The 5th Anniversary of Bond Connect: my country's financial opening to the outside world goes further

Author:Xinhua News Agency Time:2022.07.05

"Over the past five years, the 'Bond Connect' has been running smoothly and efficient, injecting new vitality and energy into the development of financial market reform and opening up, and the development of the Hong Kong International Financial Center."

At the Fifth Anniversary Forum and "Conversion" release ceremony on July 4, Pan Gongsheng, Vice President of the People's Bank of China and director of the State Administration of Foreign Exchange and director of the State Administration of Foreign Exchange, said.

Hong Kong Island Light Show, which was shot on June 25, 2022 in Tsim Sha Tsui. Xinhua News Agency reporter Wang Shen Shen

In July 2017, the "Bond Connect" was open to the north to the north, and the interconnection cooperation between the Mainland and the Hong Kong bond market was officially launched. In September 2021, the opening of the southward was also successfully landed, realizing the two -way opening of "bonds".

In the past five years, the "Bond Connect" has witnessed the rapid growth of the Chinese bond market, and has also promoted the joint development of the interconnection of the Mainland and Hong Kong's financial markets.

Today, on the fifth anniversary of the opening of the "Bond Connect", the Mainland and Hong Kong have launched the "swap" and the standing for exchange arrangements for "swap" and the RMB and Hong Kong dollars.

—— "Bond Connect" has accelerated the effectiveness of financial openness.

According to industry experts, the "Bond Connect" has its own unique mechanism, not only pay attention to adopting international general practices such as multi -level custody, and connect through infrastructure systems in the two places to effectively facilitate the "a little access" of overseas institutions. A series of arrangements such as access filing, centralized transactions, and penetrating information collection effectively support supervision and risk prevention.

"Bond" has become an important channel for overseas investors to invest in the domestic bond market.

Over the past five years, foreign investors hold the total number of Chinese bonds have increased at an average annual rate of about 40%. Data show that as of the end of May 2022, the total scale of my country's bond market reached 13.9 trillion yuan; the size of my country's bonds in overseas institutions was 3.74 trillion yuan, an increase of 2.81 trillion yuan from the "bond".

"'Bond Connect" has become a bridge and bond in the overseas financial markets in China Unicom. "Shi Jiachen, general manager of China Forestral Marketing Department of Deutsche Bank, said that the development of" Bond Connect "is the development of China's financial markets and the internationalization of RMB in the past five years. A microcosm.

——Prone RMB assets are welcomed by international investors.

Today, the Chinese bond market has become one of the indispensable elements of the global capital market.

Index suppliers such as Bloomberg, Morgan Chase, FTSE Russell have gradually incorporated the Chinese bond market into its flagship index. Foreign -funded rating institutions such as S & P and Fitch have entered the market. Panda debt issued a total of nearly 600 billion yuan ...

According to Rong Yihua, deputy director of the Financial Market Management Department of the Shanghai Headquarters of the People's Bank of China, the participation of overseas institutions in all areas and levels of the bond market has been significantly improved, and the degree of internationalization has further deepened.

As of the end of May 2022, there were 1038 overseas institutions entering the inter -bank market, covering more than 60 countries and regions including the United States, Canada, the United Kingdom, France, Germany, Italy, Japan, Singapore, Australia.

In May 2022, the International Monetary Fund decided to increase the weight of the RMB in the SDR basket currency from 10.92%to 12.28%, and the RMB weight ranked third after the US dollar and euro, and ranked third. The results of the investigation of the 2022 Reserve Management Seminar released by UBS assets management on July 4 showed that the RMB continued to steadily obtain the status of reserve currency, and 85%of the respondents considered or invested in RMB.

"The stable performance of the Chinese economy and the fundamental fundamentals of the RMB have made RMB assets become a shelter for global investors." Shi Jiachen said.

——The curtain of a new round of financial cooperation with Hong Kong and Hong Kong has been opened.

Today, the Mainland and Hong Kong's financial market interconnection and cooperation have new measures.

Pan Gongsheng announced on July 4th's "Bond Connect" forum and "Conversion" release ceremony to announce the launch of the "swap" between the Mainland and Hong Kong and the establishment of a standing exchange arrangement between the RMB and Hong Kong dollars.

"Conversion" refers to the interconnection of Hong Kong and the mainland interest rate exchange market. On the basis of "Bond Connect", domestic and foreign investors have participated in a mechanism arrangement of the financial derivative markets of the two places through the connection between Hong Kong and the Mainland financial market infrastructure, which is conducive to meeting investors' interest rate risk management needs Essence

"The 'Conversion of Tong" business will provide global investors with more convenient risk management tools and the exchange of RMB interest rate exchange and settlement process. "Said Yang Jing, deputy president of Standard Chartered Bank (China) Co., Ltd. and general manager of the financial market department.

At the same time, the Standing SCT Arrangement established by the People's Bank of China and the Hong Kong HKMA is the first time that the People's Bank of China has signed a stand -up exchange agreement. The agreement has been effective for a long time without requiring regular renewal. The exchange scale has expanded from 500 billion yuan to 800 billion yuan. The exchange process is further optimized and the use of funds is more convenient.

Experts said that the launch of the "Conversion" and standing currency exchange arrangements will further improve the connected efficiency of the financial markets of the two places and consolidate the status of the Hong Kong International Financial Center and offshore RMB business hubs.

"The experience of China's financial market development shows that expanding and opening up is a strong driving force for the marketization, rule of law, and internationalization goals of China's financial markets, and a key move to further enhance China's financial market to serve the real economy." Pan Gongsheng said.

- END -

Qiannan Fuquan: Order green peppers are popular in the market to grab "fresh" listing

Recently, in the 100 acres of pepper planting bases located in Zhuwangcheng Villag...

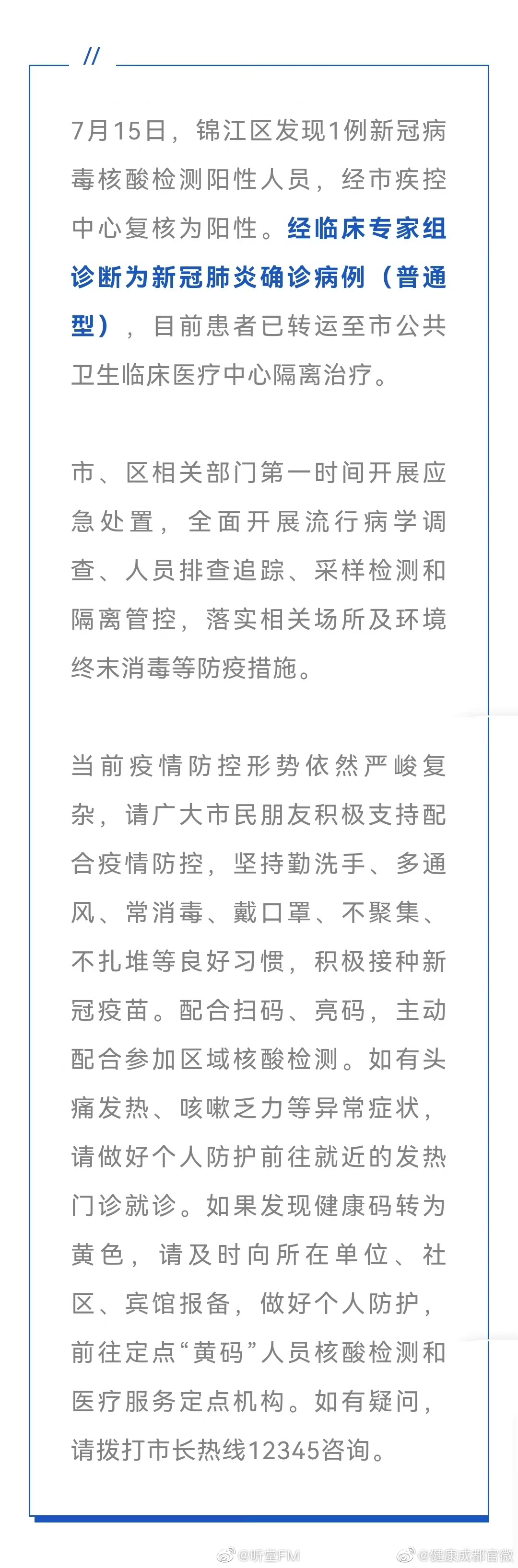

A new case of new crown pneumonia found in Jinjiang District, Chengdu

Healthy Chengdu