Announcement of the Difficulty of Difficulty of Disables and Dispensing Taxation of Urban Land in Jiangsu Provincial Taxation Bureau of the State Administration of Taxation

Author:Nanjing Tax Time:2022.06.22

State Taxation Administration Jiangsu Provincial Taxation Bureau

Announcement on the difficulty of reducing taxation and exemption of urban land use

The State Administration of Taxation Jiangsu Provincial Taxation Bureau announced 2022 No. 2

According to the "Interim Regulations on the Urban Land use Tax of the People's Republic of China", the announcement of the relevant matters of the province's urban land use tax difficulty and exemption tax (hereinafter referred to as difficulties) is now as follows:

1. If the taxpayer meets one of the following circumstances, it may be difficult to apply for difficulty:

(1) Due to comprehensive production of production and business (excluding seasonal suspension, suspension of business, and government ordered production to stop production, and suspension of business), it is really difficult to pay urban land use taxes.

(2) Severe natural disasters or other force majeure factors caused by wind, fire, water, earthquake, etc., or emergencies, public health events, public safety incidents, causing taxpayers to suffer large losses or normal production and operation activities. It is really difficult to pay the use of urban land.

(3) Encouraging industries engaged in the national industrial structure adjustment guidance directory, and it is really difficult to pay urban land use taxes.

(4) Enterprises that start bankruptcy procedures in accordance with the law, assets are not settled or expired, and their land is not used in idleness. It is really difficult to pay urban land use taxes.

(5) Project construction units incorporated into major projects, key projects or plans at or above the district level, are difficult to pay urban land use taxes during the project construction cycle.

(6) Entering rescue, relief, assistance, education, science, culture, health, sports, environmental protection, social public facilities construction, other social public and welfare undertakings, non -profit legal persons and mass groups who should pay urban land use taxes in accordance with the law, etc. It is really difficult to pay urban land use taxes.

(7) The people's governments at or above the county (city, district) are priced, and the functions of public welfare services are really difficult to pay urban land use taxes.

"There is indeed difficulty in paying urban land use tax" means that at the end of the annual period of tax reduction and exemption, taxpayer's monetary funds are not enough to pay taxes after deducting the salary and social insurance premiums of employees; The proportion of dollars and losses accounted for more than 10%of the total income.

2. If the taxpayer exists in one of the following situations, it is not allowed to apply for difficulty and deduct:

1. Entering the land of restrictions on or eliminated by the national industrial structure adjustment guidance directory.

2. The Ministry of Finance and the State Administration of Taxation stipulates that other circumstances shall not apply for difficulty and reduction.

3. Application

Difficulties in urban land use tax reduction and exemption tax is approved by the year. The taxpayer who meets the difficulty and exemption shall submit an application for deduction and exemption to the competent tax authority of the land before June 30 the following year after the end of the year, and provide the following written information in real, accurate and complete:

(1) Application form for taxpayers' tax exemption application.

(2) Reporting of tax reduction and exemptions, listing the basic situation of taxpayers, reasons, basis, scope, term, quantity, amount, etc.

(3) Certificate of land ownership or other proofs of taxpayers use land.

(4) The annual financial statements of tax reduction and exemption, other tax -related matters may not be provided; if monetary funds are not enough to pay tax applications after deducting employees' salaries and social insurance premiums The balance of monetary funds and expenditure information such as the statement of all bank deposit accounts, the salary of employees and social insurance premiums.

(5) Information related to the basis or reason:

1. If the application for discontinuation and discontinuation of business should be reduced, the use of water, electricity, gas, etc. in the year of the year should be submitted to the relevant materials that can be proved to be discontinued and deserture.

2. If you apply for exemption due to force majeure factors, etc., you shall provide meteorological information, related disaster evidence (documentation, physical evidence, etc.), insurance company claims or other information issued by the Meteorological Department of the Meteorological Department in which you will be exempted from the period. If the application of public health events and public safety events should be reduced, it shall provide information on emergencies issued by the health and health department issued by the affiliated health department, the information issued by the emergency public safety incident issued by the emergency management department, and other information that can prove the taxpayer of taxpayers.

3. Encouragement industries engaged in the national industrial structure adjustment guidance directory should provide information about the relevant content of the excerpt, including the name of the directory, the published year, the applicable industry category and small category names.

4. If an enterprise who starts to apply for bankruptcy procedures in accordance with the law shall provide a ruling document for the people's court to accept the application for bankruptcy.

5. To set up major projects and key projects at or above the district level, it shall provide materials such as major projects at or above the district level, list of key projects or plans.

6. Entering rescue, relief, help, education, science, culture, health, sports, environmental protection, social public facilities construction, other social public and welfare undertakings, non -profit legal persons and mass groups who should pay urban land use taxes in accordance with the law, etc. Related materials for registration or establishment should be provided.

7. If the people's governments at or above the county (city, district) are priced and undertaken the application of public welfare service functions, they shall provide documents or certification materials issued by the people's governments at or above the county (city, district).

4. Application for tax exemption from the difficulty of taxpayers shall be processed according to the following situations:

(1) If there is an error in the application of tax reduction and exemption information, the taxpayer shall be informed and allowed to correct it.

(2) Those who apply for tax reduction and exemption information are incomplete or in line with legal forms, and the taxpayer shall be notified at one time. (3) Those who apply for tax reduction and exemption information are complete and in line with legal forms, or taxpayers should correct all tax and exemption materials in accordance with the requirements of the tax authority, and the taxpayer's application shall be accepted.

The application for tax reduction and exemption shall issue a written certificate stamped with the seal and the date of indication.

5. Difficulties and tax reduction shall be approved by the city or county (city, district) tax authorities. The approved organs shall make a decision to reduce or do not reduce exemption within 20 working days after the taxpayer's application. For fraudulent tax reductions, the tax reduction and taxation taxes that have been enjoyed, and shall be dealt with in accordance with the relevant provisions of the tax collection management law and the implementation rules.

6. This announcement will be implemented from January 1, 2022, and the "Announcement on Clarifying the Difficulties in Urban Land Tax Difficulties" (the Soviet Taxation Regulations [2014] No. 6) is abolished at the same time. Unexpected matters have occurred before, and the processed matters are no longer adjusted according to this announcement.

Special announcement.

State Taxation Administration Jiangsu Provincial Taxation Bureau

June 20, 2022

Interpretation

Interpretation of the "Announcement of the State Administration of Taxation Jiangsu Provincial Taxation on Taxation Difficult to use Taxation and Disables of Urban Land"

In order to implement the decision -making and deployment of the Party Central Committee and the State Council on continuously promoting tax cuts and fees, further support the development of difficult enterprises, and facilitate the majority of taxpayers to enjoy the preferential policy dividends of urban land use tax in a timely manner, in accordance with the "Interim Regulations on the Urban Land use tax of the People's Republic of China 》 The provisions of the State Administration of Taxation Jiangsu Provincial Taxation Bureau on the "Announcement on Clarifying the Taxation Difficult to use Taxation Difficulties in Urban Land" (Soe Land Taxation Regulations [2014] No. 6) The "Announcement of the State Administration of Taxation's Jiangsu Provincial Taxation Bureau on the Difficulty of Taxation and Disables of Urban Land" (announcement of the relevant matters of the tax and exemption of taxation and exemption of urban land "(announcement of the State Administration of Taxation Jiangsu Provincial Taxation Bureau No. 2 222) (hereinafter referred to as the" Announcement "). The interpretation is as follows:

1. Announcement Publishing Background

The old "Announcement" was released in 2014, and some regulations were no longer adapted to the new situation and requirements of economic and social development. In order to implement the decision -making and deployment of the Party Central Committee, the State Council, and the Provincial Party Committee and the Provincial Party Committee, further increase the efforts of helping the relevant market subjects to relieve difficulties, reduce the tax burden of enterprises in difficulty, better serve the development of the market subject, and ensure that taxpayers can be timely, accurate, accurate, accurate, accurate, accurate, accurate, accurate, Convenient to enjoy preferential policies for the difficulty of using tax difficulties in urban land, and the State Administration of Taxation Jiangsu Provincial Taxation Bureau issued the "Announcement".

2. The main content and change of the "Announcement"

The "Announcement" includes three parts of the application of difficulty in applying for tax reduction and exemption, the processing procedure of the application difficulty and exemption tax, and the time of the implementation of the "Announcement" and the time traceability. Compared with the old "Announcement", the main content and changes in the "Announcement" are as follows:

(1) Modified the situation of difficulty in applying for urban land use tax and exemption and exemption and exemption and payment of urban land use tax is indeed difficult.

1. The scope of the situation of difficulty in applying for urban land use taxes can be expanded

Considering the new situation and new situation of the economic and social development of our province, the scope of the situation of difficulty in applying for urban land use taxes can be expanded. The "emergencies and public safety incidents" in the situation are new content of the announcement. The first and fourth cases are difficult to occur in the actual production and operation of the enterprise; the second situation belongs to the situation that the taxpayer suffers from major losses or normal production and operation activities due to force majeure factors, emergencies, etc., such as The impact of the new coronary pneumonia's epidemic affected by enterprises belongs to this situation; the situation of the third, fifth, sixth, and seven belongs to the situation of a public welfare service enterprise engaged in the country's encouragement and supporting the industry or the non -profit organization and government pricing.

2. Modified the standard of difficulty in using the land use tax on urban land

From the original standard to two standards, on the basis of the original "proportion of the annual loss of more than 500,000 yuan and the total loss account for more than 10%", increase the "applied tax reduction and exemption tax at the end of the year at the end of the year. The taxpayer's monetary funds are not enough to pay taxes after deducting the salary and social insurance premiums of employees.

(2) Increased the situation of the State Administration of Taxation, which clearly stipulates that it is not allowed to apply for the difficulty of using the tax use of urban land.

According to the "Announcement of the State Administration of Taxation on the Difficulties in Urban Land Taxation Difficulties and Disables Tax Examination and Approval Permission of Tax and Disables" (Announcement of the State Administration of Taxation No. 1 in 2014), " This determines the first situation that does not apply for difficulty in applying; the second situation belongs to the Ministry of Finance and the State Administration of Taxation, which is other than the above situation, clearly stipulates that other circumstances that shall not be exempted from applying for difficulties.

(3) Clarifying the processing procedures for the difficulty of applying for tax use of urban land

1. Application link: First, the time limit for the taxpayer's application for difficulty and exemption from taxpayers is relaxed. From 3 months after the original year, it is relaxed to 6 months after the end of the year. The tax authorities in which the taxpayer is located is changed to the competent tax authority where the taxpayer's land is located.

2. Provide written information: First, the requirements for some written materials have been relaxed, including: taxpayers who have no land ownership certificate, can provide other materials for taxpayers to use land; cancel the requirements for auditing the financial statements must be audited ; No taxpayers are required to provide tax payment vouchers for urban land use taxes; if they are discontinued or suspended from business, they will cancel the requirements of relevant certification documents or materials of the competent authorities or industrial and commercial departments at or above the county level. It can explain the relevant materials for discontinued and discontinued. Second, due to the expansion of the scope of the situation of difficulty in applying for difficulty, the requirements of relevant written materials have been added accordingly. 3. Acceptance session: The content and requirements of the acceptance session were added, which mainly made a standardized requirements for the application of taxpayers in charge of taxpayers' difficulties.

4. Approve link: First, the approval authority that clarifies the difficulty of reducing tax and exemption is the tax authority of the municipal or county (city, district); the second is that the tax authorities have adjusted the time limit for the tax authority to make or not be deducted. "Before April 30" was changed to "within 20 working days after the taxpayer's application"; and the third was to clarify subsequent management matters.

(4) Clarifying the implementation time of the Announce

In order to thoroughly implement the major decision -making and deployment of the Party Central Committee and the State Council on the implementation of new combined tax support policies. At the same time, the difficulty of reducing tax reduction and exemption of urban land use is approved and approved year by year. Implementation, the "Announcement on Clarifying the Difficulties in Urban Land Taxation Difficulties and Division of Taxation and Disability" (Soviet Taxation [2014] No. 6) was abolished at the same time. The taxpayer applies for tax difficulty for urban land in 2022 and is applicable to the "Announcement"; the taxpayer has not been dealt with before January 1, 2022, which is implemented in accordance with this announcement. The "Announcement" is adjusted.

Source: State Taxation Administration Jiangsu Provincial Taxation Bureau

Editor: The taxation service and publicity center of the Nanjing Taxation Bureau

- END -

Legislative protection and protection of the "Mother River" Yellow River Protection Law is about to be the second trial

The Yellow River is the mother of the Chinese nation.On June 16, a press conference of the Legislative Working Committee of the Standing Committee of the National People's Congress, Yang Heqing, spoke...

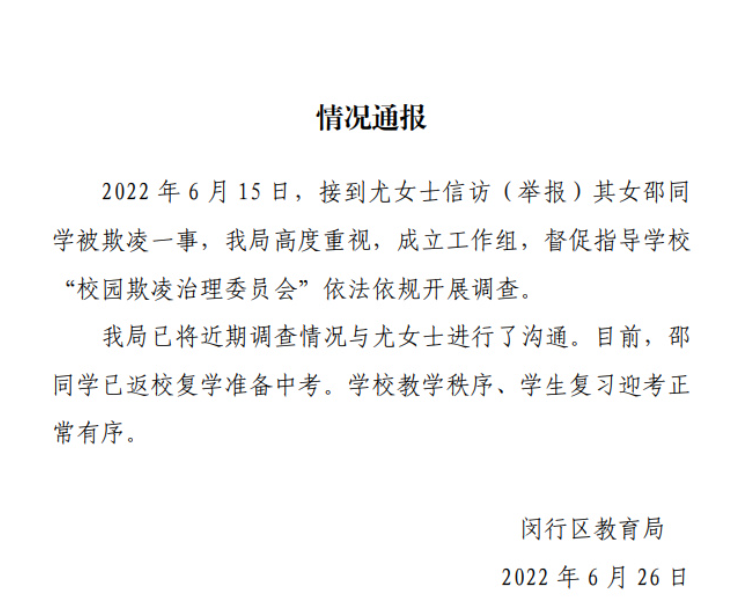

Children's stars jumped up by bullying on campus?Official response!

In response to the incident of Children Shao Yibu suspected of being bullied by ca...