The futures circle event!The first basic law began to implement, the cost of illegal costs increased significantly, and the exterior derivative market ended brutal growth

Author:Huaxia Times Time:2022.08.02

China Times (chinatimes.net.cn) reporter Ye Qing Beijing report

The "Futures and Derivation of the People's Republic of China" (hereinafter referred to as the "Futures and Derivation Methods") was officially implemented on August 1, 2022. As the first basic law of my country's futures market, industry insiders said that the implementation of the "Futures and Derivative Models" has a milestone in the development of the Chinese futures market, which is not only conducive to the ability of futures exchanges to enhance the ability of the real economy, but also The protection of investors' rights and interests.

It is understood that my country's futures law legislation began in 2013 and has been 9 years. On April 20 this year, the "Futures and Derivation Law" voted through the 34th meeting of the 13th National People's Congress Standing Committee. With the implementation stage of "Futures and Derivatives", the off -site derivative market will be further regulated.

"The cost of violations and regulations has increased significantly"

After more than 30 years of development, the Chinese futures market has become an important "stabilizer" for the high -quality development of China's national economy, and has played an important role in serving the real economy and national strategy. According to data from the China Futures Industry Association, in 2021, the cumulative market volume and turnover of the entire market reached a record high, with 7.514 billion hands and 5.8122 trillion yuan, respectively.

As of the end of 2021, there were 94 types of futures in my country. The scale of my country's commodity futures has ranked first in the world for many years, and is the world's largest agricultural product, non -ferrous metal, coke, power coal and black building materials futures market. Although the scale of the entire futures market is large enough, before the implementation of the "Futures and Derivation Laws", China's futures industry mainly relies on the administrative regulations of the "Futures Transaction Management Regulations", which is not matched with the development of the industry and market.

Jingchuan, chief economist in the Great Futures of the Great Futures, told a reporter from the Huaxia Times that the implementation of the "Futures and Derivative Models" began to implement the risk of promoting my country's futures market to further open and comprehensively integrate into the global pricing centers. Management has legal guarantee. On the basis of the law, it can build a number of competitive futures business institutions, which has laid a legal foundation for the futures industry's expansion of business and the industry's transformation and upgrading.

At the same time, the "Futures and Derivation Laws" has certain practical significance to further promote the healthy and standardized development of the futures market.

Futures trading and derivatives are a complex transaction, with many trading participants. Traders are the main body of futures transactions or derivatives trading. They are direct beneficiaries and damagers who fluctuate in futures transactions and derivatives. Futures operating agencies are the main body of intermediary services to traders, and they are also futures transactions and derivatives. Important participants in transactions; futures trading venues are organizers and self -discipline supervisors of futures transactions. Futures settlement institutions and futures service agencies are also the main body of services to provide services for time -oriented transactions.

Ye Lin, a professor at the Law School of Renmin University of China, said that the above -mentioned subjects have formed intricate legal relationships in futures transactions and derivatives. Administrative relationship formed by administrative supervision. Therefore, a set of scientific and reasonable trading rules need to be established in order to meet the requirements of futures transaction complexity.

According to Article 78 and Article 135 of the Futures and Derivation Laws, traders have the right to compensate for damages for futures business agencies engaged in the interests of traders. Once the futures operating agency makes a commitment to traders, sharing the risk of sharing interests with traders, deceptive traders, providing false trading returns to traders, misappropriated traders, etc. If traders cause losses, they shall bear the liability for compensation in accordance with the law.

In this regard, Jingchuan stated that compared with the previous "Regulations on the Management of Futures Transaction", the Futures and Derivation Law have risen to the national legal level to regulate futures and derivatives. It is solved through legal channels. From the perspective of specific penalties, after the implementation of the "Futures and Derivative Laws", the cost of manipulating the futures market and engaging in insider trading will increase significantly compared with previously.

According to Article 125 of the Futures and Derivation Laws, those who manipulate the futures market or derivative market shall be ordered to make corrections, confiscate illegal income, and impose a fine of more than ten times more or less or less; Or if the illegal income is less than one million yuan, a fine of more than one million yuan or less. Article 126 stipulates that those who are engaged in insider trading shall order correction, confiscate illegal income, and impose a fine of more than ten times more or less or less; if there is no illegal income or less than 500,000 yuan, five Fined fines of more than 5 million yuan.

Article 127 stipulates that if we establish, disseminate false information or misleading information, disrupt the futures market and derivative market, confiscate illegal income, and impose a fine of more than ten times more than ten times of illegal obedience; If the illegal income is less than 200,000 yuan, a fine of more than 200,000 yuan or less.

Jingchuan believes that the "Futures and Derivation Law" is the "Regulations on the Management of Futures Transaction" that have been implemented for more than 30 years in the past, and it is shown in the form of law. It is more standardized for the actual operation of futures companies. There are more stringent requirements to a certain extent, but at the same time, it also protects the actual operation of futures companies from law, which is conducive to the healthy development of the futures industry. Orthope derivatives market ends barbaric growth

It is understood that there are 13 chapters and 155 chapters of the Futures and Derivatives, focusing on the basic system of futures transactions, settlement and delivery, the protection system of futures traders, the supervision of futures operation agencies and futures service agencies, futures trading venues and futures settlement institutions The operation, the supervision and management of futures market, and legal responsibility have been provided. At the same time, it takes into account the derivatives market, and uniformly establishes the basic system of the development and supervision of the derivatives market and regulatory.

At the same time, the "Futures and Derivation Laws" mentioned that the state supports the healthy development of the futures market; the state encourages the use of the futures market and other derivatives markets to engage in risk management activities such as hedging. Industry insiders said that such a clear expression has undoubtedly injected a psychedelic agent into the futures industry and the physical industry, which strengthened market confidence.

The "Futures and Derivative Models" conducts more standardized management of off -site derivatives business engaged in the risk management subsidiary of futures companies. For example, the current business includes cooperation packages, basis trade, and right to trade; financing business, such as warehouse shelter pledge financing. In addition, it also includes market business on the field and off -site markets.

In recent years, the scale of China's futures market has shown a rapid development. From the scale of about 600 billion in early 2020 to the current 1.4 trillion, the scale of off -site derivatives has also shown a sharp rise. The real economy was served through the risk subsidiary's long -term quotation, off -site futures and other methods, and to a certain extent, it nurtured the market market.

Zhang Yingying, a precious metal analyst at COFCO Qi Defeng (Beijing), told the reporter of the Huaxia Times that the main body of the current off -site derivatives market is mainly institutional legal persons, including banks, securities, funds and other professional institutions. Enterprise legal person with sexual requirements. Unlike the exchanges of the derivatives such as futures, the transaction structure of off -site derivatives is that the two parties of the transaction are mutually trading opponents. Essence

For example, enterprises can not only specify any price that the current disk does not have within any period of time, but also retain the profit opportunity when the price of the asset is favorable. In addition, in the cycle of a sharp decline in asset prices, the benefits of their own inventory can also be thickened by selling options.

However, in recent years, the size of the off -site market has continued to expand, and the violations of the off -site market have also exploded frequently.

In this regard, Jingchuan said that because the off -market markets started late, most businesses are constantly exploring. In addition, under the regulatory caliber, the futures industry practitioners have not involved off -site transactions for a long time. Therefore At the same time, it is inevitable that some risk events and violations of regulations are also inevitable. The implementation of the Futures and Derivation Law clarify the legal positioning and specifications of off -site transactions, which is obviously favorable for the steady development of off -site derivatives.

Editor -in -chief: Ma Xiao Chao Editor: Xia Shencha

- END -

The Meteorological Orange of the Meteorological Orange of Zhumadian City issued a high -temperature

The Meteorological Observatory of Zhumadian City issued a high -temperature orange warning signal at 9:10 on June 8, 2022: It is expected that the highest temperature in the city and towns and streets

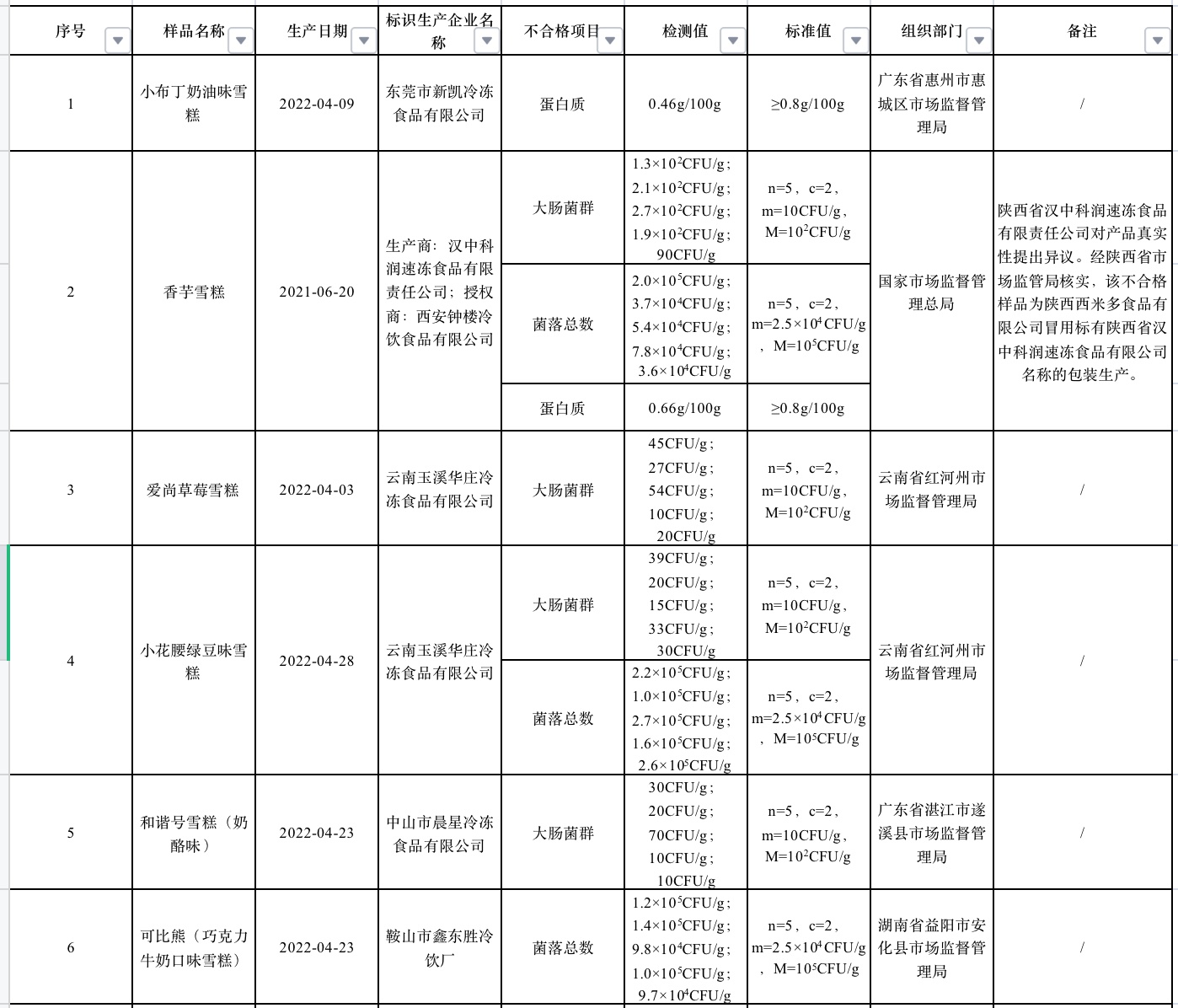

These ice cream are unqualified!Published by the General Administration of Market Supervision

The General Administration of Market Supervision announced today (16th). Since the...