Who is making money in the new energy vehicle industry chain?

Author:Changjiang Business School Time:2022.08.06

In the hot new energy vehicle industry chain, who has been making money has always been a confusing and one -word topic.

Today, I shared an article. Based on five years as the cycle, the profit situation of enterprises in various aspects of the new energy vehicle industry chain was analyzed from financial data. Try to answer this question and take a look.

Author | Yin Lu

Source | Caijingeleven

At the end of July, the 2022 World Power Battery Conference jointly sponsored by the Sichuan Provincial Government and the Ministry of Industry and Information Technology was held in Yibin, Sichuan. This is the highest specification and largest power battery meeting in China. At the meeting.

The biggest hot spot running throughout the meeting is the most controversial controversy in which links of the new energy vehicle industry chain.

At the opening ceremony, Zeng Qinghong, chairman of GAC Group, said:

"The battery accounts for 60%of my entire vehicle, so am I not working for Ningde Times."

Zeng Yuqun, chairman of Ningde Times, responded:

"The upstream capital speculation makes the price (battery raw material) from the reasonable track."

In the subsequent sub -forums, almost all the participants of the participating representatives have expressed their views on the price fluctuations of the new energy vehicle industry chain in the past two years, and many of them are opposite.

After communicating with a number of industry experts at the meeting site, "Eleven Finance" found that companies in all aspects of the industry chain were saying that they did not make money, and the views of all parties were one -sided.

Therefore, this article will try on the basis of data to explain which link of the new energy vehicle industry chain has the strongest profitability and why?

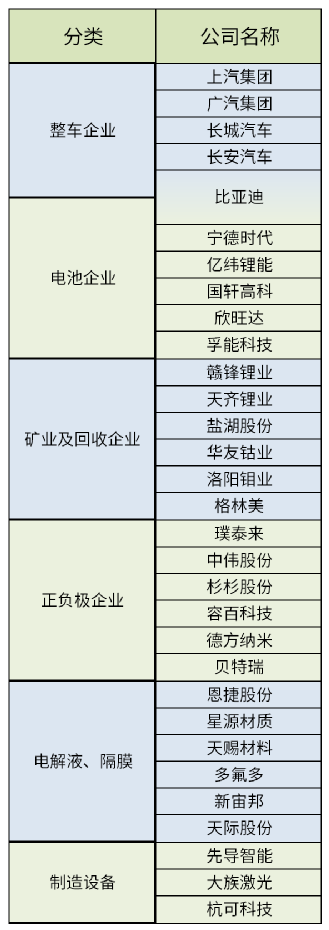

The data sample will be selected in accordance with the following methods:

1. The new energy vehicle industry chain is divided into six links: vehicle manufacturing, power batteries, positive and negative poles, diaphragms and electrolytes, mining mining and recycling, and manufacturing equipment.

2. Selecting no less than 3 in each link. Generally, more than 5 A -share listed companies, select standards for comprehensive reference market value, revenue, and market share. (The list see Wenwei Appendix)

3. The main data samples are based on the revenue, net profit, net profit margin, and gross profit margin of the past 5 years.

01

Vehicle manufacturing

The profit margin level of the vehicle manufacturing industry has declined in the past five years, which is unexpected.

SAIC and GAC gross profit margin, which relies on joint venture brands, has declined significantly since 2019, mainly due to the overall decline of the product's product power in the Chinese market, and the launch of new energy products is slow.

Among the independent brands, the gross profit margin level of the Great Wall and Changan has basically remained stable.

BYD's situation is relatively special. Although the sales and market share of new energy models have been growing rapidly since 2020, the cost reduction effect brought by scale growth is offset by the rise of raw materials. The quarterly profit level does not increase and fall.

Although the price of upstream suppliers such as power batteries such as power batteries has brought tremendous pressure to them, from the perspective of gross profit margin and net interest rate, this impact is not obvious. Revenue and profits are still mainly from fuel vehicles, which are limited due to the change in power battery prices.

However, the impact of rising battery costs on new energy vehicle manufacturers is more obvious. For example, BYD, which has been completely switched to new energy vehicles, and new forces of vehicles.

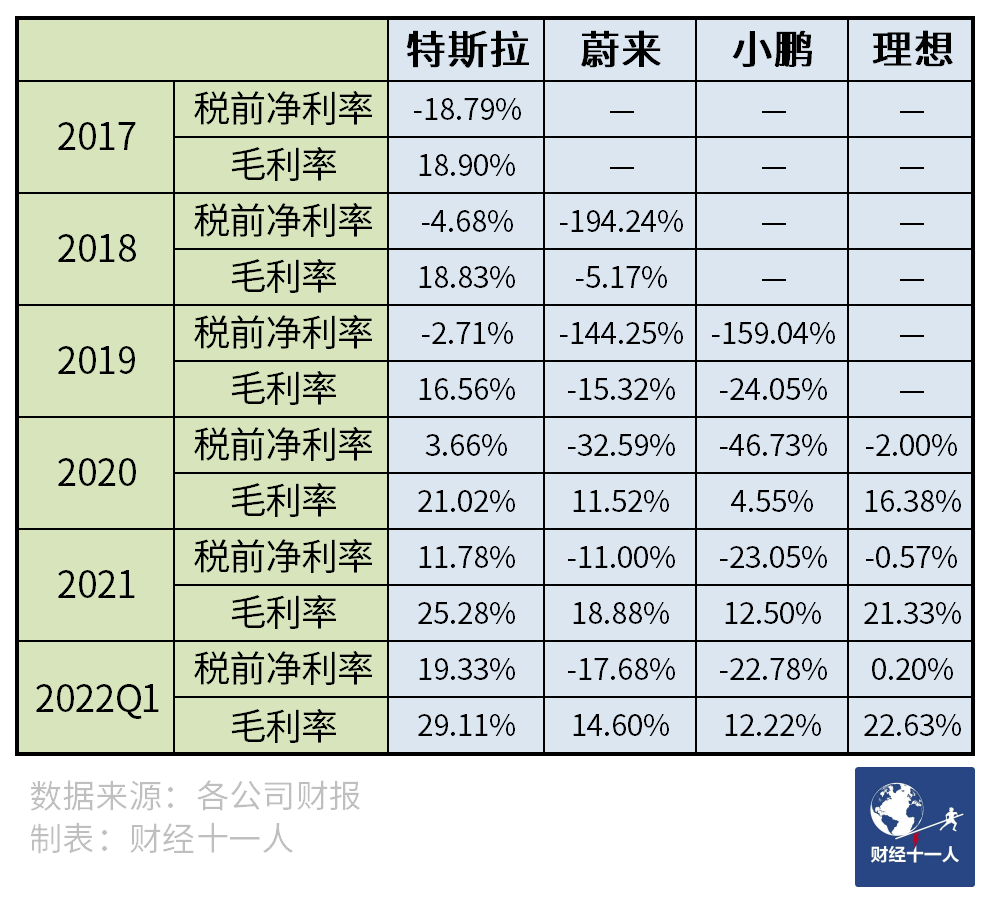

Since the new energy construction forces of new energy vehicles, the new energy vehicle Weilai, Xiaopeng and the ideal profit margin have released their financial reports, the gross profit margin and net interest rate have been significantly improved year by year.

However, in the first quarter of 2022, this improvement stopped, and the profit margin of the three fell significantly, or only barely increased. The management of the three companies mentioned that the price increase of power batteries and multiple key materials on the profit status was huge on the profitability.

Tesla is the only exception, and the profit margin has risen along the way.

From 2017 to 2022, the gross profit margin level was 18.90%, 18.83%, 16.56%, 21.02%, 25.28%, and 29.11%. At the beginning of Model3's large -scale delivery, Tesla's gross profit level began to significantly exceed the peers, and in the first quarter of 2021 and 2022, it was not affected by the soaring price of raw materials, and the gross profit level reached a record high.

There are many reasons, and three are recognized as:

1. The number of components of electric vehicles is small. After the large -scale manufacturing is achieved, the cost reduction effect brings is more significant than that of fuel vehicles.

2. The promotion and application of integrated die -casting technology further reduces the number of parts and improves production efficiency.

3. The optimization of the vehicle beam system reduces the degree of dependence on the artificial dependence of the vehicle manufacturing process. The improvement of automation has brought about improvement of production efficiency. The scale brings a stronger bargaining ability with the upstream suppliers, and the improvement of efficiency effectively offsets the impact of raw material price increases.

Tesla, as a comparison, is sufficient to prove that the decline in profitability has a reasons for raw materials, but it is still in lack of scale and technology.

At present, some of the domestic vehicle manufacturers have realized this and are following Tesla's advanced manufacturing trends, such as integrated die -casting technology.

Tesla had previously used a 6,000 -ton pressure casting machine, while an integrated die -casting machine with 9,000 tons of pressure in China was completed and put into operation.

Adopting new platforms, new technology new energy models are also listed in turns, and strive to achieve a dumping of 100,000 vehicles from annual sales to millions of vehicles. Note: GAC Group's net interest rate higher than the gross profit margin since 2019 is due to its income tax, asset impairment, and the loss of credit impairment.

02

Battery manufacturing

Battery companies have always been considered the strongest part of the new energy vehicle industry chain, but the profit margin does not support this judgment.

From 2017 to 2022, the gross profit margin and net interest rate level of major power battery companies continued to decline. Except for the abnormal fluctuations in the data of Fu Neng, the gross profit margin and net interest rate of all battery companies are highly consistent.

Of course, the decline in gross profit margin and net interest rate does not mean that the profitability of battery companies is not good. The rapid expansion of scale and the decline in profit margins occur simultaneously. Power battery companies are exchanging profits to exchange scale. This is a high -growth market. The conventional practice, at this time, seizing market share is more important than earning high profits.

Power batteries have undergone greater pressure on raw materials in this round of raw materials. The customer is a strong car company. The supplier is in short supply because of the serious supply. The battery manufacturer's bargaining ability is extremely limited. The battery factories with both ends can only accept the reality of continuous decline in profitability.

Among them, the gross profit margin of the industry's leading Ningde era decreased from 36.29%in 2017 to 14.48%in the first quarter of 2022, and net interest rates fell from 20.97%in 2017 to 4.06%in the first quarter of 2022.

03

Positive and negative

Positive and negative poles are an important upstream industry for power batteries.

The industry's benefits in the boom of the power battery market are quite abundant, but this benefit is based on the previous low starting point.

The magnitude of the first quarter of 2022 will be found in the first quarter of 2022.

In 5 years, with the lowest point in 2020, the profit margin of positive and negative polar enterprises presents a V -shaped curve.

The profit margin to the level of 2017 does not mean that these five years of positive and negative companies are in place, and their scale has long been incompetent as that year. After this round of market weakness from 2018-2020, all the high-quality companies in the industry can persist.

Today, many Chinese companies have global influence, especially the negative electrode production capacity. China occupies 90%of the world's market share. Several leading companies have monopolized the global market.

04

Diaphragm, electrolyte

The diaphragm and electrolyte are a link that is more easily ignored in the upstream industrial chain of the power battery. If it is not because of the second half of 2020, lithium hexovantic lithium phosphate is the first to open the price of lithium battery raw materials. Most of the people have never heard of this industry.

This is the same. Due to the small volume, the proportion of the entire industrial market of power batteries is small, and the diaphragm is usually easily overlooked.

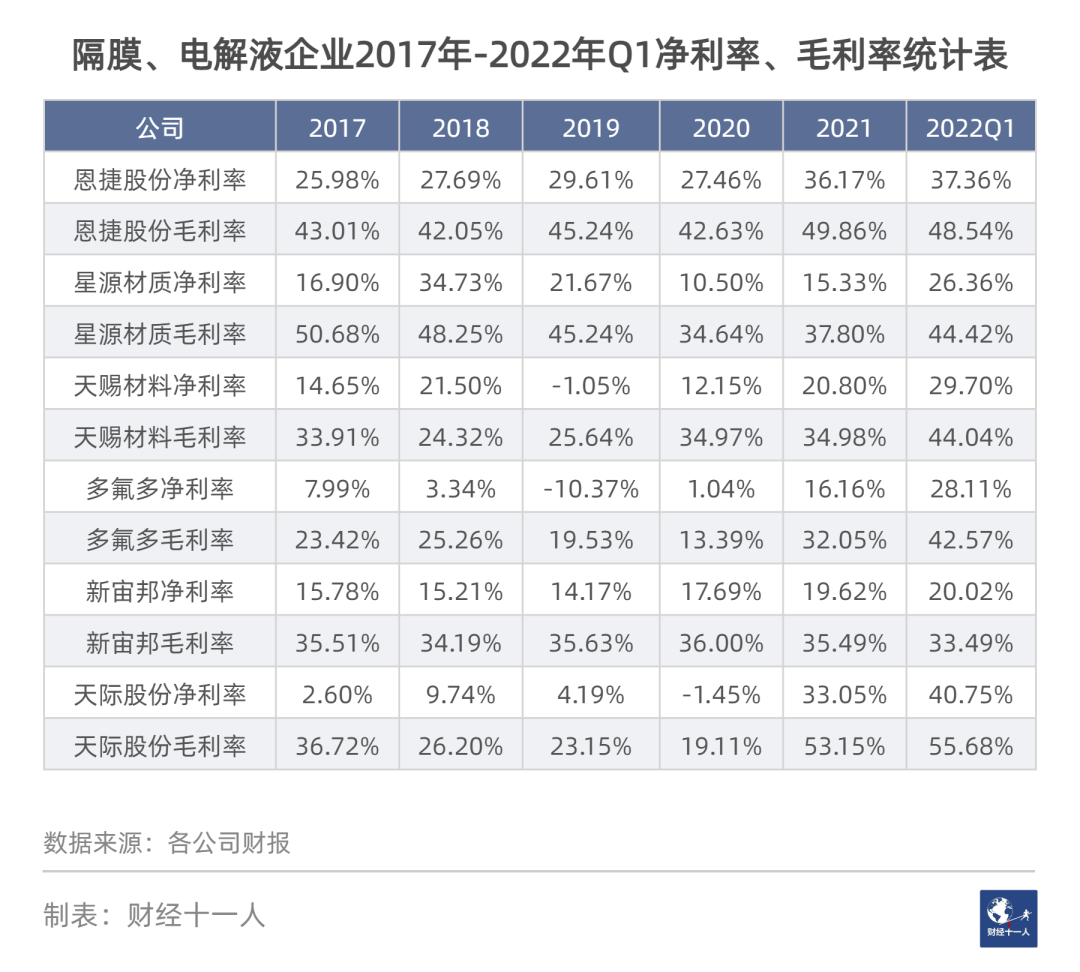

However, profit margin data shows that the diaphragm and electrolyte are typical of making a lot of money, especially the diaphragm.

As two leading companies in the diaphragm, Enjie shares are the hegemon of wet diaphragm, accounting for more than 45%of the market share. The leader of the dry method is also a nearly half of the country.

The profit margins of the two companies are very eye-catching, the gross profit margin exceeds 40%, the net interest rate is 20%-30%, and it is very stable.

The electrolyte is the starting point of this round of raw materials. At present, it is also one of the biggest beneficiaries of high prices.

The profit margins of companies such as God, polyfluoro, sky, and New Zebang have risen rapidly since 2020.

However, similar to positive and negative companies, electrolyte companies have also been severely damaged in the market that began in 2018. In the past two years, prices have skyrocketed, and profit increases are restoring their vitality for most electrolyte companies.

05

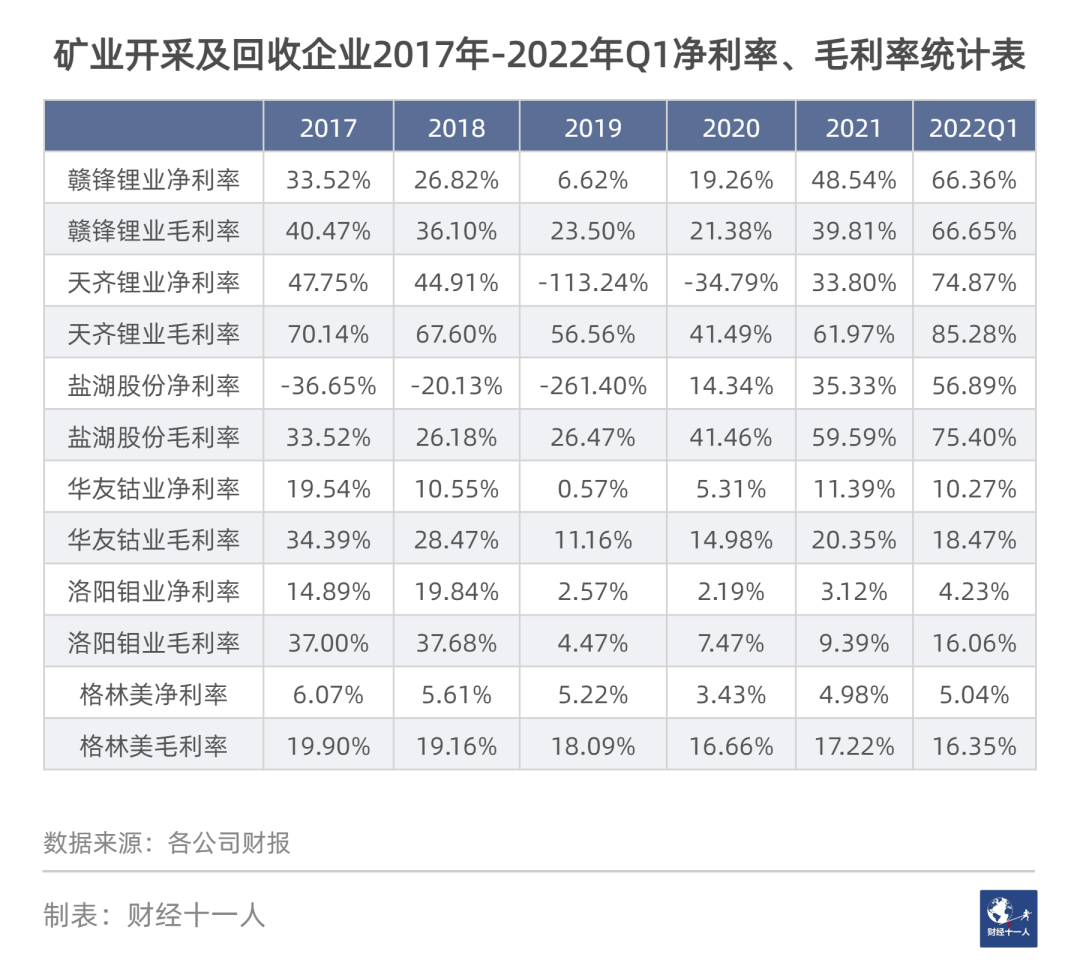

Mining mining and recycling

Mining mining companies are the most noticeable stars in the power battery industry chain in the past two years. The price of lithium carbonate has skyrocketed tenfold. The net profit of related listed companies has increased by dozens or even hundreds of times year -on -year. One link is controversial.

From the perspective of profit performance, lithium mine companies do have a huge harvest, and the gross profit margin of Tianqi Lithium industry in the first quarter of 2022 exceeds 85%.

The staff of the Ganfeng Lithium said teased: "After seeing Tian Qi's financial report, I felt that some brothers could share artillery in the future."

For the recent increasing controversy of lithium carbonate prices, some people who say that capital speculation is raised in prices, and there is hope that the state department will guide the price to return to rationality. In short, they hope to have strong external forces to limit the high prices of lithium carbonate.

The sound of opposition to this industry is not small. The most representative point of view is that the price of lithium carbonate is completely caused by the mismatch of supply and demand. It does not find ways to expand supply, and counting price control will only be counterproductive.

First of all, to answer a question. At present, does the price of nearly 500,000 lithium carbonate have capital speculation?

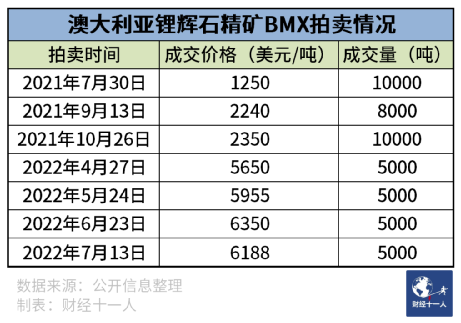

At present, the global lithium carbonate spot market mainly depends on several major mines in Australia. Since July 2021, after Australia began to determine the price in the form of auction, lithium carbonate opened the take -off mode.

In fact, the number of BMX auctions (that is, the Australian lithium mine auction electronic platform) is not large, but the biggest effect of the auction is to anchor the price of the long -term association. It is based on the BMX auction price. The transaction price is determined. If the two auction prices in June and July 2022 and July, the price of Sanpi Essence Essence in Western Australia arrived in China to the shore. More than 400,000 yuan, which is almost the same as that of the current domestic lithium carbonate, and the space of capital speculation increases lithium carbonate market prices almost no existence. How can the price of lithium carbonate return to reason? In the article "Lithium Resources is becoming a white oil" published in "Eleven of Finance":

"The price of lithium carbonate should be expected to lithium lithium salt lake. Salt lake is the main form of lithium resources, but the natural resources of different salt lakes are completely different, and the lithium lifting technology is completely different. This directly causes the production capacity of lithium lithium to increase lithium -lifting, and the speed of production is slow.

Fortunately, the continuous high price of lithium carbonate has promoted the acceleration of lithium -lifting construction in salt lakes in South America and China. According to the feedback from several lithium mine companies, it is expected that at the beginning of next year, Salt Lake lithium in South America is expected to enter the right track. "

The high profits of lithium ore enterprises are actually full of high -risk. In the chart of profit margins, the two deep grooves of the net interest rate of Salt Lake and Tianqi Lithium Industry are shocked.

Mineral mining has always been characterized by this. The mine is running smoothly and the profits are very rich, but each mine is a large project with large amounts, high risks, and long return cycles. Essence

Salt Lake and Tianqi were struggling on the edge of life and death. Although they eventually survived, a large number of lithium mine companies fell before dawn.

Except for lithium minerals, the profit status of other battery -related mineral raw materials has not changed significantly.

Nickel and cobalt were once considered to be metal elements that are prone to shortage of power batteries, but now, because they are prepared in advance, although these metal elements are not optimistic, they have not caused serious mismatches of supply and demand like lithium carbonate. As a result, price increase.

06

Equipment manufacturing

The equipment manufacturing of power batteries is a small and beautiful track, with high technical content, high industry thresholds, and difficult to enter competitors. Therefore, the advantages of leading companies are relatively stable.

From the perspective of profit performance, the profit of equipment manufacturing companies is generally higher, especially gross profit margin, with an average value of nearly 40%.

The difference between net interest rate and gross profit margin is very different, mainly because manufacturing equipment is accelerating the one -million -dollar defect rate (PPM) to one billionth defect rate (PPB), and the R & D investment of equipment manufacturing companies is huge.

07

Who is the most profitable

Now answer which link is the most profitable question.

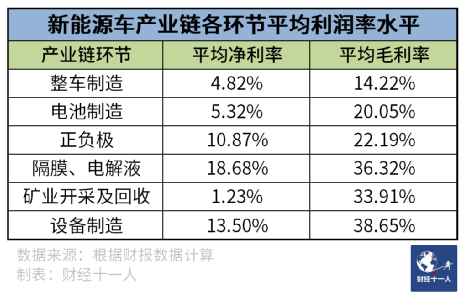

The total net profit of the sample companies in each industrial chain link from 2017 to 2022 will be added, and then except for total revenue, the average net interest rate of 5 years in this industry chain will be calculated. The average gross profit margin of all sample companies in the industrial chain link, the final result is as follows:

In terms of gross profit margin, the equipment manufacturing ranking is the highest, the diaphragm and electrolyte are slightly behind, and the mining mining exceeds 30%. These three links are high -gross profit levels.

Among them, equipment manufacturing benefits from high -tech thresholds and companies with technology. The product premium is naturally high.

High gross profit of mining enterprises is expected, and with the increase of lithium lithium production capacity, the average gross profit level of lithium mining companies is expected to continue to increase.

However, compared with more than 30%of the gross profit margin, the average net interest rate of mining and recycling enterprises is only 1.23%, which is the lowest in the links of various industries.

The huge losses of Tianqi Lithium and Salt Lake shares in 2019 are the main reasons, and this huge loss reflects the characteristics of high risk of mining development companies.

The diaphragm and electrolyte are the biggest discovery after this statistics. The average gross profit margin ranks second, and the average net interest rate ranks first.

Most people think that batteries or mining are most profitable, but the data tells us that the diaphragm and electrolyte are the most profitable.

The high profits of diaphragm and electrolytes are unexpected and reasonable. The septum market is highly concentrated, and Enjie and Xingyuan are unshakable overlords in their respective fields. They have strong bargaining ability and naturally not bad profits.

The electrolyte is the chemical industry, and the scale is the only way to reduce the cost and efficiency of this type of industry. The vigorous demand of the global market has prompted Chinese electrolyte companies to expand production capacity since the second half of 2021. Electric -liquid companies that master cost advantages will continue to expand their profit space.

As for the most fierce vehicle manufacturing and batteries at the World Power Battery Conference in 2022, the average gross profit margin is one of the first, one penultimate, and the average net interest rate is second and third. The ability to earn money belongs to the last part of the new energy vehicle industry chain.

This article takes five years as the cycle and observes the new energy vehicle industry chain with profit margins as its core indicator, in order to have a clearer understanding of different characteristics of the entire industry chain.

For example, the gross profit margin of mining is very high, otherwise it will not be able to cope with the huge risk of mining investment.

For example, positive and negative electrodes and mining are very sensitive to the fluctuations of resource prices, but the diaphragm and electrolyte are relatively stable.

Of course, companies that evaluate the new energy vehicle industrial chains only are not comprehensive enough.

Although the profit margin level of vehicle companies and battery companies is not high, but because of the large volume and strong capital strength, it is still a chain owner of the new energy vehicle industry chain.And whether it is car companies or battery companies, they are waving their check -in -shares and acquiring excellent upstream companies to further consolidate their status of their chain owners.

Appendix: List of New Energy Vehicle Industry Chain Sample Sample

The picture reprint in the article needs to be authorized.

- END -

alert!These "elderly illnesses" are concerned about young people!

The 14 -year -old Tongtong is still in junior high school in Chengdu, but recently...

Express | Wang Junlan was elected Chairman of the 12th Executive Committee of the Women's Federation of Ningxia Hui Autonomous Region

On July 23, the reporter learned from the Twelfth Congress of the Women's Women's Women's Congress that the first plenary election of the 12th Executive Committee of the Women's Federation of the Auto...