Hurry up!June 30th!You might have an additional money

Author:Fuzhou Daily Time:2022.06.19

According to the announcement of the State Administration of Taxation

From March 1, 2022 to June 30

Individual residents who meet relevant regulations

Need to apply for personal income tax of 2021

Comprehensive income settlement and settlement matters

in

When the tax refund was just opened in early March,

Someone received tens of thousands of yuan

The most one who returned 35718 yuan

No wonder sigh:

"I have motivation to work!"

in

According to the announcement, after the end of 2021, the residents need to summarize the income from four income obtained from the salary salary, labor remuneration, manuscript remuneration, and franchise fees from January 1, 2021 to December 31, 2021, and the expenses are reduced by 60,000 After the special deduction, special additional deduction, other deductions and eligible public welfare charities determined in accordance with the law, the personal income tax rate for comprehensive income is applicable and subtract the speed deduction. The tax amount has been paid in the year, and the amount of tax should be refunded or replenished, and the taxation or tax refund or taxation is applied to the tax authority.

Who needs to handle annual exchange calculations?

For one of the following circumstances, the taxpayer needs to handle annual exchange calculations:

in

(1) The pre -paid tax amount is greater than the taxable tax amount and the tax refund shall be applied for;

in

(2) The comprehensive income income obtained during the tax year exceeds 120,000 yuan and the amount of tax replenishment is more than 400 yuan.

in

The amount of tax should be refunded or the amount of tax supplies = [(comprehensive income income-60,000 yuan- "three insurances and one gold" and other special deductions-special additional deductions such as child education-other deductions determined in accordance with the law Tax rate-speed calculation deduction number] -The prepaid tax.

It is reminded that the country has decided to make a policy of income from a monthly salary and salary income of the annual annual bonus and the implementation of a monthly tax rate on a monthly basis, which lasted until the end of 2023. Therefore, when the tax exchange is performed this year, there will be a choice question for the year -end award: separate tax calculation or all income from comprehensive income tax.

Different tax calculation methods will affect the tax amount. Experts analyze that for those with relatively small salary and relatively many year -end prizes for the annual annual salary, they may choose to make the year -end award merged into the comprehensive income tax calculation method.

in

If you want to know which tax calculation method is more advantageous to yourself, a very simple way is to operate both tax calculation methods on individual tax apps, but don't confirm first, compare which tax calculation method is cost -effective. Just choose which one.

in

After the declaration is completed, you can use the personal income tax app home Report record details.

in

For example, the 2021 comprehensive income annual settlement report details show that the green "completed" label (as shown in the figure below) shows that you have completed the declaration.

in

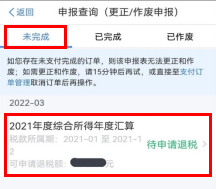

However, if the declaration record is shown in the "unfinished" label, and the word "tax refund to be applied for" (as shown below), it shows that you only submitted the annual tax refund declaration form, but did not apply for tax refund.

Application tax refund ≠ Apply for tax refund. This situation does not receive your tax refund application, so you will not receive tax refund. In response to this situation, you need to perform a "tax refund" operation.

in

Click the report of "To Apply for Tax Return"

You can see the reported record details

in

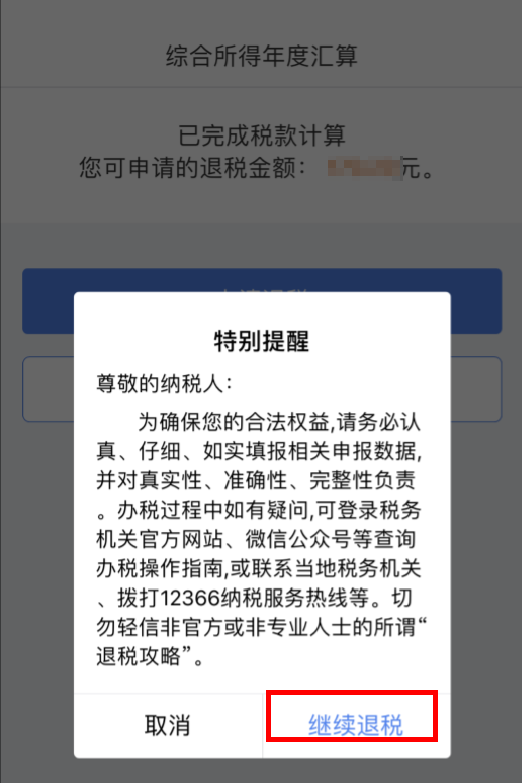

Please click "Apply for tax refund" in the lower right corner

The system will pop up special reminders

After reading, click "Continue Tax Return"

Choose a bank card that receives tax refund, click to submit

in

If you have already been in the APP "Personal Center" in the early stage

Add bank account information

The system will automatically bring out

If you need to add

Please click to add bank card information

in

It is recommended to fill in a class of bank accounts opened in China

And make sure you are in a normal state before receiving the tax refund

After the tax authorities and the State Treasury staff are reviewed and approved

You can receive the tax refund

Credit online false reporting tutorial

False filling in income, deduction, etc.

Applying for tax refund and multiple people are investigated

14 taxpayers from a service management company in Loudi City, Hunan Province misunderstood the false filling video of the Internet. In the absence of medical expenditure expenses, the special medical treatment for major illnesses was submitted.

After the tax authority was found, the unit immediately visited the unit, interviewing the company's legal representatives and financial personnel, requiring the unit to strengthen policy propaganda and counseling, report to employees one by one, and correct them as soon as possible.

in

At present, all 14 taxpayers have been corrected. Considering that the above -mentioned taxpayers confessed their mistakes after the tax authority reminded the reminder and corrected errors in time, the tax department criticized it and educated it without punishment. (The principle of "first violation")

in

The relevant person in charge of the Taxation Bureau of Loudi City, Hunan Province reminds the majority of taxpayers to handle the comprehensive income of personal income tax in accordance with laws and regulations. Tax credit.

in

When the Xiamen Taxation Department in Fujian Province conducted a comprehensive tax refund review of the 2021 income of 2021, it was found that the taxpayer Liu had obtained only the internal training certificate of the unit and did not meet the special additional deductions of the continuing education of the continuing education of the vocational qualifications. Error filling in the special additional deduction of 3,600 yuan per year. The Xiamen Taxation Bureau further reviewed and found that the taxpayer still added his grandparents to the elderly to fill in the special additional additional deduction in the case of the special additional deduction conditions of the elderly.

in

After the tax authority reminded, Liu acknowledged the mistakes and had corrected the declaration in accordance with regulations. Considering that the taxpayer can correct the tax supplement after reminding the reminder, and recognize the mistakes, the tax department has criticized and educated it without punishment.

in

Remind everyone: If you apply for tax refunds, or deducting income, deducting income, and tax refunds in accordance with the law, the tax authority will recover taxes and late fees in accordance with the law, and include the list of key personnel of tax supervision. If the annual declaration is strengthened, the circumstances will be punished according to law.

The vast number of taxpayers shall handle personal income tax in accordance with laws and regulations, and carefully read the reminder information of the personal tax app, and the application items such as revenue and special additional deductions are truthfully reported. Do not trust all kinds of "tax refund secrets" on the Internet, let alone disseminate unofficial tax -related information on online social platforms, and be taxpayers who are honest and trustworthy according to law. not

not

Wonderful video recommendation

Fuzhou citizens pay attention to

The current epidemic prevention and control situation is still complicated and severe

Don't be paralyzed, don't be lucky!

Do a good job of personal protection together:

wear mask! Wash your hands frequently! One meter!

Frequent ventilation! Don't tie! Nothing!

Cooperate with epidemic prevention, don't conceal!

not

not

Source: Hubei Release, People's Daily, China News Network, the State Taxation Administration 12366 Shanghai (International) Tax Service Center, Yangtze River Daily, etc.

not

Recommended in the future

not

The latest network red card! "Most Beautiful Bridge" is officially opened!

deal! Ticket -free! not

30 years! Yongtai Damei! not

If you think it looks good, just order it

- END -

"P+X" takeaway meal constructor new model of super three -dimensional epidemic prevention

Many physical stores and restaurants are restored, and logistics distribution and ...

Can the neighborhood committees also print offline \"follow -up code\"?This community he

In order to facilitate the entry and exit of the elderly and children, the commun...