Yunqiu help 丨 Loan is overdue with bad credit, but does it know that he does not know?Bank: You can submit a credit objection application

Author:Cover news Time:2022.08.01

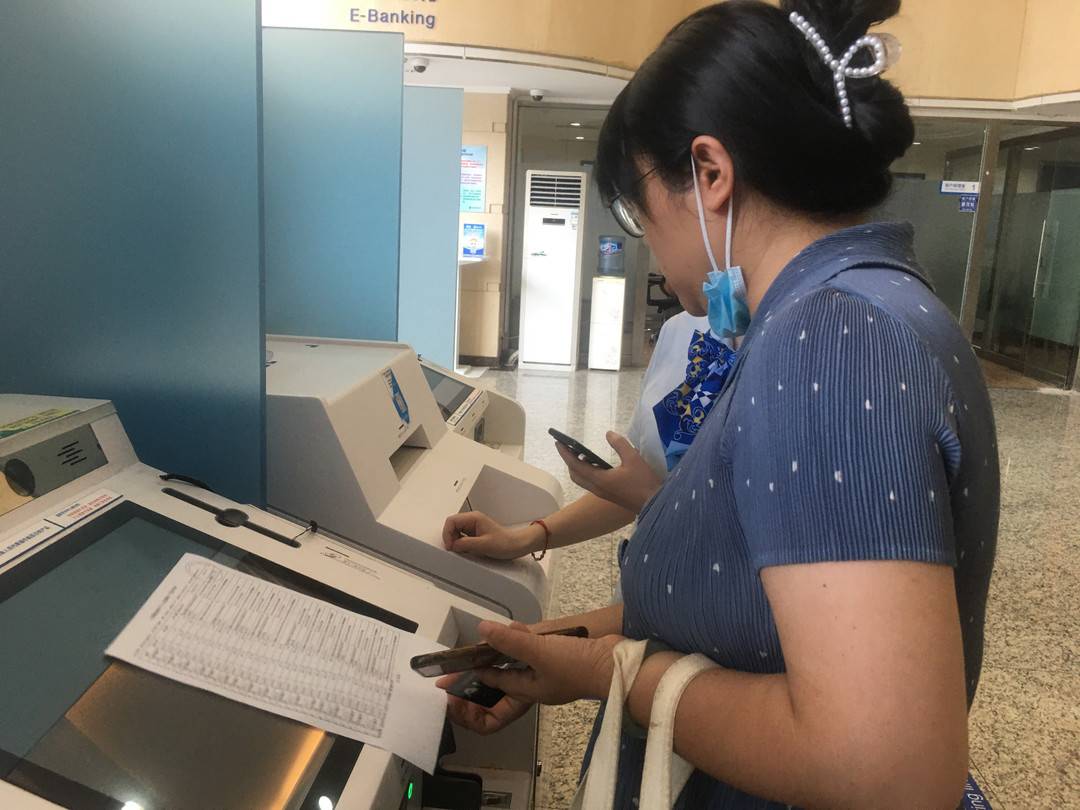

Ms. Li consults in the bank

Cover reporter Zhou Hongpan

Recently, Ms. Li in Mianyang, Sichuan reported through cover news cloud for help. She had repaid housing loans for nearly 20 years in a local bank. During the period, she had not known the repayment of her repayment. Credit cards have also been stopped. Ms. Li said that she was not malicious and non -repayment, and wanted to eliminate bad credit records.

On August 1st, the cover journalist visited the Mianyang City Sub -branch of the People's Bank of China. The person in charge of the credit section of the bank said that when the customer repays or has no repayment, the database of the financial institution will automatically send the information to the credit reporting center. Generally speaking, financial institutions will remind customers to repay the time and amount by SMS or telephone. If the reasons for financial institutions will cause customers to have bad credit records, they can submit an application for credit objection to financial institutions.

Customer: Credit cards cannot be used to find that they have bad credit records

On the morning of July 29, Ms. Li came to the business hall of the Mianyang Branch of China Construction Bank again to ask about her bad credit records.

Two months ago, Ms. Li's credit card was unavailable. I went to the bank to learn that she had a bad credit record and the credit card had been stopped in May. "During the period of stopping the card, I did not receive the bank's text messages and telephones. I didn't know this."

Ms. Li said that in 2002, she applied for a housing loan at the Mianyang Branch of China Construction Bank, and then set up a credit card. After the credit card was suspended, she went to the bank to find out that from February 2021 to June 2022, she did have seven times due to insufficient repayment amount, resulting in overdue repayment.

"I deposit the repayment deposit every month, causing the cause of these overdue time, which is that the bank deduction is still 1,2 yuan." Ms. Li said that she is not malicious and non -repayment. There is no arrears before. She questioned that when she didn't know her, with bad credit, the bank should inform the bank beforehand.

Bank: SMS notifying the bank will be investigated according to the process of overdue non -repayment

On the afternoon of July 29, Manager Wen, a loan center of the Mianyang Branch of China Construction Bank, said that Ms. Li had overdue repayment during the mortgage loan. After the deduction of the bank, the bank would tell the borrower through SMS. He found in the system that the phone number left by Ms. Li was another mobile phone number, and maybe the SMS notification was sent to another number.

The credit report provided by Ms. Li showed that the bank had querying Ms. Li's credit record 4 times, "I have my contact phone number and unit residence in the credit report record, and they should be able to contact me."

Regarding whether to send a text message to Ms. Li, Manager Wen said that they will investigate based on the process and strive to give a reply within a week. Ms. Li can apply for a credit objection to the bank for a credit reporting objection.

At present, Ms. Li has filled out the application for credit objection and submitted a credit objection to the bank.

Answer: Bad credit records do not affect family members can make objection applications

Will customers have a bad credit record, will it affect the family? On August 1st, the cover journalist visited the Mianyang City Sub -branch of the People's Bank of China. Tang Dazhen, the chief of the Credit Section of the Bank, said that the customer's bad credit records will not affect the family, but will only affect their later loans and credit quotas.

According to Tang Dazhen, credit records are the reference basis for banks to judge customer credit, and it is also the main means of bank risk prevention and control. At present, the national financial institutions use the financial credit information database uniformly. The major banks will monitor each amount of money. When the customer delays repayment or has no repayment, the database will automatically send the information to the credit reporting center, and the system will be the system. Make truth from it.

When the customer's credit is good, financial institutions will give a large amount of credit; when the customer has a bad credit record, financial institutions will adjust the credit limit. Customers are mortgaged due to bad credit records, and later loans need to be mortgaged. Generally speaking, financial institutions will remind customers to pay attention to repayment time and amount through text messages or telephones.

Tang Dazhen said that the record of adverse credit reporting may be his own reason or the reason for the bank. If it is a bank, you can submit an application for credit objection to the bank to verify whether it is a data report, or the bank does not notify it in time. If it is your own reason, you can pay off the loan in advance, and the bad credit record will be automatically eliminated after 5 years.

way of participation

1. Enter the cover news. Click the "Yunsuke" suspension window below the homepage to enter the help platform and divert to cloud complaints, Yunqiu, and cloud clues. On the help platform, after filling in the corresponding help content, you can complete the help information upload.

2. Open the "cover news" client, click to enter the blue banana page#Yun Qiu help-cloud complaint#topic online message interaction.

3. You can leave a message through the official Weibo, WeChat or Douyin account of the cover news, and the official Weibo of the green banana video to launch help.

4. You can also call the hotline 028-86969110 for help.

All the help content is deemed to be successfully released after being approved by the editor.

Cover news will answer and follow up in real time, and provide relevant assistance (in order to protect privacy, the relevant information will be confidential, please rest assured).

- END -

[Memory] Wen Huanzhang, Qilden, Kong Jingming, Su Jixian: The messenger of China and Canada Culture

Wen Huanzhang, Kai Erde, Kong Jingming,Su Jixian: The messenger of China and Canad...

Can't board the plane for 3 minutes during nucleic acid expiration?Eastern Airlines latest response

I have a 48 -hour nucleic acid for 3 minutes. The national regulations are that yo...