The dispute between the giant competition for the new highland: hjt or Topcon?

Author:Daily Economic News Time:2022.07.07

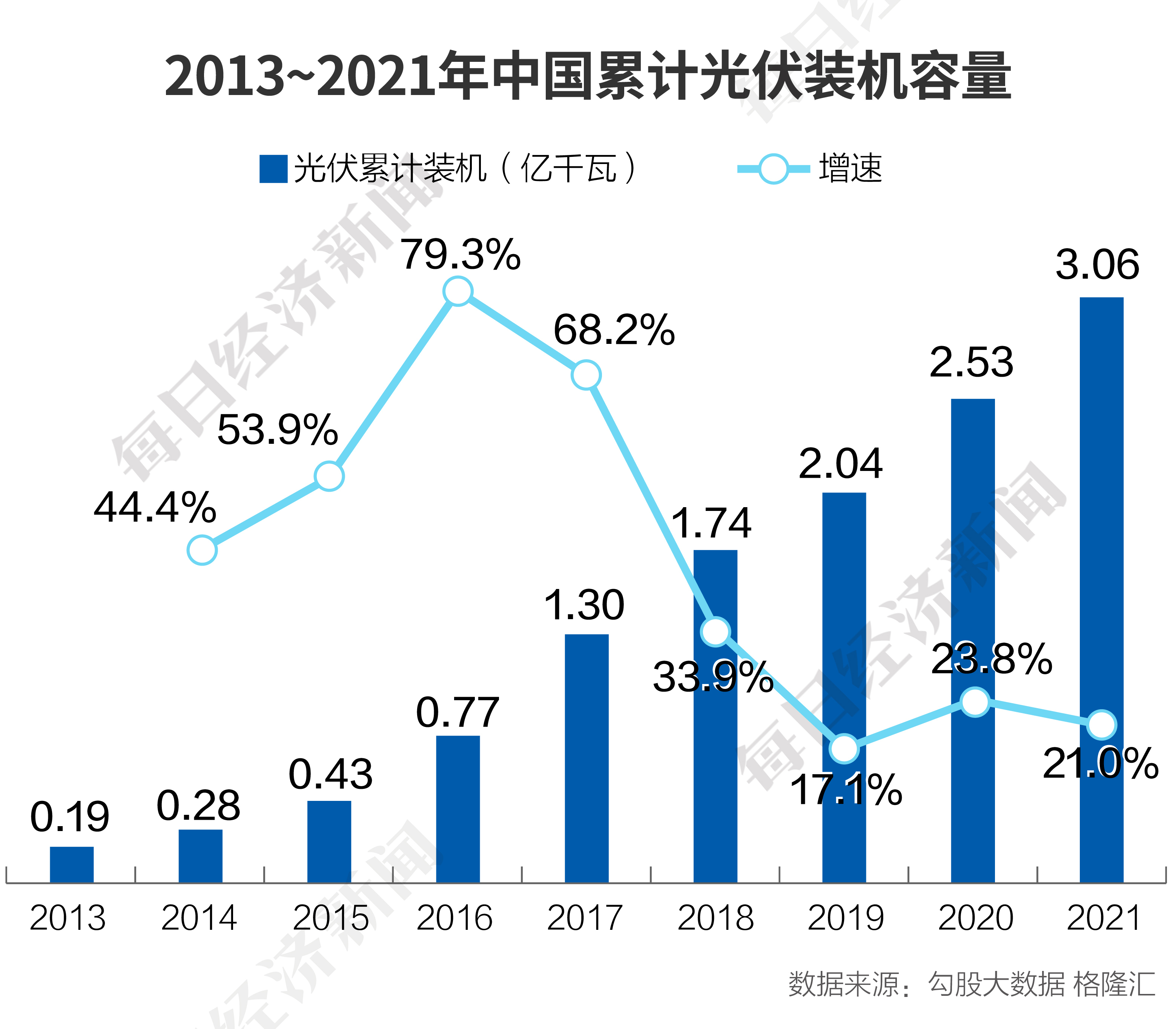

The vertical tourism industry, from time to time, the "city head change king flag", the choice of technical routes is the most critical factor. From polysilicon to single crystal silicon, many companies have fallen, but they also produce new kings such as Longji Green Energy (SH601012, a stock price of 64.30 yuan, and a market value of 487.274 billion yuan). The sizes of silicon wafers have also made many industrial chain manufacturers divided into two major alliances to warm up.

In the first half of 2022, the price increase of silicon materials had not yet dissipated, and a new round of N -type photovoltaic batteries had begun. TOPCON first sounded the number of mass production, and the TOPCON battery project was launched one after another. In contrast, HJT technology looks more lonely in terms of industrialization. However, there are also research reports that in the second and third quarters of 2022, HJT technology will enter the "performance of performance".

HJT technology really made revolutionary progress? The industrialization has lagged behind TOPCON, can it really catch up in the short term? The answer is unknown, but it is foreseeable that, regarding technology, everyone wants to get out of its own route. This is a must -have.

Photo source: Photo Network-500505877

Type N Battery Age: Challenger of the Giants

In the capital market, HJT technology has exerted its efforts. According to Wind data, from June 22nd to June 28th, the HJT leader Vajrayana (SZ300093, the stock price was 48.99 yuan, and the market value of 10.582 billion yuan) rose by 77.07%. However, the stock price of Diamond Glass has fallen sharply on June 29 until the "20cm" limit. Since then, the publicity stock price has declined all the way, as of July 7, which closed at 48.99 yuan/share. From June 29th to July 7th, diamond glass fell 25.21%. In addition, Diamond Glass received a letter of attention from the Shenzhen Stock Exchange on June 30.

In contrast, TOPCON camps have continued to rise on July 6 and July 7, with a cumulative increase of 14.24%in two days.

The capital market reflects the dynamics of photovoltaic giants, and the industry does not lack giants, let alone challengers.

The challenger thinks is the curve overtaking when the industry's technical route is switched. The earliest to throw their eyes into N -type batteries is also these challengers. The shares of the photovoltaic backplane giant (SZ300393, the stock price is 16.54 yuan, and the market value is 18.022 billion yuan), which is one of them.

Open the official website of Zhonglai Co., Ltd., the eye -catching "N -type era makes the sun more valuable", which is the expectation of the N -type battery. As early as the PERC battery was in the ascendant, Zhonglai stared at the N -type battery. According to its official website, the company has focused on the research and development, production and sales of T -type TOPCON batteries since 2016. It is the earliest technology enterprise with GW -class TOPCON battery capacity.

You know, the current mainstream PERC battery has only begun to enter mass production in 2015. Why does Zhonglai pay so much attention to the research and development of high -efficiency batteries? Lin Jianwei, chairman of the company, stated in September 2020 that high -efficiency batteries are the key to the development of the photovoltaic industry in the future. He believes that if Chinese photovoltaic enterprises want to be bigger and stronger, the research and development and manufacturing of high -efficiency batteries is indispensable. The battery is the core of the entire photovoltaic industry. Only by continuously improving the efficiency of batteries can we finally solve the problem of power station investment.

In addition to Zhonglai, the N -type battery also has another major challenger a new energy technology (Luzhou) Co., Ltd. (hereinafter referred to as a new energy). The founder of a new energy source is Liu Yong, who has always paid attention to N -type technology.

On May 24th, a new energy chief technology officer Song Dengyuan said in an interview with "Daily Economic News" reporter: "Liu Yong believed in 2018 that type N was (the future) direction. This is why he was in 2018 in 2018 When creating a new energy year, he chose to develop N -type technology. In 2019, he took the lead in realizing the 1.2GW TOPCON battery production line with independent intellectual property rights. "

After that, the N -type TOPCON battery technology has also become a hotspot of industrialization. In December 2021, Chen Jia, the general manager of the Optoelectronics Assistant and the leader of the technical research and development of Zhonglai Co., Ltd., announced that Zhonglai Optoelectronics achieved TOPCON mass production scale in 2019 As of Q3 of 2021, China -Lai provided battery and components worldwide exceeding 5GW. In addition, 16GW production capacity is being planned.

According to a new energy press release, at the end of 2021, TOPCON battery production capacity was increased to 6GW, TOPCON battery production efficiency exceeded 24.6%, and N -type production capacity at the end of 2022 will reach 20GW.

Left to the right: hjt or topcon?

Compared to Zhonglai and a new energy company, such as "All in" Topcon battery, the giants' decisions are more cautious. After all, the choice of technical routes is related to the future of the company.

In the capital market, from 2019 to 2021, the HJT battery has been speculated many times. It also believes that the HJT battery is the future of the photovoltaic industry, and TOPCON is only a transition product.

Tongwei (SH600438, the stock price of 56.93 yuan, market value of 256.273 billion yuan) tells the advantages of the HJT battery to the reporter of "Daily Economic News" on WeChat. For the sales premium of HJT batteries for PERC and TOPCON batteries, Tongwei said: "Compared to other components of single crystal, HJT components have stronger power generation capabilities. Source. In the future, a series of costs related to the area related to the construction of photovoltaic power stations such as transportation, installation, land, brackets, pile foundations, maintenance, etc. will be difficult to decrease and even increase. Effective breakthroughs are the power generation capacity to increase the power within the unit area and improve the power generation capacity at the same power. This is also the main reason for the industry to recognize HJT's premium advantage. "The power generation is higher, which means that the HJT battery will be reduced in photovoltaic costs. Play an important role in the process.

"There is a kind of clothing, only lively on the runway, not popular on the street. This is like HJT. The popularity in the capital market must far exceed the attention in the industrial circle. Why?" Li Xiande, chairman of Jingke Energy Li Xiande, Posted in its public account in August 2021.

Crystal Energy (SH688223, the stock price of 14.78 yuan, and a market value of 147.8 billion yuan) choose TOPCON or HJT? Li Xiande borrowed the words commonly used by young people to describe- "Friends are full, lovers have not reached." Perhaps in his opinion, HJT has always been in a state of "lover not reached". Therefore, "can only be said that at least it is not now, not in the short term."

The meaning of its words is that HJT is at least at the time and in the short term was not the best choice.

In fact, HJT is beautiful, but there are still many technologies that need to be overcome. In terms of Jingke Energy on June 30, the reporter of "Daily Economic News" said: "The core reason for choosing TOPCON is that TOPCON has higher mass production efficiency and better compared to PERC and other N technologies in the same period in the same period. The cost of mass production and a clearer way to improve cost reduction will be one of the most cost -effective and commercialized battery technology routes in the future. After many years of exploration and accumulation, we have mastered key technologies and core processes. In the future, TOPCON capacity investment will also be further increased, and the improvement of cost reduction is continuously promoted. "

In 2019, Jingke Energy began to lay out the N -type TOPCON capacity. In early 2022, the company put into production in Hefei and Zhejiang Haining to produce 16GW large -sized N -type high -efficiency battery production capacity. In May 2022, Jingke Energy introduced: "Hefei and Haining N-type TOPCON battery production capacity is planned to achieve full production at the end of May and at the end of June, and the current progress is progressing. Level."

On June 28, Jingke Energy's Da -type TOPCON project -Jingke Energy "Jianshan Phase II 11GW High -efficiency Battery and 15GW Component Intelligent Production Line Project" was launched.

At the same time, another large photovoltaic giant Tiantang Energy (SH688599, the stock price of 69.73 yuan, and a market value of 151146 billion yuan) also began to mass -produce Topcon. In April 2022, Tianheguang could hold the "Suqian 8GW TOPCON battery project launch meeting" in the production base of Suqian, Jiangsu.

Regarding why the TOPCON route was selected, Tiantuangneng responded in writing on July 1 to reporters: "The company has a variety of technical routes, including HJT, IBC, and perovskite. . At present, the company believes that TOPCON has reached the stage of high -efficiency and low cost mass production, which is a preferred technical route in this issue. "

The PPT provided by Song Dengyuan showed that the TOPCON battery planned 60GW+and shipped 15GW+in 2022. After experiencing challengers such as shares and a new energy source, the giant also began to lay out and move quickly.

Each has its own advantages and disadvantages: TOPCON mass production starts first

Topcon or HJT, to the left or right? Why do TOPCON mass production capacity start first?

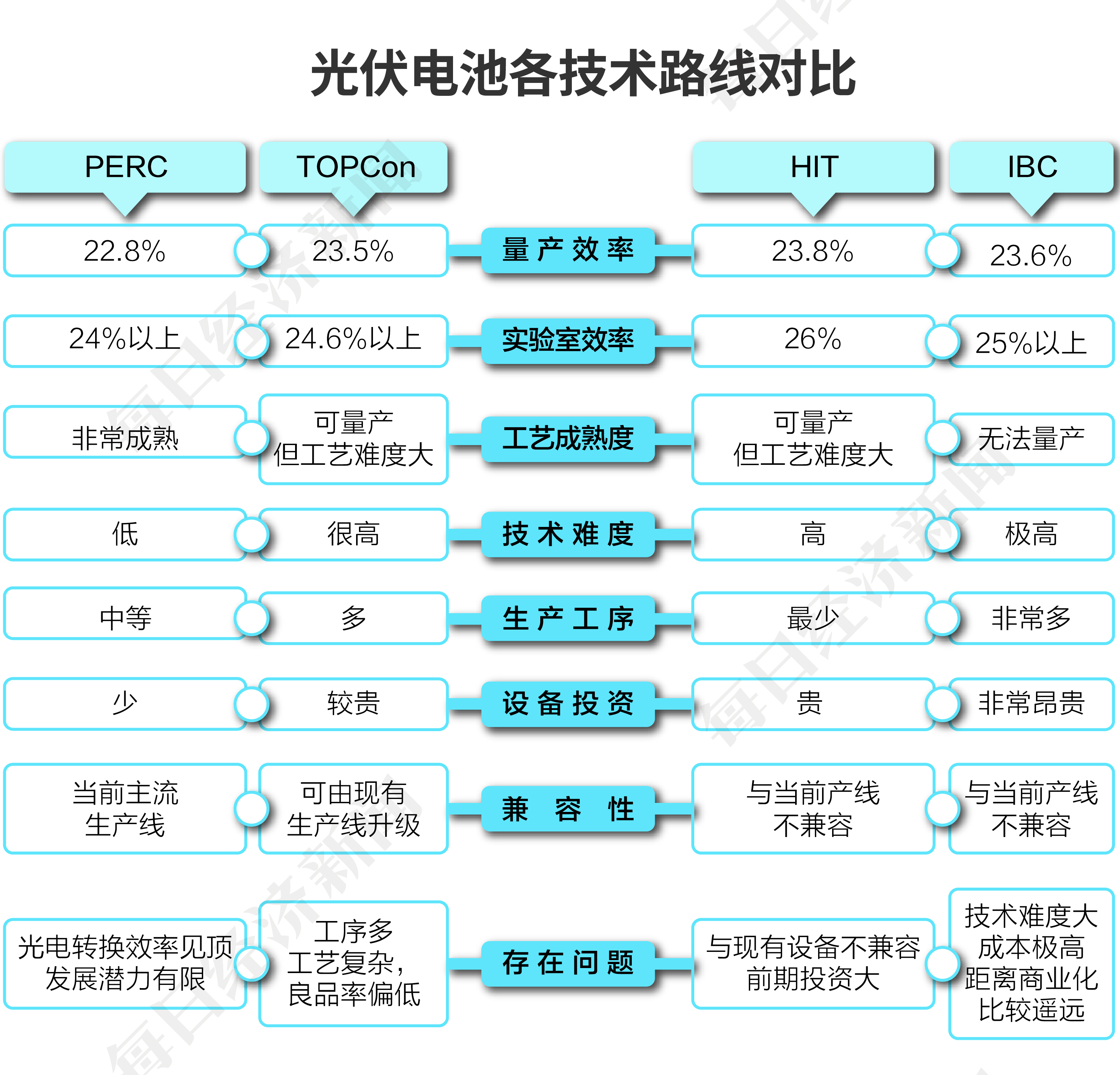

Li Xiande once said that compared to Perc, HJT has the advantages such as high efficiency, high double -sided rate, low attenuation, low temperature coefficient, TOPCON has even more. The most prominent disadvantage of HJT, including high equipment investment, large silver slurry, low craftsmanship, and weakened feasibility under large -size trend.

The reason for choosing the TOPCON route in China is similar to that, mainly TOPCON technology has obvious advantages. On July 1, Zhonglai Co., Ltd. responded to the "Daily Economic News" reporter: "Topcon has higher extreme efficiency, more stable craftsmanship, and easier to mass production. Specific advantages such as higher conversion efficiency, based on the theoretical calculation of the German ISFH Institute of ISFH Research Institute, As a result, the efficiency limit of TOPCON batteries is 28.7%, which has a leading advantage in terms of efficiency potential; secondly, low attenuation. Because the battery has high stability, the component can be in actual power stations. The first annual attenuation rate is -1%and power The annual failure rate can be controlled at -0.4%; the third is the low temperature coefficient; the fourth is double-sided power generation. "

Song Dengyuan told reporters: "Compared with heterogeneous knots (that is, HJT), TOPCON's economic advantages are very obvious. 100 million yuan/gw. Therefore, TOPCON is more economical and meets the market demand for photovoltaic development based on the premise of economy. "Tongwei shares analyzed from the perspective of a single W cost.看,在银栅线技术下,量产HJT的单瓦成本较PERC高0.2元/瓦以上,未来差距可缩小到0.1元/瓦以内。同TOPCon相比,在银栅线技术下,量产HJT's single -wal cost is more than 0.15 yuan/watt higher than TOPCON, and the future gap can be further reduced. The main part of the cost of heterogeneous single tiles is the consumption of silver pulp, the use of ITO, and the depreciation of several large parts of the machine. "".

In addition to the low equipment costs and single -www costs, TOPCON's equipment compatibility is also stronger. "Now there are more than 300 GW PERC battery production. With new technologies, it is impossible to eliminate all the old equipment, so the cost will be higher. In addition, the technical personnel and industrial workers of the photovoltaic industry (taking the TOPCON route) can also Continue to the new technical route. From this point of view, TOPCON is the first opportunity. "Song Dengyuan added.

Tongwei also recognizes this. "The equipment of the key processes of heterogeneous knots cannot be shared with PERC, such as velvet cleaning, PECVD, PVD, etc. are newly invested. TOPCON and PERC can share most of the devices of the most processes As long as the PERC workshop has reserved space, it can be upgraded directly to TOPCON, and a single GW new investment amount is limited. "

So, will the TOPCON battery be unique in the future? Song Dengyuan said with a smile: "I have always thought that the photovoltaic industry must be blooming in the future, so as to promote the healthy development of an industry. Heterogeneous knots and TOPCON technology belong to the same source, and they use advanced passivation contact technology. The passivation materials used in quality are different. In fact, I also have great expectations for heterogeneous knots. "

Zhonglai also believes that it will be full of flowers. The company said: "Generally speaking, the three technologies of TOPCON, HJT, and IBC are technologies in the N -type field. Each technology has its own advantages and disadvantages. Tolerant and open, we believe that in the next few years, in the process of turning from P -type to N -type, these technologies will have a good market stage to show their respective advantages. I believe that under the efforts of photovoltaic technology talents , The future market will definitely present a grand scene of flowers. "

However, based on the best cost -effective consideration, TOPCON may take advantage in the current stage, Song Dengyuan believes: "From the current (time node), we look at the second largest technical route that is second only to PERC, heterogeneous quality, heterogeneous quality The knot should be the third. As for the amount of various technical routes, it depends on the contribution of their technological progress to economics. We expect TOPCON to account for at least 10%of the market share in 2022, or even more. Two or three. "

The competition may start: HJT's spring is also here?

TOPCON's mass production was opened vigorously, and HJT seemed relatively lonely. However, some people in the industry mentioned to the "Daily Economic News" reporter on WeChat: "TOPCON is a transitional technology, the long -term inevitable of photovoltaic battery technology is inevitable, but the time point of HJT technology has not reached a consensus."

In fact, compared to TOPCON, HJT also has many advantages at the technical level. According to Tongwei Co., Ltd., HJT has higher efficiency potential, higher double -sided rate, larger cost potential, lower attenuation, and better temperature coefficient.

So, do you have the opportunity to "come first first" by HJT technology with better technical level? Perhaps the key is to reduce costs.

According to the article "HJT's Late Spring Come" provided by Solarzoom WeChat to reporters, it is believed that after HJT technology has gone through the "Concept Expecting Phase" from 2019-2021 "".

Solarzoom believes that there are three prerequisites for the HJT industry to really explode: First, the mass production and price performance is truly realized; second, the financial market is stable, so that the 10GW -level industry expand production is guaranteed; third, the demand of the photovoltaic industry has no crash. Risk, so that battery component companies have their willingness to expand production.

Among them, mass production is particularly attracted. Solarzoom said that the mass production of 100um thick HJT special silicon wafers can directly reduce the cost of the HJT industry chain under the current cost structure, which is about 0.17 yuan/W, thereby becoming a "victory or defeat for the realization of HJT mass production". hand".

Tongwei believes that there are two main points of HJT's future cost reduction direction, one is thin slice (provincial silicon); the other is to use small silver or silver routes on metallization to greatly reduce costs.

Regarding the development of specific technological, Tongwei shares said: "The mainstream HJT battery thickness of the industry is about 150um. HJT benefits from its low temperature process. The 130um thickness has been verified in large quantities. There are no problems in the upstream silicon wafers and batteries and downstream components. . Both the down, 120um, 110um, and even 100um are possible, but there are challenges on the slicing side. At present, the overall economy of the industry 120um and even more silicon wafers is still underwriting. "HJT No. 1 The second major cost reduction technology is to develop cheaper banking copper pulp technology. Song Dengyuan explained: "The low-temperature silver pulp used by HJT is more expensive, about 6000-7000 yuan/kg, and the price of high-temperature silver pulp used by TOPCON is about 4000-5000 yuan/kg. About 20%more. Therefore, low -temperature silver pulp has become a major cost outside the silicon wafer. "

So how to reduce costs, Song Dengyuan said: "It is to replace silver with cheap metals and use copper to replace silver. But this technology is difficult to look (realized) in the short term. Even if it is successful, other technical route batteries can be used, such as TOPCON. "

In 2022, the "big curtain" of photovoltaic N -type batteries has been opened, and the industry and capital markets are quite concerned. The mass production competition in TOPCON and HJT may have just begun. Or, or, the two coexist, blooming.

Daily Economic News

- END -

The total mileage of Tibet Highway reached 120,700 kilometers

Naqu to Lhasa highway. Figures of the District Transportation DepartmentLhasa, Jul...

Lemon strip mining company: "small technical reform" of coal selection factories to improve the high efficiency of washing and selection

Western decision -making network news coal washing equipment is singing songs happily. A ton of raw coal of coal is constantly flowing the selection production line. After bathing, it has become