Is the Shenzhen top luxury home plot rescued?300 billion central enterprise giants shot!

Author:China Fund News Time:2022.08.02

China Fund reporter Nan Shen

The real estate market has risen sharply. The developers of the Shenzhen Dinghao Peninsula city -state with a second -hand house price of 300,000 yuan/square meter are unable to be spared. They are caught in the financial crisis and cannot continue to operate. At the end of May, all members were notified for at least 6 months. But after all, in the Golden Land and the front -line seascape, the Shekou area, after two months, will turn around.

On the evening of August 1st, Last year, China Merchants Shekou, which had a sales scale of 320 billion and both the Peninsula City parent company Nanhai Holdings both announced. The subsidiaries of the two sides signed a strategic cooperation agreement to pass on debt restructuring, equity restructuring, management reorganization, and sales of agencies, etc. Methods to solve the problems faced by the real estate of the Peninsula City State, and promote the smooth progress of the fifth phase of the Shenzhen Peninsula City State State.

It should be pointed out that the agreement between the two parties is a strategic cooperation agreement, which involves the follow -up matters that need to be negotiated and there are uncertain factors.

The fifth phase of the Peninsula City State is expected

The specific cooperation model is determined after being tuned

Recently, Shenzhen China Merchants Real Estate and Shenzhen Peninsula City State Real Estate Development Co., Ltd. (hereinafter referred to as "Peninsula City State Real Estate") signed the "Strategic Cooperation Agreement on Peninsula City State Real Estate"). The wholly -owned subsidiary of Nanhai Holdings of Peninsula City State, the South China Sea Holdings, is the main body of the real estate development business of the Shenzhen regional real estate development of Nanhai Holdings. Its flagship product is the Shenzhen Peninsula City State Project.

The Shenzhen Peninsula City State Project is located in Shekou District, Nanshan District, Shenzhen, the west of Shekou Fishing Port West, and the north side is relied on Shekou Mountain Wanghai Park. The east side and the East Point -headed reclamation area are coming. The overall development of the five phases is currently developed in the first to fourth phase, and only the fifth phase of the land has not yet been developed.

The agreement shows that the two parties are interested in solving the problems faced by the Peninsula City State Real Estate in the Peninsula City State Real Estate through debt restructuring, equity restructuring, management reorganization, and sales of agencies, and promote the smooth progress of the fifth phase of the project. After the agreement was signed, the two parties planned to set up a special project work group to jointly study the five -phase project cooperation model. The specific cooperation model waits for the two parties to fully communicate and complete the relevant due diligence to determine and sign the formal cooperation agreement.

Peninsula City State Company has no continuous operation capabilities

Notify all members at the end of May to wait for at least half a year

According to public information, the Peninsula City State was in 1996. It developed the first phase in 2006. Since then, it has been developed in two, three or four, and the fifth phase has not yet started. From 2006 to 2019, the Peninsula City State was sold 4 times, with a total transaction value of more than 30 billion yuan. It is a rare single-set sales of more than 30 billion yuan in Shenzhen.

Data from a third-party intermediary platform as of August 1 show that the actual listing price of the 1-3 phase of the Peninsula City State Phase 1-3 is generally 100,000 to 120,000 yuan/square meter. Film and renovation of 141 square meters of house, with a total price of 14.37 million yuan, equivalent to 101,500 yuan/square meter; Phase III Phase III 5 rooms, 231 square meters of houses, with a total price of 26.8 million yuan, equivalent to 116,000 yuan for the unit price of 116,000 yuan /Square meter. This is still subject to the guidance price of the government, and it is reported that the real price has exceeded 300,000 yuan/square meter.

Phase 4 of the Peninsula City State has just been delivered, and there is no second -hand house. In fact, when the fourth phase of the project was still promoting the city -state real estate, the real estate of the Peninsula was already in trouble. The owners were worried that they could not pay the house and defended their rights many times. Repeatedly fell into the split storm.

Data from Tianyan Check shows that the current risk involved in Shenzhen Peninsula City State Real Estate Development Co., Ltd. has reached 100 items. Since this year, it has been listed as a compulsory executive by different courts this year. On July 18th and 20th, the company was listed as a limited consumer company by the court.

The company was still punished by the Human Resources Bureau of the Nanshan District of Shenzhen in April and June this year for arrears of salary in April and June this year. Once, 72 employees were arrears of 2.73 million yuan in salary from September 2021 to November, and 63 employees were owed in 2021. From December to 2022, the salary was 2.62 million yuan.

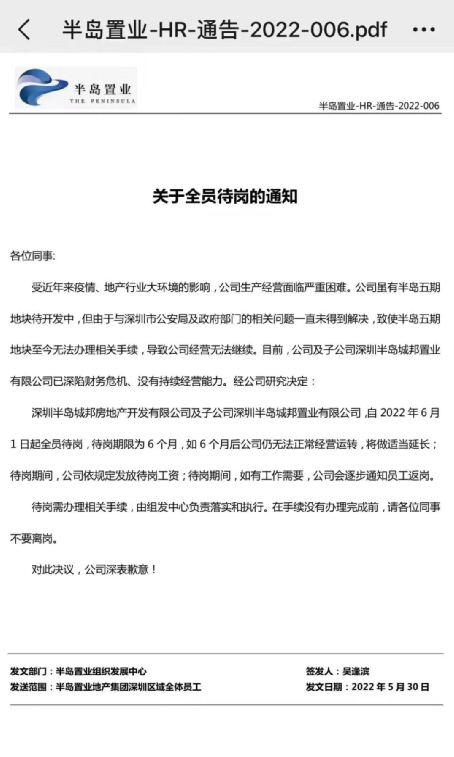

After repeated arrears of wages, the Peninsula City State Real Estate simply issued a notice at the end of May, and all members were waiting for posts.

According to the content of the notice, since June 1, Shenzhen Peninsula City State Real Estate Development Co., Ltd. and subsidiaries Shenzhen Peninsula City Real Estate Co., Ltd. will be in office for 6 months. If the company still cannot operate normally after 6 months Essence The company will only issue salary for posts during the post -post.

Nanhai Holdings, the parent company of the Peninsula City State Real Estate, has been unable to release the 2021 annual report from April 1st, which has not been suspended from April 1, and has not yet resumed trading. According to the "profit warning" issued by the South China Sea Holdings on March 18 this year, it may record a loss of about 3 billion to HK $ 3.4 billion as of the year ended December 31, 2021.

The sales of the top 100 housing companies in July turned to a decline month -on -month

Add uncertainty in market recovery

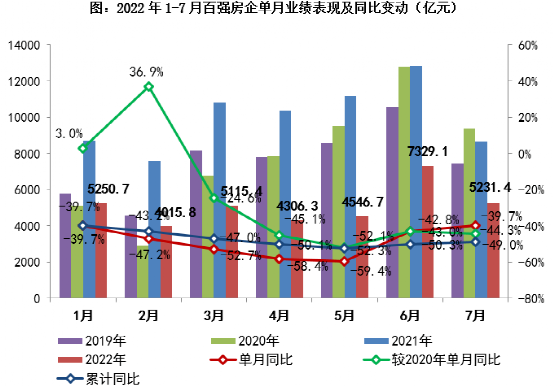

On August 1, the real estate third-party research institution Ke Rui released the sales performance of the top 100 housing companies in July and July from January to July. After two consecutive months of sales rebounded in May and June, sales returned to the decline in July.

In July 2022, TOP100 real estate companies achieved a single monthly sales trading amount of 523.14 billion yuan, slightly higher than the average monthly level in the first half of the year, a decrease of 28.6%month -on -month, and the average level of about 30%of the previous years was basically flat. The decline is slightly narrowed. Kerri said that the overall market demand and purchasing power of the market, and the industry's confidence are also low, and the pressure of enterprises is still large in the short term. In terms of cumulative performance, the year-on-year decline in the total sales trading amount from the top 100 housing companies still maintained at a high level of 49%.

From the perspective of specific real estate companies, in July 2022, nearly 80%of the top 100 real estate companies' monthly performance decreased month -on -month, of which 29 companies decreased between 30%and 50%. %. And nearly 60 % of the top 60 % of the housing companies have less than the average monthly performance in the first half of the year in July.

Yihan Think Tank believes that the suspension of loan in July has brought a certain negative impact on the market, especially the fascination of already fragile confidence again, which has once again damaged the recovery of market confidence, and it is more difficult to recover. In the closed -loop system composed of consumers, housing companies, financial institutions, local governments, and supply chains, if there is no external force to provide strong assistance for confidence recovery, the recovery process of market confidence will be extended again, and the market recovery will add uncertainty.

Edit: Xiao Mo

- END -

[Learn and implement the spirit of the 14th Provincial Party Congress] Guazhou: The "combination of breeding" and played the "enrichment of the people" in the village

In recent years, Guazhou County has adhered to the concept of green development, a...

In June, the output cycle exceeds 20 months.

In 2019, Wang Xu (a pseudonym) bought a house in the second ring of Shijiazhuang for nearly 2 million yuan. Get more. According to data from the National Bureau of Statistics, since October last year