Classics comment: Increase policy support to stimulate the vitality of private investment

Author:China Economic Network Time:2022.06.20

Core point: Mr. Zifang, a commentator of China Economic Network, believes that for so many years, we have adhered to the road of marketization and rule of law, created a large number of social wealth, gathered many civil capital, and formed a wide range of social consensus. It is precisely because people have clear and stable expectations for the future that government investment can leverage private capital and better play the "multiplication effect". From this perspective, money is not a problem to promote private investment. The key is how to stimulate the enthusiasm of private investment.

Since May, the national epidemic has shown a decline as a whole, the normal production and living order has accelerated the restoration, the economic operation has gradually stabilized, and the major economic indicators have actively changed marginally. Grasp the time window, and the economic policy should be done. The executive meeting of the State Council recently held a measure of supporting private investment and promoting projects in one way, emphasizing the need to adhere to "two unshakables", increase policy support, and use market measures and reform measures to stimulate private investment vitality.

Investment plays a key role in economic growth. Since the beginning of this year, the rapid landing and intensive construction of major projects in my country have involved effective investment involving key areas, improving people's livelihood, and long -term development potential. In investment, private investment occupies a large proportion. Data show that since the statistics of private investment in 2012, the proportion of private investment in the country has maintained more than 55%. From January to May this year, private investment increased by 4.1%, accounting for 56.9%of the overall investment.

It is said that my country's economic toughness is strong, and private investment is an important reference point. Over the years, we have adhered to the road of marketization and rule of law, created a large number of social wealth, gathered many civil capital, and formed a wide range of social consensus. It is precisely because people have clear and stable expectations for the future that government investment can leverage private capital and better play the "multiplication effect". From this perspective, money is not a problem to promote private investment. The key is how to stimulate the enthusiasm of private investment.

Things need to be done one by one. The machine has stagnated for a long time to restart, and it takes a period of preheating for a while, let alone a person? After the epidemic is stable and controllable, it is a "slow kung fu" to enhance corporate investment. It should be seen that the previous policy orientation mainly focused on "stable confidence". From the central government to the local government, the policies of the majority of market entities should be done. With the effective connection of the "Police Policies and Measures of Solid the Economy" and the inherent needs of local economic stability, the investment order of enterprises is gradually returning to normal.

"Dare to invest in money" is pretty good, and "where to spend" must be particular, which reflects the role of "the government". The meeting proposed that "102 major projects and national clear key construction areas should be selected in the" Fourteenth Five -Year Plan "to select a batch of demonstration projects to attract private capital to participate." The project "Qianjing" is clear and the income is guaranteed. Such investment opportunities How can it not attract people? In addition, whether it is "improving the efficiency of private investment procedures" or "encouraging financial institutions to adopt renewal loans, exhibition periods and other support for private investment", they are creating investment opportunities and providing policy guarantees for enterprises.

Folk investment must eventually return to market attributes, which is the deserved meaning of sustainable and healthy development. In other words, when private investment capabilities have recovered, supporting policies with phased characteristics must be considered in order. Of course, to promote the high -quality development of private investment, it still needs to continue to optimize the private investment environment -breaking the "glass doors", "spring doors", and "rotating doors" that restrict private investment to further improve the policy environment that is conducive to the development of private investment; implementation Encourage various policies and measures for the development of the private economy, and create a fair, transparent, and rule of law development environment for various types of ownership enterprises.

Folk investment is the "barometer" of economic vitality. For the growth of private investment, you may wish to support more and more care. (Mr. Zifang, Chinese Economic Network)

Economic Daily-China Economic Network Review Theoretical Channel is open for submission. Original reviews and theoretical articles can be sent to CEPL#CE.CN (#to@). For details, please refer to Economic Daily-China Economic Network Review Theory Channel's Publishing Channel.

Related articles: Investment must be accurate, not "big water"

Improve supply and demand with precision investment collaborative supply and demand

- END -

The latest notice on the visit of the audience

According to the requirements of the Dalian Cultural and Tourism Bureau's Notice o...

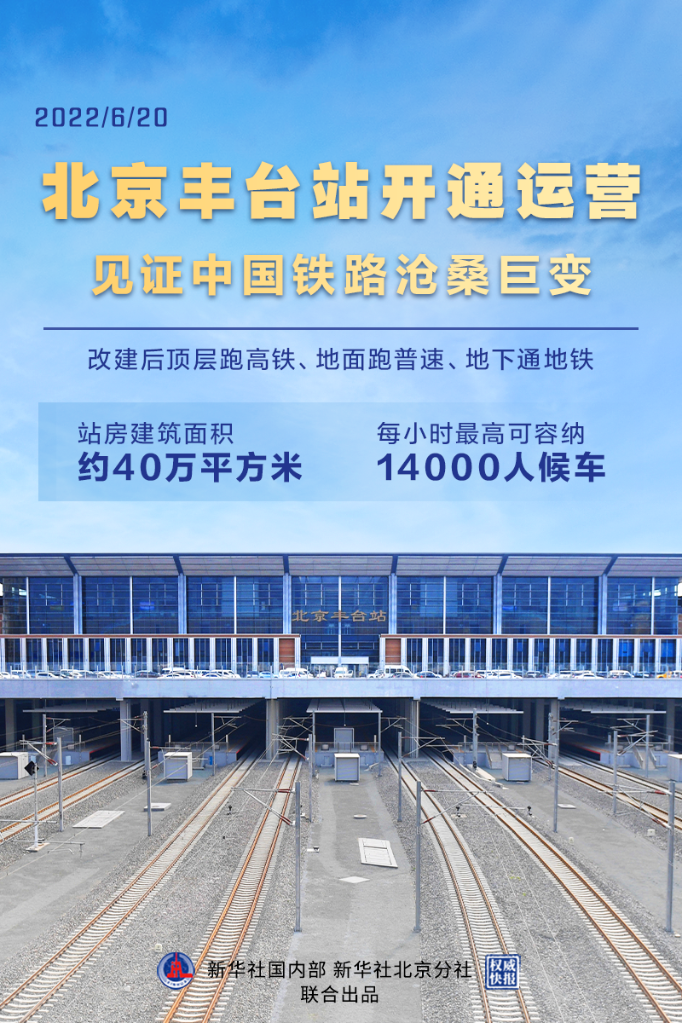

Authoritative Express News 丨 Beijing Fengtai Station Opening Operation

On June 20, Beijing Fengtai Station opened operationsThis oldest train station in ...