"Blockchain First Share" Yishi shares delisting Revelation: The Leng brothers played a big chess, no winners

Author:Daily Economic News Time:2022.07.30

Photo source: Photo Network -501024898

The former A -share "Blockchain No. 1 Share" was easy to see shares (delisting, easy to see, SH600093) to harvest an ending out of the stock in 2022, which is sighing.

This year, it was just a decade of shares to hold hands with the Leng brothers. Looking at the company's development process in those years, investors sighed that they had become the abandoned son of capital speculators from the market darling, and was shocked by the fake methods of the Leng brothers.

What makes people feel the most is a dependence on the path of alienation, which makes the final water covering difficult.

The stock price in continuous losses is high time

On November 1, 2008, a person who claimed to be Satoshi Nakamoto published "Bitcoin: A Point -Power Electronic Cash System", which was born. The following year, the blockchain was born. This technology will become a popular theme to sweep A shares after eight years.

This year, Yishi shares are also called Hejia shares, and the big head of operating income comes from automotive accessories. 8 years later, it stripped the car parts business and renamed the later Yishen shares.

From 2014 to 2015, A shares ushered in a round of high -songs. With the enthusiasm of stock trading, how many people of TVB's classic drama "Big Times" were revisited, as if they were also "fish fin rice".

At that time, the subject matter was rampant and the daily limit bloomed. A listed company's additional issuance or actual controller Yi Lord Yi will give birth to a bull stock. After June 2015, the bull market stopped abruptly, but the style of hype of the subject matter has not yet disappeared. From 2016 to 2017, A shares ushered in the repair market after bottoming out. However, investors may not remember the lessons of the subject matter hype, and they will still speculate on the heat.

Blockchain is naturally a hotspot that the market will not give up. Instead, because of the cooperation with IBM, Yisa has become the "first share of blockchain".

Photo source: Photo Network-500807940

In 2017, the main businesses of Yishi shares have become supply chain management and commercial factoring business. The 2016 annual report disclosed by the company in April wrote: "During the reporting period, we started cooperating with IBM to explore the use of blockchain technology in the field of supply chain management services. And level, further reduce transaction costs and improve the company's core competitiveness. "

In the same year, Shao Ling, former deputy dean of the company hired the IBM China Research Institute, served as the company's CTO, and said that he "cooperated with IBM to develop the online blockchain system '" easy to see block' ".

A listed company in western China cooperates with the IBM blockchain with IBM internationally renowned information companies. This "explosion point" has steadily rising the company's stock price. By February 2018, Yi Jian's stock price stood on a relatively high point in history. Nowadays, Yishen's shares have been delisted, but the major trading software still marked the "blockchain" concept and subject matter for the company. It can be seen that the blockchain has achieved its high light moment.

This highlights also belong to the helm behind the shares -Leng Tianhui.

Leng Tianhui is a prestige of Qujing Xuanwei. He had been a salesperson and deputy chief of the coal mine in Zhongcun, Qujing City in his early years, and was familiar with the local coal trading.

At the age of 25, Leng Tianhui founded Yunnan Jiutian Industry and Trade Co., Ltd. (later renamed Yunnan Jiutian Investment Holding Group Co., Ltd., hereinafter referred to as Jiutian Holdings). Coal wholesale was his most important business. In addition, there were real estate. Leng Tianhui is very good at business, and the business is getting bigger and bigger.

The second brother Leng Tianqing and Leng Tianhui do business together. According to the Hurunfu list of 2017, the two have a total of 9.7 billion yuan, ranking the richest people in Qujing for many years.

Picture source: web screenshot

In the golden age of coal in the early 1990s, the power of academic qualifications than personal wealth was far lower than the air outlet. Standing at the wind, the growth of wealth index will give people great confidence, including finding the sense of smell of the next opportunity.

The capital market is always a charming opportunity. In 2012, the "shell" was popular, and Leng Tianhui was also launched with the then Hejia Co., Ltd., and entered the old listed company.

After that, the actions of Yisan's shares in the capital market also had a lot of topics. In addition, the Hurun Rich List of celebrities at the helm and had blockchain cooperation with IBM. For a while, the company’s speculation elements were charm, and even covered the company's performance The fact.

In 2019, the stock price of Yishi shares rose by more than 80%throughout the year, which is the last highlight for the market.

Easy to see the stock price trend of 2019 (Zhou K) Picture Source: Screenshot of Oriental Fortune

Crazy virtual performance bait seduce next buyer

The train of Yishi has already moved forward. According to this track, it should be flat and stable.

But it is still derailed ...

At the beginning, Leng Tianhui suddenly turned to see the shares.

In May 2017, Leng Tianhui wanted to take the controlling stake of Jiutian Holdings to introduce Yunnan World Expo Tourism Holding Group Co., Ltd. He may smell the wind transfer of equity at that time, thinking that it was the best time to see the control of shares.

In 2016, the equity transfer incident of "Bao Wan's Controversy", "Wuchang Fish" and "Sichuan Shuangma Yi" have doubled myths in various stock prices. If it was Yi Lord at that time, Leng Tianhui could almost sell it at a high valuation.

However, the plan ended due to failure to obtain the approved by the superior units and ended it in failure. Leng Tianhui did not give up, but looked for another goal.

On October 7, 2018, Jiutian Holdings intends to entrust the voting rights of 19%of the listed company to Yunnan A little Fat Agricultural Technology Co., Ltd. to exercise. After the entrustment of this voting right is completed, the proportion of Jiutian Holdings shares to be reduced to 19.11% Essence At that time, there were rumors that had tensioned funds in the nine -day holding capital chain.

After that, Yunnan Industrial Investment Group, Dianzhong Group, Yunnan Industrial Investment Junyang and Yunnan had completed their share transfer in nine days. In August 2020, the company's controlling shareholder was changed to Yunnan Industrial Investment Group, and the actual controller was no longer Leng Tianhui.

According to media calculations, Leng Tianhui's current amount of shares of shares is more than 4 billion yuan. The 4 billion yuan has exceeded the sum of all net profit since the listing of Yishen shares.

But afterwards, Leng Tianhui's capital operation was full of calculations.

A financial reporter who had participated in the counterfeit survey of Yishen's shares recently expressed his guess to reporters through WeChat: "(Feel) Yishen's shares cold boss was in the beginning, and stepped in step by step. The company delisted in. Actually, it also caused huge amount of state -owned assets. "

If this "bureau" really exists, in addition to the scenery of the secondary market, it also includes the fraud of the company's performance -this may make the company look more worthy of acquisition.

In November 2020, since the warning letter of the Sichuan Securities Regulatory Bureau, this fidelity fraud began to be revealed step by step.

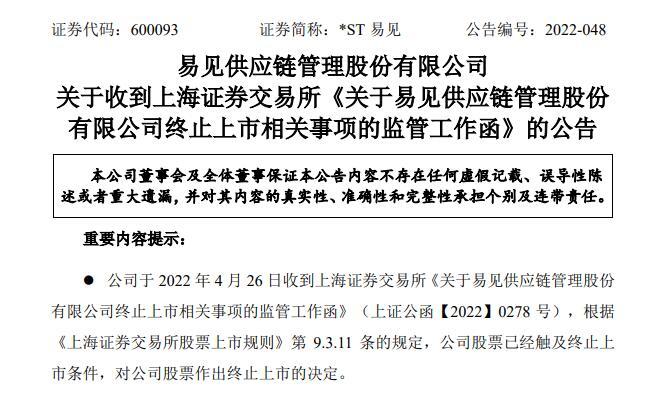

Image source: Announcement Screenshot

This warning letter pointed out that there are defects in the internal control of the shares. "" The basic business of some factoring business customers is similar to the height of the basic business and the purchase and sales contract. The scale of procurement business is not matched, and some factoring customers may belong to the same enterprise control or have a relationship. "

In April of the following year, the proportion of response ratios of Yixian shares accounting letter (important audit procedures for auditing evidence) was low.

"Daily Economic News" reporters rushed to Xuanwei, Kunming, Qujing and other places in Yunnan in May to investigate many important customers from 2015 to the first half of 2019.

(Related reports: "The first share of the blockchain" annual report is difficult to produce: 5 years of billions of bills real? The primitive controller "strange" is guaranteed by many big customers ")))

Among them, Xuanwei Zhongcun was the place of cold Tianhui. The reporter found in the investigation that there were problems with many large customers from 2017 to 2019. Some large customers jointly contracted projects with listed company subsidiaries, and were controlled by Leng Tianhui behind the customers.

This year, Yi Jian's shares received in the "Administrative Penalties and Market Prohibition Notices" issued by the Securities Regulatory Commission. From 2016 to 2020, the company passed the official seal of other companies, fictional basic purchase and sales business contracts and documents, forged Carry out the payment business of the false supply chain and the fake commercial factoring business, etc., and finally increase income and profits.

Image source: Announcement Screenshot

In addition, from 2015 to 2020, in order to fulfill the performance commitment, Yimian shares have carried out a large number of commercial supply chain trade business. From 2015 to 2020, the cumulative income increased by more than 50 billion yuan.

Behind the "blockchain" is behind the fake scams of more than 50 billion yuan. Before being pierced to counterfeit, Leng Tianhui controlled by customers also occupied more than 4 billion yuan of funds through customers.

After delisting, there are still some questions to be answered

Now that the shares of the shares are returning, the fake drama of the Leng Tianhui brothers has been pierced. It can be seen that the investors, the company, and the Leng's brothers finally got good results from it, and harmed the company's shareholders and employees.

This ending is painful, and the Leng brothers should be responsible.

But the delisting should not be the end of the stories of easy to see, and there are some questions that need an answer.

For example, some fakes are manipulated by the Leng Tianhui Brothers, but the actual controller of the other counterfeit companies is not them. Does these people need to be held accountable afterwards?

After being verified by the Securities Regulatory Commission, Yi Jian and Yunnan Yuetan Mining Co., Ltd., Shanghai Yuanchang International Trade Co., Ltd., Shanghai Dongtan International Trade Co., Ltd., Shanghai Jinyu International Trade Co., Ltd., Yunnan Yuanchang Investment Co., Ltd., Yunnan Hongshi Supply chain management Co., Ltd. and other companies' factoring business is false business.

According to the "Daily Economic News" reporter's preliminary investigation, the above -mentioned companies mostly pointed to the mysterious wealthy Huangbo of Yunnan. Born in May 1987, Huang Bo was the vice chairman of the Yunnan Young Entrepreneurs Chamber of Commerce.

What is Huang Bo's current, is it responsible for the affiliate cost incident, and has it paid the price?

In 2022, there was no clear answer to this question. Just like investors who are easy to see shares 10 years ago, they could not predict the sad exit of listed companies today.

In 2022, with the heating of the concept of new energy vehicles, the automotive industry chain has once again become the focus of the market. If you see the shares in those years in those years, maybe you can catch up with this wave of new energy vehicles, and the performance of Dongshan will come back?

Instead of being like now, the Leng brothers carefully set up scams, and in the end it was just a "no one is a winner".

Photo source: Photo Network-400090706

Reporter's "Little Smart" path dependence

From the moment of fraud, the defeat of Yisan's shares has been set.

The Leng Tianhui brothers have a large number of coal and other mineral resources in Yunnan. Even if you put your mind firmly on the coal digging, you can go to a "well -off" not to be rich and expensive. Even if you do not dig coal, you may find the direction of the material of new energy with the degree of understanding of the local understanding of resources in the local area, and you may still find the real transformation path. Even if you do not invest in new energy transformation, investment investment can get a lot of benefits.

It is also a private enterprise in Yunnan. Why can Ensijie (SZ002812, the stock price is 213.98 yuan, and the market value of 191 billion yuan) can be used as an interval with a market value of more than 200 billion yuan? You know, at that time, its popularity was not as high as the "first share of the blockchain", and the market value was almost close.

Judging from the experience of Yishen's shares, a major reason for the Leng Tianhui brothers to this day is "not doing business." They did not put their minds on the operation of listed companies. Instead, they had a series of means to speculate in concepts and stock prices, and finally completed their cash withdrawal through the stock price increase.

They did not predict the mature capital market, and they will pay more and more attention to operations and fundamentals. Path dependence makes them intoxication of the past theme hype, which must be eliminated. Whether it is the "first stock of the blockchain" or the first stock of any emerging concept, it is now necessary to speak by operation and income.

Another major reason is that too speculators have misunderstood their own future.

"Disassembling the East Wall and Make up the West Wall" occupied the funds, and the brothers Leng Tianhui intended to pass through the customs through their so -called relationships. The more mature market economy and the capital market that emphasizes supervision, "relying on relations" is a very backward ancient director. Such a fascinating logic with a small sense of superiority allows the Leng Tianhui brothers to have no fear in hollowing out the assets of the listed company.

But Mo extended his hand, and the Leng Tianhui brothers were caught after reaching out.

The defeat of easy to see the shares not only alert the operator of "unwillingness", but also announced that it is intoxicated to engage in the subject matter. After all, it is not interesting.

Daily Economic News

- END -

Water supply staff compete for 8 hours, just to do not affect citizens to make dinner for dinner

Jimu Journalist Pan XizhengCorrespondent Qin YueIntern Xiang YuchenWhen I went out...

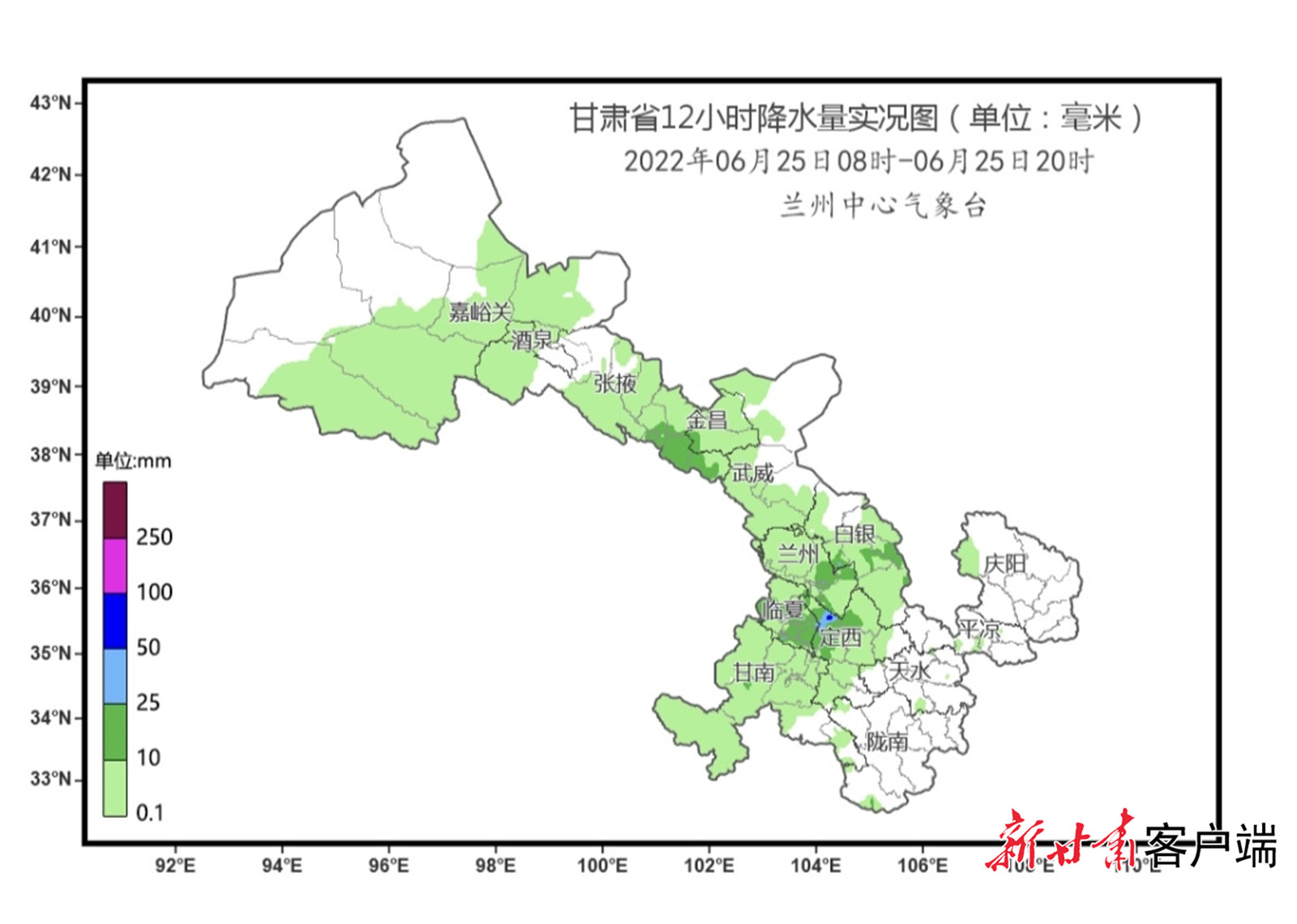

The rain is still down!Most parts of our province continue rainy weather

From 8:00 to 20:00 on June 25th to 20 hours, the real estate of the precipitation ...