One month to win 140 billion long orders!When the 100 billion silicon faucet signs the sales order, when will the five oligarch monopoly changes?

Author:Costrit Finance Time:2022.08.27

Special transformer with a total market value of nearly 100 billion yuan announced last night that the holding subsidiary Xinte Energy Company and Jingke Energy Company signed the "Strategic Cooperation Sale Agreement". During December 31st, the new special energy company purchased 336,000 tons of native polysilicon, and the total amount of the agreement was expected to be about 90.333 billion yuan.

Public information shows that special transformer starts with the three major sections of the wire and cable and transformer business, and the current business covers the three major sectors of transmission transmission, new energy, and traditional energy business. Among them, the new energy business is responsible for operation through the new special energy of the holding subsidiary, including polysilicon and landscape power stations. New Special Energy's first publicly issued A shares was accepted on June 28, and its net profit returned by 2021 increased by 804.44%year -on -year.

Not long ago, on July 12th, the special transformer announcement signed a polysilicon sales contract. Specifically for Shuangliang Silicon Materials Company, from January 2023 to December 2030, purchased 201,900 tons of native polysilicon from New Special Energy Company. The amount is expected to be about 51.744 billion yuan.

According to the research report released by Soochow Securities Analyst Zeng Duohong, etc., special transformers were signed with Jing'ao Technology, Longji Green Energy, Machine CNC, Gaojing Solar, Shuangliang Energy Sales, 2020 and 2021 in 2020 and 2021. A total of 85.32GW, the contract period from October 2020 to December 2026, the average company needs to deliver 142,200 tons of polysilicon per year.

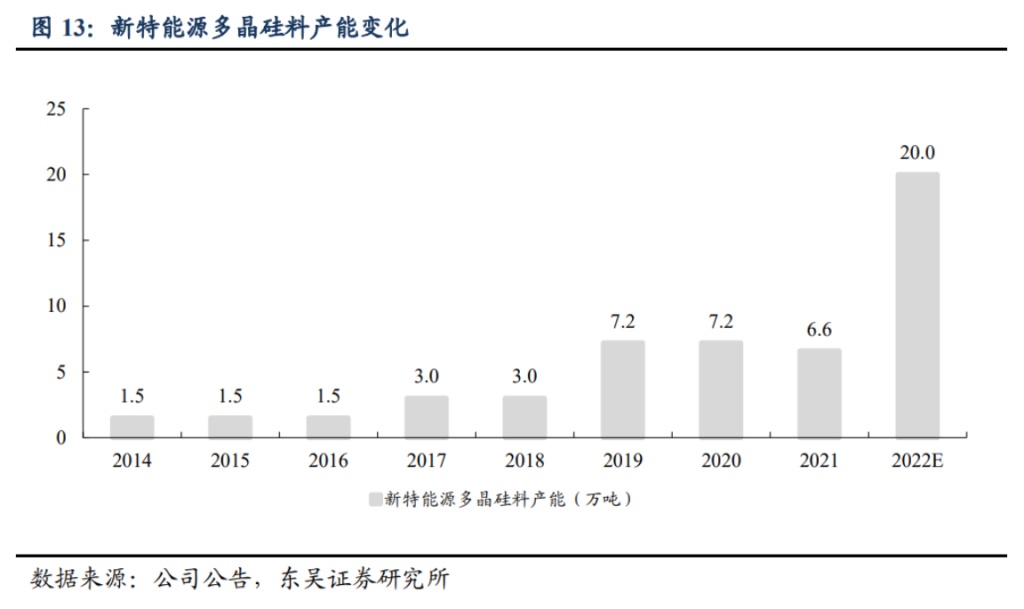

In terms of production capacity, Zeng Duohong pointed out that the technical reform of the 22Q2 Xinjiang production line was completed. The production capacity of the new special energy polycrystalline silicon material was increased to 100,000 tons/year. At the same time in the second half of 2022, the first phase of the Inner Mongolia Baotou project will be put into production, Q4 can achieve full production. It is estimated that polycrystalline silicon capacity can reach 200,000 tons/year at the end of 2022. In addition, the construction capacity of the second phase of Baotou, the first phase, the first phase, and the second phase of the Baotou, Inner Mongolia, is expected to be released in 2023 and 2024. With the expansion of the ground, coupled with the long single lock volume, the shipment continued to increase in 22 years.

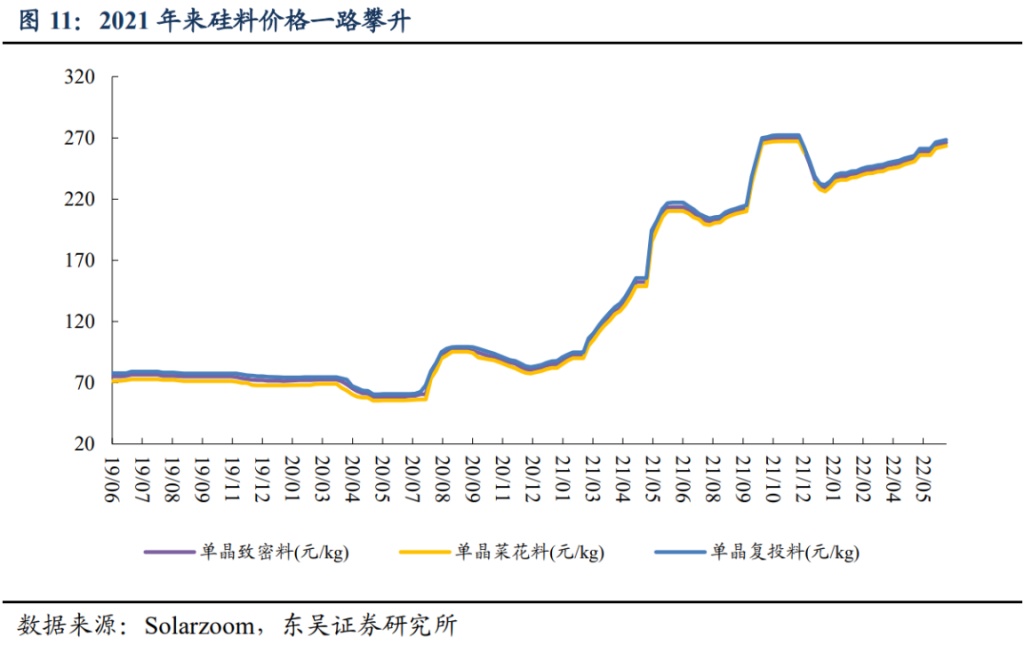

Since the beginning of this year, the price of silicon material has opened a new round of rise. According to the Silicon Industry Branch, the average price of domestic single -crystal reinforcement last week was 305,300 yuan/ton, and the weekly increased by 0.36%; the average transaction price of single crystal tightly materials was 303,200 yuan/ton, and the weekly ratio increased by 0.33%.

Shanxi Securities Analyst Xiao Suo said in a research report released on July 16 that the most short -short link of the photovoltaic industry chain is silicon material, and the price is expected to remain high during the year. It is estimated that the effective supply of silicon materials this year is about 88-900,000 tons. The production capacity of silicon wafers continues to expand and overwhelm the installation requirements. Silicon material is still in short supply, and the price will remain high. After the Ming Dynasty, the production capacity of silicon materials continued to be released, and the price of silicon materials was expected to loosen down, which will stimulate downstream demand to continue to grow high.

Judging from the profitability, the research report of Soochow Securities shows that the average sales price of PEM polysilicon in 2021 rose 247%compared with the same period of 2020, and polysilicon gross profit margin reached 58.57%. Considering the overall supply of silicon materials in China The profit is still strong.

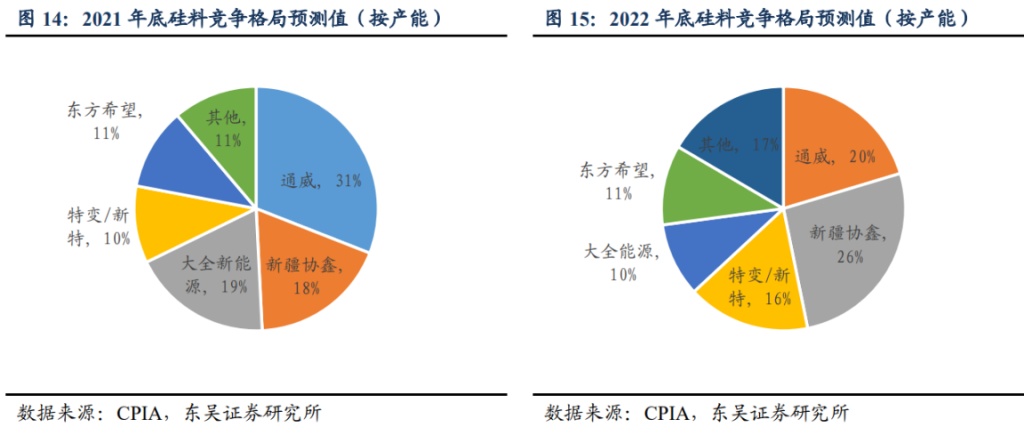

In terms of competitive landscape, Zeng Duohong pointed out that the silicon industry has formed Poly Xiexin, Tongwei, New Special Energy (Special Transformer), Great New Energy, and Oriental Hope Five Objects Monopoly. According to the calculation of polycrystalline silicon production in 2021, the new special energy is in a weaker position in the five oligarchs. However, if the expansion plan expands the production plan normally in 2022, the company's market share will be significantly improved, and the first echelon is tied with Tongwei and GCL.

It is worth noting that the special transformer has been trapped in the "power station destroyed field" storm in May this year. In the process of construction of the new special energy "Nongguang Supplementary" project, there were suspected crimes of investigating production and operation. In this regard, people insiders in the Cailai News Agency were informed that after exploration of the area and estimated scale, the important task was to contact the local natural resources bureau and other relevant departments to determine the site and land, check the three maps of the land, and obtain the land nature information. If the basic farmland is a red line, the project is basically rejected.

- END -

Tianfu Nature calendar | Walking "dead branches" (July 13, 2022)

If you see a slender dead bamboo branch in the wild, don't panic -you may encounte...

Guangdong: Fully build a "firewall" for safety production

Recently, the Guangdong Provincial Market Supervision Bureau held an analysis and ...