The first July had 24 housing companies bonds defaulted for the first time

Author:Economic Observer Time:2022.08.05

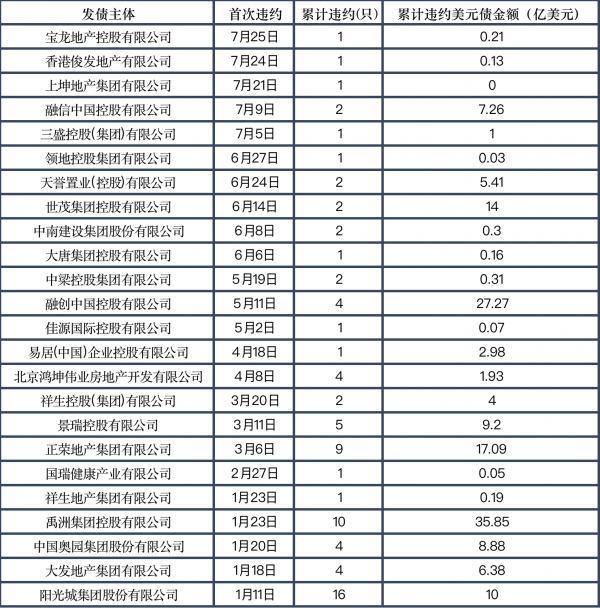

According to the incomplete statistics of reporters from the Economic Observation Network, from January to July 2022, 24 real estate bonds issued credit bonds defaulted for the first time, exceeding the number of defaults in 2021, of which 5 real estate companies broke the contract for the first time in July. The vast majority of housing companies are defaulting to US dollar bonds.

Author: Tian Guobao

Figure: Tuwa Creative

On August 3rd, Zhengrong Real Estate announced that a US dollar notes that had expired on July 7 will not be able to pay $ 13.26 million in principal and interest on August 6; another August The principal and interest of US $ 29.777 million in the 3rd of the 3rd cannot be paid on schedule.

This is the third bond default since Zhengrong's first default in March this year. After most of the domestic bonds and US dollar bonds passed the exhibition period, the remaining part of the bonds is in a substantial breach of contract. Zhengrong's latest two default US dollar bond principal is only 43.37 million US dollars.

According to the incomplete statistics of reporters from the Economic Observation Network, from January to July 2022, 24 real estate bonds issued credit bonds defaulted for the first time, exceeding the number of defaults in 2021, of which 5 real estate companies broke the contract for the first time in July. The vast majority of housing companies are defaulting to US dollar bonds.

In the first quarter, there were 9 breach of contracting enterprises. In the second quarter, a total of 10 real estate bonds issued the first credit bond of credit bonds breached for the first time.

After the Spring Festival in 2022, in order to alleviate the liquidity tension of real estate companies, the regulators advocated that real estate companies to deal with maturity bonds through exhibition and exchange offers. Under the guidance of the regulatory level, most of the domestic credit bonds of real estate companies avoid the exhibition period through the exhibition period. Bob in breach.

In the process of US dollar debt exchange offer, although most investors chose to accept new bills, a small number of investors refused to accept it.

A US dollar debt investor told the Economic Observation Network that most US dollar bonds cannot complete the exchange offer 100 %. After most of the bills have completed the exchange offer, the issuer will generally cancel the original bill. For the remaining bills that have not been exchanged, "generally do not pay or deal with it, it is hung."

From the perspective of the capital market, even if the amount is not large, as long as there is no redemption and the exchange offer is not accepted, it will be considered a breach of contract.

DM data shows that among the five real estate companies in July, the amount of Baolong dollar bonds defaults to only US $ 212.9 million, Junfa is US $ 13.03 million, San Sheng holds US $ 100 million, Rongxin is 27.865 million US dollars. After the US dollar bill exchange is required, the remaining 200,000 US dollars defaults.

From the perspective of monthly data, the number of liquidated housing companies in January and July, and five housing companies have defaults. Except for the simultaneous defaults of domestic domestic debt and overseas bonds, other housing companies are US dollar bond defaults. Of the 24 default real estate issuers, most of the first liquidated damages were at the level of 10 million US dollars.

The above -mentioned U.S. dollar debt investors believe that although the regulatory layer's identification period and exchange offer are not default, in the process of practice, the capital market generally believes that it has substantially defaulted. Under normal circumstances, once the housing company is in the bond period, the rating agency will also make corresponding feedback.

A financial person in a housing company said that the housing company treats investors as equal. For the US dollar bonds that have not completed the exchange contract, even if they have the ability to pay, they will not pay. "First, it is unfair to other investors, and the other is to pay It ’s time, who will support your exhibition period in the future."

In the second quarter, with the support of various favorable policies, the real estate market once showed signs of recovery, but in July due to factors such as the interruption of the incident, the real estate market fell again, and then passed to the capital market. The range continues to expand.

The scope of bonds expanded from the initial explosive housing companies to medium -sized private enterprises, and then spread to large private housing companies such as Country Garden and Xuhui. Since July, the negative emotions of the bond market have further spread to mixed housing companies such as Goldland and Oceania. The US dollar bonds of Vanke and Longhu have also plummeted.

Judging from the frequency of the first default, there are 8 real estate companies in 2018 for the first time. There are 3 in 2019 and 4 in 2020. Most of them are concentrated in domestic debts. A total of 13 real estate companies broke the contract for the first time; and 7 months before 2022, the number rose to 24.

The chip big man comes down on Qixi Festival, why do we choose a love replacement meal CP to give up the skyscraper, the city has another plan

- END -

Trump hinted to participate in the 2024 presidential election and slammed the Bayeng government: we became a beggar country

Former US President Trump gave a speech on Washington on the 26th, criticizing the...

It is also vinegar. Pay attention to the difference between rice vinegar, white vinegar, and vinegar. The difference is very different.

No matter which step people go, they have to find some fun and think about it. Yes...