Haitong Strategy: What are the market worry about?

Author:Broker China Time:2022.07.31

Source: Stock Market Xunye ID: xunyugen

Core conclusion: ① Since the market adjustment in early July, the real estate chain and consumer industry have fallen greatly, which stems from concerns about fundamentals. The key is still real estate. ② The proportion of real estate and related industries in my country's economy is close to 1/3. How to pay attention to the policies in the short term to solve the security of insurance buildings and stability. ③ It takes time to rest in spring cold, and keep patience in the short term. It is a reversal bottom at the end of April. The mid -term is firm in confidence.

Since the beginning of July, we have always emphasized the staged rest after the market reversed from the bottom. The reason behind it is that the fundamentals of the fundamental face have not kept up with the rising of the stock market. For details, please refer to "Rest and wait for the fundamentals -20220710", "Adjusting the Nature: Instant Spring-Cold- 20220717 "and so on. The market has been adjusted for nearly 4 weeks, and the transaction volume is shrinking. What investors are worried about what is worried about. This report has analyzed.

1. The fundamentals of real estate are the main concerns of the market

Since July 5th, the Shanghai Composite Index has a maximum decline of -5.8%, CSI 300 -8.2%, and GEM refers to -7.7%. We review the rise and fall of the industry since the market adjustment of the market and explore the crux of the market concerns.

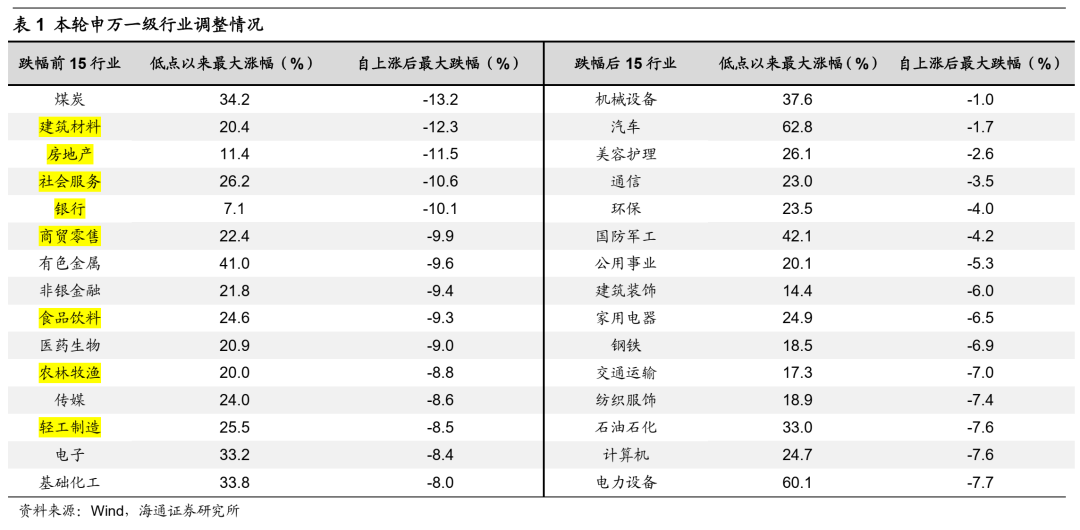

Real estate and epidemic -related industries have a large callback. From the perspective of the classification of the Shenwan industry, the decline industry is mainly divided into two categories: First, the real estate chain-related industries are affected by the "suspension of loan" storm, such as building materials (the maximum rising and falling decline since the end of June is -12.3%. ), Real estate (-11.5%), banks (-10.1%), white home appliances (-9.8%) have fallen, and the average decline in industries above June has reached -10.9%. ; Second, the consumer industry is repeatedly affected by the epidemic, such as social services (the biggest rose of -10.6%since the end of June, the same below), business retail (-9.9%), food and beverages (-9.3%), agriculture, forestry, animal husbandry and fishing (- 8.8%), Light Industry Manufacturing (-8.5%) is also large. The average decline in the above industries has reached -9.4%. See Table 1 for details. In addition, growth sections such as cars, power equipment, and communication are small due to weak relationships with real estate and epidemic, and the callback range is small. Specifically, the maximum rising decline since the adjustment of the car was -1.7%, the power equipment was -7.7%, and the communication was -3.5%. The average decline in the above industries was -4.3%.

The callback comes from concerns about fundamentals, and the key is still real estate. At present, the macroeconomic economy is still in the stage of weak recovery, and the rate of economic indicators is relatively smooth. The real estate "suspension of loan" incident and the disturbance of the epidemic in various places has made the market start to worry about economic recovery or interruption.

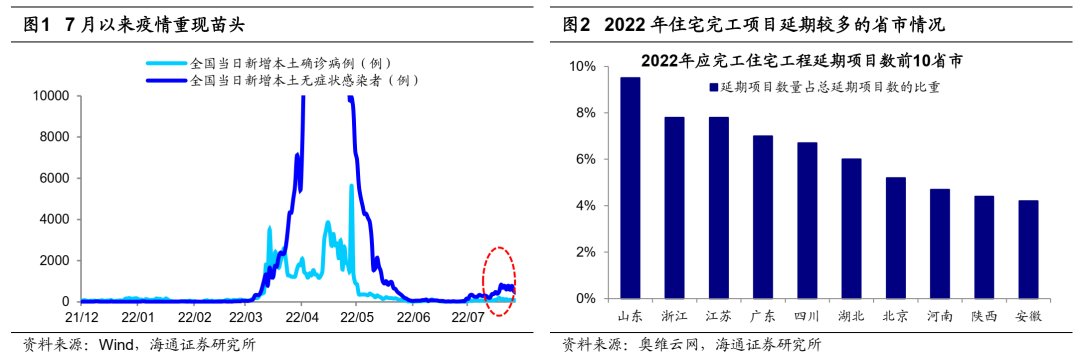

In terms of epidemic, the domestic epidemic was exuded more in July, and the epidemic in Shanghai, Shenzhen, Lanzhou, Chengdu and other places rose up one after another, forming disturbances on fundamentals. At present, the prevention and control of the epidemic in some areas has gradually made positive progress. Since 07/28, the number of positive infections in Shanghai has dropped to individual digits, and multiple high -risk zones have been lifted management and control measures. 07/29 No new infection. With the gradual control of the epidemic in various places, the impact of the epidemic on the fundamental aspect may only be staged.

The real estate "suspension" incident is the main source of market concerns. Recently, the owners of many places across the country issued a statement to stop repaying the loan until the relevant projects were completely resumed. Behind the "suspension of loan" storm is the financial difficulties facing the real estate industry. Since 21 years, some real estate companies have experienced recovery and stagnation of financing. %. From the perspective of stopping loan, according to Aowei Cloud Network, in late July, more than 320 real estate buyers have stopped loan in the country, involving 20 provinces. Nearly 1,400 residential projects have been confirmed to be extended this year, and cities above the third line are the hardest hit areas. The spread of the suspension of loan giving the real estate, which recovered the difficulty in the origin, has a heavy blow. Buyers have become more difficult for pre -sale of housing housing for housing companies, which brings greater pressure on the housing company's nervous capital chain, causing it Investors' concerns about the spread of the real estate industry chain. In addition, the downside of real estate will also indirectly affect consumption and investment, exacerbating investors' concerns about fundamentals.

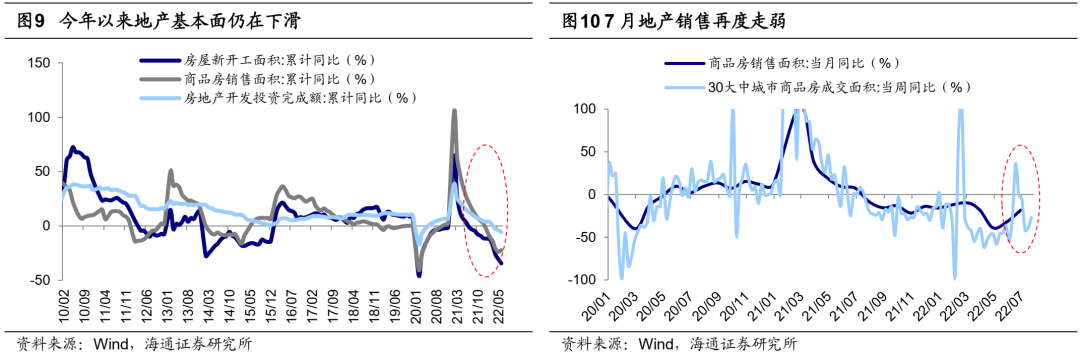

2. The proportion of real estate chains is large, and you need to keep the building in the short term.

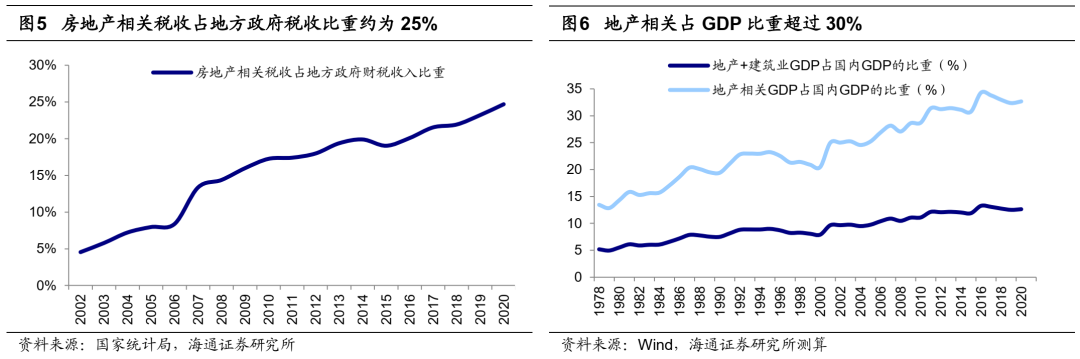

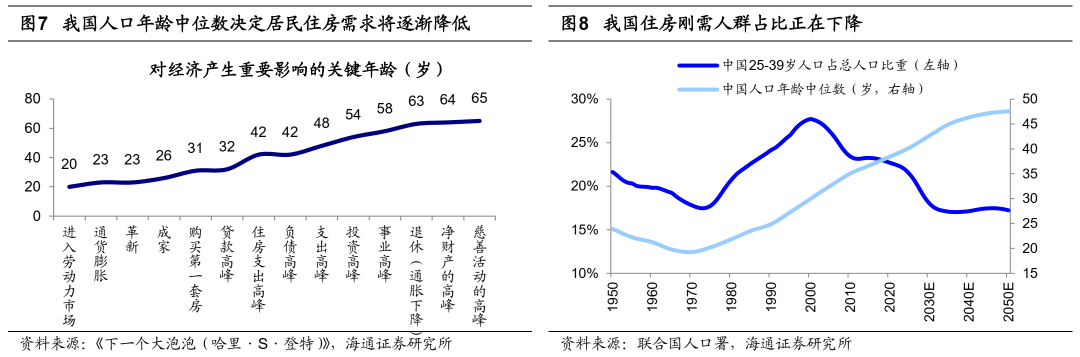

The current proportion of real estate and related industries in my country's economy is close to one -third. In July 1998, the State Council issued the "Notice on Further Deepening the Reform of the Urban Housing System and Accelerating Housing Construction" to comprehensively end the distribution of real housing objects. Since then, the demand for housing in my country has been released, and the real estate chain has gradually become the economic pillar industry. For residential assets and government income, the status of real estate is important. The current real estate accounts for nearly 60 % of the residents' assets in my country, which is the largest asset in the hands of residents. The proportion of local general public budget revenue is 78%; the proportion of real estate -related taxes (including real estate tax, urban land use tax, land value -added tax, deed tax) accounted for 25%of local fiscal tax revenue. On the whole, the real estate and construction industry GDP accounted for the proportion of the national GDP from 8.3%in 1998 to 12.7%in 2020. The proportion of the national economy is not high, but real estate is in the middle link in the national economic chain. The real estate investment industry is driven through the front -oriented effect, including steel, coal, engineering machinery, cement, non -ferrous, etc., and the rear -directional effect drives the real estate sales industry, including construction, home appliances, finance, etc. According to Haitong's macro calculation, the GDP of the real estate and construction industry in 1 unit can drive the GDP of 1.6 units in other industries. According to this, the proportion of real estate related to GDP rose from 21.4%in 1998 to the highest 34.3%in 2016. Afterwards, it fell, but it still reached 32.7%in 20 years. Although the current transformation and upgrading of my country's industrial structure is evolving, the leading industry is shifting from industry and real estate to information+service industry. At the same time, changes in the population structure will also lead to decline in demand for residential housing. The importance of real estate and related industries in my country's economy is still very prominent. Short -term focusing on how to solve real estate confidence and guarantee delivery. The proportion of real estate in the Chinese economy is very high, and it is important to replace the Chinese economy in the short term. Whether real estate can run smoothly is related to whether China's economy, finance, employment and finance can be stable. At present, the fundamentals of the real estate industry are still downward. In June 22, the cumulative decrease of real estate development investment has expanded to -5.40%year-on-year, and the newly-started area has been expanded to -34.4%. Under the impact of the release, it has been warmed up. The accumulation of housing sales area has narrowed to -22.20%year-on-year. The temperature of the commercial housing of 30 major and medium-sized cities fell from -0.1%to -27.1%from -0.1%from 06/26 to 06/26. On July 28th, the Central Political Bureau meeting responded to the recent "suspension of loan" incidents that have received much attention from the market, requiring "the city's policy to use a good policy tool box", "compact local government responsibilities, keep the property, stabilize the building, stabilize the stability Livelihood. In the future, we need to continue to pay attention to whether there are specific policies and measures to be introduced, realize the preservation of the property, stabilize the market expectations and the emotions of home buyers, and promote real estate sales to the bottom.

3. Keep patient

Chunchun may not be over, keep patient. In the reports of "Adjusting the Nature: Infalling Spring Cold -20220717", "Torment of Chun Chun Cold-201220224", etc., the adjustment of market experience since July has been qualitative to the cold spring, that is, the winter has ended, the spring has arrived, but there will still be cold spring. The reason behind the cold spring is that the repair of the fundamentals has not followed the pace of the stock market, and several factors still need to digest. First, the real estate "suspension" incident needs to be properly resolved to achieve insurance delivery. Second, the July CPI may be higher in August, and the tone of monetary policy will be unchanged at that time. The third is that the interim data needs to be digested. We expect 22Q2 A shares to eliminate the net profit growth rate of 22Q2 A shares in a single quarter of the mother. Fourth, in terms of external risks, the Fed is rapidly tightening monetary policy in the background of high inflation. Europe and some emerging market countries have certain debt concerns. For example , Argentina, Turkey, and Chile's total foreign debt accounted for GDP proportion or foreign debt relative foreign exchange reserves. The median number of sovereign debts in history in history. IMF pointed out that there are currently 30%of emerging market countries and 60%of low -income countries. In the predicament of or endown, see "Which" Gray Rhino "overseas is worthy of vigilance? -20220719. Of course, this variable is a gradually cumulative process, which does not necessarily affect the market now. It may also accumulate with the Fed's interest rate hike effect.

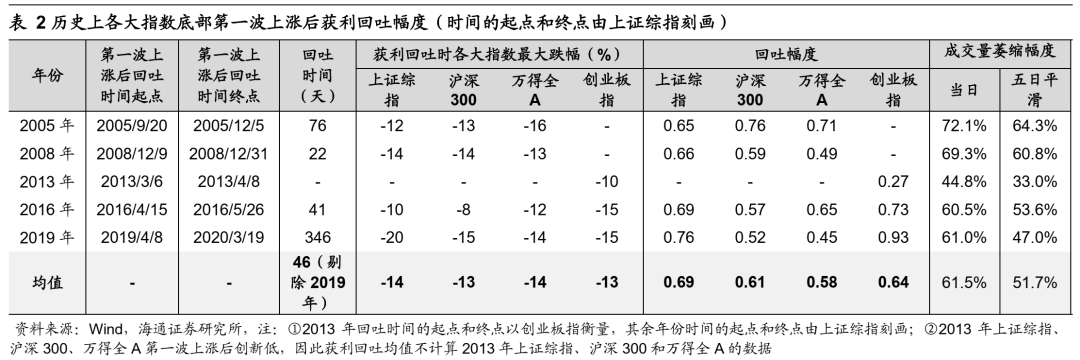

Judging from the historical adjustment time and space in history, the Shanghai Stock Exchange Index fell 46 days (excluded 2019) during the previous period of the vomiting process. The rising quotation in the early stage is 0.5-0.7. In addition, during the historical profit, the average contracted volume of the entire A transaction was 62%(52%smooth on the 5th). See Table 2 for details. As of 22/07/29, the Shanghai Stock Exchange Index has a maximum retracement of 6%. The smooth caliber was reduced by 24%. Judging from the adjustment of time and space, this time it may not be over. At the end of April, it was reversed and strategically optimistic. What conditions do we need to rebound to reverse? -20220504 "," Comparison history, this time it may be a shallow V base -20220605 "," The dawn first-20122 medium-term capital market outlook-201220618 "and other reports pointed out that the cold spring cold will not change the mid-term market in the market. Grand trends, from the perspective of investment clock and Bull and Bear cycle, the market low in April was the bottom of 3-4 years. Back up, the other two gradually stabilized. On July 28, the Politburo meeting continued to clarify the steady growth, emphasized that the macroeconomic "strive to achieve the best results", and proposed that "conditional provinces must strive to complete the expected goals of economic and social development" and "macro policies must expand demand in demand for demand Actively do ". Active response to conferences in the fields of real estate, platform economy and other fields that are concerned about the market, such as real estate requests "keeping traffic in the building and stabilizing the people's livelihood", the platform economy requires "implementing normalized supervision, and a group of" green lights "investment cases. As the policy has gradually taken effect, the worst moment of the economy has passed, and the macro -fundamental fundamentals are slowly improved. In June, the value -added of the industrial added value rose to 3.9%year -on -year, which was improved from 0.7%in May. It also increased from -6.5%in May to 0.8%in June. Therefore, we believe that the current cold cold cold will not change the reversal trend since the end of April, and we must maintain patience and strategic optimism.

In the industry, the growth of high boom is mainly to take into account the necessary consumer goods. Since the end of April this year, we have been optimistic about growing up the high prosperity represented by new energy. In the first half of this year, the demand for photovoltaic installation machines at home and abroad continued to be strong. From January to June, my country ’s new photovoltaic installation machines were+137%in the same period last year. In the first half of the year, the sales of new energy vehicles continued to volume. From January to June, the sales volume of new energy vehicles cumulatively+116%, and the penetration rate of new energy vehicles rose to 24%in June. Driven by the high prosperity, the excess returns of new energy vehicles and photovoltaic sectors have been obvious since the end of April. However, as the market has entered a period of rest of spring cold, it is normal for the field of high prosperity to take advantage of the opportunity to rest and digest. Looking back, if the prosperity of new energy vehicles and photovoltaic has gradually obtained data verification, the industry is expected to usher in performance opportunities again. In terms of new energy vehicles, consumption upgrades or relays to promote automobile consumption for new energy vehicles. The sales volume of new energy vehicles throughout the year is expected to reach more than 6 million vehicles, which will support the industry further. In terms of photovoltaic, if the upstream silicon material capacity is put in the second half of the 22nd year, and the price of silicon material has fallen, the domestic and foreign support policies will bring about the marginal change of the installation volume, and the light voltage boom will also be further entered. For details, please refer to "New Energy, New Energy, What is the prosperity of the car? -20220704.

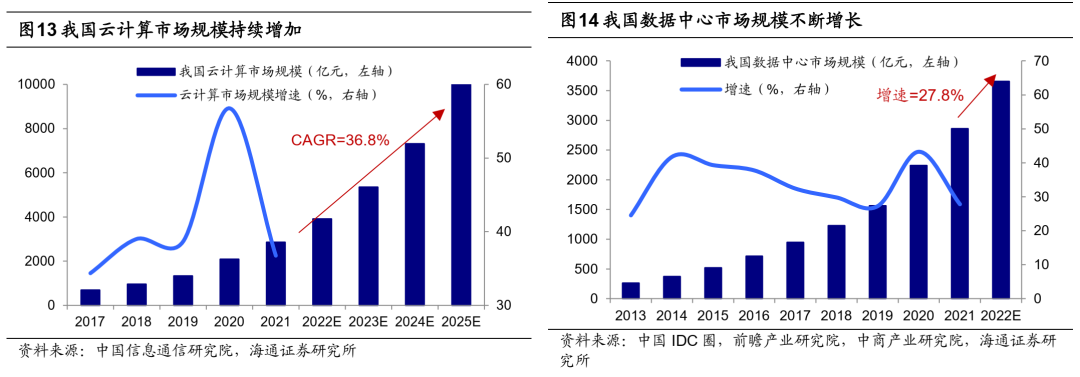

In addition to photovoltaic and new energy vehicles, you can also pay attention to the digital economy -related fields. The current development of the digital economy is a national strategy, and policy support has been increasing. On July 25th, the State Council re -letter agreed to establish a system of joint conferences of the Ministry of Digital Economy Development, study and formulate policies and measures to promote the development of the digital economy, and promote the development of the digital economy. On July 28th, the Central Political Bureau meeting's statement of the platform economy explained the predictability and stability of future policies. The digital economy first pays attention to new digital infrastructure. This is the balance point of short -term stable growth and medium and long -term economic structure adjustment. With the support of policy support, investment in data centers, cloud computing, 5G and other fields are speeding up. We calculate that investment in my country's data center will reach 527.8 billion yuan, and the compound annual growth rate of the cloud computing market will reach 36.8%during 22-25 years.

In addition, consumption must be consumed. In terms of pig farming, as of 07/28, the average wholesale price of pork is 26.9%from the same period in June. The upward price of pigs will promote the rise of pig breeding chains. In terms of pharmaceuticals, post -epidemic demand repair superimposed by long -term industry high barriers. The super proportion of 22Q2 public funds to the pharmaceutical industry has fallen to a new low of 13 years, and the cost -effectiveness of medicine has been prominent.

Risk reminder: The deterioration of domestic epidemic affects the domestic economy; hard landing in the US economy affects the global economy.

Editor -in -chief: Wang Lulu

- END -

Our city fully improves the urban environment welcoming event

Arts Avenue, Youyi Road and other roads strengthening flowers planting, frequent inspections on municipal facilities and municipal facilities, and the increase in mechanized and dust -free operations

The fare is 19 yuan!It only takes 24 minutes!Try to run today

6:23 this morningJingbang Intermodal Corporation Special ColumnThe first bus G6702...