Near November elections, high oil prices have become the burden of Biden and Democrats. Even before the announcement of the second quarter, Biden had criticized the energy giants' "earning huge profits" in the global crisis, saying that "more money made by Exxon Mobil this year than God."

▲ Nearly November elections, high oil prices have become the burden of Biden and Democrats

Politburo, including Biden, believes that the shortage of production capacity in the US refinery has led to a record -reaching refining profit margin, which is intensifying the "huge economic pain" that American families bear. In order to offset the tight supply of crude oil and low energy prices, the Bayeng government has repeatedly released strategic petroleum reserves and encouraged oil mining merchants to increase production. Despite the promised increase in production, the two companies are increasing the dividend and stock repurchase to increase supply expenditure.

Recently, the US politics demanded that the "huge profit tax" of energy giants has increased. Earlier, the British government announced at the end of May that the profits of energy manufacturers such as shells were levied 25%of the tax until the price of oil and natural gas fell to a more normal level. It is reported that the "2022 reduction of the inflation" that the U.S. Congress is currently discussed includes the guarantee stable supply through large -scale tax increases and other measures. However, this bill has been criticized by many Republicans and the public.

▲ Recently, the US politics demands that the "huge profit tax" of energy giants has increased.

In addition, some oil analysts believe that the profit of energy companies should be observed from the perspective of economic background. "Their income is still lower than Google or Apple," said Anti Lipo, an analyst of the petroleum industry, "No one will complain about the iPhone priced at $ 1,300." Libo added that Americans should expect that as currently, it is expected that as currently, it is expected that as now, it is expected that as now, it is expected that as now, From the perspective of the environment, the trend of huge profits and rising oil prices will continue.

"We may see the average national gasoline price falling to $ 4 per gallon in October, but we will not be at $ 3 or $ 2.5 or even lower." Li Bo analyzed, "Even during the epidemic period (energy period (energy sources (energy sources ) Demand decreased by 20%or 30%, and these companies remain quite high. "

Red Star News reporter Hu Yiling

Edit Guo Yu

- END -

Wanning Meteorological Station issued a thunderbolt orange warning [Class II/serious]

Wanning Meteorological Observatory, June 09, 2022 at 09:53, released the thunderbolt orange warning signal: Our city has been affected by lightning activities, and may continue, and the possibility of

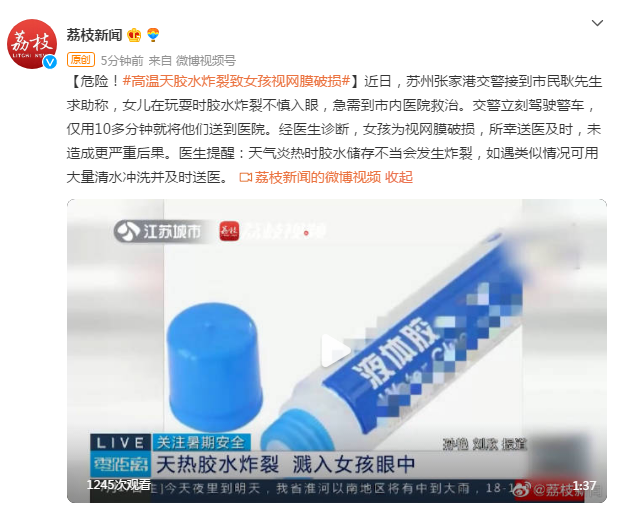

Danger!High -temperature glue frying causes retina for retina

Recently, Suzhou Zhangjiagang Traffic Police received a help from the citizen Mr. ...