Power battery plus manganese, the next wealthy industry 丨 Xinfeng direction Lite

Author:36 氪 Time:2022.08.07

When the 25th element is on the historical stage.

Text | Zhou Youhui elegant

Edit | Peng Xiaoqiu

Source | 36 氪 South China (ID: South_36kr)

Cover Source | Interview Photo Confer

This is an era of power battery grabbing money.

As soon as the lithium battery wealth movement moved, a large wave of upstream companies had risen. For example, the second German nano -nano -folding nano -rising nano -tinnum is 7 times, and the first Rongbai Technology of the ternary material has risen by 4 times.

So every technical change deserves attention. Compared to the mainstream iron phosphate, lithium manganese phosphate iron phosphate has been ready to go.

After studying and interviewing the market variables in various parties, it was found that the critical point of the commercialization of manganese -lithium -lithium -lithium has indeed arrived.

Each position of the industrial chain is trying to seize business opportunities. For the innovative point of power batteries, but also shows the upward track, it is not necessary to miss the passion of competition and the passion brought by new materials:

In mid -July, Xinwangda, Yiwei Lithium, and Ningde Times have sent manganese -based iron battery samples to car companies to test;

Upstream material companies try to try new possibilities. For example, the three -yuan material leading technology and Rongbai Technology also launched manganese -phosphate iron batteries, which means that one foot has entered this market;

In Ningde Times announced its self-developed battery M3P (manganese phosphate iron-lithium-ternary blending battery) as soon as this year's mass production. At the same time, according to the latest external news, this battery will be used in the Tesla Model Y model this year. , Material suppliers are German nano;

BYD was reported to be tested for the Byfang sample B.

Power battery delivery B means that the battery research and development have reached the second stage, that is, the battery research and development verification has been completed, and the product is assembled into the module or battery pack.

In other words, it takes about 1 to 2 years to loading the car test at the moment and the final large -scale mass production.

This will undoubtedly see a stimulus point for practitioners who find possible innovation on power batteries.

Because around the power battery, the possibility of innovation can be divided into three types: material innovation, structural innovation, and fast charge technology. This is a marathon business that can be replaced and requires long -term investment. Therefore, lithium battery "manganese", a new round of competition Already kicked off.

Manganese, the atomic order on the element cycle table is 25, which is ranked in the front of the iron element. In nature, there is only ore formed by and iron.

In the past, the biggest use of manganese was the material of stainless steel to prevent rust or corrosion. More than 95%of manganese was used in the steel metallurgical industry. But just like phosphorus that was originally used only as agricultural fertilizers, because of the rapid progress of the power battery industry, manganese also showed the possibility of large -scale cross -border applications in lithium batteries.

This wave is the participants of the industrial chain, up to the manganese -smelting chemical factory, and down to the positive pole material manufacturers. The wealth -making campaign seems to be staged again. 36 氪 After interviewing a number of related companies and investment institutions, try to answer the following questions:

1. Why can manganese elements be the protagonist of power battery materials today? Why break through the critical point of commercialization at this moment?

2. Under the changes in elements, who are the participants in this material change? Where is the company more advantageous?

3. How much does manganese affect the upstream industry? Will it become the fourth battery metal after lithium, nickel, and cobalt in the future?

Why is the era of manganese come now?

Manganese -phosphate iron lithium, as the name suggests, is a mangible manganese element mixed in lithium iron phosphate. It is currently a technical upgrade route with a clear consensus in the industry.

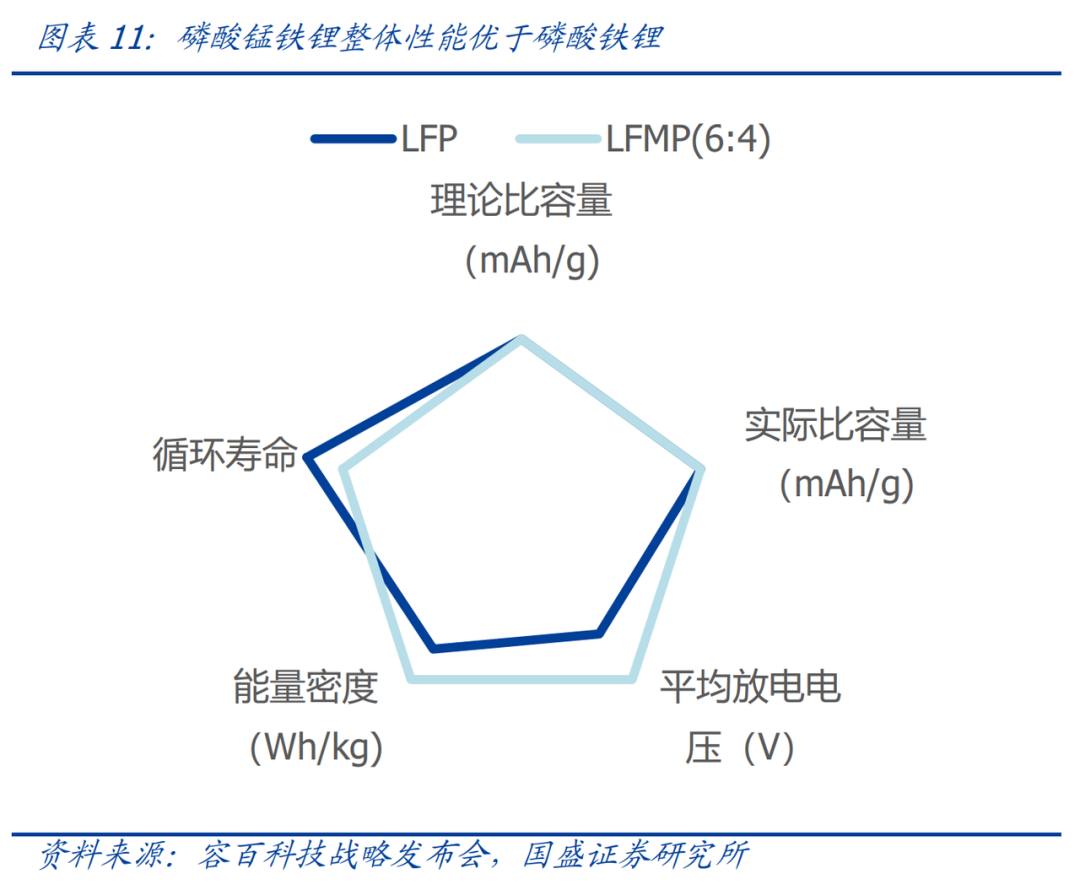

After mixed mangible manganese, the voltage platform (4.1V) of lithium manganese phosphate iron phosphate is higher. Compared with the lithium iron phosphate (3.4V), it can increase the energy density by 15%-20%. The energy density determines the endurance of the power battery. According to the calculation of BOC Securities, the cost of raw materials for lithium manganese -phosphate iron is about 28%lower than the lithium iron phosphate (manganese iron ratio 7: 3).

How to further understand the cost advantage of manganese -phosphate iron lithium?

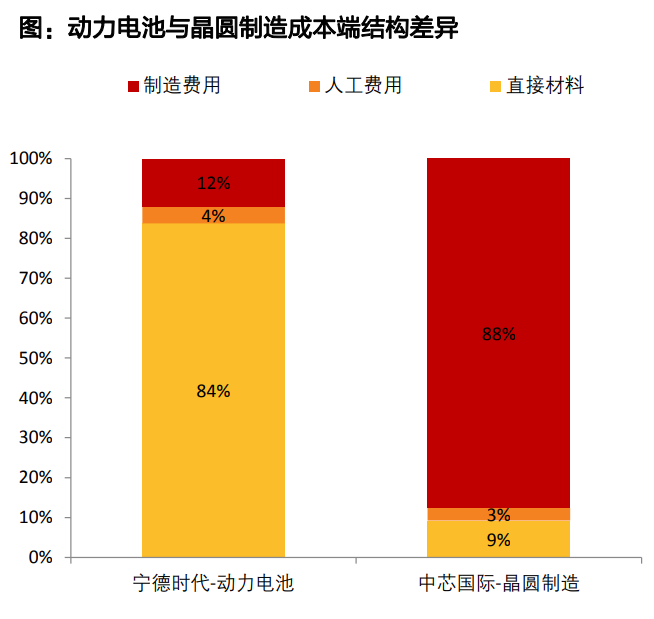

Compared with the wafer manufacturing of the same industry position, more than 80%of the cost structures of the Ningde era are direct material costs, and the space for labor and manufacturing costs is extremely small, while SMIC's direct material costs are only 9%.

Different structure of power battery and wafer manufacturing cost end Structure Source: Tianfeng Securities

In the power battery, the cost of positive materials accounted for more than 40%, so even if the energy density of 15-20%increased, the comprehensive cost that the lithium of manganese phosphate iron phosphate iron phosphate iron phosphate iron phosphate iron phosphate iron phosphate iron phosphate iron phosphate was also increased. Quite considerable. The lithium iron phosphate battery developed for several years will also reach the upper limit of the energy density of theory.

Horizontal contrasting solid -state batteries, sodium ions and hydrogen energy, such as cutting -edge technologies such as disruptive changes in the battery industry. Manganese phosphate iron lithium as an upgraded route for lithium iron phosphate does not seem to be sexy, but it is faster in commercialization in the short term. Can see market prospects.

Because the power battery industry still belongs to the traditional electrochemical industry, the speed of innovation is relatively slow, and the product needs to be verified back and forth between the upstream and downstream. It is impossible to appear in the past sixty years, based on Moore's law.

In fact, lithium manganese phosphate iron is not a new technical system. As early as 2013, BYD revealed the technology to the outside world, claiming that the energy density of 90Wh/kg of lithium iron phosphate batteries on the market could be increased to 150Wh/kg, reaching the level of mainstream ternary materials.

An earlier layout was the American chemical giant Dao Chemistry. In 2008, Tao's acquisition of a Swiss company HPL obtained the basic patent of manganese iron phosphate iron. Later, 40 tons of manganese -phosphate iron was sold to AVIC Lithium (formerly the predecessor of China Innovation Airlines). At the same time, it was sampled to Chinese and Japanese battery factories or car companies, such as BYD, Toyota, Panasonic, and Hitachi. However, the domestic policy environment did not open the commercial window of this technology. Because the mature lithium iron phosphate system was sufficient and necessary conditions for lithium manganese iron phosphate iron, and the overall liquid battery technology at that time had not yet matured.

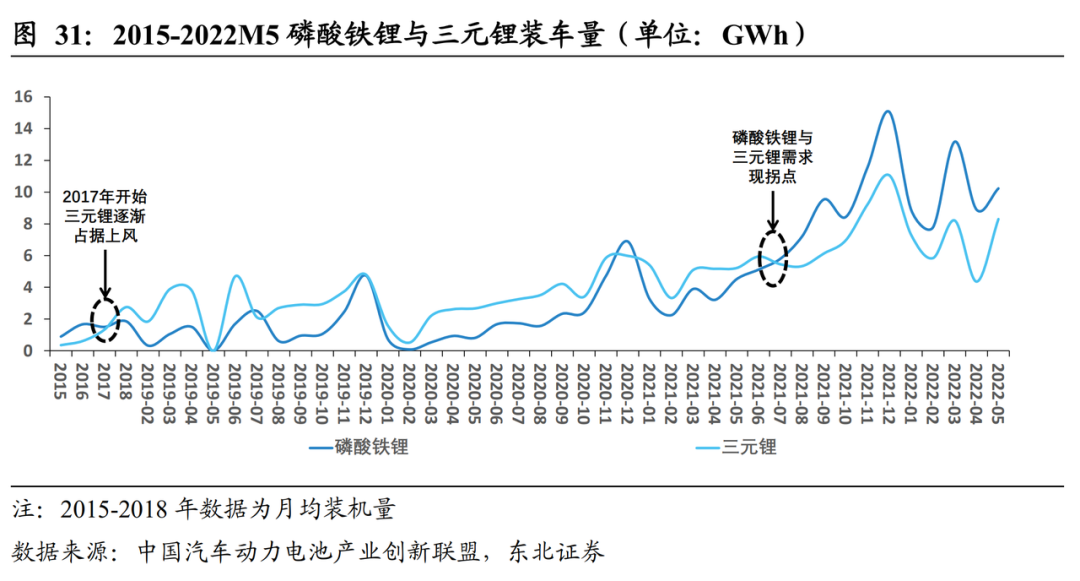

Prior to this, whether the lithium iron phosphate was bought by the market and was strongly related to subsidies. In 2014, the new energy subsidy policy tended to high -energy density batteries, and the loading volume of ternary materials with performance advantages gradually crushed the lithium iron phosphate.

At that time, due to the changes in subsidies, the amount of lithium iron phosphate fell, which caused a cliff -like decline, which caused the technical solutions of manganese -phosphate iron lithium to be sealed. Tao's chemistry, BYD and other companies in 2015 and 2016 successively exited or terminated research and development.

This technical path selection did not appear at an inflection point until 2020. BYD solved the problem of low energy density of lithium iron phosphate through the structural innovation of blade batteries and re -pushed it to the market.

The blade battery increases the single energy density to 160Wh/KG ~ 180Wh/Kg, and the cycle life exceeds 4500 times, and the life span is more than three times that of ordinary ternary batteries.

More importantly, the demand for the comprehensive performance of battery materials (such as security, fast charging technology, and product costs) in the downstream market exceeds the single pursuit of mileage. Therefore, with the climbing capacity of the blade battery and the follow -up of a number of power battery manufacturers, the installed capacity of lithium iron phosphate has risen rapidly.

In the first half of 2022, the lithium iron phosphate officially exceeded the three yuan, which made manganese -phosphate iron lithium technology re -favored and attracted major manufacturers to follow up the layout.

This is a large -scale market feedback applied by upstream technology innovation research and development. After market verification, the standard answer to the technical path can be seen.

2015-2022M5 lithium iron phosphate and ternary lithium installation vehicle volume

In addition, another core factors approaching the critical point of commercialization are the structural changes in the new energy vehicle market.

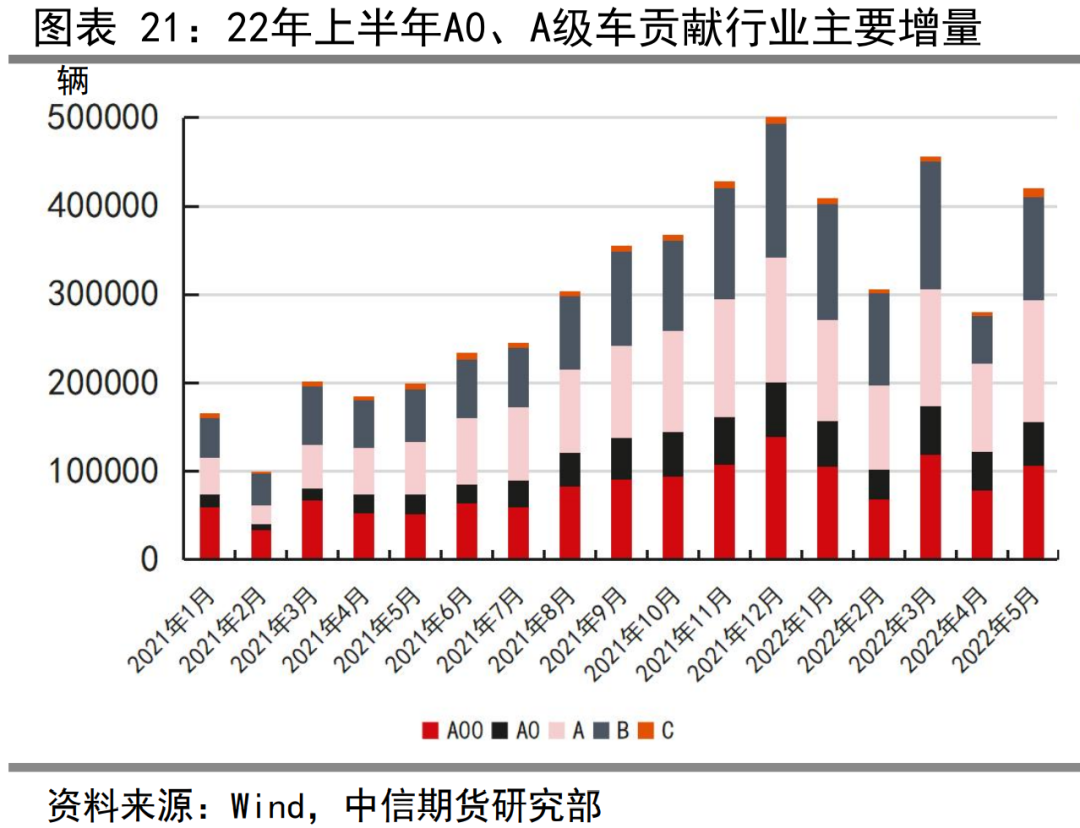

For example, the M3P battery launched in the Ningde era is suitable for A -class and B -class cars, with a range of more than 700km. Class A is the main market segment of domestic passenger cars, accounting for 55%-60%, but only 5.7%of pure tram in 2021.

Further analysis, the important reason why lithium iron phosphate is more than three yuan is the promotion of A00 models. In 2021, the A00 car market was basically occupied by new energy vehicles, and the electrification rate reached 95%+, while the other levels were 8%-20%, forming a great contrast. The ultra -low -cost Wuling Hongguang MINI EV contributed 426,000 units in 2021, with sales of only Tesla.

January 2021-May 2022 New Energy Vehicle Sales

It is foreseeable that as the first choice of family purchase, A-class and B-class cars (about 100,000 to 200,000 yuan) will become the main model of the penetration rate of new energy vehicles to continue to rise.

As shown in the figure above, from January to May 2022, A-class car sales were 580,000 units, an increase of 157%year-on-year; B-class car sales were 55 million units, an increase of 112%year-on-year, and the growth rate exceeded A00 cars. Therefore, the installed capacity of lithium manganese phosphate iron may greatly benefit from this trend change.

The giant has got the ticket

As a technology that is re -pushed to the stage, there are few startups related to lithium manganese iron phosphate iron.

The reason is that the entry voucher is difficult to grab. At present, the deepest layout of manganese phosphate iron is still the giant company, and its core advantage lies in the barriers to manufacturing. Because the preparation method of lithium iron phosphate and manganese -phosphate iron is similar, the technical upgrade route is relatively smooth, and players with funds and customer resources have pulled the production capacity scale to 10,000 tons.

In other words, lithium iron phosphate faucet has the first -mover advantage of competition.

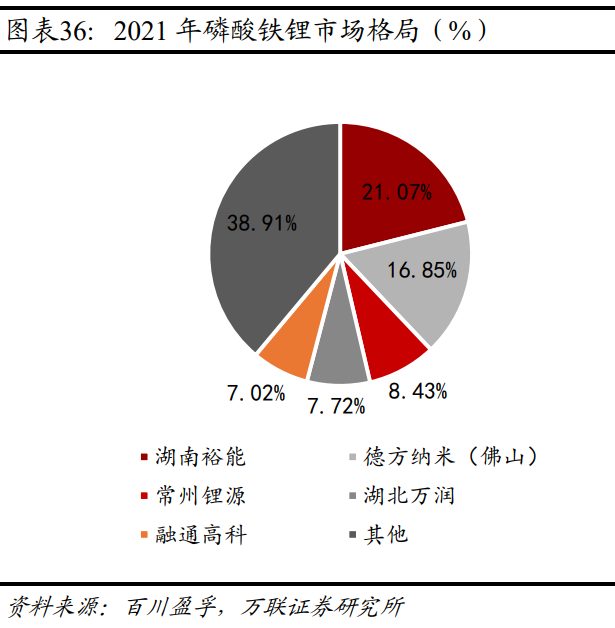

According to the market share of lithium iron phosphate materials, the largest customers of positive material companies such as Hunan Yuneng, German Nanomi, Changzhou Lithium Source, Jiangxi Sublimation, and Rongtong Hi -Tech Company are Ningde Times.

2021 lithium iron phosphate market pattern

In 2021, the installed capacity of the Ningde Times and the lithium iron phosphate power battery was 42.9GWh and 25.2GWh, respectively. The two ate the majority of the lithium iron phosphate market. The layout speed of the Ningde era is also the most leading.

Taking the M3P battery announced by Ningde Times as an example, M3P is a mangible manganese-iron lithium-triple plan that is doped by 30%-70%. According to the research and research of Zhongtai, the mass -produced batteries are expected to be a mixing scheme of 30%and medium nickel three yuan.

The important supplier behind the Ningde era is Germany nano and Jiangsu Litai Lithium (16%of the equity of Ningde Times), both of which are companies in the industry with lithium iron phosphate iron phosphate iron manufacturing patents and mature production lines. According to the company's announcement, the production capacity of manganese -phosphate iron phosphate iron phosphate has reached 440,000 tons, with a total investment of about 10 billion yuan.

So, what is the specific technical difficulty of mass production of products?

Litai Lithium had an internal technical exchanges in September last year. The interviewed executives mentioned that lithium iron phosphate is semiconductor, adding some carbon, but manganese iron lithium is an insulator. The processing technology route is difficult. The technical routes in the industry have not been unified.

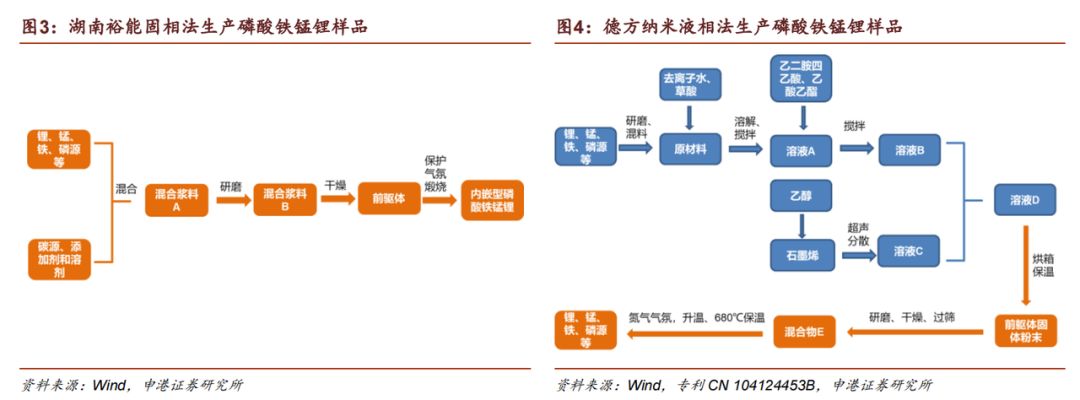

Specifically, the preparation method of manganese -phosphate iron can be divided into two types -solid phase and liquid phase method. The principle of the method is mixed lithium compounds, iron compounds, phosphorus compounds, and manganese compounds to allow them to occur in a specific environment reaction. The former is to grind the raw material into a powder directly, which is low in cost but may not be mixed unevenly. The latter is to dissolve the raw material in the solvent to respond, the performance is better, but the operation process is more complicated and may not be fully responded.

Figure: Mainstream preparation method of manganese phosphate iron lithium and liquid phase method

Litai Lithium and Hunan Yuneng uses solid phases, while German nano -nano -nano is the head of the liquid phase method. Investigation information of the comprehensive national gold securities, the amount of investment required for lithium manganese phosphate iron phosphate annual production, if the semi-solid and semi-liquid method is produced by about 180,000 to 20 million, it is similar to the production of iron phosphate. Production will be 02-06 billion yuan higher.

Highly invested capacity investment and customer resources that need time to accumulate also increased the ticket money of startups.

Junsheng Investment Song Yu's director general managers analyzed 36 氪, "The changes in the positive electrode materials of power battery have been underway, but there is basically no opportunity to start a startup, because the improvement in this field is gradual, not changeable. The production capacity and R & D strength of these giants will crush their startups. "

Under the trend of commercialization of lithium manganese iron phosphate iron phosphate iron, companies that are the first to spread their capacity will undoubtedly get the first bucket of gold first. For example, Rongbai Technology (market value of 62.4 billion yuan) of the three -yuan material leader chose to use acquisitions to shorten the gap with the opponent's production capacity.

On July 21, Rongbai Technology announced the acquisition of Tianjin Scoland at a price of 389 million yuan. The latter already owns 6,200 tons of annual production capacity. Lithium iron phosphate battery is flat. Bai Hou Shan, the founder of Rongbai Technology, said that in the past, Rong Baiyi did not participate in the competition of lithium iron phosphate, but now manganese lithium iron phosphate iron is a new opportunity. Next, it will step into the lithium iron phosphate camp.

At present, the manganese phosphate iron lithium startups seen by 36 氪 are only nano. Its founding team comes from Tao's chemistry and GE. Dr. Yu Xindi, chief scientist, was the core R & D personnel of the Tao's chemical manganese iron lithium project.

It is understood that the constructing nano -nano is building a lithium of manganese iron phosphate iron phosphate iron phosphate iron lithium in Yancheng and will be put into production at the end of the year. In February of this year, Nian Chuangnan received more than 100 million yuan Pre-A round of financing, led by Yueda Investment, and invests in institutions such as Gaoma Venture Capital, Woyan Capital, Skyworth Group and other institutions.

"At present, the core technical barriers of other companies are components and manufacturing patents, but we bought off the patents of all core cores of Tao's chemistry on manganese lithium iron phosphate iron. This is not available in many large manufacturers." Dr. Lin Zhiqing told 36 氪.

Among the patents of manganese phosphate iron phosphate iron phosphate bought by Nannan, China's patent covers the patent equity with a manganese content of more than 70%of manganese iron phosphate iron, and the patent rights covered by international patents with a manganese content of greater than 50%.

This means that in China, the manganese iron than 7: 3 will need to be paid to some patent costs if it exceeds 7: 3. Based on a core component patent, Creative Nano can directly improve the characteristics of the material from the basic chemical structure, and the technical iteration is faster.

The fourth battery metal?

In fact, the larger variables brought by lithium manganese phosphate are manganese metal itself.

"Manganese may become a more important element in the future positive electrode materials. Several material systems of high -voltage platforms/high -grams capacity are added with manganese." China Merchants Chuang Ting Lide said to 36 氪.

This is because, in addition to manganese iron phosphate iron, there are also new battery technology routes such as lithium manganate, lithium manganese base, manganese -based high manganese Purule white, nickel manganese binary in solid batteries, manganese are among them. A must -have battery metal.

Compared with manganese -phosphate iron lithium, lithium manganate used for two -wheeled vehicles has been widely used last year. In 2020, lithium manganate materials ranked first in the size of the two -wheeled vehicle battery cell market, with a market share of 45%. At present, the most promising application market for sodium batteries is energy storage, which means that manganese will not be absent in the development of future power batteries and energy storage batteries.

Based on this, CITIC Securities Research Report stated that as the penetration rate of the new manganese-based positive pole material increased, it is expected to make the lithium battery industry increased by more than 10 times between 2021-2035. Benefiting from the rapid growth of the shipment of ternary positive poles and lithium manganate materials, it is expected that the amount of lithium battery positive materials will exceed 300,000 tons in 2025, and the compound growth rate of the compound growth rate of 2021-2025 will be 32%.

In the upstream, Hongxing Development of Listed Companies in China, Sinosteel Tianyuan and Xiangtan Electraricated stocks were rapidly rising, and about 50 % of the rise in July in mid -July. The core logic of the rise is similar to that of phosphorus chemical enterprises -that is, in the case of new energy sources still in the seller's market, through the existing raw material advantages, it directly transforms from traditional chemical stocks to hot new energy standards.

In terms of process, lithium iron phosphate consists of two parts: lithium carbonate and iron phosphate. The iron phosphate production chain is phosphate-hyper pure phosphate/industrial phosphate-iron phosphate. Both phosphorus chemicals and titanium pink companies have the ability to produce iron phosphate in low -cost, and there is almost no threshold for lithium iron phosphate.

Figure: Phosphate ore-lithium iron phosphate industry chain Source: Founder Securities

After the lithium iron phosphate burst fire, multiple phosphorus chemical giants such as Chuanheng shares, China Nuclear Titanium White and Xingfa Group, based on the advantages of raw material sources, processing technology, and cost control. Related enterprises and other methods, cut into lithium iron phosphate positive materials. Among them, Nuclear Titanium White was plans to invest 12.1 billion yuan of lithium iron phosphate projects in February last year, and then rose from 15 billion to 39.4 billion yuan.

In the industry's development context of the industry, the large -scale application of manganese metal will also bring the opportunity to enter the upstream materials. The products refined by manganese ore are mainly divided into electrolytic manganese dioxide and high -purity manganese sulfate, and they are important raw materials for the downstream battery industry.

Taking Xiangtan Electric as an example, the current annual production capacity of manganese dioxide has reached 122,000 tons, and the annual production capacity of high pure manganese sulfate has reached 10,000 tons. It is understood that the high -purity manganese sulfate of Xiangtan has entered the Ningde era supply chain.

For another example, a layer -like oxide route one of the three routes of sodium batteries, the transition metal manganese raw materials used are manganese dioxide and manganese sulfate. The important player of this route, Zhongkehai Sodium, has been put into the world's first sodium battery production line in Fuyang on July 28 with a production capacity of 1gWh. The second and third largest shareholders of Zhongke Haiyin invested in Shanxi Huayang and Huawei Hubble.

It is worth mentioning that in 2016, Xiangtan Electricized Hunan Yuneng, Hunan, Hunan, in 2016. The latter Tan Xinqiao, the current chairman of the latter, has served as the chairman of Xiangtan Electrification for more than eight years. As a startup, Hunan Yuneng only used five years, and twice used equity replacement to obtain key technologies of the positive pole material, which achieved the first iron phosphate camp. These operations are exactly the handwriting of Xiangtan Electrariasis team.

As a supplier of binding Ningde Times and BYD's positive electrode materials, the commercialization of lithium manganese iron phosphate iron is undoubtedly transmitted to Xiangtan electrification.

Judging from the current proven capacity of commercialization, lithium manganese phosphate iron can not only be used purely, but completely replaces lithium iron phosphate as the positive electrode material of the power battery. , Thereby improving certain security and cost advantages.

However, any chemicals have advantages and disadvantages.

In disadvantages, the increase in manganese content will increase the number of electrolytes in contact with the manganese, so that the dissolution of manganese in the charging and discharge cycle will affect the number of batteries.

Relatively speaking, the manganese content of the second route is low and related technologies are more mature. Lin Zhiqing told 36 氪: "The high -voltage platform of lithium manganese phosphate iron is perfectly matched with ternary. The condition of mixed 20%has a small impact on the decline in energy density. In addition, due to the good thermal heat resistance of manganese phosphate iron, the three yuan can be suppressed The release of oxygen release in extreme cases can significantly increase the safety of ternary materials. "

As a result, many power battery manufacturers have taken the lead in launching the lithium and mixed ivory material solutions for manganese iron phosphate iron and ternary mixed. However, this is still a transition plan. After walking through this wave, whether manganese metal can really become "fourth battery metal", which will be tested for the time to grow larger companies on the industrial chain.

36 氪 Public account

I sincerely recommend you to follow

Let's "share

Lithium battery development momentum is positive

- END -

The county's industrial fixed asset investment continues to rise

Since the beginning of this year, Gaotai County has relying on coal cleaning and r...

Green lights are not moving at the driver's intersection, and they are investigated and punished for drunk driving because of a bad mood.

In the early morning of July 10, there were three traffic policemen in the traffic...