18.8 yuan in the door, 7,200 yuan out!Be careful in this situation

Author:Peninsula Morning Post Time:2022.06.26

The summer vacation is here,

Some illegal merchants

Starting up the idea of student consumption,

The induced consumption gradually became active.

Recently, the Nanjing Consumer Association issued a "routine loan" right to protect rights. In the case, a female college student was induced by the experience price of 18.8 yuan for consumption, but eventually carried a loan of 7,200 yuan.

△ Consumers and law enforcement officers protect their rights in beauty shops

Consumer consumption by 18.8 yuan experience price

In June 2021, the college student Mu, a student of the college student, brushed the activity of 18.8 yuan in a professional beauty shop on a video website. After the appointment was approved to experience it, the clerk turned on the "serial routine" sales model.

The clerk first did a skin test for Mu, and then it was recommended that buying a package is more cost -effective. After being rejected, the clerk recommended the annual package without limit, and was rejected again. At this time, the clerk claimed that he could make a loan for the classmates and would not affect credit reporting. Under the overall brainwashing sales of the clerks, Mu Mu finally purchased the annual package of 5,800 yuan through the loan. It is reported that this loan is 2 years. In addition to the principal of 5800 yuan, it also pays 1,400 yuan in interest, which means that Mumu has a total of 7,200 yuan.

For students without income, 7,200 yuan is already high consumption, and Mu Mu feels very regrets. During this period, Mu Mu also tried to discount the service online to other people on the Internet, but the "National Chain Transfer Package" claimed by the clerk was not recognized by other stores.

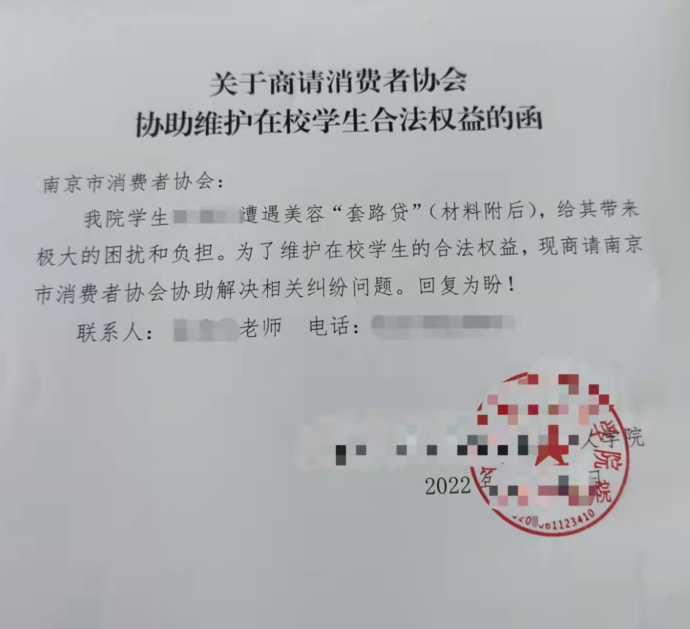

The school and the Consumer Association jointly defend their rights

After understanding the reason for the counselor of Mu, he quickly reported the situation to the college and university defense office. In March 2022, Mu Mu complained and called the police at the 12345 hotline. In June 2022, the Nanjing Consumer Association and the public security department went to the beauty shop to protect their rights.

Beauty store reception personnel are obscured on the grounds of reporting to superior companies. After checking the business license, the staff of the Consumer Association pointed out that the beauty shop is an individual industrial and commercial households, and there is no superior company. And during the investigation, the staff found that the beauty shop had denying the student's identity when inducing students to apply for loans.

After contacting the loan handling company and the person in charge of the beauty shop, they finally reached an agreement to cancel the installment loan of the installment, and the return of Mu Mu has repaid the installment amount for one year, including principal and interest.

In recent years, some small loan companies aim at university campuses and induce marketing through methods such as beauty, training, fitness companies, and issuing Internet consumption loans for college students to seduce college students with excessive advance consumption, which leads to some college students falling into the falling into the place. High loan trap, infringe on its legitimate rights and interests, and cause bad social impact.

As early as 2017, in response to the chaos of "student loans" and "campus loans", the former CBRC, the Ministry of Education, and the Ministry of Human Resources and Social Security jointly issued the "Notice on Further Strengthening the Management of Campus Loan Standards" (Banking Administrative Fa [Fa Yinfa 2017] No. 26). In 2021, the Banking Regulatory Commission, the Ministry of Education, the Ministry of Education, the Ministry of Public Security, and the People's Bank of China jointly issued the "Notice on Further Regulating the Supervision and Management of University Student Internet Consumption Loans" (Banking Supervision Office [2021] No. 28).

The notice requires to strengthen the supervision and management of college students' online loan business, clarify that a small loan company shall not issue online loans to college students, and the outsourcing cooperation institutions of lending institutions shall not adopt false, misunderstandings or induction publicity, etc. It is not allowed to accurately market the college student group, and to push the drainage college students to the lending institution. Further strengthening the management of college loans for college students with licensed financial institutions such as consumer finance companies and commercial banks, they must not lend to college students without approval.

Kind tips

The consumer group of the majority of students must establish the correct consumption concept, and timely correct the act of advanced consumption, excessive consumption, and consumption of consumption in a timely manner; strengthen financial knowledge learning, understand the dangers of non -performing online loans, improve the awareness of financial security prevention; Don't be afraid of problems, hide problems, and communicate with classmates, teachers and parents.

Source: Modern Express, Nanjing Consumers Association

- END -

Today's weather: sunny and young

It is expected that the weather in Ordos is sunny during the day to night, and the...

Lianjiang County Natural Resources Bureau issued geological disasters Meteorological risk yellow war

The Fujian Provincial Department of Natural Resources and Fujian Provincial Meteorological Administration jointly issued geological disasters Meteorological risk yellow warning at 10:10 on June 09, 20