Sichuan: Reserved tax refund nearly 80 billion yuan to make the market subject "Qingshan is always in"

Author:Sichuan Observation Time:2022.07.04

Affected by the new crown epidemic, many companies are experiencing the difficulties of climbing overlap. In order to help enterprises cross the operation, the country has issued a new combined tax support policy, and the large -scale VAT reserved tax refund of large -scale value -added taxes implemented in April is the highlight of it.

Stabilizing the market subject is to stabilize the basic economic market and retain the "green mountains" to win the future. The Sichuan Provincial Taxation Bureau fully implemented five measures for the State Administration of Taxation's "Fast Retirement of Taxation, Fragrance to Fraud, Strict Examination of internal Error, Welcome Foreign Supervisor, and continuous publicity" to ensure that the policy dividends directly reached the market entity.

Data show that from April 1st to June 25th, Sichuan has reserved more than 79 billion yuan in tax refund to more than 74,000 taxpayers, of which about 95%of the number of small and micro enterprises accounted for about 95%. A sampling survey shows that most enterprises use tax refund funds to expand production, technology research and development, purchase raw materials, and pay wages. The flowing funds are promoting the market to boost confidence and restore vitality.

Fund "Living Water" -

Not long ago, the data center of the 3rd Building 3 of Chuanxi Data Industry Co., Ltd. was officially launched. According to the plan, the exclusive clouds such as Tianyi Cloud, Mobile Cloud and other industries will be settled in the data center, providing GPU/CPU computing power and distributed cloud storage to the whole country. For service resources, promote the diversified expansion of the big data industry.

Tax cadres visit Ya'an Big Data Industrial Park where the West Sichuan Data Company is located

"Compared with traditional industries, the technical threshold and deployment cost of the big data industry are high. Infrastructure construction, equipment purchase and installation, and talent introduction require a lot of initial funds." Wang Shuai, a legal person in Sichuan West Data Industry Co., Ltd., introduced that the company was built in early 2020 It has attracted high -quality customers such as mobile, telecommunications, Ali and other high -quality customers. However, due to the low operation time, the end of the construction is still at the end of the construction. In addition, the customer's expenses are settled on a quarterly. Insufficient mobile funds are a major problem that plagues Sichuan and Western data.

Wang Shuai did not expect that when "green and yellow do not connect" in March and April, a large amount of funds "live water" to solve the difficulties. "We enjoyed a tax refund of 15.93 million yuan in July last year. In the past few months, it added to nearly 44.5 million yuan. These money must be timely." Wang Shuai revealed that the tax refund of the account has been used for project funds and talents. Introducing and product research and development, the enterprise removes the baggage and lightly moves.

The boost and recovery of confidence is both an intuitive feeling of the enterprise and the evidence of economic data. "From the perspective of the tax power index, since the implementation of large -scale tax refund in April, the expected index is expected to operate continuously at a continuously high level, 108.50 in April and 108.31 in May." The relevant person in charge of the Provincial Tax Index Office introduced.

Fast -refund taxes -the taxpayer who accelerates running

When the tax refund arrived one day, the corporate funds were relieved. However, it is difficult to get through the "high -speed road" of retention tax refund.

As far as the audit workload alone is concerned, compared with the province's 5,100 taxpayers in 2021, the tax refund is 35.6 billion yuan, and the large -scale retention tax refund policy will land for the first month this year. The tax refund was 41 billion yuan, not only the tax refund far exceeded last year, but the number of tax refund households also increased by nearly 11 times. To verify massive data, the difficulty coefficient leapt.

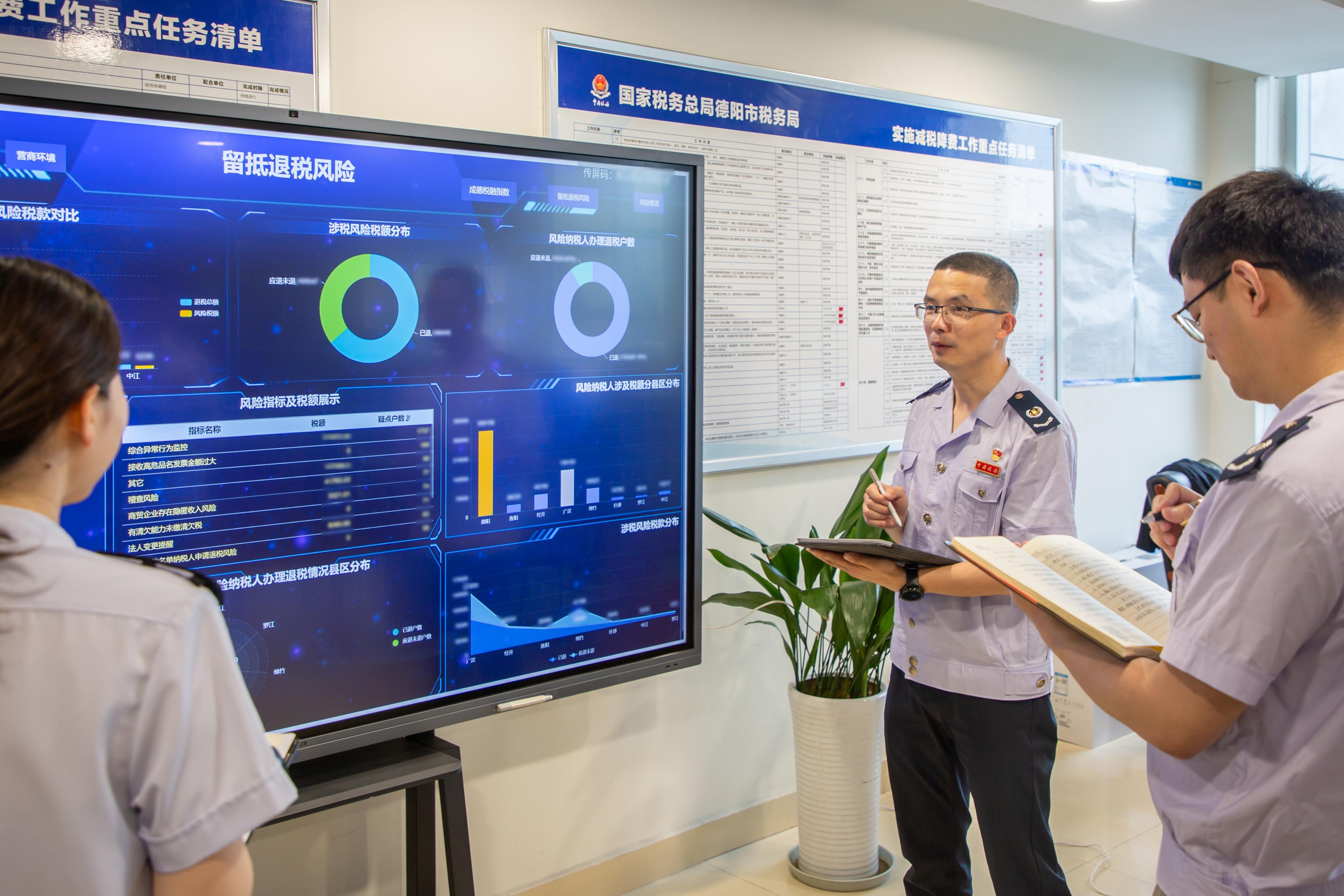

Deyang taxation cadres use big data analysis risk indicators

The policy changes should not be ignored: the reserved tax refund has a new policy and an old policy that continues to implement; it involves both incremental retention taxes and the amount of reserved taxes for the first time. "Old accounts" need to be more cautious.

Under the unified leadership of the tax refund policy implementation work leadership group, Sichuan Province, city, and county -level tax authorities have established a special work group for tax refund, and formulated the "List of Research on Tax Rebate Works". Under the overall planning of the tax cuts at all levels, the departments of the goods and labor, the collection regulations, the acceptance, the collection, the section, the inspection, and the information of the information are "twisted into a rope" while performing their duties. Accelerate running.

"I thought it would be filled in for a long time, but the keyboard was basically not moved." After logging in to the corporate account of the Electronic Taxation Bureau of Sichuan Province, Zhang Ying, the financial managers of Sichuan Liji Lebao Food Co., Ltd., experienced unprecedented tax refund. In the declaration system, the basic information and reserved taxes required for the required enterprise have been automatically pre -filled in. Zhang Ying only needs to check the information and mobilize the mouse, and submitted an application form.

The tax refund must be faster, and the process must be deleted simplified, but it does not mean that the review can be relaxed. In fact, kung fu is in front.

As early as the policy landed, Sichuan Taxation used taxes on big data to target the beneficiary list. The amount of tax refund involved in the enterprise was clear at a glance. As soon as the policy was announced, the publicity and counseling were fully rolled -closely to the policy adjustment and information system changes. Organize more than 1,000 games to ensure that tax personnel understand policies, can operate, and explain; to the outside world, more than 200,000 policy information such as the electronic tax bureau and the promise interactive platform have been passed through the three rounds, and the unread taxpayers " One -to -one "one -to -one" re -promotion and counseling to ensure that the taxpayer's clear policy, declaration, and enjoyment.

At the same time, the Electronic Taxation Bureau has quickly upgraded to open a convenient green channel for small and micro enterprises to freely fill in orders, and minimize the burden of the taxpayer's reporting as much as possible.

Strictly beware of fiercely -a solid tax refund defense

For legal enterprises, leaving tax refund is the "timely rain" of bailout, and for criminals, it is the "Tang Seng Meat". Sichuan taxation has always adhered to the two -line advancement of "fast retreat" and "strict fighting", and quickly stretched out to the "black hands" of tax refund, and took multiple measures to tighten the "fence" of risk prevention and control. "Compared with the past and legal risks of fraudulent tax refund, the tax refund involved the direct interests of 'real gold and silver', and the fraudulent tax refund links are less, the implementation is more convenient, and the profits are more profitable." Sichuan arts and sciences. Professor Fu Zhongxian, Dean of the School of Finance Management, analyzed.

Luzhou tax cadre Zhang used its own "scattered data portrait method" to carry out cheating and retained tax refund case inspections

To this end, Sichuan Tax Research formulates the guidance of the “integrated” risk prevention and control work operation of the VAT tax refund, and the guidance of the upgrading of the review work, establish and improve the “integrated” risk index model of tax refund, in real time scanning risk, differentiated development Risk response -The low -risk taxpayers focus on strengthening the service reminder and risk prevention and control in the event, and adopt a suspension of the Chinese risk taxpayer to verify the risk inspection, and the high -risk taxpayer shall implement tax audit in accordance with regulations.

"The short -term tax refund chain is short, and the key to cracking down is fast. We refine the fast work ideas into fast deployment, fast selection, fast investigation, guidance, fast transfer, fast prevention and control and other working methods." Sichuan Provincial Taxation Bureau According to Wang Yu, director of the Audit Bureau, the six departments of taxation with the public security, customs, people's banks, procuratorials, and foreign exchange management cooperation in case investigation, investigation and collection, judicial prosecution, data sharing, capital inquiry, etc. Line.

Numerous audit cadres ran on the front line of tax refund. In Luzhou, the backbone of the post -90s inspection business used its own "scattered data portrait method" to strings tens of thousands of fragmented data into line, and the vinens were touched. fact.

Inspection of the sharp sword out of the sheath, guarding the pure land. Since the large -scale tax refund policy, Sichuan has filed a case to inspect 194 enterprises, and the 170 households have cheated or obtained tax refund issues in violation of regulations. There are 25 cases of exposure, and a strong signal of "fierce tax fraud" and "severe punishment must be punished" to the society.

With the end of the first half of the year, the deployment requirements of the Party Central Committee and the State Council's "determined tax refund task in the first half of the year" were well implemented in Sichuan, the policy dividend was gradually released, and the rapid recovery of Sichuan's economic operation was promoted. Li Jie, Secretary of the Party Committee and Director of the Sichuan Provincial Taxation Bureau, said that in the next step, the Sichuan tax department will continue to adhere to the "one -handed progress, first -hand prevention risk" in accordance with the requirements of the Party Central Committee and the State Council. Real measures carry out the implementation of the tax refund policy to implement the "look back", continue to implement various combined tax support policies, and serve the overall situation of "two stability and one guarantee" with solid work results. Intersection

- END -

The road builders insist on wearing trousers: "After laying asphalt, the temperature of the road is nearly 180 ° C.

The Yangtze River Daily Da Wuhan Client July 18 (Reporter Leng Jinghua) On July 15...

A traffic accident occurred in rural areas in Linxian County, Shanxi. Five people died and 6 were injured.

China News Service Lu Liang, July 7th (Reporter Fan Lifang) On July 7, the reporte...