Even if you invited Cai Xukun, Tomson Bijian can not play online marketing

Author:Kenji Bureau Time:2022.08.09

On August 8th, Tomson Bo Jian announced the latest investor relationship record records, and finally explained a poor semi -annual report.

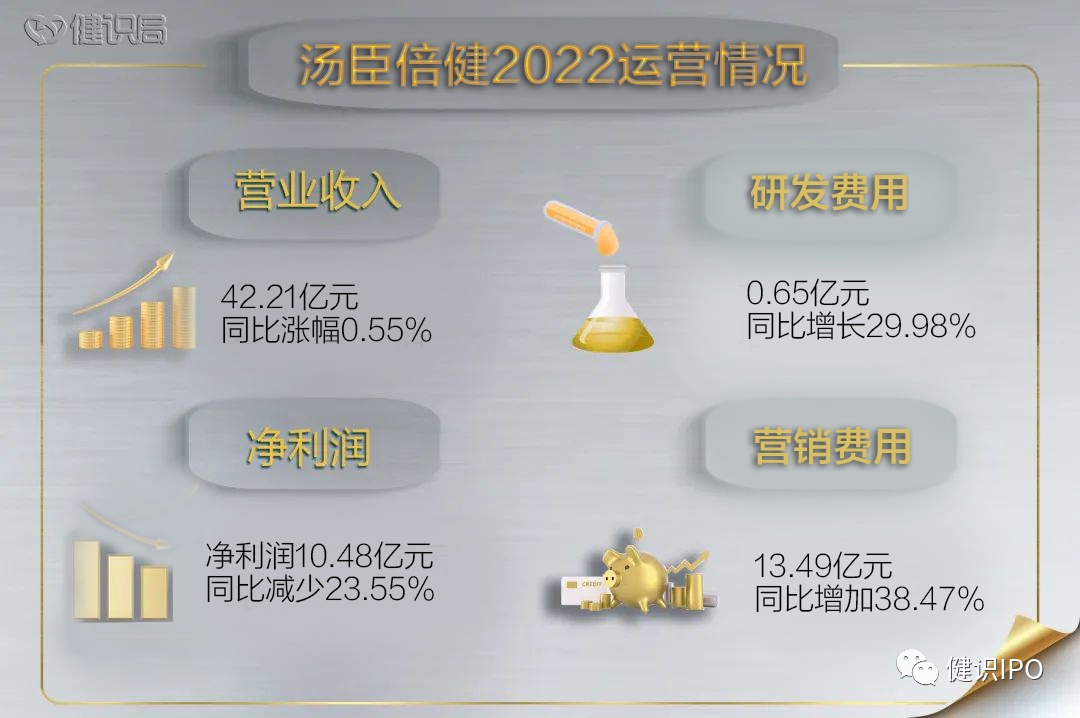

Tomson Beijian achieved revenue of 4.21 billion yuan in the first half of 2022, a slight increase of 0.55%year -on -year; net profit was 1.048 billion yuan, a significant decrease of 23.55%year -on -year. In particular, the company's operating activities in the first half of this year decreased by 53.12%, which aroused strong attention in the capital market.

Tomson's management gives an explanation: the customer structure changes.

In the first half of this year, Tomson Beijian increased its direct supply of direct supply to the e -commerce platform, but the platform costs and brand promotion fees increased significantly, leading to a significant decline in profits and cash flow. Pursuing the sales channels of the network side, for the first time, Tomson Bianjian realized the temporary frustration.

In June 2020, GNC applied for bankruptcy of the old American health product company GNC was mainly because the epidemic affected the sales of offline stores. Since then, the transformation network has become the only way out of the health care industry, but it is not expected that the network market is no longer like the past.

On the other hand, Tomson Beijian will naturally spend a lot of money.

Tomson Biso spokesperson is all a master of traffic. At the Investor Exchange Conference on August 7, Tomson Bian Jian announced that his joint care brand "Jianli Duo" became the official bone health of the Hangzhou Asian Games. ambassador.

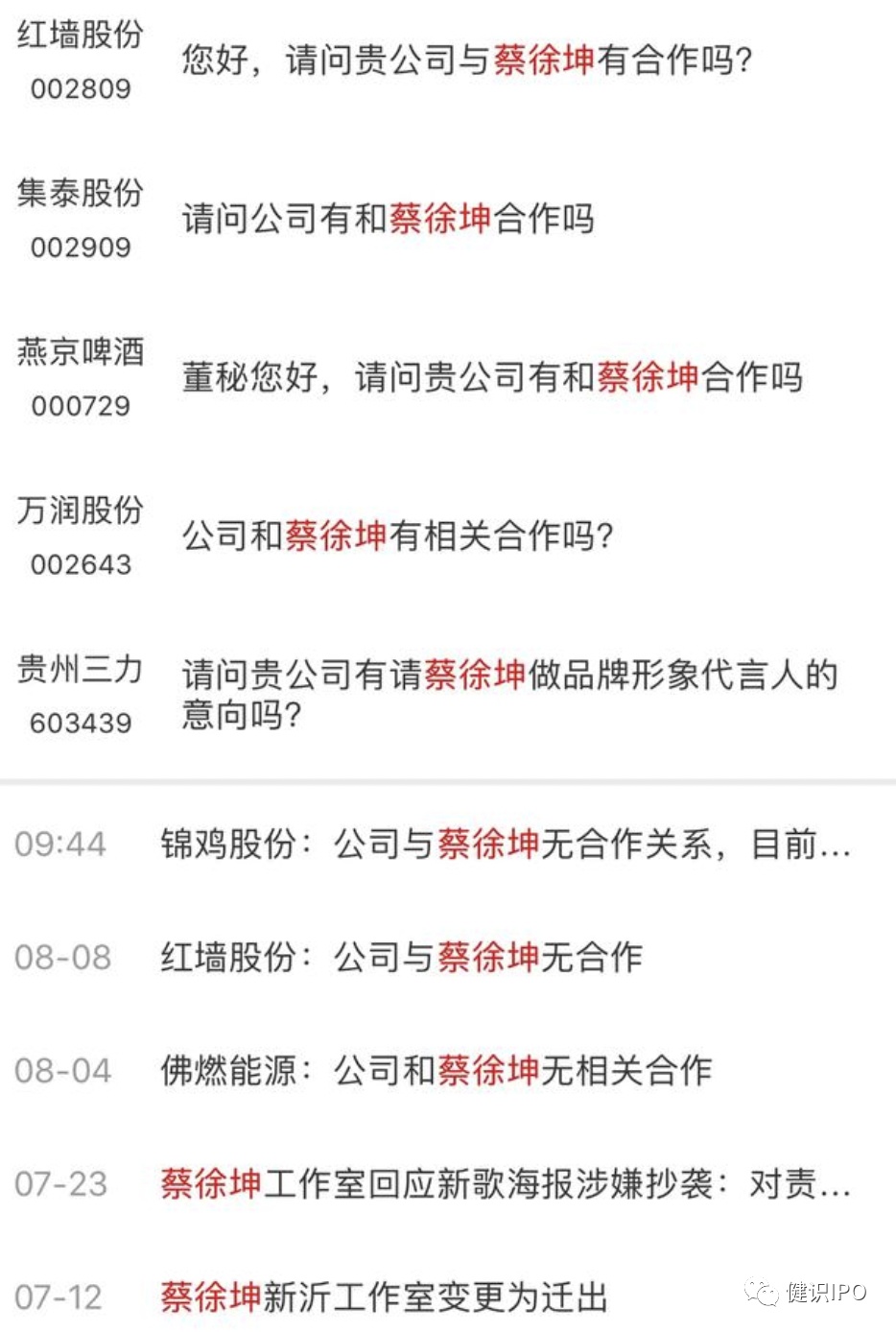

Among them, the cooperation with the spokesperson Cai Xukun did not respond greatly. Today, Cai Xukun was watched by many investors, and many companies came forward to explain that they had nothing to do with Cai Xukun.

I will continue to smash money marketing

According to Tomson Beijian's interim report, in the domestic main market, its main brand "Tomson Bijian" achieved revenue of 2.361 billion yuan, a year -on -year decrease of 7.91%; joint care brand "Jianluo" achieved revenue of 733 million yuan, a year -on -year decrease of 13.83% ; "LIFE-SPACE" domestic products achieved revenue of 177 million yuan, an increase of 49.69%year-on-year.

The decline in sales of the main brand, which is very dangerous for a health care company.

Tomson Bijian's semi -annual report disclosed that the company's operating income was about 4.22 billion yuan, of which about 1 billion yuan took the "buying model" for sales, and the other 3.2 billion yuan came from the company's own distribution. Tomson's actual sales capabilities can also be seen from these 3.2 billion yuan.

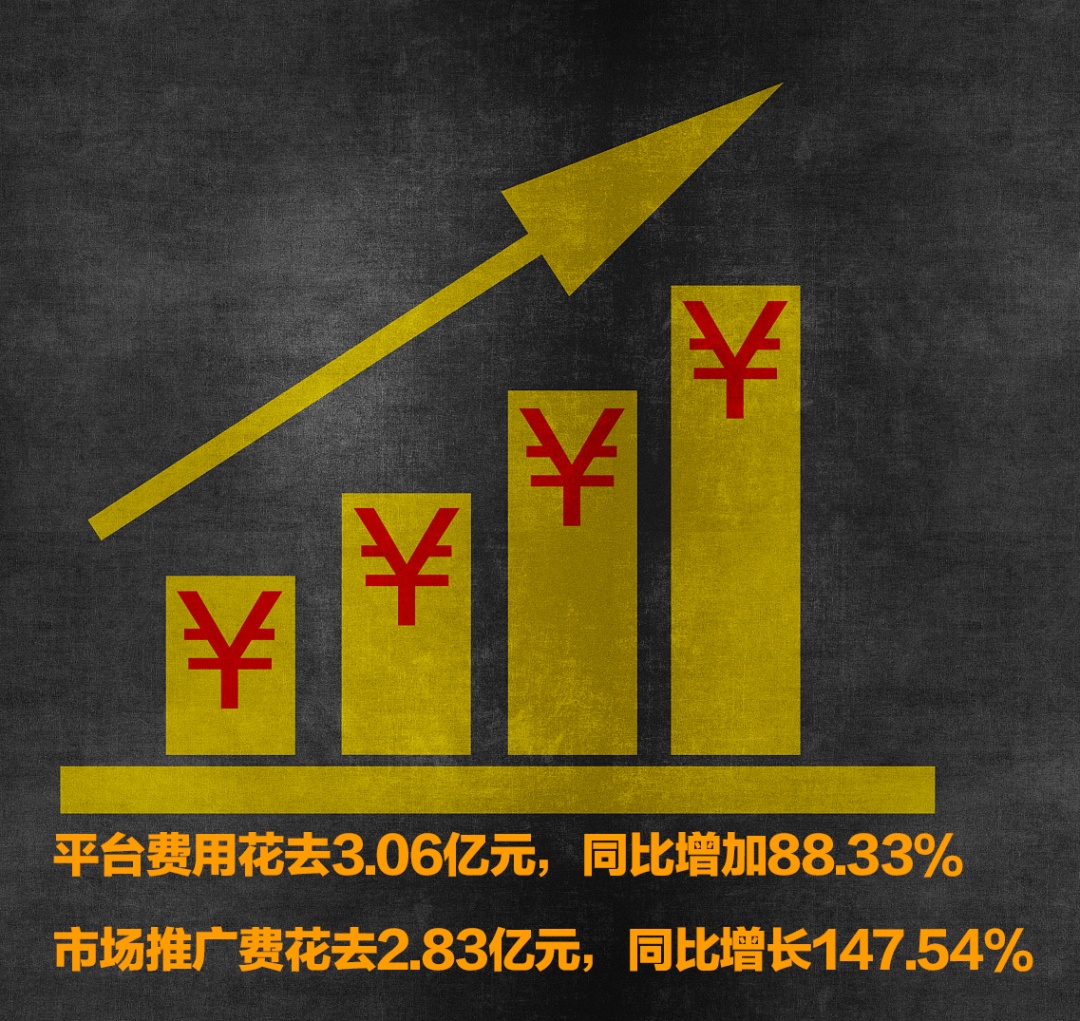

In the first half of 2022, Tomson's marketing costs increased significantly, and the sales cost reached 1.349 billion yuan, which accounted for almost one -third of the current total revenue. Among them, the biggest increase is market promotion fee and platform costs. The platform expenses spent 306 million yuan, an increase of 88.33%year -on -year; market promotion costs were 283 million yuan, an increase of 147.54%year -on -year.

Like many brands, Tomson Donaldo has increased online promotion during the epidemic. The information disclosed by the company states that the increase in market promotion costs is mainly due to the increase in the promotion costs of nutritional groups and the increase in online channel digital media.

However, it can be seen from the company's financial report that among the company's own distribution revenue of 3.2 billion yuan in the first half of the year, online channel sales fell by 17.76%.

There is only one explanation: Tomson Beijian has been fiercely smashed online marketing, but did not get the expected results.

Since the epidemic, Tomson Beijian has been increasing online promotion. In 2021, Tomson Beijian's market promotion fee increased by 98.41%year -on -year, and the platform costs increased by 434.77%year -on -year. In the first half of this year, the company bluntly stated at the investor exchange meeting: It is expected that the company's sales fee rate will remain at a high level.

This means that Tomson Beijian does not intend to change, and wants to continue to increase investment on the Internet.

In the second half of the year, if the sales strength is still insufficient, the growth rate of net profit should be slippery again?

Is health care product?

In the 2021 annual report, what Tomson brought his endorsement confidence in Tom Ken is Gu Ailing who became popular with the Eastern Olympics. Earlier, Yao Ming, Cai Xukun, Miranda Kaner ... all cooperated with Tomson Bijian.

The health giant has continuously expanded the brand's influence by virtue of the traffic flow, which essentially reflects the weak barriers of this industry.

Health products are not like medicines and do not need to do clinical trials. Most of the products are homogeneous. It is difficult to expand its own volume through the product itself, and the influence of the spokesperson is the most convenient.

However, two years after the epidemic impact, the influence of celebrity spokespersons has obviously declined, and Tomson Beijian's income has been very difficult. Among them, under the influence of epidemic, war, inflation and other backgrounds, the enthusiasm of consumption in addition to the survival of people gradually decreases; there is another reason that under the influence of multiple channels such as e -commerce, the consumption choices of related groups are more diverse. change.

In June 2020, GNC, a well -known US health care product company, said that it had applied for bankruptcy protection, which was enough to see the development of the health care products industry.

In addition to the hardships of the operating environment, the development of the public's "intelligence" has also become a sword hanging on the head of the health product industry.

Under the influence of multi -faithful sources of the Internet, the market is more trustworthy and easier to ask questions. "Is healthcare products a kind of IQ tax?" The intermittentity has become a hot topic, and some industry personnel have also begun to speak through various channels.

In 2018, Tomson Bianjian accumulated a large goodwill for acquiring Australian company LSG.The company's representative brand "Life-Space" is a probiotic brand.As of the semi -annual report of this year, the book value of the goodwill generated by the acquisition of LSG was still 1.18 billion yuan.In the first half of this year, the "LIFE-SPACE" brand provided 177 million yuan in revenue for Tomson Beijian in China, which is a great progress.But can probiotics continue to break through?What should I do if other health categories are also questioned?Tomson Beijian needs to be prepared.

Writing | Nicotinamide

Edit | Jiang Yun Jia Ting

Operation | Twenty -thirty

#Tangchen Beijian#

- END -

Accelerate the "one net" of national computing power

followClick the blue word Tianjin Digital Port to follow usOn May 22, in the compu...

Da'an District of Zigong City held the second plenary meeting of the 2022 Food and Drug Safety Committee

On July 13, the Da'an District Food and Drug Safety Committee held a second plenar...