The increase in CPI in June hit a new high!Expert: Average annual average level controlled

Author:Costrit Finance Time:2022.07.09

Fengkou Finance reporter Liu Xiao

The latest data released by the National Bureau of Statistics on July 9 shows that in June 2022, the National Residents' Consumption Price Index (CPI) rose 2.5%year -on -year, which was flat month -on -month. In June 2022, the national industrial producer's factory price index (PPI) increased by 6.1%year -on -year, which was flat month -on -month.

Dong Lijuan, a senior statistician of the National Bureau of Statistics, said that in June, the overall situation of the prevention and control of my country's epidemic was stable, and the supply of important people's livelihood goods was sufficient, and the consumer prices of residents were generally stable.

Several experts interviewed by Fengkou Finance believe that the CPI is expected to rise mildly in the second half of the year, and the probability of breaking 3%in some months is greater, but the average annual average will still be controlled within the policy goals.

Source: National Bureau of Statistics

The increase in CPI in June hit a new high in one year

The National Bureau of Statistics released data on the 9th, mainly affected by the lower base of last year. In June, the CPI rose 2.5%year -on -year, a new high since June last year, an increase of 0.4 percentage points from the previous month. The average CPI from January to June rose 1.7%over the same period of the previous year.

"In June, the overall situation of the prevention and control of the epidemic in my country is stable, the supply of important people's livelihood products is sufficient, and the overall consumer price operation of residents is stable."

Source: National Bureau of Statistics

Statistics show that in June, food prices rose 2.9%year -on -year, an increase of 0.6 percentage points from the previous month. In food, the price of food, edible vegetable oil, eggs and fresh vegetables rose between 3.2%and 6.6%. The price of fresh fruit rose 19%, and the price of pork decreased by 6%.

In June, non -food prices rose 2.5%year -on -year, an increase of 0.4 percentage points from the previous month. Among non -food, the prices of gasoline and diesel rose by 33.4%and 36.3%, respectively, and the price of air tickets rose 28.1%, and the increases were expanded; the prices of educational services and medical services rose by 2.5%and 0.9%, respectively, the same as last month.

From a month -on -month perspective, in June, the CPI decreased from 0.2%last month to flat. Among them, food prices decreased by 1.6%, a decrease of 0.3 percentage points from the previous month.

According to estimates, in June, the core CPI that deducted food and energy prices rose by 1%year -on -year, an increase of 0.1 percentage points from the previous month.

In June, the re -production and re -production continued to advance, and the supply chain of the key industrial chain was gradually unblocked and stable, and the effect of maintaining the policy of stabilizing the price continued to appear. Industrial producers' ex -factory prices rose from the previous month to flat, and the year -on -year increase continued to fall. The PPI rose from 0.1%to the same month from the previous month; the year -on -year increased by 6.1%, the increase of 0.3 percentage points from the previous month.

Data source: National Bureau of Statistics

The year -on -year increase of 2.5%derived from multiple factors

"In June, CPI rose 2.5%year -on -year, which was flat, slightly higher than market expectations." Wen Bin, chief economist of Minsheng Bank and Dean of the Institute, told Fengkou Finance that food prices were declining month -on -month, and pork prices were supported. In June, CPI foods decreased by 1%month -on -month, in line with early summer characteristics. Affected by the sunny weather and seasonal factors, the supply of vegetables and fruits is abundant. The prices of fresh vegetables and fresh fruits fell 9.2%and 4.5%, respectively, and became the most important driving force for food prices to fall.

In addition, the demand for beef and mutton in early summer declined, and the price decreased by 0.4%and 1.6%, respectively. Since the price of pork prices bottomed in April, the market rising expectations are expected to be further strong, and the phenomenon of the phenomenon of the breeding end of the farming end is reappeared. The pork futures have repeatedly hit a new high. The price of pork in June has increased by 2.9%month -on -month. The year -on -year increase in food prices is about to turn to a positive contribution.

Wen Bin said that energy prices have remained upward, and non -food prices have risen by 0.4%month -on -month. Affected by the overall international oil prices, my country's refined oil prices were raised twice at the end of May and in mid -June, and the fuel price of CPI transportation increased by 6.6%month -on -month, an increase of 32.8%year -on -year. After removing energy food, the core inflation has improved year -on -year, reflecting the restoration of the demand side.

On June 10, consumers purchased vegetables in a supermarket in Nanjing, Jiangsu Province. Xinhua News Agency

Zhou Maohua, a researcher at the Financial Marketing Department of Everbright Bank, said in an interview with the Thautou Finance that June CPI continued to rise year -on -year, mainly due to the rise in food and service prices, and the low base effect last year. The first is to recover. Since June, domestic economic activities have accelerated, and the demand for food, daily necessities and transportation services has recovered; the second is the cost factor. Available in international energy prices, the price of domestic gasoline and diesel prices rose, and the cost of traffic rose; the third was the low base effect last year. In addition, pork prices have narrowed sharply year -on -year.

Zhou Maohua said that the year -on -year growth rate of PPI continued to decline in PPI. It is mainly due to the overall slowdown of commodity prices in June, the effect of domestic commodity guarantee stability policies, the market is stable and orderly. In addition, the high base effect last year promoted PPI to fall high year -on -year.

Zhou Maohua believes that from the year -on -year trend of CPI and PPI, domestic demand is heating, but the core CPI continues to maintain the "1 era" year -on -year, reflecting that domestic demand is still weak; It has eased, but the price of energy and industrial raw materials has maintained a high level, and some enterprises are still under great operating pressure. Domestically, they still need to be alert to input inflation pressure.

Ding Yujia, a researcher at Zhixin Investment Research Institute, told Fengkou Finance that in general, the CPI showed a gentle rise. On the one hand, travel and recovery in the main cities, the orderly recovery of catering and shopping, and the 618 promotion releasing consumer demand, and the price is motivated; on the other hand, fresh vegetables and fruits ushered in the peak season of listing. Increase, the price remains downward. Under the comprehensive influence of the two aspects, the CPI manifestations were flat, and the year -on -year expanded due to the low base reasons last year. In food prices, the price of pork continued to rise, an increase of 2.9%, becoming an important support for a month-on-month. In addition, the low base of last year, a year-on-year decrease from -21.1%narrowed to -6.0%. The influence of non -food prices was affected by the continuous operation of gasoline and diesel prices and further recovery of offline service consumption. On June 10, a salesperson in a supermarket in Nanjing was organizing vegetables. Xinhua News Agency

Inflation does not constitute a greater pressure on monetary policy

Wen Bin told Fengkou Finance that in the future, my country will continue to face the situation of coexistence of structural inflation pressure and external input pressure. At the same time, the slow rise of social needs will raise the core inflation center.

Among them, structural inflation pressure is mainly reflected in food. With the pork prices entering the recovery cycle, the suppression of CPI has quietly changed the rising effect over the past year. Since April, food prices have maintained stable in the short -term decline in the price of fresh vegetables. As the flood season arrived in July, after the price of fresh vegetables rose, the cyclical rise of pork was superimposed, and the price of food prices may have a certain price increase pressure. However, recently, the Development and Reform Commission reminds relevant enterprises to maintain a normal rhythm and avoid blind pressure fences. As the off -season is approaching, the driving force for pork prices will fall in the short term, and the rise in food prices will still be mild.

Wen Bin believes that from the perspective of external input pressure, international energy prices remain high, and the Russian -Ukraine conflict has led to a global food crisis that will also threaten my country's food security. Energy and food will be the upstream of inflation. The role cannot be ignored. However, recently the global commodity market has gradually switched from the "inflation trading" model to "recession trading". The phase of the product price has fallen, which will reduce some input -type inflation pressure. At the same time, as my country's overall demand is gradually recovered, the core inflation is expected to be from the early stage. The weak interval below 1%has gradually moved to a historical average of 1.2%to 1.5%.

Wen Bin said that as a whole, the CPI is expected to rise mild in the second half of the year, and the probability of breaking 3%in some month (September and December) has a greater probability, but the average annual average is still controlled within the policy goal. At the same time, due to the influence of the base of last year and the weakening of the rising kinetic energy of the global commodity, PPI will continue to continue to fall. It is expected that inflation is not stressed in monetary policy.

Zhou Maohua believes that the CPI is expected to continue the trend of gentle raising year -on -year. From the perspective of trend, the domestic price center has a moderate rise, but the price of prices throughout the year is expected to maintain stability. On the one hand, in the second half of the year, domestic demand is recovering steadily, driving increased goods and service demand, and pork prices are expected to turn positive and crude oil prices to maintain a high impact; but on the other hand, domestic grain harvests are harvested for many years, and pork, fruits and vegetables, daily necessities and other supplies have sufficient supply. The preserved price measures can help stabilize the price of domestic energy commodities and the overall base of the second half of the year. The overall price has remained stable.

Zhou Maohua said that stable prices in the second half of the year need to continue to implement policies and measures to ensure stability and price, ensure that pig production can maintain stability, and keep alert to market supply and demand interference in the input -type inflation pressure and short -term extreme climate of crude oil prices.

- END -

Bank of Nanjing responded to the proxy village bank clearing business: not to bear the risk of funds

Nanjing Bank issued a description of the fund liquidation business of commercial b...

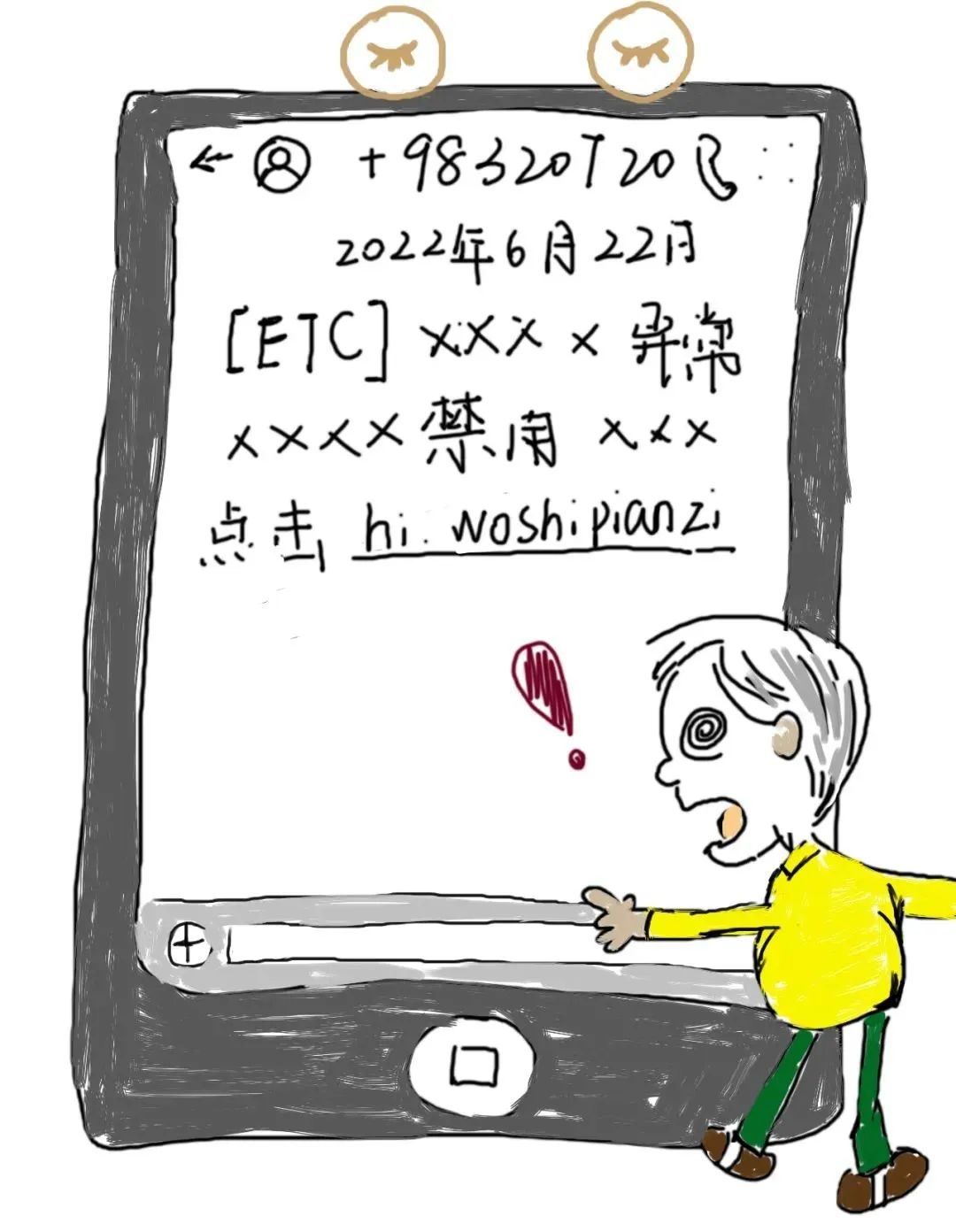

It takes a few minutes to know you the bad guy?

Modern technology brings convenience at the same timeIt also makes people lose pri...