Audit Observation | Foreign Government Financial Report Audit Internal Control Internal Control and Reference

Author:Audit observation Time:2022.07.08

From the perspective of general financial report audit and foreign government financial report audit practice, understanding that internal control of the audit unit is an important procedure for evaluating the risk of major misunderstanding of the financial report by the audit unit. This is also an important part of the risk assessment procedure in the audit of registered accountants in my country. Internal control testing procedures are further auditing procedures for the risks of the evaluation. my country's national audit standards also have requirements on understanding and inspection of internal control of the audit unit, but as a guidance clause, the audit procedures and methods that are complete and specifically standardized in practice have not been formed in practice. In the context of exploring and carrying out government financial report audits, the practice of studying the internal control inspection of foreign government financial report audits is studied. Proper evaluation, as well as improving audit efficiency and achieving audit goals, have certain reference value.

The meaning of internal control and internal control inspection

(1) The meaning of internal control

Relevant internal control specifications abroad and the "Basic Specifications of Enterprise Internal Control" and "Internal Control Specifications (Trial)" of the "Basic Regulations on the Internal Control of Enterprises" and the "Internal Control Specifications of Administrative Institutions" are all related to internal control. According to the correlation of the research, this article selects the "Internal Control" regulations in the "Internal Control of the Administrative Institution" in 2012: internal control refers Prevent and control the risks of economic activities. There are three main functions of internal control, which helps to ensure that the unit complies with laws and regulations, asset security and complete assets, and true and reliable financial information. In addition to these contents, the role of government departments can also ensure the reasonable use of public resources, preventing invading and preventing corruption. The establishment of internal control provides a reasonable guarantee for the unit to achieve the operating goals.

(2) The meaning of internal control inspection

The internal control inspection referred to in this article refers to the auditors in the government financial report audit, with legal and regulatory documents such as the accounting law, budget algorithm, the "Code for Accounting Basic Work" and "Internal Control Specifications (Trial)" The relevant provisions are based on the establishment and implementation of the internal control system of the audited unit to understand, test, and use the use of results to help make audit evaluations of government financial reports and reveal major problems in the existence of internal control. It covers general finances Understand and test the contents of the internal control in the audit.

my country's "Government Financial Report Audit Measures (Trial)" requires audit and supervision of government financial reports, and conducts audit evaluation in accordance with government accounting standards and government financial report preparation methods to promote the authenticity and integrity of government financial report information, ensuring The quality of government financial reports. From the perspective of internal control, the establishment and implementation of the internal control system of the audit unit has an important impact on the quality of financial reporting. If the audit unit does not have a good institutional environment, does not establish a complete accounting and management system, and strictly implement it, there is no effective prevention of errors and fraud, which will lead to the risk of major misunderstanding of financial statements, which will affect the authenticity and reliability of financial information. Therefore, carrying out the government financial report audit, it is necessary to check the internal control situation, judge major wrong reports that may exist in financial statements, discover the problems of internal control, make objective audit evaluations, and promote the improvement of the audited unit to improve and improve various management. Essence

Methods of foreign government financial report audit internal control inspection

For countries represented by the United Kingdom, the United States, Australia, New Zealand, etc., since the 1980s, the government's financial reporting system has gradually established the government's financial reporting system, and the audit system for government departments and government consolidated financial statements to form comparisons to form comparisons Mature and standardized government financial report audit technology methods.

(1) General practice of financial report audit internal control inspection

Testing for internal control is a general procedure for financial report audits. It is the generation and improvement of internal control that the financial report audit has developed from a detailed audit account basis and developed into an internal control basic audit characterized by sampling audit. Under the risk -oriented audit model, auditors should understand the auditing units and its environment, the risk of major misunderstanding, the implementation of control testing and substantial procedures, including internal control, and the implementation of control testing and substantive procedures.

In the internal control inspection of the financial report audit, in order to issue audit opinions on whether there is a major wrong report on the financial statements, the auditors need to understand the internal control related to the financial statements, and implement the control of the internal control of the appraisal for the risk of the evaluation. Testing to determine the effectiveness of internal control operation, the results affect the nature, time arrangement and scope of the substantive program. Under normal circumstances, internal control is considered in the audit of financial statements, and its purpose is not to express opinions on the effectiveness of the internal control of the audited unit.

(2) The main practices of foreign government financial report audit internal control inspection

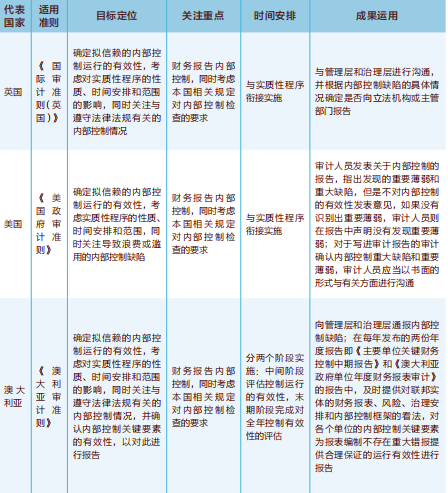

In the audit of government financial reports, internal control inspections also need to be performed, but based on the specific requirements of other domestic laws and regulations in different countries, and correspondingly adopting different audit standards, the internal control inspection practices are more abundant than the content of the general practice. This article selects three countries: Britain, the United States, and Australia. From five aspects of applicable criteria, target positioning, focus, time arrangement, and results of results, they summarize the internal control inspection of government financial report audits (see Table 1). Table 1 Comparison of the internal control inspection of the financial report of the United Kingdom, the United States and the Australian government

Applicable criteria. Britain follows the "International Audit Standards (Britain)", based on the International Audit Standards issued by the International Accountants Federation (IFAC), the International Audit and Evaluation Standard Council (IAASB), and is in addition to additional requirements where the need is required. Adding supplements is to be suitable for the requirements of British laws and regulations; the United States follows the "Guidelines for the U.S. Government Audit" formulated by the United States Audit Agency. On the basis of adopting the criteria of the Certified Public Accountant Audit Guidelines, add additional requirements for government financial report audits and adopts a single single The form of standards; Australia adopts the Australian Audit Standards formulated by the National Audit and Evaluation Standards Committee, which is generally consistent with the "International Audit Standards" in structure and content.

target setting. The goal of the British government's financial report audit internal control inspection is to determine the effectiveness of the internal control operation of the formulation, consider the nature, time arrangement and scope of the substantive procedure, and pay attention to the internal control of the laws and regulations related to laws and regulations; The goal of the U.S. government financial report audit internal control inspection is to determine the effectiveness of the internal control operation of the authenticity, consider the nature, time arrangement and scope of substantive procedures, and pay attention to internal control defects that cause waste or abuse; The goal of internal control inspection is to determine the effectiveness of the internal control operation of the author, consider the impact of the nature, time arrangement, and scope of the substantial program. The effectiveness of the element is reported to this.

Follow the focus. The practices of the three countries are basically similar. They all control the five elements (that is, the control environment, risk assessment, control activities, information and communication, and monitoring). Regulations on the requirements of internal control inspection.

Schedule. The internal control inspection of the United Kingdom and the United States is implemented with the substantial procedures of the government's financial report audits; Australia's internal control inspection is divided into two stages, namely the effectiveness of the middle stage evaluation control operation, and released the "Key financial control mid -term in the main unit in the middle stage. "Report", completed the evaluation of the effectiveness of the annual control at the end of the period, took a detailed test of the major balance relationship and disclosure of financial statements, and finally issued audit opinions of financial statements.

Use. The internal control defects found during the audit process need to communicate with the management and governance layer, and determine whether to report to the legislature or competent department according to the specific situation of internal control defects. The U.S. Audit Agency's "Financial Audit Manual" defines "control defects", divided control defects into design defects and operating defects, and defines two levels of control defects, namely "important weakness" and "major defects". The specific method is that the auditors issued a report on internal control and pointed out that the important weakness and major defects found in the discovery, but did not express opinions on the effectiveness of internal control. Weak; Audit confirming the major defects and important weaknesses of internal control in the audit report, and the auditors should communicate with related parties in writing. The specific approach of Australia is to report internal control defects to the management and governance; two annual reports released each year, the "Interim Report of Key Financial Control of the Main Units" and the "Australian Government Unit's Annual Financial Statement Audit" report, Provide views on financial statements, risks, governance arrangements and internal control frameworks of federal entities in a timely manner, and report on key elements of the internal control of each unit to provide a reasonable and effective operation effective operation effective operation.

(3) Evaluation of foreign government financial report audit internal control inspection practices

The goals and contents of internal control inspection are even more extended. Governments at all levels and their departments are responsible for the responsibilities of public funds, public assets and public resources, and need to design, implement and operate well internal control regulations to ensure the legitimate and efficient use of resources, and safeguard national law and public interests. Therefore, the goal of government financial report audit internal control inspection is also more expanded than general financial report audits. For example, No. 330 of the International Audit Standards point out that for the audit of the public sector unit, the documents authorized by the authorized audit and other special audit requirements may affect the auditors' consideration, time arrangement and scope of the audit procedure; The division often has additional responsibilities to the internal control of the audit unit. If the audit unit is reported to the obedience of the established operation rules, the laws and regulations and other regulatory requirements are observed. Test internal control can help auditors identify the risks of major violations of laws and regulations. For another example, Article 144 of the World Audit Organization's "Basic Guidelines for Financial Audit" states that the financial auditing goals of public sector are usually wider than the financial statements. Even if there is no additional audit goal, the public will expect reports that they will not comply with the situation stipulated by the authorities. The effectiveness of internal control. The implementation of internal control inspection can be connected with the substantive program, or it can also be carried out separately. In the general sense, the financial report audit is to first understand the internal control execution situation, and then determine whether the control test is performed, and then the nature, time and scope of the substantial program through the control test, which is the coherent process of connecting the front and back. However, from the international practice of government financial report audits, internal control inspections can be connected with substantive procedures, and it can also be implemented independently by substantive procedures. The internal control inspection of separate implementation is to focus on the government's key departments and institutions in the scope of the audit unit. For example, the Australian government's consolidated financial statements contain nearly 250 government entities, and the main entities that perform internal control inspections in the medium -term period are about 25 each year, accounting for 10%of the total number of entities.

The communication level of internal control defects is higher and communication matters are wider. Internal control defects not only prevent government agencies from achieving organizational goals, but also may cause illegal use of public funds to use illegal and unsatisfactory, infringe on public interests, or even endanger national security. Therefore, for the internal control defects found in the government financial report audit, the audit authority needs to bear more responsibilities, and exceeds the general financial report audit in terms of reporting levels and details. The "International Audit Guidelines" pointed out in the 265th that an auditors who execute physical audits of public sector may need to report to the legislature or other competent authorities internal control defects worthy of attention. Internal control defects, regardless of whether its potential impact is significant, may require an auditors to report on matters related to more internal control than general internal control defects, such as controls related to compliance with laws and regulations or contract agreement clauses.

The internal control inspection results have multiple reflex methods in the audit report of the financial report. From the perspective of international practices, although internal control inspection is a necessary link for financial report audits, not all countries report internal control in the financial report audit report. Some countries require auditors to report internal control in the financial report audit, regardless of whether the internal control defects are found; some countries further require the key elements of the internal control of the audited unit Report the effective operation of operation. The degree of reporting on internal control is different, and the required internal control inspection procedures, the degree of inspection, and the corresponding inspection risks are different. Compared to internal control inspections to determine the nature, time arrangement and scope of the substantial program, the effectiveness of the effectiveness of internal control is the most guaranteed internal control inspection. Audit inspection, obtain more audit evidence, and assume higher implementation risks.

Drediting for foreign government financial report audit internal control inspection practices

Regardless of whether it is based on the requirements for auditing evaluation of government financial reports, or the responsibilities of issues and risks of the audit authorities, inspection of internal control is an important procedure in the audit of government financial reports. Judging from the practice of foreign audit organs, we can get the following reference:

(1) The goals of internal control inspection take into account audit evaluation and other requirements

Understanding and testing the internal control of the audit unit is the basic procedure for the audit of the financial report. The purpose is to identify the risk of major misunderstanding and more accurately publish audit opinions on financial statements. However, for the government financial report audit, the goal of internal control inspection is not limited to this, but also the relevant requirements of national laws and regulations.

In the establishment of internal control inspection goals, first of all, based on the needs of audit evaluation, understand internal control and perform control testing to determine the degree of obtaining audit evidence in the substantive procedure, so that the audit authorities can publish audit evaluation on financial statements. At the same time, the requirements of relevant laws, regulations and policy systems should also be considered. For example, Article 115 of the National Audit Standards of my country proposes that when an audit investigation understands the audited unit and its relevant situation, it may focus on items that may be related to major illegal acts. Essence Article 64, paragraph 2 of the "Internal Control Standards for Administrative Institutions (Trial)" issued by the Ministry of Finance of my country, stipulates that the audit institutions of the State Council and its dispatch agencies and local people's governments at or above the county level will audit the unit at all levels. It should be investigated to understand the effectiveness of the establishment and implementation and implementation of the unit, reveal the defects of relevant internal control, propose audit opinions and suggestions in a targeted manner, and urge the unit to make rectification. These regulations have requested the audit organs' inspection internal control. Therefore, in the audit of government financial reports, the requirements of auditing evaluation and relevant laws and regulations should be comprehensively considered, and appropriate internal control inspection targets should be determined, and the corresponding audit content is further clarified to better play the role of financial report audits. (2) Internal control inspection focuses on the major issues found discovered

Based on the publicity of government agencies, major problems in their internal control should be disclosed to relevant competent departments, regulators and the public to strengthen supervision and improvement from external.

Internal control issues such as inadequate institutional, irregular power operation, and poor supervision and management may also lead to missed reports on government financial reports, resulting in the consequences of incidents of illegal and illegal matters, affecting the true and reliable and effective use of financial information. If the degree and consequences of these internal control issues are serious, they should be revealed and reflected as the issues of audit discovery, and proper suggestions should be made.

In the way of the problem reflected: First, it is revealed in the audit report. In specific forms, major internal control issues can be integrated in the government financial report audit report, or a separate internal control report report. The second is to reflect to the competent department. Summarize major internal control issues in the system, write major internal control issues and reports of audit recommendations, submit the competent authorities, and track the rectification process of the issue. At the same time, the internal control issues that are commonly existing in government departments due to the top -level design of the system can summarize and communicate with the relevant management departments and put forward suggestions to improve the system.

(3) Clarify the degree and criteria of internal control problems

In the audit of the financial report, the severity of the problems of internal control need to be distinguished. The impact of different degrees of issues on the major error reports of financial statements is different, and the audit procedures and report levels of the auditors are also different.

my country's "Guidelines for Internal Control Audit of Enterprises" stipulates that "internal control defects are divided into design defects and operating defects according to their causes, and they are divided into major defects, important defects, and general defects according to their influence." In the audit of my country's government financial report, we also need to establish relevant concepts on the existing problems of internal control, such as internal control defects, internal control problems, major internal control issues, internal control general issues, etc. Determine the extent and standards of internal control problems to help auditors make appropriate judgments, take corresponding audit procedures, and make objective audit evaluation of government financial reports.

Author: Shanxi Government Financial Report Examination Project Group

Members of the research group: Li Jing, Lu Xiaohui, Guan Jin Rui, Zhan Ya, Teng Yang, Liu Wenjie, Sun Qingyong, Yang Yajun, Qiao Jian, Che Yanping, Xu Zehui, Li Dongrui, Li Ruiwen, Wang Hao, Hu Xiaofeng

Write: Lu Xiaohui

Source: "Audit Observation" magazine 2022 Issue 6

- END -

(People happy life) Jilin farmers embrace the "literary dream" rural literary flavor gradually stronger

Zhang Xiaoying is at work (data map).The latest issue of the Mountain Flower farme...

State Grid's Power Supply Company of Fengrun District, Tangshan City: Flush "Dam"

Recently, the rainfall is frequent. We must strengthen the inspection and inspecti...