The old man insisted on transferring 400,000 "stocks".

Author:Pole news Time:2022.08.01

Jimu Journalist Leihara

Correspondent Cui Fan

Jimu Journalists learned from the Wuhan Branch of Pudong Development Bank that recently the bank's Binjiang Business District Sub -branch successfully intercepted the telecommunications network fraud case to prevent Mr. Li from transferring 400,000 yuan to the unknown account, avoiding economic losses caused by telecommunications fraud to customers.

Bank staff, police and Mr. Li exchange anti -electrical knowledge knowledge

At 9 am on July 28th, nearly 70 -year -old customers Mr. Li hurriedly rushed to SPD Bank Wuhan Binjiang Business District Sub -branch, asking for a exchange of 400,000 yuan in funds on the card and remitting the money immediately. The old man in the seventies, in a hurry to change the exchange, also asked for remittance immediately, which immediately caused the alertness of the staff of the branch hall. They quickly reported the situation to the supervisor of Luo Manli. Director Luo took the initiative to receive Mr. Li and patiently verify the business background of the business.

Mr. Li said that he recently joined a group chat with stock trading. In the group, "teacher" explained the knowledge of stock speculation. He could conduct overseas investments, had high returns, and public welfare charity activities. Mr. Li specially emphasized that this stock speculation group has one -to -one "customer service commissioner" to dock with him to guide him how to trap his stock. After studying for several issues, Mr. Li felt good. On July 27, under the guidance of the "Customer Service Specialist", he downloaded a stock speculation app and registered. He entered the ID card information, bank card number and password according to prompts.

When Director Luo checked Mr. Li's chat history, he found that the information of the "Customer Service Specialist" sent to Mr. Li was a construction company in other provinces! In addition, from the chat information provided by Mr. Li, the "Customer Service Specialist" also prevented him from going to the bank on the grounds of limited amount of Mr. Li's bank. At this time, the bank's supervisor has basically judged that Mr. Li is encountering telecommunications network fraud and clearly informed that this is a telecommunications fraud with "high returns to get high returns" as a bait.

Although bank staff continued to communicate with Mr. Li, Mr. Li was still convinced of the words "customer service commissioner". Mr. Li said that there is usually a habit of stock trading and buying funds. I feel that the teachers in the stock group are pretty good, and 400,000 funds in Cali are also transferred from the three parties of securities transactions.

In order to stabilize Mr. Li and prevent him from suffering unnecessary funds, Director Luo actively accompanied Mr. Li to check the balance on the self -service machine and asked him to modify the transaction password. At the same time, the bank staff contacted the police in the area to the branch. Under the discouragement and publicity of the police and bank staff, Mr. Li finally realized that he was deceived. After the incident, the staff sent the information on the information reporting of the chat records, software and other information, and assisted Mr. Li to uninstall the app. When leaving, Mr. Li expressed his gratitude to the bank again.

Bank staff and police said that Mr. Li encountered a typical telecommunications network fraud. Fraud gangs often used high -yield and high -return investment as bait, and used investors to quickly get rich to implement crimes. Pudong Development Bank prompts the majority of stores that when encountering information such as "investment experts", "mentor", "inside news", "rich reward", etc., they must maintain a little calm. Maybe these behaviors are fraud. The relevant person in charge of the bank said that the next step will strengthen the propaganda and education of internal employees 'anti -electrical fraud, actively carry out the study and training of risk cases of telecommunications network fraud, improve employees' ability to identify and emergency treatment of fraud cases, and use professional knowledge as customers as customers. Build a "protection network" of funds.

(The picture is provided by the correspondent)

- END -

One shot!The young mother was unconscious, and an emergency cesarean section gave birth to a dying baby boy!Fortunately……

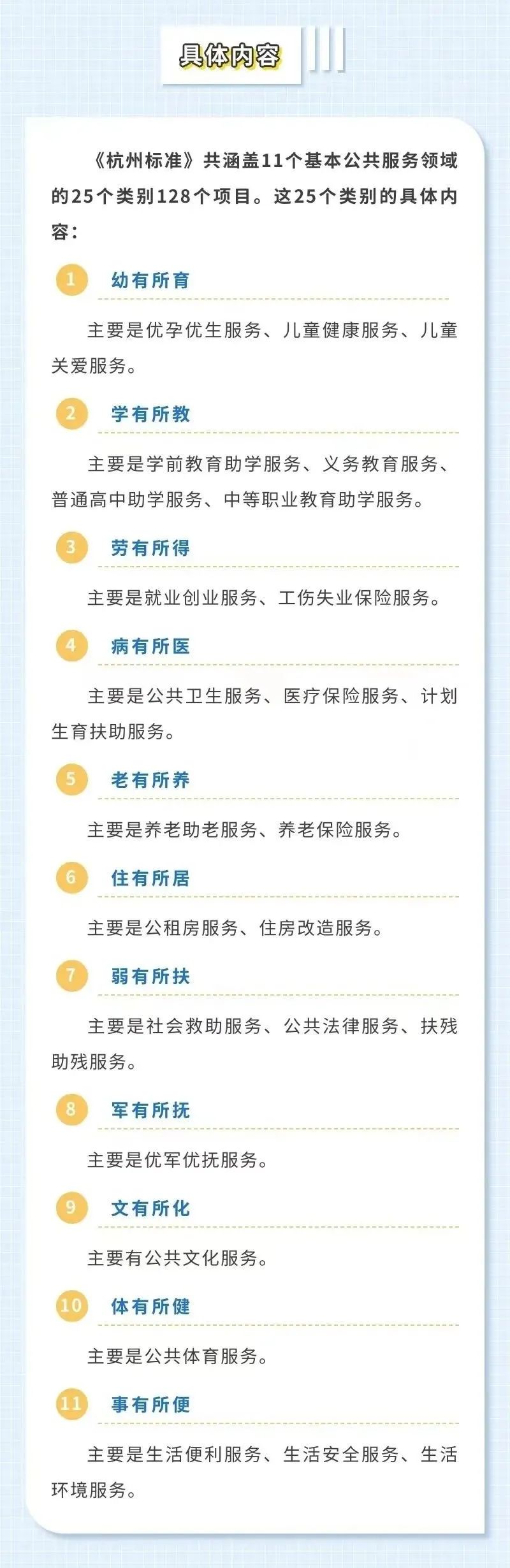

Hangzhou was released for the first time!It's about every citizen

Source: Hangzhou PublishedThe copyright belongs to the original author, if there i...